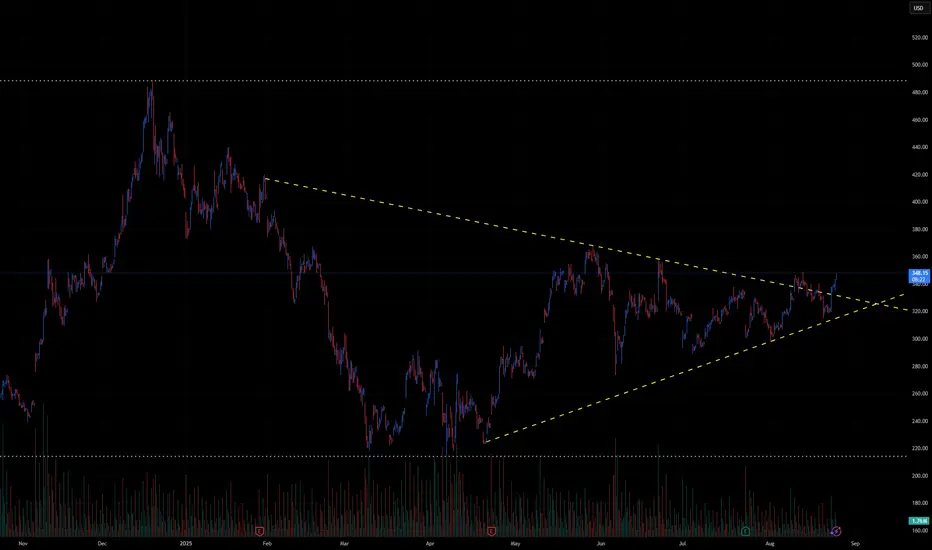

🚗 TSLA Technical Outlook – Symmetrical Triangle Breakout Watch

Ticker: TSLA (Tesla, Inc.)

Timeframe: 30-minute candles

🔍 Current Setup

TSLA has been consolidating for months inside a large symmetrical triangle, marked by:

Descending resistance: from ~380 down to ~347.

Ascending support: from April lows near ~240, now rising toward ~320.

Current price: ~348, testing the upper boundary of the triangle.

This structure signals compression after a major downtrend, and the breakout direction will likely define TSLA’s next big move.

📊 Breakout Levels

🚀 Upside (Bullish Scenario)

Trigger: Break and close above 350–355.

Intermediate Targets:

370–380 → First resistance zone.

400–420 → Extension levels.

Measured Move Target: ~450+ (based on the triangle height projection).

🔻 Downside (Bearish Scenario)

Trigger: Failure at resistance and break below 320, confirmation under 310.

Intermediate Supports:

300 → Psychological level.

280–260 → Stronger support zone.

Measured Move Target: ~250 (triangle projection downward).

📈 Volume Analysis

Volume has been contracting steadily during the triangle’s formation.

A major volume spike will be key to confirming whichever direction TSLA chooses.

⚖️ Probability Bias

TSLA is at the make-or-break resistance zone (~350).

A breakout above 355 would strongly favor bulls, targeting 380 → 400+.

But a rejection here and break below 320 would shift momentum bearish, sending TSLA back toward 280–260.

✅ Takeaway

TSLA is at a critical inflection point inside a long-term triangle:

Bullish Break > 355: Targets 370 → 400 → 450+

Bearish Break < 320: Targets 300 → 280 → 250

Watch for volume-backed confirmation, as this move could define Tesla’s next multi-week trend.

Ticker: TSLA (Tesla, Inc.)

Timeframe: 30-minute candles

🔍 Current Setup

TSLA has been consolidating for months inside a large symmetrical triangle, marked by:

Descending resistance: from ~380 down to ~347.

Ascending support: from April lows near ~240, now rising toward ~320.

Current price: ~348, testing the upper boundary of the triangle.

This structure signals compression after a major downtrend, and the breakout direction will likely define TSLA’s next big move.

📊 Breakout Levels

🚀 Upside (Bullish Scenario)

Trigger: Break and close above 350–355.

Intermediate Targets:

370–380 → First resistance zone.

400–420 → Extension levels.

Measured Move Target: ~450+ (based on the triangle height projection).

🔻 Downside (Bearish Scenario)

Trigger: Failure at resistance and break below 320, confirmation under 310.

Intermediate Supports:

300 → Psychological level.

280–260 → Stronger support zone.

Measured Move Target: ~250 (triangle projection downward).

📈 Volume Analysis

Volume has been contracting steadily during the triangle’s formation.

A major volume spike will be key to confirming whichever direction TSLA chooses.

⚖️ Probability Bias

TSLA is at the make-or-break resistance zone (~350).

A breakout above 355 would strongly favor bulls, targeting 380 → 400+.

But a rejection here and break below 320 would shift momentum bearish, sending TSLA back toward 280–260.

✅ Takeaway

TSLA is at a critical inflection point inside a long-term triangle:

Bullish Break > 355: Targets 370 → 400 → 450+

Bearish Break < 320: Targets 300 → 280 → 250

Watch for volume-backed confirmation, as this move could define Tesla’s next multi-week trend.

交易开始

MASSIVE WIN OVER $420 TODAY免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。