Macro Overview

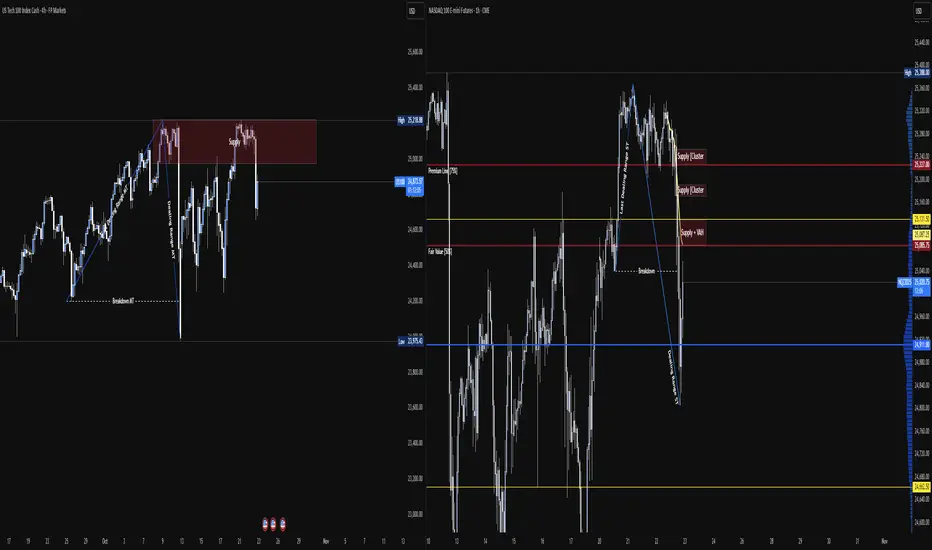

After the daily structure break, the market retraced into the origin supply zone, confirming the redistribution phase.

Today, price re-entered the macro Value Area and is now approaching the VAH, where institutional activity may lead to a new redistribution cycle toward the lower value edge (VAL).

The medium-term bias remains bearish — the short-term structure has realigned with it.

Context Summary

– Daily: confirmed bearish structure after origin breakdown.

– Re-entry into macro VA after short-term extension.

– VAH at 25,130–25,227 aligns with supply + negative delta clusters.

– Fibonacci 0.75 level (25,228.50) marks the center of premium liquidity.

– Bias remains short below VAH.

Execution Plan

Bias: Short [Medium & Short-term alignment]

Entry Zone: 25,087.50 → 25,228.50 (Supply + VAH + 0.75 Fib)

Stop Loss: 25,370

TP1: 24,800.00

TP2: 24,650.50 (VAL)

Trigger: Redistribution on negative delta cluster near VAH.

After the daily structure break, the market retraced into the origin supply zone, confirming the redistribution phase.

Today, price re-entered the macro Value Area and is now approaching the VAH, where institutional activity may lead to a new redistribution cycle toward the lower value edge (VAL).

The medium-term bias remains bearish — the short-term structure has realigned with it.

Context Summary

– Daily: confirmed bearish structure after origin breakdown.

– Re-entry into macro VA after short-term extension.

– VAH at 25,130–25,227 aligns with supply + negative delta clusters.

– Fibonacci 0.75 level (25,228.50) marks the center of premium liquidity.

– Bias remains short below VAH.

Execution Plan

Bias: Short [Medium & Short-term alignment]

Entry Zone: 25,087.50 → 25,228.50 (Supply + VAH + 0.75 Fib)

Stop Loss: 25,370

TP1: 24,800.00

TP2: 24,650.50 (VAL)

Trigger: Redistribution on negative delta cluster near VAH.

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。