青岚加密课堂:1月30日 BTC分析| 利空缠身,比特币何去何从?欢迎来到青岚加密课堂,咱们今天对BTC 四个周期包括消息面进行分析:

-------------------------

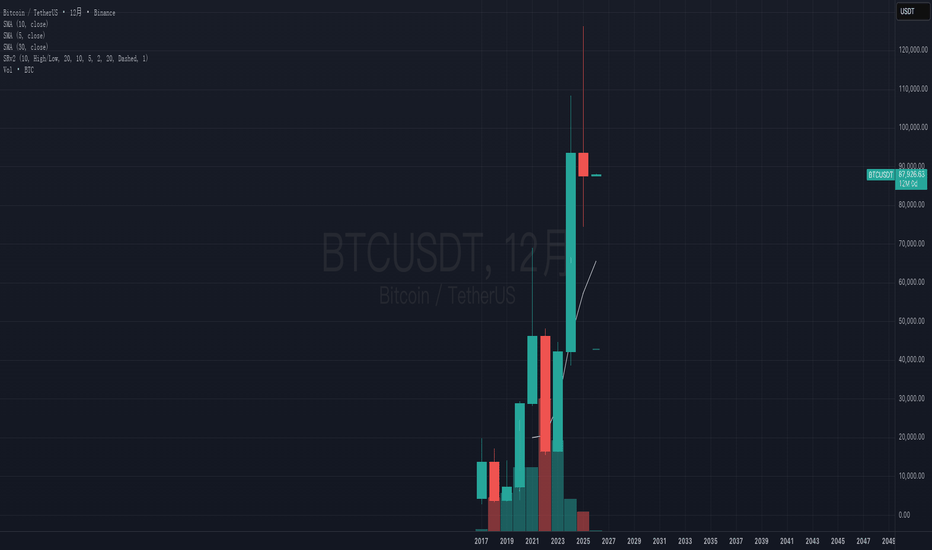

首先来看技术面,最近这段时间,BTCUSDT的走势真是弱势得有点让人心疼呀:

* 15分钟图(短线): 哎呀,你看,最近的K线,比特币从8万8附近一路跌到了现在8万2千5左右,跌幅不小哦。目前的MA均线系统,5周期和10周期均线已经死死地压在20周期均线下方了,呈现出典型的空头排列。MACD指标呢,DIF和DEA都在零轴下方,虽然绿柱(空头动能)看起来稍微有那么一点点缩短,但整体依然是强烈的空头态势。RSI指标现在38左右,已经进入了超卖区域,说明短线抛压有点重了,可能会有技术性修复,但反弹空间预计不大。

* 1小时图(中短线): 和15分钟图的情况差不多,更长的K线也在讲同一个故事——下跌。MA均线系统也是标准空头排列,价格在所有均线下方挣扎。MACD方面,DIF和DEA深陷零轴以下,绿柱子还在那里顽强地扩张着,空头力量非常足。RSI呢,25左右,这可真是跌得很厉害了,妥妥的深层超卖区,暗示着这里可能会有那么一丢丢的反弹需求。

* 4小时图(中长线): 看看最近的K线,下跌趋势是更加明确和强劲的。所有MA均线都呈现空头排列,价格离它们越来越远。MACD更是夸张,DIF线大幅度地在DEA线下方运行,而且绿柱子还在加速放大,这简直就是空头开足了马力在往下冲啊!RSI指标23左右,也是一个非常低的超卖水平,但架不住MACD的强大空头信号,反弹空间看起来有限。

* 1日图(长线): 咱们把时间拉长到日线图,虽然之前有过反弹,但最近这几根K线也是连续收阴,价格已经跌破了所有重要的日线均线。MA均线系统同样是空头排列。MACD的DIF线也死叉了DEA,而且都在零轴下方,绿柱子才刚刚开始放大,这意味着日线级别的空头趋势才刚刚确立并可能加速。RSI指标30左右,也刚刚触及超卖边缘,这可不是一个容易V型反转的位置,反而更像是一个趋势的延续。

再来结合消息面,最近的消息面那真是“利空缠身”呀:

你看,新闻里好多都在说比特币跌破了8万5,甚至一度触及8万1,市场流动性激增,高达17.5亿美元的多头头寸被爆仓,这可不是个小数目。大家都在担心8万美元的关键支撑位能不能守住,甚至有分析说,如果8万守不住,可能就要去7万5了!这种恐慌情绪是实实在在的。

而且,不仅仅是加密货币圈,全球市场都弥漫着避险情绪。A股、黄金、白银、大宗商品都在跌,地缘政治紧张局势也让投资者们纷纷撤离风险资产。虽然有一些关于DePIN、RWA代币化、Solana ETF流入等积极消息,但这些大多是细分领域或者长期利好,短期内根本抵挡不住BTC这波资金外流和恐慌情绪。就连咱们青岚姐的分析也说得很清楚:“偏空,轻仓博反弹”,还提到了“BTC变盘预警,隔夜巨震后早盘如何防守”,这跟咱们的技术分析是高度一致的。

综合以上所有分析,咱们的预判是这样的:

目前比特币(BTCUSDT)在短、中、长期都处于明确的下跌趋势中。虽然15分钟、1小时和4小时图的RSI都显示市场处于超卖状态,可能会引发技术性的小幅反弹,但这种反弹很可能只是下跌途中的修正,而非趋势反转。尤其是日线级别的MACD空头动能才刚开始显现,这预示着下跌趋势可能还会继续。

关键的支撑位和阻力位,咱们得看好了:

* 当前最关键的支撑位: 就是81000美元附近,这里如果被有效跌破,下一个目标很可能就是80000美元的整数关口。咱们要特别留意,新闻里甚至提到了75000美元,咱们要做好最坏的打算。

* 近期遇到的阻力位: 短期反弹可能会在83500-84000美元附近遇到阻力,这里是15分钟和1小时图上的一些均线压力。如果能站稳,下一道阻力就是85000美元这个重要的心理关口和之前的支撑位,这里现在已经转化为强阻力了哦。

至于可能出现的反转形态: 鉴于目前这种多周期共振的下跌态势,短线出现V型反转的可能性很小。更可能的是价格会在某个关键支撑位附近进行震荡筑底,以消化卖盘,但目前还没有看到明确的底部反转形态。

做单思路嘛: 咱们现在整体上要保持偏空的思路,短期的技术性反弹可以看作是做空的机会,但一定要轻仓操作,因为这种超卖情况下的反弹也可能比较剧烈。如果没有十足把握,咱们就选择观望,等待更明确的筑底信号出现。记住,风险控制永远是第一位的!

最后,青岚姐给大家一句交易金句吧:“市场永远是对的,但你的策略决定了你是否能活下来,别跟趋势较劲,也别跟钱过不去。”

-------------------------

受限于图表篇幅和平台合规准则,行情分析有时效性,

最新的分析已更新在我的青岚加密课堂:qinglan.org

或欢迎点击我的头像关注我,通过主页展示的渠道进行更多技术探讨。

Btc!

青岚加密课堂:2026年1月28日早间BTC行情分析欢迎来到青岚加密课堂,咱们今天对BTC 四个周期包括消息面进行分析:

1. 整体趋势判断

长期趋势(日线图):从日线图看,咱们的MA均线是空头排列的,MA5 < MA10 < MA20,价格也在这几根均线下方。MACD DIF线死叉DEA线,而且负柱体还在放大,RSI也处于中低位并继续下行。这说明啥呢?哎呀,长期来看,咱们BTC是处于一个下跌调整的阶段,之前的上涨势头受到了比较大的打击哦。消息面上,虽然有南达科他州计划投资比特币、机构持续增持这些长期利好,但像达里奥的宏观悲观预警、知名投资人看淡加密这些声音,也给长期走势蒙上了一层阴影,大盘在消化之前的高位风险。

中期趋势(4小时图):不过呀,在中期4小时图上,咱们看到了一个比较积极的信号!MA均线已经形成了多头排列,MA5 > MA10 > MA20,而且MACD的DIF线已经金叉了DEA线,红柱子也放得挺大的。RSI也是从低位回升。这说明在中期,经过之前的深度回调,咱们BTC正在努力反弹上涨呢!消息面上的以太坊ETF资金回流、Tether推出合规稳定币、多家银行布局比特币服务,都是给这个中期反弹提供了资金和信心的支撑。

短期趋势(1小时和15分钟图):再看回咱们短期的1小时和15分钟图,情况就有点复杂了。1小时图上,MA5虽然下穿了MA10,但整体均线(MA5, MA10 > MA20)还是多头排列的,MACD红柱子在缩短,RSI也在回落,说明短期多头动能有所减弱,进入震荡调整。15分钟图上,就更明显啦,MA均线开始形成空头排列,MACD DIF线已经死叉DEA线,绿柱子在放大,RSI也在持续回落。这说明在超短期,咱们BTC是呈现震荡偏空的走势,有回调压力哦。消息面也印证了这一点,青岚姐的早报里就说了BTC失守89k,9万美金是关键阻力,还有“坠落之星”的K线预警,都提示咱们短期不要急着追高。

2. 关键支撑位和阻力位

强阻力位:根据技术分析和消息面,咱们的90000美元是一个非常关键的心理关口和技术阻力。1小时图上的MA20大约在88500附近,中期4小时图的MA20大约在88193附近。短期来看,89600美元也是一个重要的压力位,如果上不去,回踩的可能性就大。往上冲的话,9万关口上方,就要密切关注日线图上的MA10(约89216)和MA20(约91397)了,这些都是比较强的阻力。

强支撑位:短期来看,88500美元是一个需要关注的支撑。如果这个位置守不住,下一个支撑可能会在88000美元附近,这也是1小时图的MA20附近。再往下,就得看4小时图的MA10(约88528)和MA20(约88193)附近了。更远一点,日线图在86000美元附近也有前期低点支撑,这个位置会是比较强的心理防线,不能轻易跌破哦。

3. 可能出现的反转形态

短期内:15分钟和1小时图上,由于多头动能减弱,咱们需要警惕形成M头(双顶)或者头肩顶的风险,尤其是在89600-90000美元区域久攻不下时,如果快速跌破支撑位,那就真的要小心了。

中期内:4小时图目前是上涨趋势,但MACD金叉后红柱体已经在缩短,如果DIF线再次下穿DEA线形成死叉,那就要警惕回调的加深,甚至可能形成震荡平台后选择方向。

长期内:日线图已经处于下跌调整,如果86000美元附近的支撑能够稳固,并且配合更多利好消息刺激,咱们是有可能走出W底(双底)的形态,或者形成一个更大级别的区间震荡筑底。

4. 咱们的做单思路总结

综合来看,咱们BTC当前处于一个长期偏空但中期反弹,短期震荡偏空的复杂局面。

不要急着追高!9万美元是一个非常重要的关口,消息面和技术面都提示咱们这个位置有很强的阻力。

短线操作要谨慎:如果你是短线交易者,当前15分钟和1小时图都显示多头动能减弱,甚至有回调迹象,可以考虑在89600-90000美元附近轻仓尝试做空,目标看88500、88000甚至更低。但记得严格止损,毕竟中期反弹的势头还在。

中长线布局等待机会:对于中长线投资者,现在不是一个追高的好时机。咱们可以耐心等待,如果价格能有效突破90000美元并站稳,或者回踩到87000-88000美元的支撑区间并出现明确的止跌信号,结合消息面的利好继续释放,那才是咱们逢低布局,或者确认突破后跟进的好机会。

关注宏观面:美元指数的走弱、黄金的上涨,长期看是利好比特币的,但短期内这种资金轮动可能造成加密货币的波动。特朗普的美联储主席人选和FOMC会议,都可能带来政策不确定性,咱们要保持警惕。

总而言之,目前是多空交织,博弈激烈的阶段。咱们要做的就是保持冷静,管住手,在关键位置附近多看少动,等待市场给出更明确的方向信号,或者等待更具性价比的入场机会。

市场是人性的放大器,耐心与纪律,才是穿越牛熊的船票。

-------------------------

受限于图表篇幅和平台合规准则,行情分析有时效性,

最新的分析已更新在我的青岚加密课堂:qinglan.org

或欢迎点击我的头像关注我,通过主页展示的渠道进行更多技术探讨。

青岚加密课堂:2026年1月27日早间BTC行情分析欢迎来到青岚加密课堂,咱们今天对BTC 四个周期包括消息面进行分析:

多周期技术面分析

咱们先从大局观开始,再慢慢聚焦到短期走势。

1. 1日图(长期趋势)

哎呀,从日线图来看,最近40根K线可真是走得不怎么漂亮。价格呀,一直被MA5、MA10、MA20这几根均线压得死死的,均线呈现一个明显的空头排列(短期均线在长期均线下方)。最近的收盘价88609.48,还是在所有均线下方呢,这说明呀,长期趋势目前是下跌的。

MACD指标更是一言难尽,DIF线和DEA线都在零轴下方,并且DIF还在DEA下方,MACD柱子也是长长的负值,显示空头动能非常强劲。RSI指标在43左右,虽然不是极度超卖,但也偏弱,没有看到强烈的反转信号。

关键支撑位:日线级别的强支撑,咱们可以先关注一下86000美元这个区域,这是最近一段时间的低点;更远一点,85000美元附近也会有一定支撑力。

关键阻力位:上方的阻力首先是MA5均线(约88490),然后是MA10(约89619),再往上就是90000美元这个整数关口和MA20(约91471)。

2. 4小时图(中期趋势)

4小时图和日线图的情况有点类似,也是在一个下降通道里挣扎。虽然最近的几根K线有尝试向上反弹,比如最新的收盘价88609.47稍微站上了MA5,但价格依然在MA10和MA20下方,均线排列依旧是空头趋势。所以,中期趋势仍是下跌,但有企稳反弹的迹象。

MACD指标虽然DIF和DEA还在零轴下方,显示空头主导,但DIF线已经开始向上勾头,有尝试上穿DEA的趋势,MACD柱子也从深绿柱缩短,甚至开始出现微弱的红柱,这说明呀,下行动能有所减弱,可能会出现一波反弹。RSI也是在43左右,从之前的低位有所回升,没有进入超卖区,给了咱们一些反弹的想象空间。

关键支撑位:短期支撑在88200-88000美元区域,如果跌破,下一站就是87000美元。

关键阻力位:上方阻力首先是MA10(约89619),然后是90000美元整数关口。

3. 1小时图(短中期趋势)

哇,咱们再来看1小时图,这里就有点不一样了哦!最新的收盘价88609.47,已经稳稳地站上了MA5、MA10、MA20,并且均线已经形成了一个小小的多头排列(MA5 > MA10 > MA20),这可是个积极信号!MACD指标也给力,DIF线已经上穿DEA形成金叉,并且两者都来到了零轴上方,MACD柱子也是红柱,且在不断拉长,显示短中期趋势目前是上涨的,多头动能正在增强。

RSI指标在59左右,处于一个健康的强势区域,并没有过热,说明上涨还有空间。

关键支撑位:短线支撑可以看MA5(约88400),88000美元也是一个关键支撑。

关键阻力位:咱们可以关注88800-89000美元这个小平台,突破后上看90000美元。

4. 15分钟图(短期趋势)

嗯,最短期的15分钟图,跟1小时图的节奏是差不多的。价格在88609.48,同样位于所有短期均线上方,并且MA5、MA10、MA20也是多头排列,显示短期趋势是上涨的。

MACD指标DIF线虽然在最新的K线中稍微向下勾头,但依然在DEA上方,且MACD柱子仍为正,只是略有缩短,说明短期上涨动能略有放缓,但强势格局未变。RSI在60左右,同样健康。

关键支撑位:最近的MA5均线(约88584)是第一支撑,然后是88450。

关键阻力位:上方的88800-89000美元仍是关键阻力区域。

---

消息面结合分析

咱们技术面看完了,再来结合这些最新的消息面,理一理思路。

从消息面来看,整体氛围有点谨慎偏空。

利空消息比较突出的是:

【1】稳定币市值缩水,资金流向黄金而不是比特币,这说明市场情绪很脆弱,加密生态系统正在经历资金流出,而不是流入等待抄底,这个信号非常重要,会压制BTC的长期走势。

【26】比特币错失宏观利好,黄金和股市却表现强劲,甚至ETF都有大额流出(【28】提到隔夜ETF流出17.3亿),这都表明比特币目前的“数字黄金”叙事并不被市场广泛认可,避险属性不足。

【23】美国政府可能在1月30日停摆,历史数据显示这对比特币并非利好,增加了宏观不确定性。

【46】【48】MicroStrategy虽然还在买,但买入速度放缓,而且融资模式是发股,这让市场有些担心。

当然,也有一些利好消息,但更多是围绕着以太坊和一些特定赛道:

【3】【49】英国批准比特币以太坊ETP、贝莱德上线比特币收益ETF,这些都是机构合规化进程的积极信号,长期来看是利好,能为市场引入更多资金。

【36】【37】【47】Bitmine大举增持ETH,构建百亿以太坊金库并质押,这显示了机构对ETH的信心,也会间接提振整个加密市场。

【12】ZKP加密货币等特定赛道表现抢眼,说明市场热点还在,但资金分散了。

总结一下消息面给咱们的启发:

尽管短期技术面有反弹迹象,但宏观上资金正撤离加密市场,并且比特币未能抓住宏观利好,机构ETF持续流出,这些都给大盘蒙上了一层阴影。机构资金更青睐传统避险资产(黄金、白银)和传统股市。这表明,目前比特币的上涨缺乏坚实的外部资金支持,更多可能是内部资金轮动或短线抄底行为,反弹的持续性存疑。

---

交易建议和做单思路

综合咱们技术面和消息面的分析,现在可以给出明确的判断和做单思路啦!

