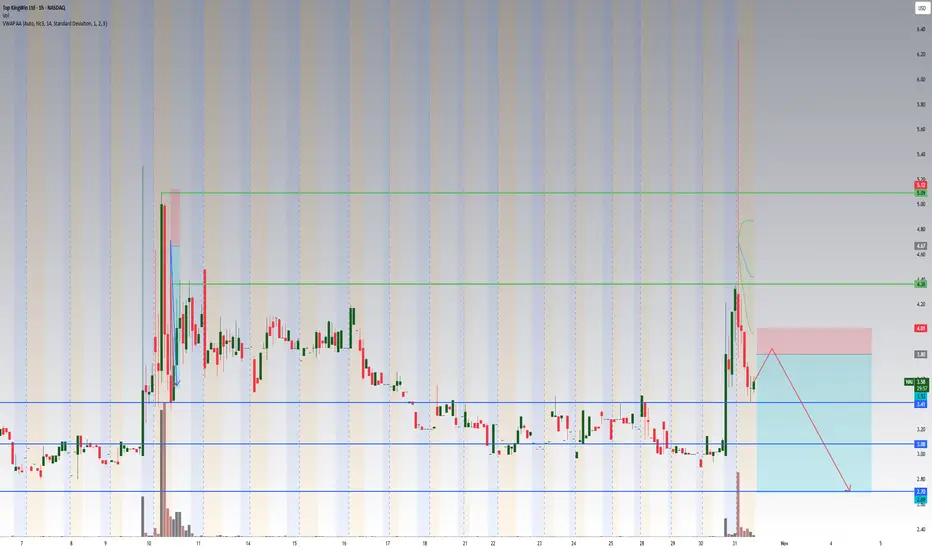

Ticker: WAI (Top KingWin Ltd)

Sector: Financial / China micro-cap

Float: ~1.8M

Pre-market Change: +17%

Pre-market Volume: ~3.9M

Rotation: ~2× float

Bias: Short after exhaustion

📊 Thesis

WAI is showing a low-float, low-volume gap with around 2× float rotation in pre-market trading.

These types of moves often start with a fast emotional push shortly after the open, followed by a sharp fade once liquidity dries up.

The float is small enough to attract momentum traders, but total dollar volume (~$14M) suggests limited sustainability unless volume expands aggressively at the open.

📈 Trading Plan

Zone Level Action

Resistance / Short zone 3.80–4.00 Watch for a failed breakout or topping wick

Confirmation add Below 3.50 (VWAP fail) Short continuation trigger

Stop-loss 4.20 Above morning breakout / high-of-day

Target 1 3.40 VWAP / early support

Target 2 3.00 Gap-fill zone

Target 3 2.80–2.60 Full unwind potential if volume dies out

⚙️ Trade Logic

Wait for first push into resistance (3.80–4.00).

Look for rejection wicks + heavy tape stall.

Confirm short only after VWAP rejection and break under 3.50.

Gradual scale-out through support levels — no need to overstay.

🧠 Key Notes

Avoid chasing pre-market moves; liquidity is limited.

Use smaller size and limit orders only due to low float.

Stay flexible — if VWAP is reclaimed and held for 15+ minutes, cut and reassess.

Summary:

WAI has decent pre-market attention but lacks the volume depth to sustain higher levels. A controlled short approach near $4.00, using VWAP confirmation, offers the best asymmetry for a morning fade.

Sector: Financial / China micro-cap

Float: ~1.8M

Pre-market Change: +17%

Pre-market Volume: ~3.9M

Rotation: ~2× float

Bias: Short after exhaustion

📊 Thesis

WAI is showing a low-float, low-volume gap with around 2× float rotation in pre-market trading.

These types of moves often start with a fast emotional push shortly after the open, followed by a sharp fade once liquidity dries up.

The float is small enough to attract momentum traders, but total dollar volume (~$14M) suggests limited sustainability unless volume expands aggressively at the open.

📈 Trading Plan

Zone Level Action

Resistance / Short zone 3.80–4.00 Watch for a failed breakout or topping wick

Confirmation add Below 3.50 (VWAP fail) Short continuation trigger

Stop-loss 4.20 Above morning breakout / high-of-day

Target 1 3.40 VWAP / early support

Target 2 3.00 Gap-fill zone

Target 3 2.80–2.60 Full unwind potential if volume dies out

⚙️ Trade Logic

Wait for first push into resistance (3.80–4.00).

Look for rejection wicks + heavy tape stall.

Confirm short only after VWAP rejection and break under 3.50.

Gradual scale-out through support levels — no need to overstay.

🧠 Key Notes

Avoid chasing pre-market moves; liquidity is limited.

Use smaller size and limit orders only due to low float.

Stay flexible — if VWAP is reclaimed and held for 15+ minutes, cut and reassess.

Summary:

WAI has decent pre-market attention but lacks the volume depth to sustain higher levels. A controlled short approach near $4.00, using VWAP confirmation, offers the best asymmetry for a morning fade.

交易结束:到达目标

Sharing clean, logical market analysis focused on liquidity, structure and volume. No signals, no pressure — just education. If you want more insights, you’re welcome to join: t.me/CE3vdc5m72w4MjRk

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

Sharing clean, logical market analysis focused on liquidity, structure and volume. No signals, no pressure — just education. If you want more insights, you’re welcome to join: t.me/CE3vdc5m72w4MjRk

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。