1. Market Structure Overview

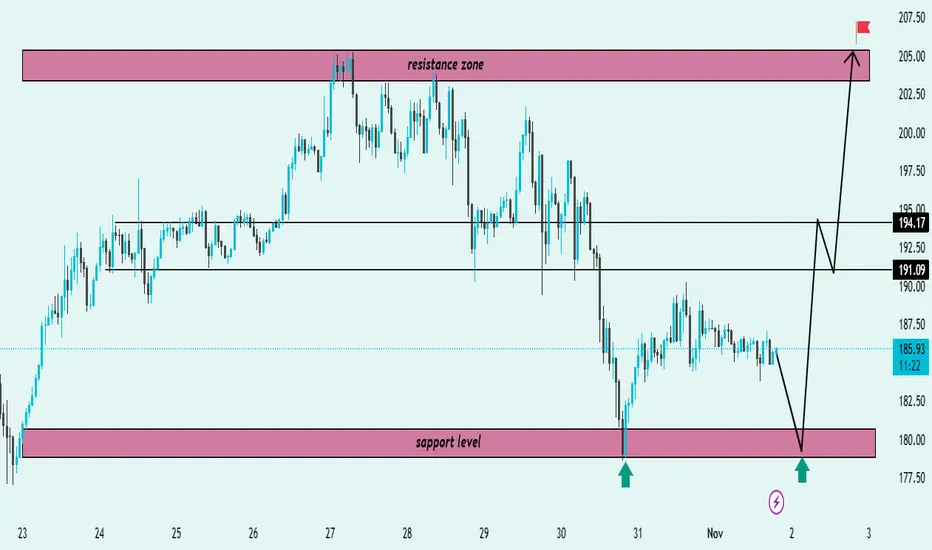

The chart shows Solana (SOL/USDT) trading within a well-defined range between a support level (~$179–$182) and a resistance zone (~$203–$207).

The price has recently tested the support zone multiple times (marked by green arrows), confirming its strength as a key demand area.

2. Key Technical Levels

Support Level: $179–$182 → Major demand zone where price has bounced twice.

Resistance Zone: $203–$207 → Supply area where previous rallies have reversed.

Mid-level Zones:

$191.09: Intermediate resistance (potential short-term reaction point).

$194.17: Secondary resistance before the upper target zone.

3. Price Action Insight

Price is currently consolidating around $185, showing indecision after a prior drop.

The black projection arrows suggest a potential liquidity sweep of the support zone before a bullish reversal.

Expected structure:

A final dip toward $180 to retest support.

A bullish reaction leading to a higher low formation.

A break above $191–$194, confirming bullish continuation.

A final push toward the resistance zone ($205) — the main target.

4. Trade Bias

Bias: Bullish from support

Confirmation Needed: Strong bullish candle or breakout from $191 resistance.

Invalidation: Daily close below $178 support.

5. Target Projection

Primary Target: $194

Final Target: $205 (resistance zone / flagged target)

Summary:

SOL/USDT is showing a potential bullish reversal setup from the $180 support zone. If price confirms strength with a bounce and breaks above $191–$194, the next rally could target the $205 resistance zone. A breakdown below $178 would invalidate the bullish scenario.

The chart shows Solana (SOL/USDT) trading within a well-defined range between a support level (~$179–$182) and a resistance zone (~$203–$207).

The price has recently tested the support zone multiple times (marked by green arrows), confirming its strength as a key demand area.

2. Key Technical Levels

Support Level: $179–$182 → Major demand zone where price has bounced twice.

Resistance Zone: $203–$207 → Supply area where previous rallies have reversed.

Mid-level Zones:

$191.09: Intermediate resistance (potential short-term reaction point).

$194.17: Secondary resistance before the upper target zone.

3. Price Action Insight

Price is currently consolidating around $185, showing indecision after a prior drop.

The black projection arrows suggest a potential liquidity sweep of the support zone before a bullish reversal.

Expected structure:

A final dip toward $180 to retest support.

A bullish reaction leading to a higher low formation.

A break above $191–$194, confirming bullish continuation.

A final push toward the resistance zone ($205) — the main target.

4. Trade Bias

Bias: Bullish from support

Confirmation Needed: Strong bullish candle or breakout from $191 resistance.

Invalidation: Daily close below $178 support.

5. Target Projection

Primary Target: $194

Final Target: $205 (resistance zone / flagged target)

Summary:

SOL/USDT is showing a potential bullish reversal setup from the $180 support zone. If price confirms strength with a bounce and breaks above $191–$194, the next rally could target the $205 resistance zone. A breakdown below $178 would invalidate the bullish scenario.

交易开始

JOIN MY TELEGRAM CHANNEL LINK 👇🏻

t.me/Classicallegendschool

t.me/Classicallegendschool

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

JOIN MY TELEGRAM CHANNEL LINK 👇🏻

t.me/Classicallegendschool

t.me/Classicallegendschool

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。