短期趋势(15分钟/1小时):上涨

目前来看,1小时和15分钟图都呈现出明显的上涨结构,短期均线多头排列,MACD金叉并位于零轴上方,RSI也处于强势区域。这说明呀,最近几个小时比特币正在经历一波技术性反弹。

做单思路:短期可以考虑在回调时逢低做多,关注88400-88000美元附近的支撑。止损放在近期低点下方。

中期趋势(4小时):下跌中的反弹

4小时图虽然MACD有向上勾头的迹象,但整体均线仍然是空头排列,价格也还在MA10、MA20下方。这波反弹,在4小时级别上,更像是下跌趋势中的一次技术性反弹。

做单思路:对于中期操作者来说,如果短期反弹触及4小时级别的关键阻力位(比如90000美元或MA10)未能有效突破,同时伴随量能萎缩或出现顶部反转形态,可以考虑短线高空。咱们要警惕,不要把反弹当反转哦。

长期趋势(1日):下跌

日线图的空头趋势非常明显,MACD指标深陷零轴下方,均线空头排列。再加上消息面指出,资金正在持续流出加密市场,宏观利好未能转化为比特币的涨势,机构ETF也持续流出。这些都表明,长期来看,比特币仍然处于一个下跌趋势中,尚未见到明确的底部信号。

做单思路:对于长期投资者,目前仍建议保持谨慎观望,或者等待更明确的筑底信号出现。在86000美元甚至85000美元这样的强支撑区域可以考虑小仓位试探性建仓,但务必控制好风险。短期反弹都是给咱们降低成本或止损离场的机会。

关键支撑位和阻力位:

短期支撑:88400美元、88000美元。

中期支撑:87000美元、86000美元。

短期阻力:88800美元、89000美元。

中期阻力:90000美元、90500美元。

长期阻力:91500美元(日线MA20)、92000美元。

可能出现的反转形态:

短期:如果价格能放量突破89000美元并站稳,并伴随MACD金叉持续放量,则有望延续反弹至90000-91000美元。如果不能有效突破阻力,可能会形成M顶或头肩顶等短期看跌形态,再次回到震荡下跌。

中期/长期:目前日线和4小时级别,还没有看到明确的底部反转形态(比如W底、三重底或者长期趋势线的突破)。在没有基本面扭转(比如ETF资金持续流入、宏观环境极大改善)的情况下,目前的“反弹”都是在熊市大背景下的波动,很容易形成“一日游”行情,大家一定要小心呀。

咱们预判,目前BTCUSDT在短期内可能会在现有基础上继续小幅反弹,目标可能触及89000-90000美元区间。但是,由于中期和长期趋势仍然偏空,且消息面显示资金持续流出,缺乏上行动力,所以这波反弹大概率难以持久,一旦触及重要阻力位,很可能会再次承压回落。咱们做单思路就是:短期抓住反弹机会,但要快进快出,切忌恋战,中长期保持空头思维,等待高位做空或更低的支撑位。

---

最后,送给大家一句交易金句:

“市场情绪如潮汐,退潮时方知谁在裸泳。莫被短线诱惑,方能把握长线乾坤。”

希望今天的分析能帮到大家,咱们下期再见啦!

-------------------------

受限于图表篇幅和平台合规准则,行情分析有时效性,

最新的分析已更新在我的青岚加密课堂:qinglan.org

或欢迎点击我的头像关注我,通过主页展示的渠道进行更多技术探讨。

青梅煮币:为什么说BTC本轮底部可能在6万至6.9万美元? 一、从图表上分析

先看图,这是比特币的周线,自2018年以来的线形图。(线形图是按收盘价画的线,对于中长线可以去掉一些噪音)

形态上,有一个巨大的上升楔形,形态下沿也是上升趋势线,这是结构性的支撑,可能是本轮回调的底部。前一轮牛市是双顶结构,线形图的顶部(按周线收盘价计算),双顶构成的支撑区间是60000-66000,按K线图的顶部是64800 - 69000。随着时间推移,楔形下沿/趋势线的支撑在上移,与双顶支撑区重合。所以,总的来说,60000 - 69000是一个值得关注的区间,有可能在这里筑底。

二、比特币美股化

早年来看,比特币与美股没有相关性,但随着美国机构、公司、ETF等一系列的进入,比特币与美股相关度总的趋势是在增加的。美股的特点是回撤幅度通常不极端,回撤时间也往往较短。比特币可能会受到影响。

三、整体环境走向了量化宽松比特币与宏观经济政策的关系:即量化宽松政策从量化紧缩(QT)转向量化宽松(QE)后,比特币并没有立刻上涨,而经历了几个月的震荡之后,才反转向上,2019年时就是这样。

青岚加密课堂:2026年1月22日早间BTC行情分析欢迎来到青岚加密课堂,咱们今天对BTC 四个周期包括消息面进行分析:

1. 数据整合与技术面分析(短、中、长期趋势剖析)

咱们先从短周期看到长周期,把这些K线图揉在一起讲,这样大家更能理解当下市场的全貌。

15分钟 K线(超短线):震荡偏强,但波动剧烈,咱们要非常小心。

最近的45根15分钟K线,价格在88000附近获得支撑后,出现了一波强劲的反弹。MA均线系统在短线形成了一个小小的多头排列,MA5(90136)位于MA10(90008)和MA20(89987)上方,这说明短期的买盘动能是比较足的。MACD指标呢,DIF和DEA两条线刚在零轴上方完成了金叉,MACD柱状图也从负值转正,动能是积极的。RSI指标从低位爬升到了中性偏强的区域,没有超买。

但是呢,这波动可不小呀,前几个小时还从接近90300直接跌到88100附近,然后又迅速拉回90000上方,这说明短线多空博弈非常激烈,市场情绪很不稳定。

1小时 K线(短线/日内):止跌企稳,尝试反弹,但上方压力不小。

拉长到1小时图,咱们能看到BTC在经历了一波从93000跌到87000的下跌后,近期的K线开始收阳,价格回到了90000附近。MA均线系统虽然整体上还在一个偏空的区域,但MA5(89899)和MA10(89673)已经向上交叉,并且MA5甚至站到了MA20(89370)上方,这是一个积极的信号,说明短线的抛压有所缓解。MACD指标DIF线也刚刚从DEA线下方金叉,MACD柱状图从绿色转为红色,这同样支持了短线反弹的判断。RSI也从极度超卖的16.7回升到了54.93,说明市场情绪有所修复。

不过呀,咱们得留意,虽然止跌了,但反弹的力度还需要进一步观察。前期的下跌积累的套牢盘可不少呢。

4小时 K线(中线):下跌趋势中的修复性反弹,大趋势未改。

再来看4小时图,从97000跌到87000,这个下跌趋势是很明显的。目前价格在87000附近找到支撑后,也有了一定的反弹。MA均线排列上,短期均线(MA5, MA10)仍然在长期均线(MA20)下方缠绕,整体还是偏空头排列,尽管MA5(89829)在MA10(89663)上方,显示短期有支撑,但距离改变整体的空头格局还很远。MACD指标虽然也出现了金叉,但是DIF和DEA都还在零轴下方,并且MACD柱状图虽然转正,但数值非常小,这说明这次反弹的内在动能并不强劲,更像是下跌后的技术性修复。RSI从极度超卖的17.22回升到41.39,但仍在50中轴下方,没有站稳。

1日 K线(长线):明确的下跌趋势,当前处于关键支撑考验期。

日线图上,BTC从接近98000的高点一路跌到87000,这是个非常清晰的下跌趋势。MA均线系统呈现出标准的空头排列,MA5(90888)在MA10(93311)和MA20(92439)的下方(这里MA20比MA10小,有点小问题,但整体均线向下排列的趋势是清晰的)。MACD指标DIF和DEA线虽然还在零轴上方,但是DIF已经大幅度向下死叉DEA线,MACD柱状图是深红色的负值,并且在扩大,这清楚地表明日线级别的下跌动能依然强劲。RSI指标从高位70.05跌破了50中轴,目前在45.81,表明市场已经转为中性偏弱,空头占据主导。

2. 消息面结合与综合判断

咱们再把技术面和消息面结合起来看,会发现很多东西能相互印证呢。

首先,最近的行情波动剧烈,咱们技术面看到的15分钟和1小时的V形反弹,很大程度上是受到【35】和【38】特朗普关于取消关税的言论刺激。这种宏观利好消息,短期内提振了市场风险情绪,导致大量被套的多头平仓,甚至一些空头也开始回补,引发了【14】和【30】高达6.65亿美元甚至10亿美元的杠杆头寸清算,这正是价格剧烈震荡、迅速反弹的直接原因。

但是呢,【3】青岚姐自己的分析 和 【34】投资银行Compass Point的警告 都告诉咱们,虽然短期有反弹,但中期还是要谨慎,尤其是在98000美元(短期持有者平均成本线)这个关键阻力位未能突破前,追涨需谨慎。日线图的MACD死叉和RSI在中轴下方,也印证了【3】日线价格被MA20(92431美元)压制,空头排队的观点,以及【40】比特币创历史新高前,或将再次震荡回调的预测。

此外,【18】和【23】以太坊跌破3000美元,甚至有62.5%概率跌至2500美元的消息,也显示出主流币种整体市场的脆弱和悲观情绪,这对比特币也是一种拖累。【25】日本国债动荡也给全球金融市场带来了不确定性,风险资产自然会受到影响。

当然啦,长期来看,【19】和【22】贝莱德看好以太坊在代币化领域的潜力,以及【27】ARK Invest预测比特币可能达到80万美元,这些都是非常积极的长期叙事,说明数字资产的价值基础在不断加强。【29】Coinbase CEO在达沃斯激辩比特币,也提升了比特币的全球认可度。但这些长期利好,目前还没有转化为短期内改变下跌趋势的强大动能哦。

3. 交易建议与总结

综合来看,BTCUSDT目前正处于一个非常关键的节点。

短期(15分钟/1小时): 咱们看到了一波由消息面驱动的强劲反弹。

关键支撑位: 89500-89800美元。

关键阻力位: 90500-91000美元。

反转形态: 暂未形成明确的短线反转形态,更像是V型反弹后的高位震荡。如果90500-91000附近遇阻回落,可能会走出M顶形态。

做单思路: 短线操作空间小,波动大,不确定性强。如果你是激进的短线交易者,可以尝试在89500附近轻仓做多,目标90500-91000,但要严格止损,破89200立马离场。反之,如果在90500-91000附近出现滞涨或放量下跌,可考虑轻仓短空。

中期(4小时): 处于下跌趋势中的修复性反弹阶段。

关键支撑位: 88000-88500美元(前期低点),下方更强的支撑看87000-87500美元。

关键阻力位: 91000-91500美元(4小时MA均线压制),如果能突破并站稳,上方可看92000-92500美元。

反转形态: 目前的反弹缺乏强劲的底部结构支持,MACD和RSI虽有改善但力度不足。真正的反转需要看到更清晰的W底或头肩底形态,并在成交量的配合下突破重要阻力。

做单思路: 建议谨慎观望为主。如果你想参与,可以在91000-91500美元附近寻找做空机会,止损设置在92000上方。如果价格回调到87000-88000附近能再次获得支撑,并出现放量反弹信号,可以小仓位尝试多单。

长期(1日): 整体大趋势依旧是下跌,目前只是下跌途中的技术性调整。

关键支撑位: 85000-86000美元(消息面和日线K线反复提及的强支撑,也是箱体下沿)。这是咱们的“生命线”,一旦有效跌破,风险会进一步加大。

关键阻力位: 92000-93000美元(日线MA20压制),更强的阻力在94617美元(分析师提及的短期持有者平均成本线)。

反转形态: 日线级别的MACD仍处于死叉状态,RSI在中轴下方,没有看到任何长期反转的迹象。

做单思路: 长期投资者目前应保持观望。不建议在这个位置盲目抄底。在真正改变日线空头趋势,并有效突破94617美元阻力前,任何反弹都可视为逢高减仓或空头布局的机会。如果85000-86000的强支撑能够守住,并在此区域震荡筑底较长时间,再考虑长期布局也不迟。

总结一下呀,咱们的预判是: 短期可能还有冲高动能,但上方阻力重重,冲高后回落的风险很大。中期看,这波反弹更像是下跌趋势中的一个技术性修复,并不是大趋势的反转。长期来看,咱们的大饼还在下跌的通道里,需要时间和更明确的底部信号来确认方向。所以呀,做单思路就是:短线快进快出,中线高空为主,长线耐心等待,咱们宁可错过,也不要犯错!

交易金句: “市场永远是对的,但你的判断力可以让你站在对的那一边,而不是追逐它。”

希望这次分析能帮到大家,咱们下次再见!

-------------------------

受限于图表篇幅和平台合规准则,行情分析有时效性,

最新的分析已更新在我的青岚加密课堂:qinglan.org

或欢迎点击我的头像关注我,通过主页展示的渠道进行更多技术探讨。

青岚加密课堂:2026年1月19日早间BTC行情分析欢迎来到青岚加密课堂,咱们今天对BTC 四个周期包括消息面进行分析:

先说结论:短期暴跌后进入超卖修复,中期上涨结构面临考验,长期牛市格局仍在但需休整。整体预判为先反弹后震荡,关键看反弹力度。

一、 周期与技术面糅合分析

1. 日线(长期趋势):格局在,但累了。

趋势与形态:价格在1月14日创下新高后,进入高位平台整理。今早的大跌(从约95400跌至最低91910)可以看作是突破前高后的深度回踩和获利盘集中了结。MA5(5日均线)开始走平,MA10、MA20仍呈多头排列,说明长期上涨的大结构还没被破坏,但短期上攻动能明显减弱。

关键位:92500-93000区域是前期平台和MA20均线附近,构成关键支撑带。如果有效跌破,可能进一步下探90000心理关口。上方95500-96500是近期高点区域,形成强阻力。

指标:MACD红柱子(动能)在缩短,RSI从超买区回落至51.6,属于健康回调。但今早的急跌让日线级别出现了超卖迹象。

2. 4小时线(中期趋势):结构破坏,进入调整。

趋势:价格已经跌破了从1月12日开始的上升趋势线,确认了中期调整格局。MA5、MA10均线开始拐头向下,有下穿MA20形成死叉的趋势。

关键位:92500是前一波上涨的起涨平台和斐波那契0.382回撤位,是多空必争之地。下方更强支撑在90000-91000(0.5回撤及前期密集成交区)。反弹的初步阻力在94500-95000(跌破的趋势线反压及MA20均线)。

指标:MACD在零轴上方高位死叉后,快慢线快速下穿零轴,绿柱子(空头动能)急剧放大,显示空头力量强劲释放。RSI跌至32.3,进入超卖区,存在技术性反弹需求。

3. 1小时 & 15分钟线(短期趋势):暴跌后的疗伤与反弹试探。

走势:今天早上7-8点(UTC)的15分钟和1小时图上演了“瀑布行情”,成交量巨幅放大,这是典型的恐慌性抛售。但随后在92500下方(最低91910)获得买盘支撑,价格快速反弹至92500上方,并在此位置附近横盘震荡。

关键信号:

背离初现:在15分钟图上,价格创出新低(91910)时,RSI指标并未同步创新低,形成了底背离,这是短期止跌反弹的第一个技术信号。

超卖反弹:1小时和15分钟的RSI都一度跌至10以下的极端超卖区域,目前修复至20-30区间,反弹动能仍在积累。

关键位:短期支撑就在92500,跌破则可能再次测试早盘低点。阻力在93500-94000(早盘跳水后的反弹高点及1小时MA10均线压力)。

二、 消息面共振解读

消息面和咱们的技术面形成了强烈共振:

1. 利空兑现与消化:青岚姐在晨报和早评里都提到了“早盘变盘预警”、“先疗伤别冲锋”。今早的暴跌,结合消息面看,可能部分消化了“比特币元老抛售”、“ETF单日资金流出”等利空,同时市场也提前反应了部分主流币(如SHIB、ADA)技术破位的情绪。

2. 长期信心仍在:另一方面,“美国比特币ETF创近三月最佳周流入”、“先锋集团首次投资比特币股票”、“MicroStrategy暗示继续增持”这些消息,都表明机构和中长线资金对后市的信心并未动摇。这为长期趋势提供了基本面支撑。

3. 市场情绪切换:消息面频繁提及“社交叙事主导”、“资金寻求新机会(如ZKP等)”,说明市场热点在轮动,资金从部分高位资产流向新叙事,这加剧了BTC市场的波动和获利了结压力。

三、 咱们的预判与做单思路

综合来看,市场经历了一次“暴力洗盘”。短期情绪释放过度,有技术性反弹需求;但中期调整格局已定,需要时间修复。

预判:未来1-2天大概率在92500-94500区间震荡筑底。走法可能是:在92500支撑上反复测试夯实 -> 向上尝试触碰94000-94500阻力 -> 遇阻回落再次确认支撑。直接V型反转创新高的可能性较低。

做单思路:

短线(日内):低多为主,高空为辅。可在价格回踩92800-92500且出现小级别(如15分钟)止跌信号时,轻仓试多,目标93500-94000,止损放在92500下方。若反弹至94000-94500滞涨,可考虑短空,快进快出。

中线(未来几日):耐心等待更明确的企稳信号。理想的介入做多位置在91500-90500区域(强支撑区),或者等待价格重新站稳95000并伴随4小时MACD金叉。当前不宜盲目追涨杀跌。

长线:持有现货的学员,只要不跌破90000关键位,可以继续持有,忽略短期波动。想加仓的,可以采取分批定投的方式,在90000、88000等关键支撑位附近布局。

最后,送大家一句今天特别应景的金句:市场最好的老师不是暴涨,而是暴跌,它能让你看清谁在裸泳,也能让真正的价值浮出水面。保持耐心,保持清醒,咱们一起穿越周期。

-------------------------

受限于图表篇幅和平台合规准则,行情分析有时效性,最新的分析已更新在我的青岚加密课堂:qinglan.org 或欢迎点击我的头像关注我,通过主页展示的渠道进行更多技术探讨。

青岚加密课堂:2026年1月18日早间BTC行情分析欢迎来到青岚加密课堂,咱们今天对BTC 四个周期包括消息面进行分析:

