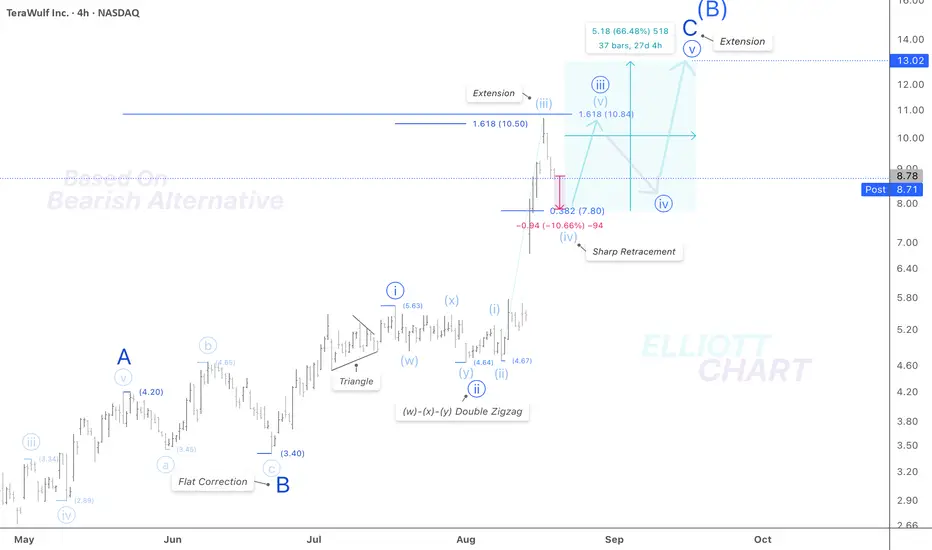

As anticipated,  WULF pulled back 6.4% today, in line with the ongoing corrective phase of Wave (iv).

WULF pulled back 6.4% today, in line with the ongoing corrective phase of Wave (iv).

📉Wave Analysis

The extending impulsive Minor Wave C may have completed internal subwave (iii) of Minute Wave iii(circled), peaking slightly above the 10.50 Fibonacci extension target. As anticipated, a sharp retracement in Wave (iv) is now unfolding, with price declining toward the 0.382 Fibonacci retracement level. >> 7.80

📈Trend Analysis

The upward trend — with a potential final rise of 66% and a technical target 🎯near $13 — is expected to continue into mid-September. Once the structure of Minor Wave C completes, the countertrend advance of Intermediate Wave (B) — the second leg of a developing flat correction in Primary Wave ②, in progress since April 9 — will likely give way to a similarly graded decline in Wave (C), possibly extending through year-end.

#CryptoStocks #WULF #BTCMining #BitcoinMining #BTC

WULF $MARKETSCOM:BITCOIN

WULF $MARKETSCOM:BITCOIN  BTC

BTC  BTCUSD

BTCUSD

📉Wave Analysis

The extending impulsive Minor Wave C may have completed internal subwave (iii) of Minute Wave iii(circled), peaking slightly above the 10.50 Fibonacci extension target. As anticipated, a sharp retracement in Wave (iv) is now unfolding, with price declining toward the 0.382 Fibonacci retracement level. >> 7.80

📈Trend Analysis

The upward trend — with a potential final rise of 66% and a technical target 🎯near $13 — is expected to continue into mid-September. Once the structure of Minor Wave C completes, the countertrend advance of Intermediate Wave (B) — the second leg of a developing flat correction in Primary Wave ②, in progress since April 9 — will likely give way to a similarly graded decline in Wave (C), possibly extending through year-end.

#CryptoStocks #WULF #BTCMining #BitcoinMining #BTC

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。