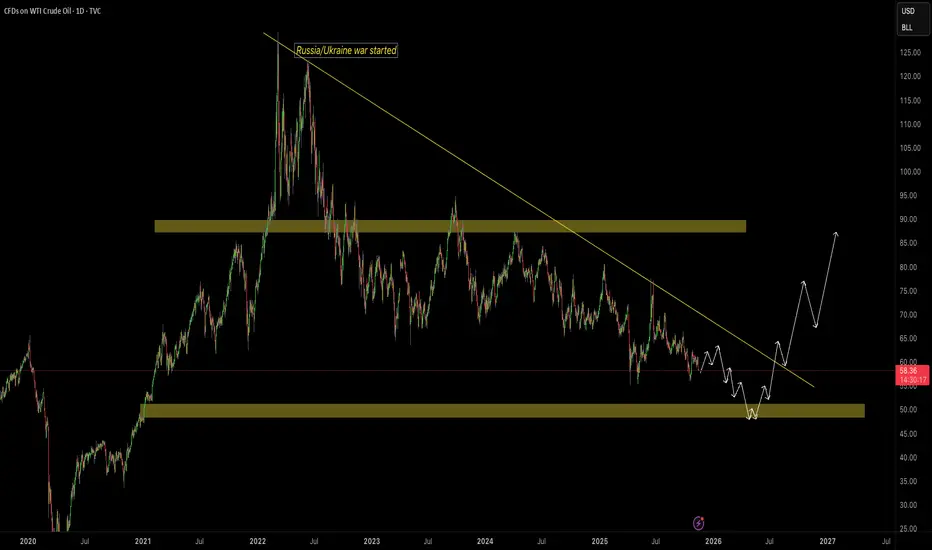

On the HTF, we can see Crude oil has overall been bearish since 2022 because :

- Geopolitical tensions priced in and faded out.

- Decreased oil consumption of oil. Demand reduced

- Oversupply concerns - OPEC maintained higher levels of oil product. Too much supply & less supply hence lower oil Prices.

· Historically, The markets keep an equilibrium on the price of oil which healthy prices being around $40 - $80 per barrel. This is where oil spends most of its time.

They wouldn’t let oil price drop too low since it would cost producers too much & if its too high, then the consumers will suffer so price always remain a balance.

Future Analysis/forecasts:

· Now we are seeing that Major central banks around the world adopting loose monetary policies and cutting interest rates following suits with the Federal Reserve.

-This would result in more economic activity, more manufacturers using oil etc therefor the demand for Oil will pick up again and we can see price start to rise.

- Geopolitical tensions priced in and faded out.

- Decreased oil consumption of oil. Demand reduced

- Oversupply concerns - OPEC maintained higher levels of oil product. Too much supply & less supply hence lower oil Prices.

· Historically, The markets keep an equilibrium on the price of oil which healthy prices being around $40 - $80 per barrel. This is where oil spends most of its time.

They wouldn’t let oil price drop too low since it would cost producers too much & if its too high, then the consumers will suffer so price always remain a balance.

Future Analysis/forecasts:

· Now we are seeing that Major central banks around the world adopting loose monetary policies and cutting interest rates following suits with the Federal Reserve.

-This would result in more economic activity, more manufacturers using oil etc therefor the demand for Oil will pick up again and we can see price start to rise.

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。