咱们从技术面来详细看看各个周期的表现吧。

* 15分钟 K线图: 短线来看,情况不太妙哦。最新的几根K线都是红色的,价格持续向下。咱们看看均线(MA)就知道啦,MA5、MA10、MA20都呈现出空头排列,而且都向下发散,这明摆着是个短期下跌趋势。MACD指标呢,DIF和DEA都深陷零轴下方,并且还在继续往下走,MACD柱状图也是负值,而且越来越长,这说明短期的空头力量是相当强劲的。RSI指标也在35-40这个比较低的区间晃悠,虽然接近超卖,但还没看到明显的反弹迹象。所以呀,超短线操作,得非常谨慎,甚至考虑空单机会呢。

* 1小时 K线图: 比特币在短线尝试反弹了一下,但很快又撑不住了,继续走弱。你看,前几个小时MACD柱状图还转正了呢,可现在又变回负值了,而且DIF和DEA也开始向下发散,MA5也下穿了MA10。这表明多头力量在短期内没能站稳脚跟,空头又重新夺回了主动权。RSI也从50多回落到了40出头,说明买盘的动能明显不足。咱们得注意,小时图的反弹失败,可能会带来更深的短线回调哦。

* 4小时 K线图: 中期趋势这里,咱们要特别注意了。价格在经历了一段上涨后,最近开始出现回调压力。虽然咱们的MA5和MA10一度在MA20上方,但最新的数据来看,MA5和MA10的距离非常近,都在向下运行,而且都在MA20下方了。这可不是个好兆头,说明中期上涨动能正在减弱,甚至可能已经进入了盘整或者回调阶段。MACD的DIF和DEA虽然还在零轴上方,但你看,它俩也开始向下交叉了,柱状图也从正转负并持续扩大,预示着中期下跌的动能可能会加强。RSI指标在50-55区间向下,进一步确认了中期动能的衰减。

* 1日 K线图: 咱们把目光放长远一点,日线图的长期趋势还是很健康的。尽管最近几天价格有些回调,但总体来看,MA5、MA10、MA20依然保持着多头排列,并且都向上倾斜。这说明比特币还是处在一个非常强劲的长期上升通道里。MACD的DIF和DEA线都在零轴上方保持金叉向上,MACD柱状图也是正值,表明长期的多头力量依然主导市场。RSI指标虽然从高位稍微回落了一点,但仍然保持在60以上,处于强势区域,说明市场整体情绪还是偏乐观的。所以,长期看好比特币的大方向,这个回调更像是牛市中的一次健康调整。

好啦,技术面咱们看完了,咱们再结合一下消息面,做个综合判断和做单思路哈。

从消息面来看,有一个非常振奋人心的消息,那就是比特币ETF强势吸金14亿美元(新闻19、9),机构资金正在持续涌入,这可是长期看涨比特币的强大基本面支撑!连Coinbase的CEO都出来辟谣说白宫和加密行业关系没那么差(新闻8),也算是给市场吃了个定心丸。这都说明比特币的大方向是乐观的。

但是,咱们也看到了CryptoQuant的报告指出,“比特币需求回升但熊市未改”(新闻7),还有月底820亿美元的期权到期(新闻36),可能会带来短期的市场震荡。再加上Jefferies的策略师提到量子计算对长期比特币存储价值的潜在威胁(新闻26),这些都在提醒咱们,短期波动和潜在风险是存在的,不能盲目乐观。

而山寨币方面呢,像ZKP(零知识证明)技术被反复提及,什么6000倍、5000倍的潜力(新闻2, 5, 20, 34, 50),预售项目也层出不穷,比如Pepeto(新闻4, 12, 18, 22, 27)被早期DOGE/PEPE投资者看好,还有DOGE近期也飙升了25%(新闻16)。这说明市场上的风险偏好在上升,有部分资金正在寻求高倍回报的机会,从比特币流向了一些新的或有叙事的热点山寨币。但是呢,像SHIB出现了“死亡交叉”和期货资金流出(新闻23, 32, 37),ETH活跃用户破800万但价格停滞不前(新闻30),这些都说明山寨币市场也并非一片大好,而是分化非常严重的。

综合所有这些分析,咱们的预判和做单思路是这样的:

* 长期趋势(1日图):上涨。 尽管短期有回调,但日线级别的MA均线多头排列,MACD金叉上行,以及持续的ETF机构资金流入,都明确指向比特币的长期牛市格局。对于长期投资者,目前的回调可以被视为逢低吸纳的机会。

* 中期趋势(4小时图):震荡/回调。 4小时图的技术指标显示出多头动能减弱,有进入盘整或回调的迹象,特别是MACD死叉向下。这可能意味着在大的上涨趋势中,正在经历一个中期的调整期。

* 短期趋势(1小时、15分钟图):下跌。 最短期的走势非常疲软,均线空头排列,MACD持续下行,显示空头占据主导。

关键支撑位和阻力位:

* 上方阻力: 短期看,95200-95250是 immediate 的压力区。往上,95400-95500(1小时/4小时图的近期高点和MA20附近)会是较强的阻力。再往上,95800-96000是中期重要阻力。而咱们之前冲高的97000-97900区域,更是上方的强阻力。

* 下方支撑: 短期看,95050-95100是 immediate 的支撑。如果跌破,94800-94900(1小时图前低)是下一个观察点。更强的支撑在94500-94293(4小时图前低)。日线级别的MA10(大约93700附近)是一个非常关键的长期支撑。

可能出现的反转形态:

鉴于当前短期和中期都在回调,但长期是上涨的,咱们要关注几个点:

1. 短期止跌企稳: 在15分钟或1小时图上,如果价格能在94800-94900或94500区域形成双底、头肩底等底部反转形态,并伴随成交量放大,MACD出现金叉,那可能会是短线超跌反弹的信号。

2. RSI背离: 如果价格继续下跌,但RSI指标不再创新低,形成底背离,这往往是反弹的早期信号。

3. 大周期均线支撑: 如果价格回调到日线MA10(约93700),甚至日线MA20附近,并在这里获得支撑,走出阳线吞噬形态,那将是长期多头继续发力的表现。

做单思路呢,咱们可以这么来:

* 短线交易者: 鉴于15分钟和1小时图的短期弱势,咱们可以考虑逢高做空,目标看向94800-94900,甚至94500附近。但一定要快进快出,严格止损,毕竟大趋势是多头,这种短期空单风险相对较高。如果价格触及强支撑,并且出现止跌信号(如放量拉升、MACD金叉),也可以尝试小仓位抢个反弹。

* 中线交易者: 4小时图显示动能减弱,中期可能在调整。咱们可以暂时观望,不急于入场。等待价格在中期重要支撑位(例如94500-94293或者日线MA10附近)企稳,并且MACD、RSI等指标给出明确的看涨信号时,再考虑建仓或加仓。

* 长线投资者: 长期趋势依然是上涨的,机构资金在不断流入。对于长线持币者,目前的回调正是健康调整,可以在94500以下,特别是日线MA10(93700左右)甚至MA20附近,分批进行定投或抄底,为下一波上涨做好准备。

总的来说,咱们的市场就像这南方的天气,变化多端,短期阴雨,中期多云,但长期来看,阳光总会再来!

-------------------------

受限于图表篇幅和平台合规准则,行情分析有时效性,最新的分析已更新在我的青岚加密课堂:qinglan.org 或欢迎点击我的头像关注我,通过主页展示的渠道进行更多技术探讨。

最后送给大家一句交易金句:“面对市场的风浪,保持冷静的头脑,才能看清潮汐的方向,稳稳地抓住属于咱们的机会。”

青岚加密课堂:2026年1月15日早间BTC行情分析欢迎来到青岚加密课堂,咱们今天对BTC 四个周期包括消息面进行分析:

好啦,闲话不多说,直接上干货!

1. 多周期技术面分析与趋势判断

15分钟K线(短期趋势:震荡偏弱)

最近走势:这15分钟图啊,最近一个交易日(从1月14日晚上开始),价格从94700左右一路飙升到97500上方,涨势非常猛烈,成交量也显著放大,真是让人看了血脉贲张。不过,最近几根K线出现了明显的回调,价格从97500跌回到96500附近,短期动能有所减弱。

均线(MA):短期均线MA5和MA10在97500上方形成了一个“死叉”,然后一路向下,目前价格已经跌破了MA5和MA10,并且MA5和MA10也向下穿破了MA20,形成了短暂的空头排列。这说明短线资金正在获利了结,卖压不小。

MACD:DIF线已经下穿DEA线,形成了一个明显的“死叉”,并且MACD柱(BAR)在零轴下方持续放大,这表明短期下跌动能正在增强。

RSI:RSI指标从高位75以上迅速回落到40附近,脱离了超买区,但依然在下行,显示出短期多头力量的衰竭。

1小时K线(中短期趋势:高位震荡,上涨动能减弱)

最近走势:从1月14日晚22点开始,1小时图也显示出强劲的拉升,价格从95000附近直接冲上了97500。但最近四小时,价格一直在97500到96500之间震荡,没能继续向上突破。

均线(MA):MA5和MA10虽然仍在MA20上方,但近期开始走平甚至有拐头向下的迹象,K线价格已经跌破了MA5和MA10,这暗示着短期的上涨趋势正在失去原有的强势。

MACD:DIF和DEA线仍在零轴上方运行,MACD柱虽然还在零轴上方,但高度已经明显收缩,甚至最近两根K线BAR值开始转负(-130.543和-262.9416),这说明上涨的动能正在减弱,甚至开始出现回调信号。

RSI:RSI从70以上的高位回落,目前在60附近,表明市场情绪不再那么狂热,但也还没有到超卖的程度。

4小时K线(中期趋势:强劲上涨,但有回调风险)

最近走势:4小时图在过去几天表现出了非常强劲的上涨趋势,从1月13日20点开始,价格从92000直接拉升到97000以上,非常漂亮。最新的几根K线虽然有所回调,但整体趋势线依旧向上。

均线(MA):MA5、MA10、MA20呈现出完美的多头排列,所有均线都在向上发散,价格也远高于所有短期均线,这是非常典型的上涨形态,说明中期趋势非常健康。

MACD:DIF和DEA线在零轴上方持续向上运行,MACD柱也在零轴上方持续放大,虽然最新一根柱子有所收缩,但整体多头动能依然强劲。

RSI:RSI一直维持在70-80的超买区域,这在一个强势的牛市里是正常的表现,它只是提醒我们风险在累积,并不直接表示反转。

1日K线(长期趋势:上涨,牛市确立)

最近走势:日线图显示,比特币价格从去年11月底的低点(85000美元附近)一路震荡走高,近期更是突破了95000美元,逼近10万美元大关,这真是咱们多头最想看到的呀!

均线(MA):MA5和MA10已经成功上穿MA20,形成金叉,并且三条均线都向上发散,这是一个非常清晰的多头排列信号,明确告诉咱们,长期趋势是上涨的。

MACD:DIF线已经上穿DEA线,形成了一个强烈的“金叉”,并且MACD柱在零轴上方持续放大,这说明长期上涨动能非常充足,牛市格局已经确立。

RSI:RSI从11月的低点(20多)一路上升到现在的68左右,正处于一个健康的强势区域,尚未进入极端超买,仍有上涨空间。

2. 消息面结合分析

咱们来看消息面,那可真是锣鼓喧天,一片大好啊!

重大利好:美国通胀数据低于预期(10),推动市场风险偏好全面回升,直接引爆了BTC的上涨。比特币突破9.5万、9.7万,直指10万美元(10, 15, 24, 38),矿工股也全线飙升(24)。巨鲸们重返现货市场,大笔扫货(27, 38),说明大资金看好后市。德国DZ银行推出加密平台(3),Visa试点稳定币结算(14),Bitwise等机构申请Chainlink ETF(40, 46, 50),这些都意味着机构的接受度越来越高,加密货币正在主流化。青岚姐之前也分析了,比特币彩虹图进入“清仓甩卖”区域,预示着中期买入良机(30)。

长期积极:俄罗斯敲定加密货币交易合法化法案(31),将为数字资产发展铺平道路。Binance创始人赵长鹏(CZ)预测加密货币“超级周期”即将开启(48),这些都给市场注入了长期的信心。

短期担忧:Coinbase对参议院加密法案的反对(8, 19, 22, 23),主要是担心SEC权力扩张和DeFi限制,这会给监管带来一些不确定性,但目前来看对BTC的直接影响有限。Sui网络故障(25)是特定项目事件,不影响比特币大盘。AI诈骗风险(16)是行业发展中需要关注的问题,但更多是风险提示,非直接行情利空。

3. 综合判断与交易建议

综合来看,咱们可以得出一个比较明确的预判:

长期(1日图):明确的上涨趋势。日线图上多头排列,MACD金叉,RSI健康向上,加上各种利好消息面的烘托,咱们可以说比特币已经进入了一个新的牛市阶段,或者至少是牛市初期,突破10万美元只是时间问题。

中期(4小时图):强劲的上涨趋势。技术指标和均线形态都显示多头非常强势。虽然价格可能出现短期回调,但每次回调都可能是逢低布局的好机会。

短期(15分钟/1小时图):高位震荡偏弱。在经历了一波快速上涨后,短线指标显示多头动能减弱,有获利了结的迹象。目前正处于短期回调或高位盘整阶段,但这种回调更像是上涨途中的技术性调整。

关键支撑位与阻力位:

短期支撑位:咱们可以关注96200-96000美元区域,这是15分钟图最近回调的低点,也是一个比较重要的心理关口。如果这里能稳住,说明短期回调可能结束。再往下看,95500美元附近,是之前1小时图多次触及的支撑。

中期支撑位:95000-94800美元区域是4小时图上的关键支撑,这里是之前突破的阻力位,现在应该转化为强支撑。如果回调到这个位置并企稳,那可真是绝佳的入场时机呀!

长期支撑位:咱们可以看93000-92000美元,这是日线图上MA5和MA10附近,也是这波上涨行情的重要支撑区域。

短期/中期阻力位:最直接的阻力就是最近的高点,97500-97800美元。如果能有效突破并站稳这里,那下一个目标就是98000美元的整数关口。

长期阻力位:咱们的最终目标当然是100000美元这个大关口!这是一个极强的心理阻力位,突破需要很大的动能,但一旦突破,上方空间可能会进一步打开。

可能出现的反转形态:

目前来看,没有明显的长期或中期反转形态出现,整体仍是上涨趋势。短期的回调更像是技术性调整。在15分钟和1小时图上,虽然出现了MACD死叉和RSI回落,但这通常只是短线动能的衰减,而非趋势的彻底反转。咱们要警惕的是如果价格持续跌破重要支撑位,比如95000美元,并且成交量放大,那可能意味着回调会更深。但在目前的市场情绪和消息面下,这种深度回调的概率相对较低。

做单思路:

咱们的做单思路应该以逢低做多为主。

短线操作者:可以等待15分钟或1小时级别价格回踩至96000-96200美元区域并出现企稳信号(比如K线收阳,RSI止跌回升)时,考虑轻仓介入多单,止损放在95800下方。短期目标看97000-97500。

中长线布局者:如果价格能给到95000美元附近的强支撑区域,那可是非常好的布局多单的机会!咱们可以大胆分批建仓,目标看向100000美元甚至更高。止损可以放在94000下方。

金句分享:

“市场总在诱惑我们追涨杀跌,但真正的机会,往往藏在恐惧中买入,在贪婪中卖出,保持耐心,才能与价值同行。”

-------------------------

受限于图表篇幅和平台合规准则,行情分析有时效性,最新的分析已更新在我的青岚加密课堂:qinglan.org 或欢迎点击我的头像关注我,通过主页展示的渠道进行更多技术探讨。

青岚加密课堂:2026年1月12日早间BTC行情分析欢迎来到青岚加密课堂,咱们今天对BTC 四个周期包括消息面进行分析:

一、多周期技术面糅合分析

1. 短期(15分钟图):震荡反弹,但动能不稳。

* 走势:价格在昨夜从90500附近拉起来,最高冲到91200上方,但很快在91100-91300区域受阻回落。目前(数据截止到08:45)又拉回到91139附近。整体是一个宽幅震荡的格局,低点从90500慢慢抬升到90700,但高点被压着打,上不去。

* 指标:MA5和MA10在零轴下方刚形成金叉,MACD也在零轴下金叉翻红,显示短期有反弹动能。但RSI在50-60之间徘徊,不算强势。关键是价格始终无法有效站稳在91200-91500这个前期小平台之上,说明多头力量不够坚决。

2. 中期(1小时 & 4小时图):震荡筑底,面临方向选择。

* 走势:1小时图看,价格在90500-91500这个箱体内已经震荡了超过一天。4小时图更明显,自1月10号从90300附近反弹后,一直在尝试上攻,但每次接近91500-92000区域就乏力。

* 指标:

* 1小时:MA20(90731)走平,价格在其上下穿梭。MACD在零轴附近粘合,快慢线几乎走平,柱状线微弱,典型的震荡无趋势信号。RSI在50附近,中性。

* 4小时:均线系统(MA5/10/20)高度粘合,价格缠绕其中。MACD在零轴下方,但绿柱开始冒头,有底背离的初步迹象(价格低点未创新低,MACD低点抬高),这是个需要重点关注的潜在看涨信号。但需要价格放量突破来确认。

3. 长期(日线图):下跌趋势中的弱势反弹。

* 走势:日线级别,比特币仍处于自1月5日高点(94789)以来的下跌通道中。目前价格在MA10(91553)和MA20(89791)之间运行,MA20在下方向上拐头,提供一定支撑,但MA10在上方形成压制。

* 指标:日线MACD在零轴上方,但红柱缩短,快慢线有走平迹象,显示下跌动能衰减。RSI在54附近,处于中性偏弱区域。整体看,日线级别是下跌后的弱势整理,尚未形成反转趋势。

二、消息面与市场情绪结合

消息面上,多空交织:

* 利多:

1. 机构动态:MicroStrategy的Saylor发推暗示可能再买BTC,Bitmine大额增持ETH质押,都显示了“大玩家”的长期信心。

2. 宏观叙事:CZ喊话“超级周期”,Samson Mow预测马斯克可能入场,这些虽然偏远期,但能提振市场情绪。

3. 产品创新:X平台(原Twitter)推“智能现金标签”,Solana集成X App,这些都在降低加密货币的使用门槛,是长期的利好。

* 利空/谨慎:

1. 巨鲸动向:Bitfinex上的巨鲸在加速平仓比特币多头(消息8、10),这通常是大行情前的信号,但方向不确定,可能是获利了结或转向。

2. 链上异动:中本聪时代矿工转移2000枚BTC(消息34),虽然不一定立刻卖出,但增加了市场的不确定性。

3. 市场结构:整体情绪偏向观望,青岚姐的晨报也提到了“变盘预警”和“多空拉锯”(消息1、8)。

三、综合预判与做单思路

核心判断:市场正处于一个关键的多空平衡点,短期偏向于在90500-91500区间内继续震荡,但中期(4小时级别)的底背离信号暗示,震荡后向上突破的概率在增加。不过,在日线级别明确转势前,仍需保持谨慎。

关键位:

* 上方阻力:91500(近期震荡上沿,也是1小时和4小时MA均线密集区)、92000-92500(前期平台与日线MA10压力)。

* 下方支撑:90500-90700(近期震荡下沿与多次回踩低点)、90000(心理关口与日线MA20支撑)、89500(强支撑)。

做单思路:

1. 短线(日内交易者):在90500-91500区间内高抛低吸。靠近91500不破,可轻仓试空,止损91800,目标90800-90500。回踩90500-90700企稳,可轻仓试多,止损90200,目标91200-91500。快进快出,严格止损。

2. 中短线(持仓1-3天):重点观察91500的突破情况。如果价格能放量站稳91500以上,可以视为4小时底背离确认,可跟进多单,目标看向92500-93500。如果价格放量跌破90500,则震荡格局可能被打破,需警惕再次测试90000甚至89500支撑,届时可考虑顺势短空。

3. 仓位管理:当前市场方向不明,总仓位务必控制在3成以下,任何单笔交易止损设置要明确。不要追涨杀跌。

最后,送大家一句今天的心得:交易不是赌方向,而是在概率优势出现时下注,在风险失控前离场。耐心等待市场给你发牌,比急着去猜底摸顶更重要。 好了,今天的盘面就解析到这里,我们保持关注,盘中如有异动,咱们再及时沟通!

