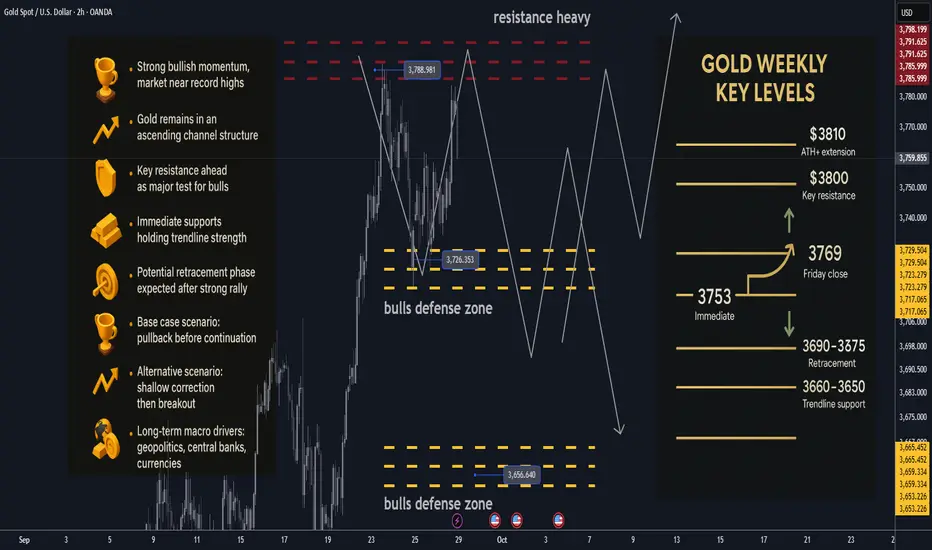

🏆 Friday’s Close & Recent ATH: Gold closed the week near $3,769, not far from its latest all-time high ($3,734) as bullish momentum continues to dominate. Every dip is being met with strong buying interest, reinforcing the uptrend.

📈 Trend Structure: The market remains firmly inside an ascending channel on both 1H and 4H charts. The broader structure is bullish, with corrections appearing as healthy consolidations rather than reversals.

🔑 Key Resistance Levels: The most critical resistance sits at $3,800, a psychological and technical barrier. Beyond that, $3,810–3,820 represents potential breakout extension targets if bulls push through.

🛡️ Support Zones: Immediate support rests at $3,753–3,755, aligned with a rising trendline. Deeper supports lie at $3,690–3,675, with stronger downside protection at $3,660–3,650. A sustained break below $3,650 would signal deeper correction risk.

⚖️ Likely Scenarios:

o Scenario 1 (Base Case) – A short-term pullback toward support before continuation higher.

o Scenario 2 – A shallow correction, followed by a direct breakout above $3,800.

Probabilities currently favor Scenario 1 due to overbought conditions.

📊 Short-Term Targets: On continuation, upside levels to monitor are $3,740 → $3,780 → $3,800, with a possible push toward $3,810 ATH+ extension.

💡 Market Sentiment Drivers: Geopolitical tensions, central bank accumulation, and persistent currency debasement concerns remain key macro tailwinds. These factors underpin the long-term bullish bias, despite near-term choppiness.

🔄 Retracement Outlook: Analysts suggest a retracement is due after the strong run-up. A controlled dip into the $3,660–3,640 zone could offer buying opportunities for swing traders targeting another leg higher.

🧭 Risk Levels to Watch: Holding above the ascending trendline (around $3,630–3,640) keeps the bullish structure intact. A decisive break below this area could trigger a deeper correction toward channel midpoints.

🚀 Overall Weekly Outlook: Gold remains in a strong bullish trajectory with $3,800 as the major battleground. Expect short-term pullbacks, but the path of least resistance is still higher, with long-term prospects pointing toward $4,000.

📈 Trend Structure: The market remains firmly inside an ascending channel on both 1H and 4H charts. The broader structure is bullish, with corrections appearing as healthy consolidations rather than reversals.

🔑 Key Resistance Levels: The most critical resistance sits at $3,800, a psychological and technical barrier. Beyond that, $3,810–3,820 represents potential breakout extension targets if bulls push through.

🛡️ Support Zones: Immediate support rests at $3,753–3,755, aligned with a rising trendline. Deeper supports lie at $3,690–3,675, with stronger downside protection at $3,660–3,650. A sustained break below $3,650 would signal deeper correction risk.

⚖️ Likely Scenarios:

o Scenario 1 (Base Case) – A short-term pullback toward support before continuation higher.

o Scenario 2 – A shallow correction, followed by a direct breakout above $3,800.

Probabilities currently favor Scenario 1 due to overbought conditions.

📊 Short-Term Targets: On continuation, upside levels to monitor are $3,740 → $3,780 → $3,800, with a possible push toward $3,810 ATH+ extension.

💡 Market Sentiment Drivers: Geopolitical tensions, central bank accumulation, and persistent currency debasement concerns remain key macro tailwinds. These factors underpin the long-term bullish bias, despite near-term choppiness.

🔄 Retracement Outlook: Analysts suggest a retracement is due after the strong run-up. A controlled dip into the $3,660–3,640 zone could offer buying opportunities for swing traders targeting another leg higher.

🧭 Risk Levels to Watch: Holding above the ascending trendline (around $3,630–3,640) keeps the bullish structure intact. A decisive break below this area could trigger a deeper correction toward channel midpoints.

🚀 Overall Weekly Outlook: Gold remains in a strong bullish trajectory with $3,800 as the major battleground. Expect short-term pullbacks, but the path of least resistance is still higher, with long-term prospects pointing toward $4,000.

注释

🎁Please hit the like button and🎁Leave a comment to support our team!

注释

broke 3800/3810 USD resistance and set a new ATHon Sunday Asian market open. 3900/3950 USD up next.

注释

gold broke ATH and now trading at 3865 USD.silver also getting ready for the ATH breakout.

注释

odds of US govt shutdown increased to 75% overnight注释

ProjectSyndicate Market Summary | Weekly update📊 WTD performance

🟡 GOLD (XAUUSD): ~3,882.00 | +148.00 (+3.97 %)

💶 EURUSD: ~1.1742 | +42 pips (+0.36 %)

💷 GBPUSD: ~1.3449 | +50 pips (+0.37 %)

💴 USDJPY: ~147.47 | −138 pips (−0.93 %)

📈 SPX: ~6,715.79 | +77.84 (+1.17 %)

📈 NDX: ~24,800.73 | +297.60 (+1.21 %)

🗞 Highlights This Week (Gold & FX)

🇺🇸 Dovish Fed expectations re-ignited on weak private payrolls, fueling gold and pressuring USD

🟡 Gold pierced $3,890 intraday and held above $3,850 amid safe-haven demand

💶 EUR/USD rallied on USD softness; GBP/USD held gains amid mixed UK data

💴 JPY strengthened as USD weakness and risk aversion boosted Yen demand

📈 U.S. equities gained modestly as rate cut hopes kept sentiment supported

🟡 Gold Market Note – This Week

Gold extended its rally, reclaiming fresh highs near $3,890/oz as expectations for multiple Fed cuts gained traction.

Support zones now cluster near $3,800, while resistance lies above $3,900. The metal remains on track for a strong weekly close.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1400%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1400%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

相关出版物

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1400%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1400%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

相关出版物

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。