Wave Analysis — Bullish Alternative Scenario📈 (Long-Term)

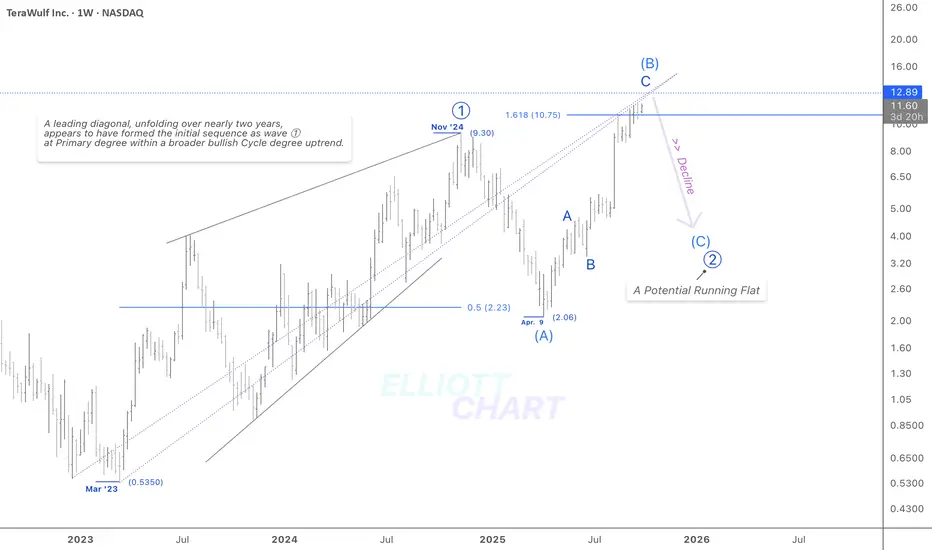

As a potentially bullish alternative, Primary Wave ⓵ may have formed as a Leading Diagonal at the root of a broader upward trend likely in Cycle degree and has been correcting through its Primary Wave ⓶ since November.

The second leg of this correction — Intermediate Wave (B), a countertrend rally — appears to be in its final stages, edging below the key equivalence lines of Diagonal Wave ⓵ — 📑part of my personal technical approach.

Once Wave (B) completes, a final decline in Int. Wave (C) is expected, likely completing the (A)-(B)-(C) corrective sequence as a Running Flat — thereby finalizing Primary Wave ⓶.

#StocksToWatch #MarketAnalysis #TechnicalAnalysis #ElliottWave #WaveAnalysis #TrendAnalysis #FibLevels #FinTwit #TradingView

#Investing #WULF #DataCenters #BitcoinMining #CryptoMining #AIStocks #HPC #AI #BTC #Bitcoin #BTCUSD WULF

WULF  BTC

BTC  AI

AI  BTCUSD

BTCUSD  BITCOIN

BITCOIN

As a potentially bullish alternative, Primary Wave ⓵ may have formed as a Leading Diagonal at the root of a broader upward trend likely in Cycle degree and has been correcting through its Primary Wave ⓶ since November.

The second leg of this correction — Intermediate Wave (B), a countertrend rally — appears to be in its final stages, edging below the key equivalence lines of Diagonal Wave ⓵ — 📑part of my personal technical approach.

Once Wave (B) completes, a final decline in Int. Wave (C) is expected, likely completing the (A)-(B)-(C) corrective sequence as a Running Flat — thereby finalizing Primary Wave ⓶.

#StocksToWatch #MarketAnalysis #TechnicalAnalysis #ElliottWave #WaveAnalysis #TrendAnalysis #FibLevels #FinTwit #TradingView

#Investing #WULF #DataCenters #BitcoinMining #CryptoMining #AIStocks #HPC #AI #BTC #Bitcoin #BTCUSD

免责声明

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

免责声明

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.