-------------------------

受限于图表篇幅和平台合规准则,行情分析有时效性,最新的分析已更新在我的青岚加密课堂:qinglan.org 或欢迎点击我的头像关注我,通过主页展示的渠道进行更多技术探讨。

青岚加密课堂:2026年1月9日早间BTC行情分析欢迎来到青岚加密课堂,咱们今天对BTC 四个周期包括消息面进行分析:

1. 技术面分析与周期趋势

15分钟周期(短线):

从最近的15分钟K线看,比特币呀,现在就是在90800到91500这个小区间里震荡。你看,MA5、MA10、MA20这几条均线,都缠绕在一起了,方向感特别弱,一下子金叉一下子死叉,让人头晕。MACD的DIF和DEA也老是在0轴附近打转,一会儿冒个头,一会儿又沉下去,柱子也时大时小,说明多空力量非常胶着,谁也奈何不了谁。RSI指标也是,一直徘徊在40-60之间,既没超买也没超卖,典型的短线震荡走势。所以呀,短线来看,就是一个震荡偏弱的格局。

1小时周期(短中期):

再放大一点看1小时图,就能感受到这波行情的“跌宕起伏”了。价格从前几天93000多跌下来,最近才在90000附近企稳反弹。虽然短期均线MA5、MA10有向上勾头的迹象,甚至出现了MA5上穿MA10的小金叉,但这都是在长期均线MA20下方运行,想要彻底扭转空头排列,难度可不小。MACD指标,DIF和DEA虽然在0轴下方形成金叉,红色动能柱也开始冒头,但还没能突破0轴,这说明反弹动能不够强,随时可能熄火。RSI也在50-60区域,表明反弹动力一般般。所以,1小时级别,可以定义为下跌趋势中的震荡修复。

4小时周期(中线):

看向4小时图,咱们能明显看到,从94000多的高点跌下来,是一个非常清晰的下跌趋势。均线系统目前还是空头排列,MA5、MA10、MA20都向下。虽然最近几根K线有尝试反弹,MA5也开始向上勾头,但它还远在MA10和MA20的下方呢。MACD指标呢,DIF和DEA一直在0轴下方,空头力量依旧占据主导,虽然绿色动能柱有所收敛,最近也出现了DIF金叉DEA的信号,但这金叉位置离0轴实在太远了,更像是一个超跌后的技术性反弹,想要真正逆转趋势,还需要更多强劲的动能。RSI从低位反弹到40多,也只是技术性修复。总体来说,是中线偏空,但短线有反弹需求。

1日周期(长线):

最后,咱们看看日线图,这可是决定大方向的关键呀!从去年的107000跌下来,比特币经历了一个比较大的回调。不过呀,最近的价格是在85000附近筑底后,开始尝试反弹,目前维持在91000左右。均线方面,MA5和MA10虽然还在MA20下方,但已经开始走平并向上靠拢,甚至有形成金叉的迹象,这是一个积极的信号!MACD指标更是给力,DIF线从DEA下方完成金叉,红色动能柱也开始出现并逐渐放大,这通常被认为是底部企稳,酝酿反弹的信号哦。RSI也从超卖区反弹到50附近,说明多空力量正在重新平衡。所以,日线级别,咱们判断是长期下跌趋势中的底部震荡反弹,有初步企稳迹象。

2. 消息面结合与综合判断

咱们再结合这50条最新消息来看,市场的情绪可是复杂得很,多空交织,信息量非常大!

利好消息方面:

机构入局是大趋势:摩根士丹利(#10, #11, #43)这种大咖都在加速布局数字资产,包括现货交易、数字钱包和内部ETF,这可是实实在在的利好呀,说明传统金融对加密市场的认可度越来越高,长期资金入场的确定性也更强了。

监管趋于完善:世界自由金融申请美国银行牌照,要发行联邦监管的稳定币USD1(#9, #26, #36),还有华尔街与加密巨头开会,讨论DeFi监管豁免(#6),这些都指向了加密行业正在走向合规化、主流化,对市场长期发展是好事。

生态建设不停歇:Optimism基金会提议回购OP代币(#14, #46, #47),Layer2生态在努力赋能代币价值。佛罗里达州还在推动比特币储备法案(#39),这都显示了行业内外对加密资产价值的肯定。

科技巨头加码AI:微软投入800亿美金加码AI(#16),AI和区块链的结合未来潜力无限,这也是加密市场长期增长的动力之一。

利空或中性偏空消息方面:

短期资金压力:咱们最直接感受到的,就是消息里提到比特币ETF流出7.29亿美元(#13),这直接导致了价格回调,也印证了青岚姐前面说的“九万关口多空拉扯”这个判断(#1)。资金短期出逃,市场肯定承压呀。

个别项目风险:Zcash团队集体辞职(#12, #37, #38)导致ZEC价格暴跌,Truebit协议遭黑客攻击损失2600万美元(#15, #50),这些都是单一项目风险,虽然不直接影响比特币,但会打击市场整体信心。

地区政策差异:中国禁止RWA代币化(#48),这可能会阻碍香港加密市场的开放步伐,对亚洲市场来说,不是个好消息。

美股疲软与经济担忧:美国家庭通胀担忧加剧,劳动力市场信心下滑(#33),标普500指数可能面临调整,这可能传导到风险资产,包括加密货币。

综合来看:

当前市场,短期确实承受着ETF资金流出和宏观经济的不确定性带来的压力,所以15分钟和1小时周期都是震荡偏弱,或者下跌后的修复。90000美元这个关口,多空双方拉扯得很厉害,正如青岚姐说的“九万关口多空拉扯”。但是呢,从更长期的视角,也就是日线图和消息面来看,机构对加密货币的布局、监管环境的逐步清晰化,都预示着比特币未来的价值空间是巨大的。日线MACD的金叉,就是这种长期积极信号的体现。

3. 交易建议

根据咱们的综合分析,现在比特币的走势呀,就像一艘刚从风暴中驶出的船,船体还在晃悠,但远方的灯塔已经亮了。

短期(15分钟)趋势:震荡偏弱。 价格在90800-91500之间波动,方向不明确,追涨杀跌风险大。

关键阻力位:咱们盯着91500和91800这两个位置。如果能带量突破91500并站稳,短期情绪可能会好转一点。

关键支撑位:下方看90800,这是最近的震荡区间下沿,再往下就是90000美元的心理大关,以及消息面提到的92224附近的均线支撑,虽然有些矛盾,但92224是日线5日均线,咱们的日线最新收盘价是91456,所以92224更像是未来的一个阻力。结合消息面“90000美元这...”提到的90000关口,以及日线20日均线大概89417,这些都是强支撑。

可能出现的反转形态:如果能有效跌破90800,并测试90000大关,可能会出现小级别的M头形态,短线偏空。反之,如果在90800-91000得到有效支撑,并向上突破91500,则可能向上突破震荡区间。

中期(1小时、4小时)趋势:下跌趋势中的技术性反弹。 反弹动能还不够强,上方压力较大。

关键阻力位:咱们主要看91500-92000区域,这里是1小时图的MA20附近,也是4小时图的MA10和MA20的密集区。如果能突破这里,才能说反弹站稳脚跟。再往上就是93000的前期高点。

关键支撑位:主要关注90000美元这个整数关口,这是市场重要的心理防线和技术支撑。一旦跌破,可能回到89000甚至更低。

可能出现的反转形态:4小时MACD金叉,这是好事,如果能配合放量,并连续收阳,突破并站稳92000,那么中期趋势就有望从下跌转为震荡筑底。如果反弹无力,在91500-92000受阻回落,并再次跌破90000,则可能继续探底。

长期(1日)趋势:下跌趋势中的底部震荡反弹,初步企稳。 日线MACD金叉,但仍在0轴下方,需要时间确认。

关键阻力位:首先是92000-93000这个区间,这是多空拉锯的焦点。再往上就是消息面提到的95000-96000的前高压力区了。

关键支撑位:最重要的就是90000美元,这是咱们反复提到的多空拉锯关口。如果这里能守住,并且日线MACD的金叉能够持续,那么后续震荡上行的可能性就比较大。

可能出现的反转形态:日线MACD金叉,如果未来能配合价格在90000上方构建一个W底或者头肩底等经典底部形态,并且放量突破颈线,那长期趋势的反转就非常值得期待了。

咱们的做单思路:

当前市场有点像“黎明前的黑暗”,或者说是“春江水暖鸭先知”的初期。短期虽然震荡偏弱,不适合重仓追涨杀跌。但是,中长期来看,机构资金持续布局、监管环境改善的利好消息,加上日线级别的企稳信号,让咱们对未来还是有信心的。

激进型选手:可以在90000-90500附近尝试轻仓介入多单,并严格设置止损,比如89500下方。目标看向91500-92000,甚至更高。但是切记,仓位要小,快进快出哦。

稳健型选手:可以继续观望,等待价格有效突破92000并站稳,或者等到回调到89000-90000区间得到更强支撑时再考虑布局。不急着入场,等待趋势更明确。

空单呢? 除非短期能快速跌破90000大关,否则目前做空风险也挺大的,毕竟下方有强支撑,而且长线有企稳迹象。

总而言之,言而总之:咱们现在是处于一个长线布局的好时机,但短线还需要多点耐心,多点观察。就像青岚姐常说的,投资呀,最忌讳的就是心急吃不了热豆腐。

最后给你们一句金句:

交易不是一场百米冲刺,而是一场马拉松,耐得住寂寞,才能守得住繁华!咱们下期再见!

-------------------------

受限于图表篇幅和平台合规准则,行情分析有时效性,最新的分析已更新在我的青岚加密课堂:qinglan.org 或欢迎点击我的头像关注我,通过主页展示的渠道进行更多技术探讨。

青岚加密课堂:2026年1月8日早间BTC行情分析欢迎来到青岚加密课堂,咱们今天对BTC 四个周期包括消息面进行分析:

首先看技术面呀:

短期(15分钟 & 1小时): 这两个周期啊,K线走势非常清晰地显示比特币正在经历一场下跌趋势,而且下跌动能不小。你看,价格现在跌破了所有短期均线,MA5、MA10、MA20已经呈现出明显的空头排列,价格被均线压制得死死的。MACD指标呢,在零轴下方,DIF线已经明确在DEA线下方,负动能柱还在扩大,这说明短期下跌势头非常强劲。RSI指标都在35附近徘徊,已经进入超卖区域,从技术上看,短期可能会有挣扎着向上反弹的需求,但力度嘛,得保持警惕哦。

中期(4小时): 4小时图上,前几天从89000冲高到94000附近,走得挺强势的,但最近几根大阴线直接把价格砸了下来。虽然较长期的MA10和MA20依然是多头排列,但价格已经跌破了MA5,而且最关键的是,MACD指标已经形成了明确的死叉(DIF跌破DEA),并且负动能柱开始显著扩大,这是一个非常强烈的卖出信号,就像咱们开车油门踩到底,但速度却上不去了,哦,甚至在减速。RSI也从高位回落到42左右,显示买盘力量正在快速衰竭。所以,中期趋势现在是从上涨转为回调下跌。

长期(1日): 1日图显示,比特币整体上依然处于健康的上升趋势,毕竟从11月底的低点一路反弹上来,大趋势没有被破坏。不过,咱们最近看到它在94k附近冲高回落,今天的K线也是一根大阴线。价格已经跌破了MA5,但还在MA10和MA20上方得到支撑,这说明长期趋势的基础还在,但短期内市场的情绪有点“虚”了,需要消化一下前期涨幅。MACD的DIF虽然还在DEA上方,也还在零轴下方尝试上穿,但红色动能柱正在快速缩短,这暗示了长期上涨动能大幅减弱,咱们得警惕后续形成死叉的可能性。RSI从高位回落到53左右,买盘力量减弱。

再结合消息面分析呀:

咱们看到,消息面上利空因素比较集中,对市场情绪有不小的冲击力。比如,【41】加密货币总市值单日跌超3%,【35】比特币连跌两日,90000面临考验,还有【50】美国现货比特币ETF首周出现净流出2.43亿美元,这可是个实打实的利空信号呀,说明机构资金短期内有离场观望的意愿。柬埔寨的加密诈骗案【1】和Ledger数据泄露【36】也在打击着普通投资者的信心。同时,美国参议院关于稳定币奖励法案的争议【2】【5】【13】【24】也为市场带来了不确定性。

当然啦,也有一些长期利好,像摩根士丹利申请以太坊ETF【17】,美国将没收的比特币纳入战略储备【26】,这些都是对加密货币长期发展有积极影响的。但短期内,这些利好似乎被更近期的抛压和负面情绪盖过了风头,市场更关注眼前的风险。

咱们的预判和做单思路就来啦:

综合来看,目前比特币正处于一个短期和中期都在回调下跌,且下跌动能较强的阶段,而长期趋势虽未完全改变,但上涨动能明显减弱。

短期操作思路(日内): 鉴于15分钟和1小时图的明显弱势,咱们不建议盲目抄底做多。如果价格反弹到91200-91500附近(短期阻力位),可以考虑短线轻仓做空,止损放在91700上方。下方关键支撑首先看90800附近,如果跌破,下一目标就是咱们消息面也提到的90000这个心理关口。如果90000被有效跌破,短期可能加速下跌,那咱们就得跟着趋势走了。

中期操作思路(几天到一周): 4小时图的MACD死叉是个很强的信号,说明中期回调还会继续。咱们应该保持观望或逢高做空的策略。如果价格能在90000-89500区域(中期支撑位,也是4小时MA10和MA20附近)企稳,并且出现明确的止跌信号,比如带量阳线、MACD重新金叉等,咱们可以考虑轻仓尝试做多,目标看向92500-93000。但如果90000这个“生命线”被有效跌破,那咱们就要及时止损,并且把中期展望调整为偏空。

长期操作思路(几周到几个月): 日线图仍是上升趋势,大方向没变。对于长期投资者来说,这波回调反而是个积累筹码的好机会,可以在89000-87000甚至更低的强支撑区域分批定投买入,毕竟机构还在积极布局,美国政府也把比特币列为战略储备,这些都是长期看好的基石呀。

关键支撑位: 短期看90800,心理关口90000。中期看89500-89000。长期看87000。

关键阻力位: 短期看91200-91500。中期看92500-93000。长期看94000。

可能出现的反转形态: 短期内,如果90000未能守住,可能会形成一个更大型的头部形态,从而引发更深度的回调。反之,如果在90000或89000附近出现W底或看涨吞没等K线组合,并且伴随MACD金叉和RSI回升,则可能形成短期反弹的底部。

总的来说,咱们现在处于一个短期和中期偏空,长期趋势未改但动能减弱的复杂局面。操作上要保持耐心,严格控制风险,不要轻易逆势,尤其是不要在支撑位附近盲目抄底,或者在阻力位附近追涨。

---

耐心是捕捉趋势的罗盘,纪律是规避风险的船桨。

-------------------------

受限于图表篇幅和平台合规准则,行情分析有时效性,最新的分析已更新在我的青岚加密课堂:qinglan.org 或欢迎点击我的头像关注我,通过主页展示的渠道进行更多技术探讨。

青岚加密课堂:2026年1月7日早间BTC行情分析

欢迎来到青岚加密课堂,咱们今天对BTC 四个周期包括消息面进行分析:

1. 技术面分析,咱们从短到长看起

15分钟K线(超短线走势)

