Hi Traders, Sharing a clean structural setup spotted on the Nifty weekly chart. Hope this helps you in your planning. Feedback and thoughts are always welcome!

Nifty Weekly Trade Setup — Targeting 26,300--::

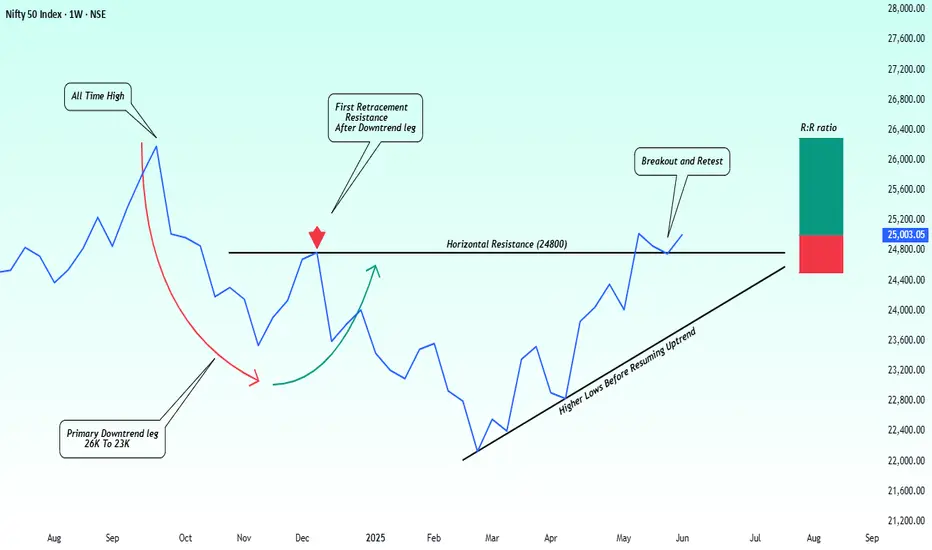

Following a significant correction from the all-time high near the 26000 zone Nifty formed a well defined primary downtrend leg bottoming around 22000. What’s developed since is a classic structural shift from distribution → accumulation → potential markup let's discuss.

After the downtrend price attempted a retracement rally, but it was rejected at the prior breakdown zone and creating a clear horizontal resistance. This rejection led to a base formation supported by a series of higher lows, indicating reduced selling pressure and early signs of buyer strength.

Eventually, Nifty broke above the resistance zone and more importantly held its retest, turning resistance into support. This clean breakout + retest structure is often a precursor to trend continuation.

Technical Highlights-:

Primary Downtrend: 26000 To 23000.

Failed Retracement Resistance: 24800.

Breakout Confirmation: Price moved above and retested 24800.

Structure: Series of higher lows.

Support Zone: 24800 To 24500.

Momentum: Bullish price action with controlled pullbacks.

Trade Setup-:

Bias: Long

Entry: Current levels or dips toward 24900

Stop-Loss: Below 24500

Target:26000, 26300 (previous all-time high zone)

Rationale-:

This trade aligns with classic price action principles:

Breakdown zone turned into support.

Structure of higher lows holding firm.

Valid breakout-retest confirmation.

Risk clearly defined with natural invalidation.

With Nifty respecting structure and momentum building gradually, a revisit to the 26300 zone looks increasingly probable in the coming weeks.

Hope you will like the idea, Best regards- Amit.

Nifty Weekly Trade Setup — Targeting 26,300--::

Following a significant correction from the all-time high near the 26000 zone Nifty formed a well defined primary downtrend leg bottoming around 22000. What’s developed since is a classic structural shift from distribution → accumulation → potential markup let's discuss.

After the downtrend price attempted a retracement rally, but it was rejected at the prior breakdown zone and creating a clear horizontal resistance. This rejection led to a base formation supported by a series of higher lows, indicating reduced selling pressure and early signs of buyer strength.

Eventually, Nifty broke above the resistance zone and more importantly held its retest, turning resistance into support. This clean breakout + retest structure is often a precursor to trend continuation.

Technical Highlights-:

Primary Downtrend: 26000 To 23000.

Failed Retracement Resistance: 24800.

Breakout Confirmation: Price moved above and retested 24800.

Structure: Series of higher lows.

Support Zone: 24800 To 24500.

Momentum: Bullish price action with controlled pullbacks.

Trade Setup-:

Bias: Long

Entry: Current levels or dips toward 24900

Stop-Loss: Below 24500

Target:26000, 26300 (previous all-time high zone)

Rationale-:

This trade aligns with classic price action principles:

Breakdown zone turned into support.

Structure of higher lows holding firm.

Valid breakout-retest confirmation.

Risk clearly defined with natural invalidation.

With Nifty respecting structure and momentum building gradually, a revisit to the 26300 zone looks increasingly probable in the coming weeks.

Hope you will like the idea, Best regards- Amit.

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。