Supply Side: The oversupply situation has become a consensus, and the geo-political support has failed

- Global supply remains consistently tight: The OPEC report in November adjusted the global oil situation to be in an oversupply state. The current daily production exceeds demand by 500,000 barrels, while the previous month's estimate was a shortage of 400,000 barrels. The IEA has continuously raised the expected global crude oil supply surplus for six consecutive months, and it is predicted that in 2026, there will be a record-breaking surplus of nearly 4 million barrels per day. At the same time, the supply increase in the United States is significant. As of the week of November 21, the total number of oil drilling rigs in the United States increased to 419. The Trump administration also plans to open new drilling areas in the west coast and the Arctic. Additionally, although OPEC+ has suspended production increases in the first quarter of next year, the overall supply growth trend remains strong, making it difficult to change the oversupply situation.

- Geopolitical risks have marginally eased: There have been signals of peace talks in the Ukraine conflict. US officials stated that Ukraine has agreed to the terms of the peace agreement, with only some details yet to be finalized. Zelensky expects to "as soon as possible" visit the United States to advance the agreement. This news has weakened the geopolitical risk premium for oil. Although Russian refineries and export ports have been attacked multiple times recently, Russia can buffer through methods such as temporary storage in floating tanks, and the short-term export pressure is limited, making it difficult to have a substantive impact on supply.

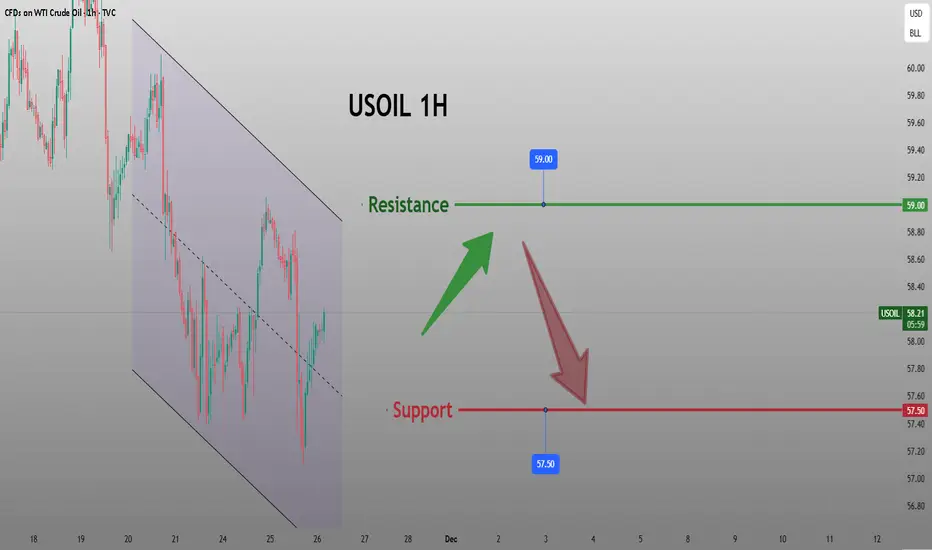

Crude Oil Strategy Analysis

sell:58.5-59

tp:58-57.5

sl:59.5

- Global supply remains consistently tight: The OPEC report in November adjusted the global oil situation to be in an oversupply state. The current daily production exceeds demand by 500,000 barrels, while the previous month's estimate was a shortage of 400,000 barrels. The IEA has continuously raised the expected global crude oil supply surplus for six consecutive months, and it is predicted that in 2026, there will be a record-breaking surplus of nearly 4 million barrels per day. At the same time, the supply increase in the United States is significant. As of the week of November 21, the total number of oil drilling rigs in the United States increased to 419. The Trump administration also plans to open new drilling areas in the west coast and the Arctic. Additionally, although OPEC+ has suspended production increases in the first quarter of next year, the overall supply growth trend remains strong, making it difficult to change the oversupply situation.

- Geopolitical risks have marginally eased: There have been signals of peace talks in the Ukraine conflict. US officials stated that Ukraine has agreed to the terms of the peace agreement, with only some details yet to be finalized. Zelensky expects to "as soon as possible" visit the United States to advance the agreement. This news has weakened the geopolitical risk premium for oil. Although Russian refineries and export ports have been attacked multiple times recently, Russia can buffer through methods such as temporary storage in floating tanks, and the short-term export pressure is limited, making it difficult to have a substantive impact on supply.

Crude Oil Strategy Analysis

sell:58.5-59

tp:58-57.5

sl:59.5

交易开始

Demand side: Seasonal off-peak period approaching, with weak boost: Current crude oil demand has shown signs of weakness. High-frequency data indicates that the total demand for refined oil products has not shown sufficient recovery, and it is about to enter the seasonal off-peak period with a gradual decline. The pace of global economic recovery has slowed down, and the IEA predicts that the growth rate of crude oil demand in the coming years will only be 80 - 120 thousand barrels per day, far below the historical average. Although the operating rate of US refineries has rebounded to 90%, it is only a small increase due to seasonal stocking for heating purposes, and it is difficult to reverse the overall weakness in the demand side.Market sentiment and related indicators: Short sellers dominate, with limited impact from the US dollar: The net long position of WTI oil price funds has dropped to a five-year low, indicating a low bullish sentiment in the market. The WTI spot spread has turned into a futures premium state, indicating a sufficient supply in the short term, further reinforcing the bearish expectations of the market. At the same time, although the expectation of US interest rate cuts persists, the fluctuation of the US dollar index has been covered by the supply and demand fundamentals, and it is difficult to provide effective support for crude oil.

Trading strategies and analysis: Gold, BTC, crude oil, foreign exchange, etc.

Free trading signals: t.me/+xTRS6kLO0VFkZjIx

Free trading signals: t.me/+xTRS6kLO0VFkZjIx

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

Trading strategies and analysis: Gold, BTC, crude oil, foreign exchange, etc.

Free trading signals: t.me/+xTRS6kLO0VFkZjIx

Free trading signals: t.me/+xTRS6kLO0VFkZjIx

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。