你看哈,最近这44根15分钟K线,简直就是坐了一趟过山车!从昨天晚上(1月6日)到今天早上(1月7日),BTC先是冲高到94000附近,然后突然在凌晨0点后开始急剧下跌,直接跌破了93000、92000,最低探到了91500左右。最近这几根K线又稍微有点企稳反弹的迹象,目前在92700附近震荡。

MA均线: 短期MA(MA5/MA10)已经形成了明显的死亡交叉,并且MA5、MA10、MA20都呈现空头排列,价格在均线下方运行,显示出非常强的短线卖压。

MACD: MACD指标也从之前的零轴上方快速掉头向下,DIF线已经下穿DEA线,形成死亡交叉,并且DIFF和DEA都在零轴下方,MACD柱状图由红变绿并持续放大,说明短线空头力量非常强势。

RSI: RSI一度跌破30的超卖区(最低到22.29),现在稍微回升到40多一点,表明虽然短期跌幅很大,有些超卖,但整体买盘力量还是不足以形成强力反弹。

1小时K线(短线走势)

咱们再看1小时图,这47根K线也清晰地展示了从1月5日早上开始的一波上涨行情,从91000附近一直冲到了94500左右,涨势很猛呀!但好景不长,从1月6日晚间开始,特别是从昨天午夜12点那根大阴线开始,价格就掉头直下,直接把前几天的涨幅吃掉了不少。

MA均线: MA5/MA10均线在最高位区域(94000附近)形成了死亡交叉,现在MA5、MA10和MA20都开始向下发散,价格已经被短期均线压制。

MACD: MACD指标在零轴上方完成了死亡交叉,MACD柱状图也由红转绿,并持续放量,这跟15分钟图的走势高度一致,确认了短线级别的下跌趋势。

RSI: RSI也从高位(80左右的超买区)快速回落,一度跌到27.53的超卖区,现在回到46附近,同样预示着短线急跌后有技术性反弹需求,但整体弱势。

4小时K线(中线走势)

接着看4小时图,这47根K线从12月底到1月初,比特币是走了一波非常漂亮的上涨行情,从87000多一路涨到了94789的高点。是不是给人一种牛市要来了的感觉?但是,最近这几根K线,特别是今天(1月7日)0点和4点这两根,直接把前期的涨幅回吐了不少,当前价格已经从高点下来了好多。

MA均线: MA5均线在最高点附近已经下穿了MA10均线,形成死亡交叉,价格也跌破了MA5和MA10。虽然整体均线还没有完全空头排列,但上升势头已经被打破。

MACD: MACD指标在零轴上方形成了死亡交叉,DIF和DEA都开始向下,MACD柱状图也从红色变为绿色,虽然量能还在缩小,但已经明确了中线级别的调整风险。

RSI: RSI从70以上的超买区回落到54附近,说明中线级别的多头动能正在减弱,进入调整区域。

1日K线(长线走势)

最后,咱们看1日K线,这60根K线展示了比特币从11月初的10万+跌到8万多,再一路震荡回升到9万多,最近冲高到94000+。整体来看,虽然有大起大落,但从8万多上来这一波还是比较健康的。

MA均线: 价格目前还在MA5上方,MA5、MA10、MA20虽然排列得不紧密,但整体仍是多头趋势,或者说上涨趋势没有完全改变,只是有所放缓。但是最新的价格已经接近或跌破MA5,长线的多头力量在接受考验。

MACD: MACD指标DIF线还在零轴上方,并且还没有形成死亡交叉,但DIF和DEA的距离正在缩小,MACD柱状图绿色能量柱很小,说明长线多头动能有所减弱,但还没有转为空头。

RSI: RSI在60附近,处于健康区间,既不是超买也不是超卖,但比前几日的数值有所回落,暗示上涨动能减弱。

---

2. 消息面结合,看看外面发生了啥

这50条消息,咱们可以大致分成几个类别:

1. 机构利好消息 (很给力啊!):摩根士丹利申请比特币和Solana现货ETF(第5、8条),这可是大机构的动作呀,说明他们是真的看好加密货币的长期价值。还有贝莱德两天内从Coinbase提取超7亿美元的BTC和ETH(第13、25条),这直接就是机构在囤货啊,大资金的动向咱们得重点关注!Coinbase推出衍生品数据仪表盘(第3条),也说明行业基础设施在不断完善。MSCI暂不剔除MicroStrategy(第12、23、28条)也减少了市场对MSTR抛售比特币的担忧,对持有大量比特币的公司是利好。沃尔玛OnePay应用上线比特币以太坊交易功能(第50条),这简直是加密货币走向日常支付的一大步,让更多人能接触到!

2. 市场波动与风险 (需要注意哦!):最明显的就是Solana上的Meme币“114514”在24小时内暴跌超过70%-90%(第2、15条),这种极端波动性肯定会让一些散户感到恐慌。还有,比特币挖矿公司MARA向FalconX存入519.46枚BTC(第6、19条),这可能是矿工在套现,会增加短期抛压。鲸鱼高倍空头爆仓浮亏超700万美元(第11、22条),说明市场波动剧烈,多空博弈非常残酷,一些激进的空头被“打爆”了,但随后价格又跌回来了,说明有新的空头进场或者多头力量不足。最新的BTC跌破93000、92000 USDT关口(第29、32、35、46条),这直接反映了短期的下跌压力。加密恐慌指数回升到42,虽然比之前好,但依然处于“恐慌”级别(第16条)。

3. 宏观与监管 (咱们得留心!):韩国拟重罚遭黑客攻击的交易所,并考虑预防性冻结加密账户(第40、47条),这说明监管趋严,对投资者来说既是保护也是一种风险。特朗普关税案的裁决(第39、48条)虽然不是直接影响加密市场,但会影响全球经济和风险偏好,间接对BTC有影响。

4. 其他 (了解一下就好):Telegram创始人澄清与俄罗斯无关(第1条)、Discord秘密提交IPO申请(第14、21条)、白银市值超越英伟达(第9条)等等,这些对BTC的直接影响不大,更多是市场信息噪音。

---

3. 交易建议:咱们预判和做单思路

综合来看,各位同学,咱们现在看到的是一个非常典型的 多空拧麻花 的市场局面,正如青岚姐在消息面里提到的一样(第7条),市场在短线出现急剧回调,但长线结构支撑还在,机构入场的大趋势也还没变。

短期(15分钟、1小时): 目前走势是 下跌趋势。价格在最近24小时内出现了快速、放量下跌,短期均线空头排列,MACD形成死亡交叉并处于零轴下方,RSI也曾触及超卖区。这表明短期内空头占据主导,市场情绪偏向悲观。虽然急跌后有技术性反弹的需求,但如果反弹无力,很容易再次探底。

中期(4小时): 走势从之前的上涨转为 回调/震荡。4小时图的上涨趋势已经被打破,MA均线出现死亡交叉,MACD也形成了死叉。这意味着中期内,价格可能需要一段时间来消化获利盘和调整结构,暂时不宜盲目追涨。

长期(1日): 走势仍处于 上涨趋势中的健康回调/震荡。日线级别看,整体多头结构尚未被破坏,MACD虽然动能减弱,但DIF仍在零轴上方。机构(摩根士丹利、贝莱德)的持续布局和加密货币落地应用(沃尔玛)的进展,都给长期趋势提供了坚实的底部支撑。这次回调更像是牛市进程中的一次“洗盘”,把不坚定的筹码洗出去。

关键支撑位和阻力位:

短期阻力位: 93000 USDT、93500 USDT (这是今天早盘和昨天夜间的关键心理关口,也是反弹容易遇到的压力区)。

短期支撑位: 92000 USDT (这是大家都在关注的一个强支撑,也是青岚姐消息里提到的关键位)、91500 USDT (最近的低点)。如果跌破91500,那么很可能要去测试90000。

中期/长期阻力位: 94000 USDT - 94800 USDT (这是这波上涨的高点,也是多头需要重新突破才能继续上行的区域)。

中期/长期支撑位: 90000 USDT (重要的心理关口和日线级别的支撑),再往下就是88000 - 87000 USDT这个区域(4小时图的启动平台)。

可能出现的反转形态:

短期来看,如果在91500-92000区域能够形成W底或头肩底这样的底部反转形态,配合成交量放大,那么短线可能会迎来一波不错的反弹。中长期来看,如果能在90000附近企稳并筑底成功,形成更大的底部形态(比如双底、三重底),那将是长期多头重新发力的信号。

做单思路总结:

咱们现在处于一个短线回调、中线调整、长线趋势不变的复杂局面。

1. 对于短线操作的同学: 市场情绪偏空,不建议盲目抄底。可以等待价格在91500-92000区域企稳,出现明确的底部反转信号(比如带长下影线的K线、小级别双底),并且MACD出现金叉,RSI从超卖区回升,再考虑小仓位短多。如果价格持续在92000下方运行,或者反弹无力跌破91500,那么就要警惕进一步下跌的风险,可以考虑短空到90000甚至更低。记住,短线波动大,仓位管理是关键!

2. 对于中长线布局的同学: 这次回调可以看作是逢低吸纳的机会,但也不用急于一时。可以分批建仓,比如在92000附近轻仓,如果继续跌到90000甚至88000附近,再加仓。机构的长期看好是毋庸置疑的,但短期调整是正常的市场行为。

3. 风险控制: 无论哪种操作,一定要设置好止损点!特别是高杠杆的同学,最近市场波动剧烈,避免被“插针”爆仓。

总之呀,行情急跌下来,咱们不要慌,要冷静分析。短线需要谨慎,等待企稳信号;长线依然看好,但要耐心等待更好的入场时机。

---

最后送大家一句交易金句: 熊市是财富的重新分配,牛市是财富的加速放大。保持耐心,静待花开。

-------------------------

受限于图表篇幅和平台合规准则,行情分析有时效性,最新的分析已更新在我的青岚加密课堂:qinglan.org 或欢迎点击我的头像关注我,通过主页展示的渠道进行更多技术探讨。

青岚加密课堂:2026年1月6日早间BTC行情分析欢迎来到青岚加密课堂,咱们今天对BTC 四个周期包括消息面进行分析:

首先,咱们这次分析的K线数据,可是涵盖了15分钟、1小时、4小时和1日这四个周期,每个周期咱们都仔细看了最近的100根K线,总计400个数据点呢!消息面方面,我给大伙儿整理了最新的50条资讯,真是干货满满,咱们现在就开始!

技术面,短中长期,层层剥茧:

从15分钟K线图来看,哎哟,这超短期走势,前面刚经历了一波强劲的拉升,价格从92400附近一路冲到了94700多,上涨势头相当猛!但最近这几根K线呢,动能明显减弱了,价格在94000附近开始震荡回落。你看,MA均线已经出现了短暂的空头排列趋势,MA5跌破了MA10和MA20,MACD也给出了一个死叉信号,红柱转绿柱,动能柱持续收缩,RSI也从高位回落到中性区域。这说明什么呢?说明超短期内,咱们的BTC可能要经历一个调整或者小幅回调,得多留个心眼。

再看1小时K线图,中短期趋势上,那可是妥妥的上涨趋势,价格一直维持着上升通道,高点不断被刷新。不过,最新的这几根K线,也透露出一些疲态。虽然总体均线还是偏多头排列,但MA5和MA10有点缠绕在一起了,MACD也出现了一个死叉,快线DIF向下穿过慢线DEA,并且绿色能量柱正在放大,RSI也从超买区回到了中性区。这表明,虽然整体上涨趋势没变,但短期内市场在消化前期涨幅,可能会有一段盘整或者小幅回撤。

轮到4小时K线图了,这可是咱们判断中期走势的重要依据哦!从最近的100根K线来看,BTC经历了一波非常清晰且强劲的上涨行情,价格底部在不断抬高,妥妥的多头趋势!均线系统呈现出完美的多头排列,MA5、MA10、MA20都是向上发散,并且短周期均线在长周期均线之上,这可是非常强烈的看涨信号!MACD指标也是保持在零轴上方,虽然最近的红色能量柱略有收缩,但DIF线仍然在DEA线之上,这表明多头力量依然占据主导,只是上涨速度可能有所放缓,RSI也保持在强势区域,虽然从超买区稍有回落,但仍在高位运行。所以,中期来看,咱们对BTC的态度依然是乐观的,上涨趋势非常稳固。

最后是1日K线图,这代表着咱们的长期趋势方向。从长周期来看,BTC在经历了一段回调后,从12月底开始,就开启了一轮强劲的反弹,并成功扭转了之前的颓势,进入了明确的上升通道!均线系统也是呈现出强劲的多头排列,所有均线都向上发散,并且MACD在零轴上方形成了一个清晰的黄金交叉,红色能量柱持续放大,RSI也稳定在50上方,并且还有进一步上升的空间。这简直就是告诉咱们,长期趋势非常健康,妥妥的大牛市格局呀!

消息面,暖风频吹,但也要警惕暗流:

结合咱们最新的消息面来看,利好消息真的是占据了绝对主导!

你看,Solana现货ETF都开始单日吸金上千万美元了(消息1),这说明机构资金对加密货币的配置热情很高,而且不止是BTC,整个市场都在受益。

美参议员直接呼吁把比特币纳入国家战略储备(消息3, 9),这可是历史性的利好,直接把比特币提升到国家战略层面,极大地增强了它的合法性和稀缺性预期。

委内瑞拉原油开发可能降低比特币挖矿成本(消息5, 8),这会直接提升矿工利润,刺激挖矿产业发展,间接利好币价。

以太坊2026年都被预测要涨到1.5万美元,市值冲击2万亿了(消息7),这会带动整个加密市场的乐观情绪。

更重要的是,Bitwise研究主管都说了,机构采用加速、加密监管转向、AI乐观情绪是推动比特币上涨的三大主因(消息15),高盛也认为监管明确是机构采用的关键催化剂(消息49)。这些都指向了机构资金的持续流入和监管环境的改善,这可是市场上涨最坚实的支撑!

还有呢,Boros未平仓合约量创新高(消息10),巨鲸们的多单浮盈超千万美元(消息26, 29),甚至有新钱包500万USDC豪掷杠杆做多(消息28, 33),以及以太坊质押队列爆满(消息27, 32, 38, 41),这些都表明市场资金活跃度极高,大户们信心十足,市场情绪也从恐慌转向中性(消息24),甚至有分析师指出比特币反弹中的投降式抛售可能意味着市场已充分出清(消息25),为后续上涨打下基础。

美联储维持利率不变的概率高达82.8%(消息44),这宏观经济环境也给风险资产带来了稳定预期。

当然,也有一些小插曲,比如Coinbase数据泄露(消息2)、Drake推广加密赌场被诉讼(消息6)、NFT Paris活动取消(消息16, 21),以及美国加密市场结构法案可能延迟到2027年甚至2029年落地(消息35, 42)。这些消息提醒咱们,加密市场依然存在风险,监管落地需要时间,并且部分细分赛道(如NFT)可能仍处于熊市。但这些负面消息目前来看,影响范围有限,并没有改变市场整体的乐观情绪。

咱们的预判和做单思路:

综合来看,亲爱的朋友们,咱们可以得出明确的结论:

长期和中期趋势:毫无疑问,明确的上涨趋势! 4小时和1日图都给出了非常强劲的牛市信号,均线多头排列,MACD能量柱充沛,RSI表现强势。机构资金的持续流入和监管的积极信号,为这轮上涨提供了坚实的基本面支撑。

短期趋势:在经历了前期快速拉升之后,15分钟和1小时图显示市场正在进行短期回调或高位震荡整理。MACD的死叉和RSI的降温,都在提醒咱们,短期动能有所减弱。

关键支撑位和阻力位:

短期阻力位:咱们关注94,000 - 94,200这个区间,以及最高点94,789。如果能有效突破并站稳94,789,那上方空间可能会进一步打开。

短期支撑位:首先看93,500附近。如果跌破这里,那咱们需要关注4小时图上的MA10(大约在92,800-92,900左右),以及前期的强支撑位92,000-92,500区域。

长期重要支撑:1日图的MA5(大约在91,900左右)和MA10(大约在89,900左右)是咱们要关注的非常重要的长期趋势线支撑,只要价格不有效跌破它们,大方向就没问题。

做单思路:

考虑到目前短期的回调和中长期的看涨,咱们的做单思路可以是这样的:

1. 激进型选手:可以在短期回调到93,500附近,或者更稳妥一些,在92,500-93,000这个区域寻找入场机会,以多单为主。止损可以放在92,000下方,目标看向94,789,甚至更高的95,000-96,000。

2. 稳健型选手:耐心等待短期回调企稳的信号,比如15分钟或1小时MACD重新形成黄金交叉,或者价格在关键支撑位(如92,500-93,000)附近出现明显的止跌K线形态(比如锤子线、启明星等),再考虑分批入场多单。长期来看,逢低布局依然是主旋律。

3. 注意风险:虽然大方向看涨,但短期波动依然剧烈,合约交易务必控制好仓位和杠杆,设好止损。消息面上,虽然利好主导,但潜在的监管不确定性(法案延迟)和一些负面事件(如数据泄露)也需要保持警惕。

目前市场处于一个“短期回调、中期上涨、长期牛市”的阶段。短暂的调整是为了更健康的上涨,所以别被短期的波动吓到啦!

最后送大家一句话金句:短期看情绪,中期看结构,长期看信仰,但最终都要尊重趋势!

