The Short Case: Overbought Technicals and Valuation Stretch

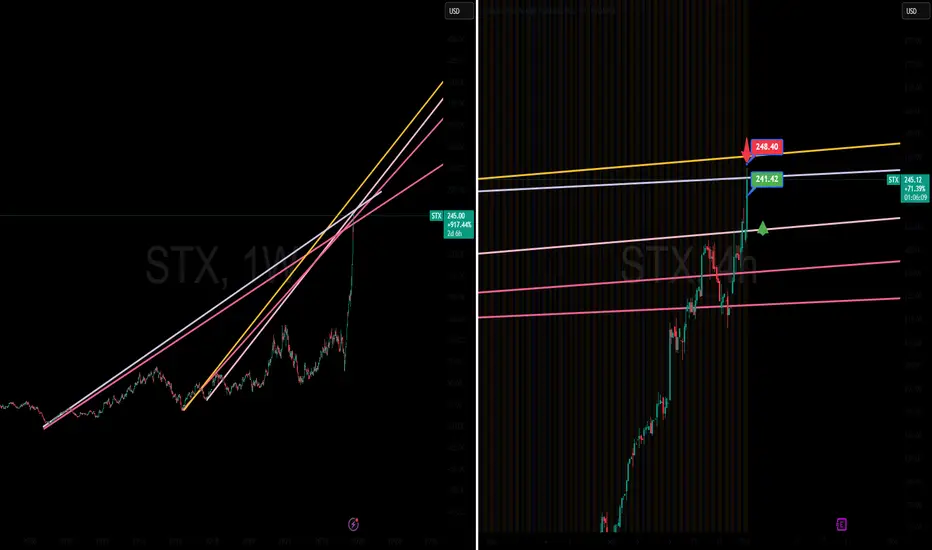

The primary argument for a tactical short trade on Seagate Technology (STX) is purely based on the extreme rate of recent appreciation and overbought technicals, which create a high-probability mean-reversion setup.

Extreme Price Momentum: The stock has seen a massive YTD rally (over 150%) and has been climbing rapidly over the last month (up ≈37% in the last month alone). This kind of parabolic move is rarely sustainable without a period of consolidation or a sharp pullback.

Overbought Indicators: Multiple technical analysis sources (from the search) indicate that STX is overbought on key oscillators like the RSI (Relative Strength Index) and Williams %R. While an overbought condition can persist, it signals increased risk for a momentum reversal.

Price Target Disparity (Risk): Although STX is benefiting from the AI/Mass Data boom, its current price ($236.06 - $248.80 range) is well above the consensus average analyst price target of approximately $173.58. Trading this far above the median fair value exposes the stock to significant downside if any news catalysts shift sentiment or if analysts begin lowering ratings/price targets.

Trade Idea:

Initial Short (Red Arrow): Short a smaller position at $244.60, anticipating the top is near after the large run.

Scale-In (Aggressive/High-Risk): Only if trading volume is extremely high and the price briefly tags $248.80 then immediately reverses lower (a 'blow-off' top), you could aggressively add to the short at $248.80 with a tight stop-loss above it.

Take Profit (Green Arrow): Cover the entire short position at $240.84 for a swift profit.

The primary argument for a tactical short trade on Seagate Technology (STX) is purely based on the extreme rate of recent appreciation and overbought technicals, which create a high-probability mean-reversion setup.

Extreme Price Momentum: The stock has seen a massive YTD rally (over 150%) and has been climbing rapidly over the last month (up ≈37% in the last month alone). This kind of parabolic move is rarely sustainable without a period of consolidation or a sharp pullback.

Overbought Indicators: Multiple technical analysis sources (from the search) indicate that STX is overbought on key oscillators like the RSI (Relative Strength Index) and Williams %R. While an overbought condition can persist, it signals increased risk for a momentum reversal.

Price Target Disparity (Risk): Although STX is benefiting from the AI/Mass Data boom, its current price ($236.06 - $248.80 range) is well above the consensus average analyst price target of approximately $173.58. Trading this far above the median fair value exposes the stock to significant downside if any news catalysts shift sentiment or if analysts begin lowering ratings/price targets.

Trade Idea:

Initial Short (Red Arrow): Short a smaller position at $244.60, anticipating the top is near after the large run.

Scale-In (Aggressive/High-Risk): Only if trading volume is extremely high and the price briefly tags $248.80 then immediately reverses lower (a 'blow-off' top), you could aggressively add to the short at $248.80 with a tight stop-loss above it.

Take Profit (Green Arrow): Cover the entire short position at $240.84 for a swift profit.

GoldenTraders is a premier trading community dedicated to helping you navigate the complexities of the financial markets with confidence and clarity.

Please join for more trade Ideas.

GoldenTraders: discord.gg/nrCvUT8yzt

Please join for more trade Ideas.

GoldenTraders: discord.gg/nrCvUT8yzt

免责声明

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

GoldenTraders is a premier trading community dedicated to helping you navigate the complexities of the financial markets with confidence and clarity.

Please join for more trade Ideas.

GoldenTraders: discord.gg/nrCvUT8yzt

Please join for more trade Ideas.

GoldenTraders: discord.gg/nrCvUT8yzt

免责声明

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.