echnical Overview:

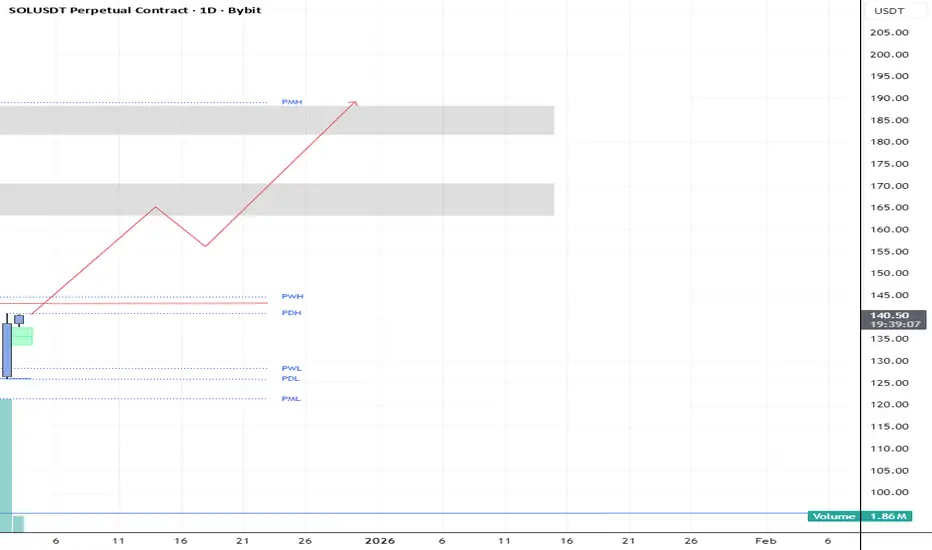

Timeframe: 1 Day

Pair: SOL/USDT

Bias: Bullish (Reversal / Expansion Phase)

Context:

Price swept the previous weekly low (PWL) and daily low (PDL) liquidity before showing a strong bullish rejection candle from the discount zone.

The reaction suggests accumulation and potential for a bullish expansion phase targeting premium liquidity levels.

Structure Breakdown:

Liquidity Sweep: Price cleared downside liquidity below 130–135 zone before rebounding sharply.

BOS: A break of short-term structure to the upside signals shift in order flow.

Imbalance Zone: Small FVG (green box) is being mitigated, confirming strength from buyers.

Target Zones:

PDH / PWH: Near 150–155 USDT – short-term liquidity targets.

PWH / PMH: Around 175–185 USDT – long-term bullish objective.

Invalidation: Daily close below 128–130 would invalidate the bullish outlook.

Timeframe: 1 Day

Pair: SOL/USDT

Bias: Bullish (Reversal / Expansion Phase)

Context:

Price swept the previous weekly low (PWL) and daily low (PDL) liquidity before showing a strong bullish rejection candle from the discount zone.

The reaction suggests accumulation and potential for a bullish expansion phase targeting premium liquidity levels.

Structure Breakdown:

Liquidity Sweep: Price cleared downside liquidity below 130–135 zone before rebounding sharply.

BOS: A break of short-term structure to the upside signals shift in order flow.

Imbalance Zone: Small FVG (green box) is being mitigated, confirming strength from buyers.

Target Zones:

PDH / PWH: Near 150–155 USDT – short-term liquidity targets.

PWH / PMH: Around 175–185 USDT – long-term bullish objective.

Invalidation: Daily close below 128–130 would invalidate the bullish outlook.

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。