-------------------------

受限于图表篇幅和平台合规准则,行情分析有时效性,最新的分析已更新在我的青岚加密课堂:qinglan.org 或欢迎点击我的头像关注我,通过主页展示的渠道进行更多技术探讨。

青岚加密课堂:2026年1月4日晚间BTC行情分析欢迎来到青岚加密课堂,咱们今天对BTC 四个周期包括消息面进行分析:

技术面分析:不同周期,不同洞察

短期表现(15分钟K线): 从最近的K线看,价格在91000-91400的区间里小幅震荡,虽然之前有过一波下跌,但MACD已经给出了一个短线的金叉信号,RSI也从低位回升,说明呀,短期内有止跌企稳的迹象,出现了一点反弹的势头。不过,MA均线排列有些交织,还没形成非常明确的单边趋势,更像是筑底反弹的过程。

中短期走势(1小时K线): 1小时图上,从1月2号开始整体是个上升趋势,非常不错!但是呢,最近几个小时MACD却形成了死叉,RSI也从高位下来了,这意味着短期上涨的动能有所减弱,可能会面临一个小幅的回调或者进入震荡整理。但是别担心,价格依然稳稳地站在MA20等较长期的均线之上,所以这更像是健康的回调,而不是趋势反转哦。

中期展望(4小时K线): 哇,到了4小时图,画面就完全不一样了!这里展示的是一个非常强劲的上涨趋势!MA均线系统呈现出完美的多头排列(MA5在MA10上方,MA10在MA20上方),MACD的DIF和DEA线都在零轴上方且持续向上,能量柱更是又粗又长,显示着买方力量十足。RSI虽然接近超买区,但也证明了市场的火热程度。中期来看,走势非常乐观。

长期趋势(1日K线): 咱们的日线图,这可是个重量级信号!在经历了前期的回调和震荡(也就是所谓的“冷熊”)之后,日线MACD终于形成了明确的黄金交叉,DIF线上穿DEA线,能量柱也从负值转为正值并持续放大。MA均线也已经完成了多头排列。这清楚地告诉咱们,比特币的长期趋势正在发生关键性的反转,一个从底部蓄力、向牛市迈进的阶段可能已经开启啦!(请注意,咱们的日线数据是截至1月4日08:00 UTC+8,比短周期数据稍早一些。)

消息面结合:利好扎堆,信心大增!

从咱们收集的50条消息面来看,市场情绪简直是“杠杠的”:

核心利好:最重磅的莫过于美国比特币现货ETF在本周吸金4.59亿美元!这可是实实在在的机构资金流入,对市场信心是巨大的提振。同时,新生巨鲸以创纪录的速度囤积比特币,持仓已超1200亿美元,这说明大资金对BTC的未来充满了信心。还有不少巨鲸将以太坊(ETH)兑换成WBTC,这也间接说明资金正在向比特币这个“数字黄金”集中。连ARK Invest的Cathie Wood都表示比特币的四年周期模式已经终结,这意味着市场可能走向更成熟、更可持续的增长模式。

中性信息:虽然其他一些消息,比如Aave、WLFI等项目代币回购的讨论,或者Solana生态的亮眼表现,都在加密货币市场内部活跃,但对BTC本身的直接影响较小。关于Strategy集团可能因2025年Q4比特币下跌而蒙受损失的消息,那已经是过去时了,而且他们也在积极建立现金储备,说明有应对措施。

风险提示:关于SOL杠杆仓位清算风险和加密用户暴力攻击事件,提醒咱们市场波动性和潜在的安全风险依然存在,需要注意。

交易建议:明确预判与做单思路

综合咱们所有的分析,我的判断是:

短、中、长期趋势方向:

短期(15分钟、1小时): 短期偏向于震荡整理或小幅回调,但整体处于上涨趋势中的调整。

中期(4小时): 呈现出强劲的上涨趋势。

长期(1日): 已经出现明确的趋势反转信号,转向长期上涨趋势。

关键支撑位和阻力位:

当前价格: 大约在91400 USDT附近。

直接阻力位: 咱们首先要关注91600 - 91800这个区间,这是短周期图上的近期高点。如果能有效突破并站稳,上方空间就打开了。

直接支撑位: 短期可以留意91000 - 91100这个区域,如果回落到这里,很可能会遇到买盘支撑。

中期重要支撑位: 更强的中期支撑在90400 - 90700,这是4小时图上多次突破的关键位置,现在变成了非常重要的支撑位。

长期核心支撑位: 日线图上,87000 - 88000是咱们判断长期趋势的关键防线,只要不跌破这个区域,长期看涨的格局就不会改变。

可能出现的反转形态:

目前短期内的MACD死叉和RSI回调,更像是上涨过程中的健康调整,而非趋势反转形态。鉴于日线和4小时图的强势表现,这种调整很可能是市场在消化前期涨幅,为后续的上涨蓄力,咱们不必过于担忧。

做单思路呢,咱们可以这样来:

结合强劲的长期和中期上涨趋势,以及消息面带来的重大利好,咱们的操作策略应该以逢低做多为主!

入场时机: 如果短期价格能够回撤到咱们的91000 - 91100,或者更好的位置是90400 - 90700这个中期支撑区间,并且出现了明显的止跌信号(比如K线收阳、带长下影线,或者出现看涨吞没形态),那就会是咱们非常好的入场做多机会。

止损设置: 考虑到风险管理,止损可以设置在关键支撑位下方一点,比如90000甚至89500下方,这样能保护咱们的本金。

突破追涨: 如果价格能够有效突破并站稳91800这个阻力位,并且伴随着放量,那么咱们也可以考虑轻仓追涨,目标看向更高的位置。

记住,市场情绪偏向乐观,资金正在积极入场,咱们要顺势而为,抓住机会!

交易金句:

"真正的交易者,在市场喧嚣中保持清醒,在趋势启动时坚定同行。"

-------------------------

受限于图表篇幅和平台合规准则,行情分析有时效性,最新的分析已更新在我的青岚加密课堂:qinglan.org 欢迎点击我的头像关注我,通过主页展示的渠道进行更多技术探讨。

青岚加密课堂:2026年1月4日早间BTC行情分析欢迎来到青岚加密课堂,咱们今天对BTC 四个周期包括消息面进行分析:

1. 数据整合与技术面分析:

15分钟周期(超短线):

数据表现: 从咱们最新观察到的K线数据来看,BTCUSDT在91000 USDT附近进行了一个高位震荡。在01/04 08:00左右经历了一波猛烈的拉升,从90628直接冲到91610的高点,成交量也随之放大。但随后几根K线出现了小幅回落,收盘价在91124到91254之间徘徊。

技术指标:

MA均线: MA5、MA10、MA20均线在拉升后呈现多头排列,但最近几根K线收敛,甚至MA5开始下穿MA10,有形成死叉的趋势。这意味着短期上涨动能正在减弱。

MACD: DIF和DEA在08:00后大幅拉升,MACD柱状图(BAR)也达到了高点,显示强劲的上涨势头。但最新几根K线显示,DIF开始下穿DEA,BAR也转为负值并持续扩大,形成了明显的MACD死叉,且死叉位置较高,这是短期看跌的信号,暗示价格有回调需求。

RSI: 在冲高时一度达到83.49,处于严重超买区域。随后回落到63.33,虽然仍在50上方,但已明显脱离超买,显示买盘情绪有所降温。

总结: 短期来看,BTC在经历了一波快速拉升后,目前处于高位震荡并伴有回调压力。

1小时周期(短线):

数据表现: 1小时图显示,BTC在01/04 08:00也出现了一根非常长的阳线,从90628拉升至91341,成交量巨大,随后两根K线在高位震荡,收盘在91124-91254之间。整体来看,近期的趋势是向上走的,虽然过程中有回调,但每次都能创新高。

技术指标:

MA均线: MA5、MA10、MA20均线呈现清晰的多头排列,且均线间距开始拉开,这表明短线上涨趋势非常强劲。

MACD: DIF和DEA在不断向上运行,BAR也持续为正值,并保持在一个较高的水平,虽然最新几根K线BAR有所收缩,但尚未形成死叉,上涨动能仍在。

RSI: 一度达到77.84的超买区域,最新回落到72.23,仍处于较强区域,说明市场情绪偏向乐观。

总结: 短期上升趋势明显,但高位有一定抛压,需要留意后续能否有效突破前高。

4小时周期(中线):

数据表现: 从咱们4小时图来看,比特币在最近几根K线表现非常强势,连续收阳,从89969涨到最新的91254。这表明中线多头力量占据主导地位。成交量在最近两根阳线也显著放大。

技术指标:

MA均线: MA5、MA10、MA20均线形成完美的多头排列,且向上发散,这是一个非常强烈的上涨信号,显示中线趋势处于强劲的上升通道中。

MACD: DIF和DEA均在零轴上方运行,且DIF持续向上拉开与DEA的距离,BAR也持续放大并为正值,表明中线上涨动能充足,非常健康。

RSI: 从低位42.25一路攀升,最新已达到70.99,进入超买区域,但趋势向上,说明市场热度很高。

总结: 中期趋势非常乐观,处于一个强劲的上涨周期。

1日周期(长线):

数据表现: 日线图显示,比特币在经历了一段下跌后,近期呈现筑底反弹的态势。最近几根K线连续收阳,价格从87225一路上涨到91254,展现出底部支撑强劲,多头正在努力扭转局势。

技术指标:

MA均线: 长期均线MA20仍高于MA5和MA10,显示大趋势依然偏空,但MA5和MA10已经开始向上抬头,并且MA5即将上穿MA10和MA20,如果能成功突破并形成多头排列,那将是长期趋势反转的强烈信号。目前来看,MA5即将金叉MA10和MA20,是一个非常值得期待的积极信号。

MACD: DIF线仍在DEA线下方,但两者距离在快速缩小,BAR值持续为正且不断放大,显示空头力量衰竭,多头力量正在积聚。MACD金叉指日可待。

RSI: 已经从低位42.25回升至58.15,脱离了弱势区域,并显示出上升势头,表明买盘信心正在恢复。

总结: 长期来看,比特币正处于从底部反弹并尝试扭转颓势的关键阶段,筑底反弹的格局初见雏形,多头有很强的意愿扭转长线趋势。

2. 消息面结合:

结合最新的消息面,咱们能看到一些很有意思的点:

宏观与风险: Matrixport预警2026年高风险高波动,美联储保尔森表示通胀若降温可能降息(偏鸽派),以及通胀可能酝酿新一轮周期,这些宏观消息给市场带来了一些不确定性,尤其是对长期趋势。不过,美联储的降息预期如果实现,短期对加密市场是利好。

市场情绪与预期: Polymarket预测比特币1月涨至10万美元概率升至38%,涨至9.5万美元概率为69%,这可是非常乐观的短期预期啊!美政府持有超300亿美元加密货币,比特币占比高达97%,这也为BTC提供了强大的基本面支撑。

巨鲸动向: "BTC OG内幕巨鲸"扭亏为盈浮盈150万美元,显示大资金对市场的信心恢复。但也有地址在巨额做空BTC和ETH,浮亏超180万美元,这说明市场分歧还是蛮大的,有大资金在博弈。这提醒咱们要谨慎,市场波动可能会加剧。

以太坊生态: Vitalik的ZK-EVM和PeerDAS突破,以及Bitmine大规模质押ETH、ETH质押退出队列降至8万枚而等待质押的ETH超100万枚,这些都是对ETH的巨大利好!虽然咱们主要看BTC,但ETH的强势也会带动整个加密市场的情绪,特别是联动效应。易理华的ETH回本操作也进一步增强了市场信心。

Web3和区域发展: 香港Web3峰会聚焦创新应用,对行业发展是积极信号,有利于长线布局。

市场共识: 10x Research提到市场普遍看跌的共识可能存在问题,这本身是一种逆向思维的看涨信号,如果大家都看跌,那市场可能反而要涨了呢。

3. 交易建议:

综合咱们K线和消息面的分析,青岚老师给咱们捋一下:

短期(15分钟-1小时)趋势:震荡偏弱回调

虽然1小时图显示短线趋势是上涨的,但15分钟图的MACD死叉和RSI从超买区回调,暗示短期内有回调需求或进入高位震荡整理。

关键支撑位: 90800 USDT (15分钟MA20附近),下方强支撑在90500 USDT。

关键阻力位: 91600-91700 USDT(近期高点),有效突破这个位置才能继续向上。

反转形态: 如果在90500-90800区域形成W底或强力支撑,可能带来新的短线反弹。反之,如果有效跌破,短期可能继续下探。

中期(4小时)趋势:强劲上涨

4小时图呈现非常健康的多头排列和MACD指标,表明中期上涨趋势非常稳固。即使短期有回调,在中期看来也只是上涨途中的盘整。

关键支撑位: 90000-90100 USDT (4小时MA5和MA10附近),这是咱们可以考虑的加仓区域。

关键阻力位: 92000 USDT,突破这个位置将打开更大的上涨空间。

反转形态: 目前没有看到明显的中期反转信号,趋势非常明确。

长期(1日)趋势:筑底反弹,等待反转确认

日线图虽然还没有完全走出下降趋势,但MACD柱状图积极放大,RSI回升,最重要的是MA5即将金叉MA10和MA20,这都是非常积极的信号。长期趋势正在从熊市向牛市转换的关键节点。

关键支撑位: 89000-89500 USDT (日线MA5和MA10附近),这是长期买入的策略性区域。

关键阻力位: 92000 USDT上方,如果能站稳并突破日线MA20,那么长期牛市的信号就非常强了。

反转形态: 目前日线正在构建底部,一旦MACD金叉和均线多头排列形成,就是长期上涨趋势的正式确认。

咱们的预判和做单思路:

整体来看,市场情绪是偏乐观的,尤其是中长期趋势呈现强劲的上升动能,日线级别的底部反弹和趋势反转信号也越来越明显。消息面上,BTC的基本面和ETH的利好都给市场带来了信心。

做多思路(主导): 咱们应该以逢低做多为主。短线上,如果比特币回踩90800 USDT甚至90500 USDT附近,并在这些支撑位企稳,可以考虑轻仓介入多单。中长期来看,任何跌破90000 USDT的回调都可能是非常好的建仓或加仓机会。大家可以关注90000 USDT这个整数关口,也是4小时周期的一个强支撑。

风险控制: 尽管趋势乐观,但15分钟周期的短期回调风险仍然存在,加上有大鲸在做空,所以短线操作一定要设置好止损,避免追高。同时,Matrixport和通胀的宏观风险,也提醒咱们要对2026年的市场保持一份谨慎。

总结一下:

短线震荡回调,中长线看涨。操作上,短线咱们可以观察回调到关键支撑位(如90500-90800)后的表现,如果出现止跌信号,可以考虑短多。而中长期投资者,逢回调就是买入的机会,特别关注90000-90100的支撑区域,以及日线级别的趋势反转信号。

记住咱们交易的金句:趋势是朋友,耐心是武器,风险是常客。 祝大家交易顺利,新年大吉!-------------------------

受限于图表篇幅和平台合规准则,行情分析有时效性,最新的分析已更新在我的青岚加密课堂:qinglan.org 欢迎点击我的头像关注我,通过主页展示的渠道进行更多技术探讨。

青岚加密课堂:2026年1月3日晚间 ETH行情分析欢迎来到青岚加密课堂,咱们今天对ETH 四个周期包括消息面进行分析:

首先,咱们从各个周期的K线数据来看,近期ETH的表现可真是跌宕起伏,但总体趋势还是能看出来的:

15分钟 K线(超短期): 最近K线的数据区间大概在3076美元到3142美元之间。从01月03日早上高点3137美元一路回调,到了下午15:15左右触及3082美元的低点,然后开始了一波反弹,目前在3106美元附近震荡。成交量在下跌和反弹的过程中都有明显放大,说明市场交易非常活跃,短期的多空博弈激烈呀。

MA均线: 短期均线MA5、MA10、MA20在3100-3103附近纠缠,虽然最新一根K线MA5有向上拐头穿越MA10和MA20的迹象,但排列还不清晰,显示出短线是个震荡行情。

MACD: DIF线在负值区域,但正加速向上穿越DEA线,MACD柱状图已经由负转正并持续放大。这是一个短线金叉信号哦,表明短期卖盘压力减弱,有企稳反弹的动能。

RSI: RSI从超卖区24.07快速回升到54.71,显示短线超跌反弹的动能充足,但还未进入超买区。

1小时 K线(短期): 最近K线显示,ETH从01月01日开始了一波强劲的上涨,特别是01月02日晚间到01月03日凌晨,一小时K线连续拉升,从3050美元冲到了3146美元的高位!不过呢,从01月03日午后开始,又经历了一波回调,目前在3106美元附近。成交量在冲高时非常巨大,回调时也伴随着大额成交,短期波动剧烈。

MA均线: 短期均线MA5、MA10、MA20出现了死叉排列,MA5和MA10都已经跌破了MA20,并且都处于当前价格上方,形成了短期的压力位,显示短线正在经历回调。

MACD: DIF和DEA虽然仍在正值区域,但DIF已经下穿DEA形成了死叉,MACD柱状图显著为负并不断扩大。这可是明确的短期空头信号,回调风险不容忽视哦。

RSI: RSI从超买区84.66迅速回落到57.2,表明市场的短期过热情绪正在降温,多头力量有所衰减。

4小时 K线(中期): 从12月29日开始,ETH走出了一波非常漂亮的上涨行情,从2930美元左右一路冲到了01月03日凌晨的3150美元高点,目前在高位进行震荡调整,回调幅度相对较小。成交量在上涨过程中持续放大,是健康的量价配合。

MA均线: MA5、MA10、MA20依然保持着非常标准的多头排列,而且MA5 (3109.29) 仍然远高于MA10 (3084.54) 和MA20 (3035.69)。这说明中期上涨趋势非常稳固,目前的回调只是健康的调整。

MACD: DIF和DEA都在正值区域,DIF仍然在DEA之上,MACD柱状图虽然有所收敛,但依然是正值。这表明中期多头动能虽有减弱,但仍然占据主导地位,尚未出现反转信号。

RSI: RSI从接近超买区78.85回落到68.77,依然处于强势区域,说明中期多头力量犹存,只是稍作休息。

1日 K线(长期): 回顾11月,ETH经历了一波显著的下跌。但从12月初开始,它迅速V型反转,走出了一个强劲的长期上涨趋势,目前价格已经突破了之前的一些压力位。

MA均线: 日线图上,MA5 (3036.29) 已经清晰地向上穿越MA10 (2985.12) 和MA20 (2966.09),并且均线呈现出完美的多头排列。这是一个非常强烈的长期看涨信号,表明多头力量正在全面复苏并掌控大局。

MACD: DIF线在负值区域加速向上穿越DEA线,形成了清晰的金叉,MACD柱状图也由负转正并持续放大。这再次确认了日线级别的底部反转和强劲的上涨动能。

RSI: RSI从超卖区27.72强势回升到57.09,进入强势区域,进一步巩固了长期上涨的趋势。

2. 消息面结合与综合判断

咱们再来看看最新的消息面,好消息和坏消息都有,但整体感觉是:

利好消息主导,牛市预期强烈:

最直接的利好莫过于ETH的质押热潮,BitMine追加8.2万枚ETH,验证者队列逼近百万ETH,这说明机构对ETH的长期价值非常看好,质押还会减少市场流通量,对币价是实打实的支撑。

巨鲸持续增持ETH,大手笔从交易所提币,这通常是长期看涨的信号。Cathie Wood支持的公司也在买入ETH,说明传统资金的配置意愿很强。

大佬们普遍看好牛市,易理华直言2024年是牛市定调,传统金融机构对2026年加密市场也持普遍看好态度。这些信心喊话对市场情绪有很大提振。

Meme币和AI概念币的活跃也反映出市场流动性充裕,投机情绪高涨,资金乐于追逐热点,这通常是牛市的特征之一。

短期回调压力和风险警示:

当然,也不是没有“噪音”啦。最让咱们担心的是有巨鲸开了ETH和BTC的空单,这意味着短期可能会有抛压。

Coinbase比特币溢价指数连续负值和比特币真实需求放缓的“误判”,也给美国市场情绪泼了点冷水,如果大饼需求不振,ETH也很难独舞。

还有那个特朗普下令打击委内瑞拉这种地缘政治事件,也可能引发短期的市场恐慌,需要留心。

3. 交易建议与做单思路

综合咱们K线和消息面的分析,大方向已经非常明确了,不过短期波动还是要警惕哈!

