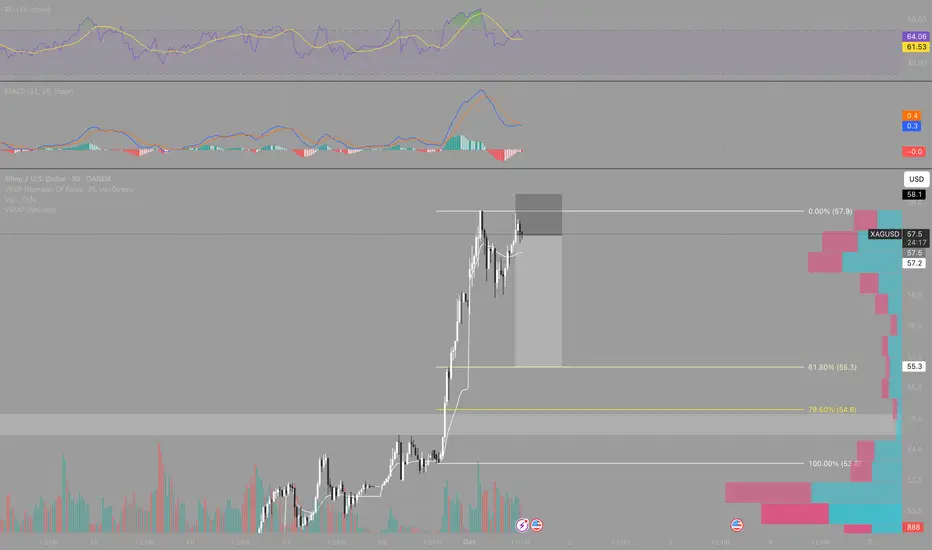

This is not a high-probability setup, but it is a tactical idea that can offer a good risk-to-reward with small risk: price is at resistance after a very vertical move, showing signs of exhaustion and some confluence with a potential bounce on the DXY.

The plan is a low-risk short with attractive R:R:

• Entry around the current rejection / highs.

• Tight stop above the recent high.

• Targets at corrective levels (VWAP / volume nodes / Fibonacci retracements of the last bullish leg).

The point is not to “catch the final top”, but to exploit a possible corrective move inside a broader uptrend on the higher timeframes.

In fact, the ideal scenario would be that this correction actually develops, so that:

1. Price and RSI can cool down from these extended levels.

2. A clear, confirmed support forms (reaction in price, volume, clean rejection).

3. Then we can look for long entries aligned with the main trend, with a much better structure and lower squeeze risk.

In short: the current short is a speculative trade with controlled risk and good potential R:R, but the higher-probability plan is still to let the correction play out and join the long side from a solid support.

The plan is a low-risk short with attractive R:R:

• Entry around the current rejection / highs.

• Tight stop above the recent high.

• Targets at corrective levels (VWAP / volume nodes / Fibonacci retracements of the last bullish leg).

The point is not to “catch the final top”, but to exploit a possible corrective move inside a broader uptrend on the higher timeframes.

In fact, the ideal scenario would be that this correction actually develops, so that:

1. Price and RSI can cool down from these extended levels.

2. A clear, confirmed support forms (reaction in price, volume, clean rejection).

3. Then we can look for long entries aligned with the main trend, with a much better structure and lower squeeze risk.

In short: the current short is a speculative trade with controlled risk and good potential R:R, but the higher-probability plan is still to let the correction play out and join the long side from a solid support.

注释

Quick update: price has now pushed back into the 78.6% retracement (~57.6) and is respecting the short-term descending trendline on M15, forming a potential lower high. The current M15 candle is the last one of the active H1 candle, so its close is key.• If this M15 candle closes bearish, it will leave a clean H1 rejection right at the 78.6% Fib.

• That same close would also favour a bearish MACD cross on M15, confirming loss of upside momentum exactly at resistance.

I am already in the short from this zone; a bearish close here would be the ideal confirmation for the scenario outlined earlier: corrective move lower from 78.6%, first target around 57.2–57.0 (where I plan to move the stop to break-even), with room for deeper downside if momentum picks up.

注释

In this kind of setup I always like to move my stop to breakeven as soon as the trade develops a bit, knowing it can reverse at any moment. It can feel frustrating to get tagged out at breakeven over and over, but it’s the best way to protect capital – especially when the whole point of the trade is simply to get exposure to a potentially larger move.I’m not trying to “be right”; I’m trying to participate in a move with a high risk-reward profile while risking as little as possible. That’s why I focus on zones where price often reacts and gives me the chance to get the trade to breakeven quickly.

注释

If we see a break above 57.3 its good signal to hold a little bit more交易开始

Okey okey, good signal, but we still observing the price and evaluating posible BE注释

Im looking the price to reach 61.8% (57.0) and 78.6 (56.8) in 5 mins. If I see rejection and big volume here im out or BE, depend of the strength of the reactions.注释

We see a strong reaction in 5 mins candles but still respecting the HH and LL, so we looking now to see a continuation of this structure on lower timeframes. If we see some equal low or a break of the top trend line in 5 mins we should close the trade.注释

Im moving sl above the latest hh in lower timeframes aprox 57.7注释

I add an other point with very low risk an sl very close注释

two entries: 57.682 and 57.418 SL 57.9 TP 54.85注释

If the price reacts 57,271 out注释

if breaks this zone down, we still holding a bit more注释

Good signal here: we just had a fake breakout on the lower timeframes above the intraday descending trendline and into the 61.8–78.6% zone, followed by an immediate rejection back below it.

• On the 1m/15m you can see price spike above the trendline, fail, and then dump back inside the short box, keeping the sequence of lower highs intact.

• The last push into ~57.5–57.7 was sold aggressively and we’re now trading back below the 61.8% retracement, with RSI and MACD rolling over again.

For now I’m still holding the short, but carefully:

• Bias remains to the downside as long as price stays below 57.5–57.6.

• The plan is the same: protect capital first (stop at breakeven as soon as possible) and let the position work only if the correction extends towards the lower levels discussed earlier.

Fake breakout + rejection at Fib resistance is a good confirmation for the idea, but it’s still a counter-trend trade, so risk management stays tight.

注释

fake fakeout??注释

or fake fake fakeout???注释

its a typical fake fake fake takeout fake注释

hold it注释

Get ready for the roller coaster注释

a hard trade its always a good trade注释

Bulltrap注释

We still there注释

hold on boy 注释

Every body its out now so lets see交易结束:到达止损

we out, small loss SL hit on 57.9免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。