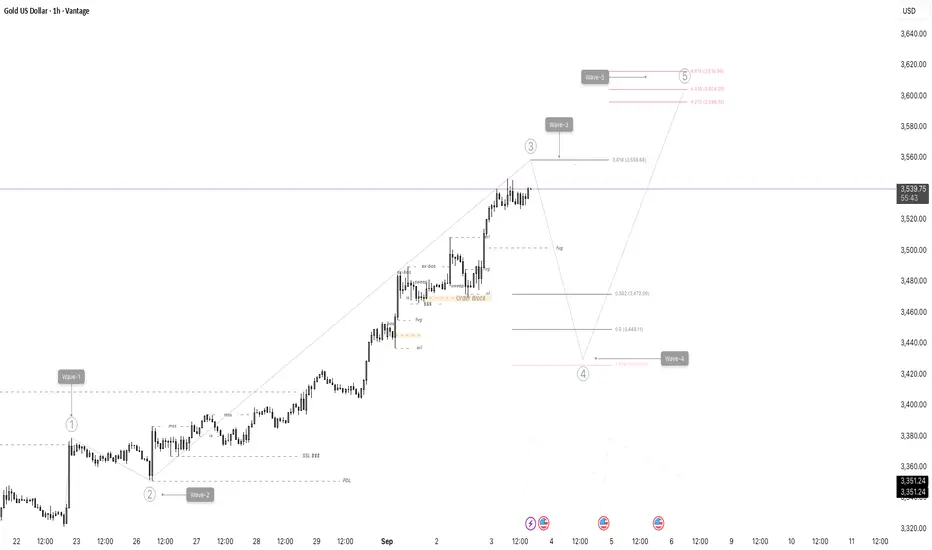

This trading plan combines Elliott Wave analysis with Fibonacci retracement and extension levels, focusing on key psychological points to guide entry, exit, and risk management decisions for the Gold/USD 1-hour chart.

Fibonacci Levels & Psychological Zones:

Wave 3 is approaching a Fibonacci extension zone near 3,558 - 3,616 (from 3.618 to 4.618 levels). This acts as a key resistance and potential Wave 3 target.

The retracement for Wave 4 correction is expected to land within the important Fibonacci retracement zones:

- 38.2% (~3,472)

- 50% (~3,449)

- 61.8% (~3,426)

These Fibonacci levels serve as psychological support zones where Wave 4 could end and Wave 5 might begin.

Fibonacci Levels & Psychological Zones:

Wave 3 is approaching a Fibonacci extension zone near 3,558 - 3,616 (from 3.618 to 4.618 levels). This acts as a key resistance and potential Wave 3 target.

The retracement for Wave 4 correction is expected to land within the important Fibonacci retracement zones:

- 38.2% (~3,472)

- 50% (~3,449)

- 61.8% (~3,426)

These Fibonacci levels serve as psychological support zones where Wave 4 could end and Wave 5 might begin.

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。