1. 明确趋势方向:

长期趋势: 上涨。日线图已明确走出V型反转,各项指标都发出强烈的买入信号。

中期趋势: 上涨。4小时图处于健康的多头排列和震荡调整中,上升势头未改。

短期趋势: 震荡回调后企稳反弹。1小时图正在回调,15分钟图短线有企稳反弹迹象。

2. 关键支撑位和阻力位:

关键阻力位:

短线(15分钟/1小时): 3110-3115美元(短线回调前高点),3120-3125美元(1小时图MA20附近)。

中线(4小时): 3135-3140美元(4小时图近期高点,短期阻力),3150美元(重要心理关口)。

关键支撑位:

短线(15分钟/1小时): 3090-3095美元(15分钟图近期低点,也是较强支撑),3080-3085美元(1小时图近期回撤的低点)。

中线(4小时): 3070-3075美元(4小时图的短期支撑,不宜有效跌破),3030-3040美元(4小时图MA20附近,也是日线图金叉后的重要支撑)。

3. 可能出现的反转形态:

短线(15分钟/1小时): 如果价格能在3090-3095美元区间有效企稳,并伴随15分钟MACD金叉动能持续增强,有望形成一个短期的W底反转形态,向上突破3110美元。但如果跌破3080美元,则可能会形成M头,开启更深度的短线回调。

中线(4小时): 价格目前处于上涨后的健康回调。如果能在3070-3075美元区间找到强支撑,并出现看涨吞没或启明星等K线组合,则回调结束,继续上攻。反之,如果有效跌破3070美元,则可能形成双顶或头肩顶的雏形,需要警惕。

长线(1日): 1日图目前处于强势上涨初期,出现反转形态的可能性非常小。除非有超预期重大利空事件,否则目前大概率是上涨途中的健康调整。

4. 做单思路:

咱们预判: 咱们ETH啊,现在是处于长期和中期都非常强势的上涨趋势中,不过短线正在经历一个必要的技术性回调。消息面虽然有短期风险,但长期看好情绪占据上风,特别是机构对ETH的质押和增持,都给市场提供了强大的基本面支撑。回调就是给咱们上车的好机会呀!

具体策略:

短线激进型操作: 密切关注15分钟图和1小时图。如果ETH在3090-3095美元附近企稳,并且15分钟MACD金叉动能持续,RSI向上发散,可以考虑短线轻仓做多,目标看回3110-3120美元的短线阻力。止损位严格设置在3080美元下方。

中长线稳健型布局: 既然大趋势是牛市,咱们可以利用这次短线回调来分批布局。建议在3070-3080美元的区间,甚至如果能跌到4小时图MA20附近(大约3030-3040美元),都是非常好的中长线建仓区域。目标可以看得更远,比如前高3150美元甚至更高的3200-3300美元。止损位可以设置在日线MA20下方,比如2950美元,保护好咱们的本金哦。

风险管理: 别忘了咱们看到的巨鲸空单和地缘政治风险,所以任何时候都要控制好仓位,分批建仓,不要满仓操作。

最后,送给大家一句交易金句:“面对市场的潮起潮落,咱们要学会用冷静的头脑去驾驭趋势,而非用冲动的情绪去追逐泡沫。” 祝大家交易顺利,咱们下期再见啦!

-------------------------

受限于图表篇幅和平台合规准则,更多关于实时资讯对市场情绪影响的量化拆解,已更新在我的青岚加密课堂,qinglan.org个人资料页 (Profile)。欢迎点击我的头像,通过主页展示的渠道进行更多技术探讨。

青岚加密课堂:2026年1月3日晚间BTC行情分析欢迎来到青岚加密课堂,咱们今天对BTC 四个周期包括消息面进行分析:

1. 技术面分析与趋势总结

15分钟K线(超短期):

从最近的40根K线来看,BTCUSDT在今天(01/03)下午经历了一波快速下跌,从90300附近跌到89300,成交量也放大了不少。不过,随后价格就迅速反弹了,目前正在90000-90100区间震荡修复。

均线排列: 最近几个周期,MA5、MA10、MA20均线曾有过短暂的空头排列,但在最近的几根K线上,MA5和MA10已经向上突破MA20,形成了短期的多头排列,虽然均线缠绕比较紧密,说明短期内多空双方在激烈争夺,市场方向感还不十分明确。

MACD: MACD指标在下跌时DIF和DEA形成了死叉,MACD柱状图持续为负。但在最近的几根K线中,DIF已经向上穿过了DEA,形成了金叉,并且MACD柱状图也由负转正并逐渐放大。这表明短线买方力量正在增强,是一个积极的信号。

RSI: RSI一度跌至20多,进入超卖区,随后迅速反弹到50多,目前在57附近,表示市场从超卖状态中恢复,但尚未进入超买区,还有一定的上涨空间。

1小时K线(短期):

近47根K线显示,比特币在1月1号到1月3号凌晨有一波明显的上涨,从87500附近冲到了90900上方。但今天下午也出现了一次较大幅度的回调,直接跌破了所有短期均线。

均线排列: 曾有过一段健康的多头排列。但由于最近的回调,价格跌破了短期均线,目前MA5和MA10粘合,并且MA20在它们上方,MA5和MA10甚至有向下交叉MA20的迹象,这表示短期的上涨势头有所减弱,进入震荡或者回调阶段。

MACD: MACD在上涨时表现出强劲的多头势头,DIF和DEA持续向上。但最近的回调导致DIF向下穿破了DEA,形成了死叉,且MACD柱状图转为负值并持续放大。这是一个短期的看跌信号,显示短期卖方力量占据优势。

RSI: RSI从70以上的高位回落,目前在56附近,说明市场从过热状态中冷却下来,短期内多头情绪有所降温。

4小时K线(中期):

近47根K线展示了比特币自12月下旬以来的一个非常清晰的上升趋势。虽然中间有一些小幅回调,但整体结构是向上推进的。

均线排列: MA5、MA10、MA20均线保持着非常完美的多头排列,并且均线之间保持着健康的距离,价格也一直运行在所有均线之上。这是一个非常强劲的中期上涨趋势信号。

MACD: MACD指标持续在零轴上方运行,DIF和DEA保持金叉状态,MACD柱状图为正值。虽然最近的柱状图有所收敛,但并未形成死叉,仍然处于多头强势区域。

RSI: RSI大部分时间运行在55-70之间,表明中期市场保持强势,但没有过度超买。目前在62附近,比较健康。

1日K线(长期):

近48根K线描绘了比特币从11月初的下跌,到12月下旬开始企稳反弹的走势。整体上,长期的下跌趋势正在被逆转。

均线排列: 11月经历了一段下跌后的空头排列,但从12月底开始,MA5、MA10、MA20均线已经形成了多头排列,并且均线开始逐渐发散向上。这是一个非常重要的长期趋势反转信号。

MACD: MACD指标在11月下旬曾出现死叉,但从12月下旬开始,DIF向上穿过了DEA,形成了非常明确的金叉,MACD柱状图也由负转正并持续放大。这表明长期下跌趋势已经结束,新的上涨趋势正在形成。

RSI: RSI从11月下旬的超卖区(20多)稳步回升,目前在53附近,显示出长期趋势的强势回归。

2. 消息面结合与综合判断

从消息面来看,市场情绪可谓是喜忧参半,但长期乐观主调不变。

长期利好: 易理华的“2024年牛市已定调,对空头发出警告” (#2, #15) 给市场注入了强心剂。ETF的规模扩张和IBIT跻身前六 (#8) 再次验证了传统资金的涌入。美国立法者正制定数字资产监管框架 (#6) 也带来了监管明确性的预期。此外,巨鲸持续将BTC移出CEX (#13),以及对ETH (#22, #23, #31, #34, #36) 和山寨币 (#26, #35, #37, #50) 的大量增持和炒作,都显示出市场资金的活跃度和风险偏好正在提升。乐观派甚至押注年底冲击15万美元 (#44),这些都与日线和4小时线的技术面强势吻合。

短期担忧: 最值得咱们关注的是CryptoQuant研究主管的警告 (#20, #41),他指出“市场误判巨鲸行为,比特币真实需求已逼近负值”,并且“剔除干扰后的数据显示,比特币巨鲸的持仓实际上正在下降”。这与咱们普遍认为的巨鲸增持是相悖的,可能会给短期市场带来压力。同时,Coinbase比特币溢价指数连续20日负溢价 (#29) 也暗示了美国市场情绪的降温。更直接的是,有鲸鱼再次开启了高达10倍BTC和15倍ETH的空单 (#48),加上地缘政治风险 (#47) 曾导致市场应声回落,这些都是短线压力的来源。尤其要注意比特币跌破89,000美元可能引发4.94亿多单清算 (#21) 的预警,这是一个非常关键的短期支撑位。

3. 咱们的预判与做单思路

综合所有分析,咱们可以这样来总结:

长期趋势: 上涨。日线图已经从长期的下跌中走出来,形成了明确的多头趋势,MACD和均线都发出了积极的信号。消息面上,虽然有短期波动,但机构资金和宏观趋势都指向一个牛市的启动。

中期趋势: 上涨。4小时图显示非常健康的多头趋势,虽然最近有过小幅回调,但这被视为健康的市场调整,而非趋势逆转。

短期趋势: 震荡偏弱/回调后的修复。1小时图经历了较大幅度的回调,目前处于短期弱势,MACD死叉显示卖方力量仍在,价格在均线下方徘徊。15分钟图显示短期内有从下跌中反弹修复的迹象,但动能可能不足以迅速突破上方阻力。

关键支撑位与阻力位:

短线支撑: 89700-89800(15分钟图最近反弹的低点),更关键的支撑是89000美元(新闻中提及的多单清算点,一旦跌破可能引发连锁反应)。

短线阻力: 90300-90400(15分钟和1小时图近期高点,价格多次受阻),向上突破后看90800-91000。

中线支撑: 89500-89600(4小时图MA5/MA10附近,也是1小时图的关键支撑),88800-89000(4小时图MA20附近,也是一个强心理关口)。

中线阻力: 90500-91000(4小时图近期高点,也是历史短期阻力),突破后上看92000-92500。

可能出现的反转形态:

短线: 如果比特币能稳住89700-89800的支撑,并在90300-90400附近形成双底或头肩底的雏形,那么短期有望继续向上修复。反之,如果有效跌破89000,尤其是伴随放量,就可能形成一个短期的下降趋势,向下测试更低的支撑。

中期: 目前4小时图强势,直接反转的可能性不大。回调更可能是蓄势,等待再次向上突破。若出现连续的放量阴线跌破88800甚至88000,则需警惕。

长期: 日线图已形成反转,目前处于上升趋势初期,短期回调只要不跌破88000下方的关键均线支撑,整体看涨格局就不会改变。

咱们的做单思路:

既然咱们看到长期和中期是上涨趋势,而短期只是回调后的修复,那么咱们的整体策略应该是逢低做多为主,但短线操作要谨慎,注意风险控制。

1. 激进型选手: 在15分钟K线显示MACD金叉,且RSI不超买的情况下,可以在89800-90000附近尝试轻仓做多,目标看90300-90400,止损设置在89700下方。如果价格突破90400并站稳,可以考虑追多,目标看向90800-91000。

2. 稳健型选手: 等待价格回调到1小时图或4小时图的关键支撑位再考虑入场。比如等待价格回踩89500-89600区域,并且没有放量跌破,可以考虑多单介入,止损放在89000下方。中线目标可以看向91000、92000甚至更高。

3. 风险控制: 89000美元是一个非常重要的清算价位,务必要密切关注。一旦有效跌破并伴随大量抛售,空头可能会占据主导,届时需要及时止损,甚至可以考虑短线空单博弈。同时,CryptoQuant关于真实需求的警告也提醒咱们不要盲目乐观,保持警惕。

总的来说,咱们现在处于一个长线看涨,但短线有风险释放的阶段。记住呀,在交易的世界里,永远不要与趋势为敌,但也要学会敬畏市场中的不确定性。

交易金句: “趋势为友,风控为盾,耐心为矛,方能行稳致远。”

-------------------------

受限于图表篇幅和平台合规准则,更多关于实时资讯对市场情绪影响的量化拆解,已更新在我的青岚加密课堂,qinglan.org个人资料页 (Profile)。欢迎点击我的头像,通过主页展示的渠道进行更多技术探讨。

青岚加密课堂:2026年1月3日早间BTC行情分析欢迎来到青岚加密课堂,咱们今天对BTC 四个周期包括消息面进行分析:

1. 数据整合与技术面分析

【15分钟 K线数据分析】

K线数量: 40根。

近期趋势: 短期来看,比特币在90000附近呈现震荡偏弱的态势。价格在经历了一波冲高后,目前正在小幅回调。

MA均线: 短期均线(MA5: 90130, MA10: 90069, MA20: 90045)开始粘合,价格(90099)略低于MA5,但仍在MA10和MA20之上。这意味着之前的多头排列正在受到考验,短期动能有所减弱。

MACD: 短线MACD已形成死叉,DIFF(54.48)跌破DEA(54.70),绿色能量柱刚刚冒头,并且有放大的趋势,这表明短线卖方力量开始占据上风。

RSI: RSI14(52.64)处于中性区域,既没有超买也没有超卖,给短线调整留下了空间。

【1小时 K线数据分析】

K线数量: 40根。

近期趋势: 1小时图显示,比特币仍处于一个上涨趋势中的小幅回调。最近几根K线出现了滞涨和回落的迹象,价格从高点90961有所回撤。

MA均线: 均线系统(MA5: 90102, MA10: 90066, MA20: 89701)仍然保持多头排列,但价格(90099)已经跌至MA5附近,均线有收敛的迹象,多头力量在减弱。

MACD: MACD也形成了死叉,DIFF(382.74)已经下穿DEA(394.22),绿色能量柱体出现并正在放量。这进一步确认了1小时级别正在进行回调。

RSI: RSI14(61.25)从中性偏强的区域回落,表明短期的上涨动能正在冷却。

【4小时 K线数据分析】

K线数量: 40根。

近期趋势: 4小时图则显示出非常明确的强劲上涨趋势。自12月29日08:00以来,比特币开启了一波强劲的拉升。

MA均线: 均线(MA5: 89782, MA10: 89198, MA20: 88659)呈现完美的多头排列,且均线间距较大,显示上涨势头非常坚挺。价格(90099)稳稳地运行在所有均线之上。

MACD: MACD指标保持在金叉状态,DIFF(487.08)和DEA(244.61)持续向上发散,红色能量柱体持续放大,表明中长期上涨动能十足,且非常强劲。

RSI: RSI14(66.78)在高位运行,但并未进入极度超买区域(通常在70以上),这意味着上涨仍有空间。

【1日 K线数据分析】

K线数量: 40根。

近期趋势: 日线图的意义可就重大啦,它告诉我们,比特币的长期趋势已经成功从下跌转为上涨,目前正处于上涨的初期阶段,势头非常猛!

MA均线: 均线系统(MA5: 89013, MA10: 88272, MA20: 87885)已形成清晰的多头排列,价格(90099)牢牢站稳在所有均线之上,确认了长期趋势的反转。

MACD: 日线MACD也成功形成了金叉,DIFF(-377.90)上穿DEA(-987.15),红色能量柱持续放量,这可是趋势反转的强烈信号呀!

