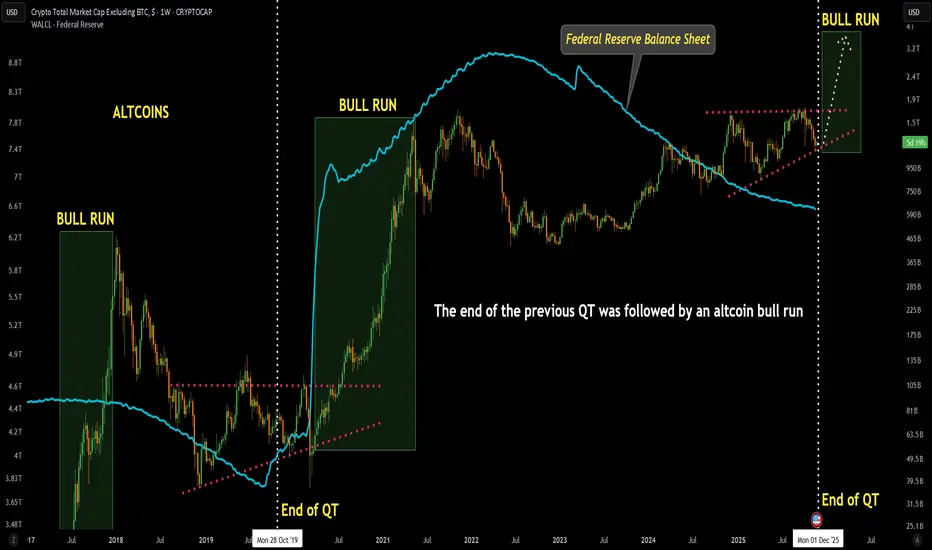

Altcoin Total Market Cap (excluding BTC) with Fed Res Balance Sh

📈 BULLISH BIAS

My Strong Bias Based on This Chart:

Altcoins are setting up for a massive macro breakout sometime after QT ends, likely aligning with 2025/2026 liquidity expansion.

✔ Ascending triangle at macro scale

✔ Higher lows for 3+ years

✔ Liquidity cycle bottoming

✔ Historical repeatability

✔ Market cap still below all-time-high resistance

This is a textbook accumulation → expansion setup.

Bullish Scenario

If the pattern breaks the 1.6–1.8T resistance:

Altcoin market cap could rise to 3–4T in the next macro wave

Strongest rallies likely in high-beta alts (Layer 1s, AI, RWA, gaming, DePIN)

📌 This aligns with the historical 2–3× expansions after QT ends.

Timing:

This chart places the next projected end of QT around Dec 2025, aligning with:

Falling inflation

Slowing economy

Future liquidity cycle turning

Expected rate cuts cycle (market pricing 2025 pivot)

This adds macro confirmation to a bullish thesis.

📉 Bearish Scenario (Risk Factors)

A bearish shift happens if:

Macro conditions worsen dramatically

Fed delays the liquidity pivot

Breaks the ascending support (~1.1T)

This would push altcoins into a deeper consolidation.

But based on liquidity trends, this is less likely.

🎯 Final Bias

The chart is strongly bullish.

Altcoins are compressing inside a macro ascending triangle, and historical patterns show a massive bull run begins when QT ends. My projection for a Dec 2025–2026 altcoin explosion is highly aligned with macro liquidity cycles.

This is one of the strongest macro setups for altcoins we’ve had in years.

My Strong Bias Based on This Chart:

Altcoins are setting up for a massive macro breakout sometime after QT ends, likely aligning with 2025/2026 liquidity expansion.

✔ Ascending triangle at macro scale

✔ Higher lows for 3+ years

✔ Liquidity cycle bottoming

✔ Historical repeatability

✔ Market cap still below all-time-high resistance

This is a textbook accumulation → expansion setup.

Bullish Scenario

If the pattern breaks the 1.6–1.8T resistance:

Altcoin market cap could rise to 3–4T in the next macro wave

Strongest rallies likely in high-beta alts (Layer 1s, AI, RWA, gaming, DePIN)

📌 This aligns with the historical 2–3× expansions after QT ends.

Timing:

This chart places the next projected end of QT around Dec 2025, aligning with:

Falling inflation

Slowing economy

Future liquidity cycle turning

Expected rate cuts cycle (market pricing 2025 pivot)

This adds macro confirmation to a bullish thesis.

📉 Bearish Scenario (Risk Factors)

A bearish shift happens if:

Macro conditions worsen dramatically

Fed delays the liquidity pivot

Breaks the ascending support (~1.1T)

This would push altcoins into a deeper consolidation.

But based on liquidity trends, this is less likely.

🎯 Final Bias

The chart is strongly bullish.

Altcoins are compressing inside a macro ascending triangle, and historical patterns show a massive bull run begins when QT ends. My projection for a Dec 2025–2026 altcoin explosion is highly aligned with macro liquidity cycles.

This is one of the strongest macro setups for altcoins we’ve had in years.

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。