RSI: RSI14(54.28)刚刚从中轴线上方开始发力,距离超买区域还很远,显示长期上涨潜力巨大。

---

2. 消息面结合分析

咱们来看一下这50条消息,筛选出和比特币以及加密市场强相关的:

长期利好强劲:好多消息都透露着浓厚的牛市预期!你看,【20】和【26】贝莱德和Coinbase等14家巨头都预测2026年稳定币、AI和隐私将成为关键,贝莱德更是预测稳定币将挑战法币,这可是重塑金融系统的节奏啊!【38】灰度研究主管和【47】嘉信理财CEO都明确预测比特币将在2026年创历史新高,原因包括对替代价值储存的需求、美元疲软、美联储降息以及监管进展。这给了咱们长期持有的底气!【50】甚至有机构预测2026年比特币价格区间在12-17万美元,机构资本是关键。

资金流入与空头被爆:【15】巨鲸代理人说资金正从黄金白银转向加密市场,可能引发空头挤压,且不会出现回调。这话可真够霸气的!【41】和【29】的数据也印证了这一点,过去24小时比特币清算了2.09亿美元,空头爆仓超过80%,这说明市场多头力量非常强劲,一旦拉升,空头就得遭殃。

短期突破与回调:【33】比特币突破90000美元大关,这和咱们K线分析的价格走势完美吻合。但是,【18】1月2日比特币ETF净流出2061枚,这个消息短期来看有点小利空,说明在冲高后,确实有一部分资金选择了获利了结,这和咱们15分钟和1小时K线的小幅回调是对应上的,印证了青岚姐说的“短期有点累”。

宏观与监管环境改善:【40】美SEC加密怀疑论者离职,可能意味着监管环境趋向宽松。【13】美参议员卢米斯力推加密法案,希望能为美国加密市场建立明确的监管框架,这都是长期的利好。

其他积极信号:【36】MicroStrategy股票流动性超特斯拉、英伟达,显示企业对BTC的信心;【37】美股加密板块普涨,整体市场情绪乐观;【39】金涌投资披露ETH持仓,机构也在积极配置。

---

3. 交易建议

好了,各位亲爱的同学们,根据咱们刚才细致入微的分析,现在青岚姐就来给大家捋一捋短、中、长期的预判和咱们的做单思路:

【短期趋势(15分钟)】:目前是震荡偏弱的小回调,MACD死叉,多头排列在瓦解。

【中期趋势(1小时)】:处于上涨趋势中的回调,MACD死叉,多头动能减弱。

【长期趋势(4小时和1日)】:强劲的上涨趋势已确立,日线MACD金叉,均线多头排列,并且消息面是实实在在地偏向多头,机构看好、资金流入、空头被爆,这些都不是闹着玩的!

综合预判:

哎呀,看到这里,咱们心里是不是就有底了?比特币目前处于一个非常健康且强势的长期上涨周期中,但短期因为冲高后,积累了一些获利盘,所以正在进行一个良性的小幅回调。就像青岚姐在消息面里看到的【1】说的,“突破九万,站稳了吗?”短期看确实有点累,需要喘口气,进行技术性调整。但从更长周期来看,突破是有效的,而且是趋势反转的信号!

关键支撑位与阻力位:

短期阻力位:咱们先看90230到90400附近,再往上就是历史新高附近,也就是消息里提到的90960甚至92000-94000这个大关口。这可不是随随便便就能冲过去的呀!

短期支撑位:最近的支撑在89900附近,如果跌破,会看向89700(1小时MA20)和89400这个前期的整理平台。

中长期强支撑:如果回调幅度加大,不用慌张哦,下方还有4小时MA10(89198)、4小时MA20(88659)以及日线MA10(88270)、日线MA20(87880)这些坚实的防线。消息面里也提到了88000和85000是重要的支撑位,这些都是咱们可以重点关注的“抄底”区域。

可能出现的反转形态:

目前来看,短期小周期虽然有回调迹象,但并没有出现明确的顶部反转形态。更多是上涨途中的“旗形整理”或“箱体震荡”,也就是为下一波上涨积蓄力量。如果价格能有效站稳在90000上方,并突破90960这个近期高点,那新的上涨空间就打开了。反之,如果89400和88600这些关键支撑都守不住,那咱们就要警惕回调加深的风险了。

做单思路:

1. 对于长期投资者(咱们说的“囤币党”):目前的短期回调是上车的好机会呀!特别是接近89400、88600、88000这些强支撑区域,可以考虑分批建仓或加仓。毕竟日线趋势已经反转,大方向是向上妥妥的。

2. 对于短线交易者:

观望回调结束:现在15分钟和1小时都是MACD死叉,说明短线动能偏空,所以不建议盲目追多。可以耐心等待15分钟或1小时级别MACD再次金叉,或者价格在关键支撑位(比如89400、89000区域)企稳并出现看涨信号后再考虑入场做多。

逢低做多为主:回调到强支撑位时,比如89400附近,可以尝试轻仓布局多单,止损放在支撑位下方一点点。

突破追多需谨慎:如果价格强势突破90960甚至92000,虽然是看涨信号,但一定要结合成交量,并且设置好止损,避免假突破被套。

风险控制:青岚姐在【4】和【9】、【10】的几条消息里都反复强调了风险控制和仓位管理的重要性。合约交易务必设置止损,控制好仓位,避免爆仓。咱们炒币不是赌博,而是有计划的投资呀!

总结一下,大趋势积极向上,小周期正在休息。这个休息是为了更好的冲刺。所以,咱们的策略就是:长期看好,耐心等待短期回调企稳后的逢低做多机会。

交易金句:

“耐心是交易者的美德,等待比行动更考验智慧。在市场蓄力时保持冷静,在机会来临时果断出击。”

-------------------------

受限于图表篇幅和平台合规准则,更多关于实时资讯对市场情绪影响的量化拆解,已更新在我的青岚加密课堂,qinglan.org个人资料页 (Profile)。欢迎点击我的头像,通过主页展示的渠道进行更多技术探讨。

2026年,比特币会复制历史吗?首先祝愿大家2026年一切顺利!去年初,我曾预测了2025年比特币的走势,当时判断可能会复制之前几次牛市的周期,然后再10月结束本轮牛市。

最终结果非常幸运,真的应验了,说明虽然短暂,但历史属于依然有效。不过2026年还会再次复制历史吗?

我觉得有难度,一方面之前几次牛市,并没有华尔街的参与,市场由散户主动,波动性大。而现在,华尔街成为市场主力,他们有强大的算法和对冲工具,市场再想随心所欲就不容易了。

所以我觉得2026年可能会是打破历史的一年。

首先,3年牛市,调整1年的周期可能会被颠覆。至少今年有美联储降息的预期,而黄金等贵金属涨幅颇丰,比特币的价值凸显。而且市场流动性一旦充裕,加密货币也不容易走熊市了。

当然,不走熊市,也不一定走牛市,非常可能走震荡市。

其次,每一次熊市调整都有超过70%的幅度。而现在看,大量的杠杆交易,以及ETF参与,如果还有这么大的振幅,不容易。所以调整的幅度可能也会缩小,比如50%左右。

当然,这些预测的依据都非常主观,缺乏数据支撑,所以只能作为参考。交易上,还是要严格执行策略。

青岚加密课堂:2026年1月2日早间BTC行情分析欢迎来到青岚加密课堂,咱们今天对BTC 四个周期包括消息面进行分析:

1. 数据整合与技术面分析:

咱们就从短到长,一步步剖析。

15分钟 K线(超短期视角):

数据表现和趋势: 最近15分钟K线显示,价格在87900到88900之间震荡上行后,在分析时点(88871.79)附近又略有回落。整体上看,短线多空拉锯比较激烈,成交量在拉升时有所放大,但回调时量能也在,说明上方抛压不小。

技术指标: MA均线在近期多次缠绕后向上发散,显示短线多头尝试掌控局面。MACD指标在0轴上方运行,DIF和DEA线虽然有粘合和回落的迹象,但红柱子还在。RSI指标在60附近,处于健康区域,但离超买不远,一旦快速拉升可能会出现短线超买回调。

1小时 K线(短期视角):

数据表现和趋势: 从1小时图看,比特币在87600附近找到了支撑,然后开始了一波反弹,目前在88871附近。这波反弹的力度还不错,K线实体逐渐放大,说明买盘力量在增强。

技术指标: MA均线呈现出多头排列的趋势,MA5、MA10、MA20都向上翘头,并且价格稳定在均线之上。MACD指标在0轴下方完成了金叉,且红柱持续放大,这是一个很积极的信号,表明短期上涨动能很强劲。RSI指标一路上扬,目前接近66,也反映了这种强势。

4小时 K线(中期视角):

数据表现和趋势: 4小时图上,比特币在87200-87500区域筑底后,已经形成了一波较为稳健的反弹,当前价格已经站稳在近期震荡区间的中上部。

技术指标: MA均线方面,短期均线开始向上穿越长期均线,有形成多头排列的早期迹象,K线大部分时间都运行在均线系统上方。MACD指标更给力,它在0轴下方形成了清晰的金叉,并且红柱子持续增长,这是一个明确的中期趋势扭转信号。RSI指标也从低位稳步抬升至57左右,显示中期动能正在积累。

1日 K线(长期视角):

数据表现和趋势: 日线图上,价格此前经历了较长时间的下跌,但在87200附近止跌,开始出现底部反弹的迹象。虽然最近几天都是阳线,但整体来看,反弹的幅度相对前期下跌还是比较小的。

技术指标: MA均线依然是空头排列,短期均线(MA5, MA10)虽然开始尝试走平或轻微上翘,但长期均线(MA20)还在下行,并且价格目前仍运行在MA20之下,表明长期下跌趋势还没有完全改变。不过,MACD指标在0轴下方出现了金叉,红柱也开始显现,这是长期趋势下跌动能衰竭,反弹力量开始萌芽的信号,但是这个信号的效力,咱们还得结合外部消息来判断。RSI指标从30附近反弹到49,脱离了超卖区域,但还没到强势区。

2. 消息面结合与综合判断:

咱们这次的消息面可真是五花八门,有特别看好的,也有敲警钟的,正好跟技术面形成了有趣的对比,简直是多空激战的缩影呀!

利好方面,咱们看到了一些非常提振信心的消息:

Tether在新年夜豪购8888枚比特币,并且明确表示会将季度利润的15%持续配置到比特币(消息#32、#34),这是实打实的机构买入,而且是长期策略!

特朗普政策转向,美国加密行业监管从高压变包容,以及数字资产信托(DAT)和资产代币化等金融实验的兴起(消息#1、#4),这都预示着加密市场将迎来更广阔的机构和传统金融资金流入。

Coinbase高管也看好2026年前ETF、稳定币和清晰的监管规则会加速加密货币的应用(消息#33),咱们可以看到市场对未来监管和合规化通道充满了期待。

还有B HODL增持比特币,土库曼斯坦合法化挖矿交易,以及链上数据显示比特币抛压正在被市场吸收,市场处于均衡状态(消息#13、#15、#19、#26)。这些都表明,尽管有抛压,但下方承接力强,且不断有大资金在布局。

但是呢,咱们也不能忽略那些警示信号,尤其是这几条:

最最重要的是,分析师@alicharts指出,比特币的10周移动平均线和50周移动平均线形成了“死亡交叉”,历史数据显示这通常预示着50%到60%的深度回调,可能跌至3.8万到5万美元区间(消息#44)。我的天呐,这个长线信号可是非常严肃的,它直接挑战了咱们短中期技术面看到的乐观情绪。

青岚姐在分析中也直接点明了,“长期下跌趋势还没改,现在正好卡在一个关键的多空拉扯区域”(消息#2)。这跟咱们日线均线的分析不谋而合。

此外,2025年末比特币和以太坊ETF都出现了撤资,资金流向了Solana和XRP(消息#16),这说明一部分资金在进行调仓,并非无差别看好。以太坊有大额净流入币安的情况,也可能带来抛售压力(消息#20)。短期内,过去24小时全网爆仓2.02亿美元,其中多单占了近七成(消息#21),说明市场波动性仍高,盲目追高容易被清算。

3. 交易建议:

综合咱们的分析,BTCUSDT目前正处于一个短中期向上修复,但长期趋势仍面临巨大不确定性的关键节点。

短期趋势(15分钟/1小时): 呈现震荡偏上涨的态势。1小时MACD金叉,均线向上发散,有较强的反弹动能。

中期趋势(4小时): 处于底部反弹,尝试扭转下跌趋势。4小时MACD金叉且红柱放大,预示着中期买盘力量正在集结。

长期趋势(1日): 整体仍是下跌趋势中的反弹。虽然日线MACD金叉,但MA均线仍是空头排列,而且最重要的,那个10周/50周移动均线死亡交叉的长期预警,咱们必须高度重视。这意味着目前的上涨,可能是一个熊市中的反弹,而不是牛市的开始。市场正在关键的多空拉扯区域,就像青岚姐说的,多头有底气,但空头也随时可能发力。

关键支撑位和阻力位:

短线支撑: 大概在88500 - 88600 USDT附近,是1小时图上的短期均线支撑。

短线阻力: 集中在88900 - 89200 USDT,是近期高点和心理关口。

中线支撑: 大约在87800 - 88000 USDT,是4小时图上的重要支撑区。

中线阻力: 大约在89500 - 90000 USDT,这是突破长期下降趋势的关键点,也是此前震荡区间的顶部。

长线阻力: 需要关注日线MA20附近(约89000-90000 USDT),以及92000-94000 USDT这一带的历史阻力区。如果能有效突破并站稳这些位置,长期趋势才有望扭转。

可能出现的反转形态:

短期内: 如果价格在88900-89200区域遇到强劲抛压未能突破,可能会形成双顶或头肩顶的短线反转形态,再次向下测试88500甚至更低支撑。

中长期: 目前虽然是反弹,但如果无法突破并站稳90000以上,并且伴随消息面进一步恶化(尤其是死亡交叉的应验),可能会形成“下跌旗形”或“下降三角形”,预示着更大级别的下跌。

咱们的做单思路呢,得这样:

1. 短线(15分钟/1小时): 在当前的强势反弹中,可以考虑逢低做多,比如在88500-88600附近寻找买入机会,目标看88900-89200。但是止损一定要带好,因为上方阻力不小,且长线有风险。如果突破89200,可以少量追多,但随时准备止盈。反之,如果短线在89000附近出现滞涨或放量下跌,也可以考虑短空。

2. 中长线(4小时/1日): 目前是一个观望为主,谨慎建仓的时期。虽然中期信号向好,但长期信号仍是警示。在90000 USDT这个重要阻力位没有被放量有效突破并站稳之前,不建议进行大规模的长期配置。如果能突破90000并站稳,再考虑逐步加仓,但也要留意那个长线死亡交叉的潜在威胁。如果价格反弹到90000-92000区域后受阻回落,甚至跌破87500,那么很可能就是死亡交叉的预言开始应验,咱们就要果断减仓或离场了。

总而言之,目前市场有点儿像“刀尖上跳舞”,短中期有资金推动,但长线警钟长鸣。咱们要保持警惕,灵活应对,不要被短期情绪左右哦。

交易金句: “市场是情绪的放大器,但决策必须基于理性。”

-------------------------

受限于图表篇幅和平台合规准则,更多关于实时资讯对市场情绪影响的量化拆解,已更新在我的青岚加密课堂,qinglan.org个人资料页 (Profile)。欢迎点击我的头像,通过主页展示的渠道进行更多技术探讨。

青岚加密课堂:2026年1月1日早间BTC行情分析欢迎来到青岚加密课堂,咱们今天对BTC 四个周期包括消息面进行分析:

1. 数据整合与趋势初探:

从最近的数据看,比特币在不同周期呈现出复杂的走势:

15分钟和1小时周期:近期经历了一波下跌,目前在努力企稳反弹。

4小时周期:在一次短暂拉升后,又回到了震荡下行的趋势中。

1日周期:虽然整体处于一个较长时间的下行趋势,但似乎正在酝酿一些积极的长期信号。

2. 技术面分析:

咱们来逐个周期详细看看:

15分钟 K线(短线):

趋势:最近从89000上方经历了一次快速下跌,但在87400附近找到了支撑,目前正在尝试反弹。成交量在下跌和反弹中都有所放大。

MA均线:MA5(87928)刚刚上穿了MA10(87836)和MA20(87797),形成了短期金叉,显示出短线有买盘介入,价格开始走强。

MACD:DIF线(19.51)成功上穿DEA线(-26.36),形成金叉,并且BAR柱从负转正,正值持续放大。这可是个很强的短线看涨信号哦。

RSI:从之前的30多超卖区回升到55左右,也支持短线反弹的判断。

1小时 K线(中短线):

趋势:在过去12小时内,比特币从89000上方持续下跌,整体呈下降趋势。目前的反弹仍然在消化这波下跌的压力。

MA均线:MA5(87813)虽然高于MA10(87737),但依然低于MA20(88139),说明价格还在较长期的均线压力之下,多头力量仍需努力。

MACD:DIF线(-144.71)和DEA线(-117.15)仍在零轴下方运行,虽然负的BAR柱在收敛,表明下跌动能在减弱,但还没有形成明确的看涨信号,死叉结构还在。

RSI:在46.85,从超卖区有所回升,但仍在50以下,显示中短期依然偏弱。

4小时 K线(中线):

趋势:在12月29日那波强劲拉升后,比特币未能守住成果,近期呈震荡下行趋势,尤其是从12月31日16:00开始,价格又经历了一次较为明显的下跌。

MA均线:MA5(88014)已经下穿了MA10(88286)和MA20(88160),形成了新的死叉排列,这是中期趋势偏空的信号。

MACD:DIF线(21.36)下穿DEA线(92.80),形成死叉,BAR柱也由正转负,负值逐渐放大,表明中期下跌动能正在增强。

RSI:在48.95,处于50下方,进一步确认了中期偏弱的走势。

1日 K线(长线):

趋势:从11月初的110000高点一路震荡下行,大趋势是偏空的筑底过程。

MA均线:MA5(87848)在MA10(87687)和MA20(87755)之间缠绕,且整体方向仍向下,表明长期处于弱势震荡格局,趋势尚未明朗。

MACD:DIF线(-845.51)成功上穿DEA线(-1174.60),形成金叉,并且BAR柱是正值且在放大!这是一个非常重要的信号,预示着长期底部可能已经形成或正在形成,并且有潜在的看涨动能。

RSI:在46.12,虽然仍低于50,但已经从极度超卖区(20-30区间)持续回升,与MACD的信号相呼应,指向长期筑底的可能。

3. 消息面结合与综合判断:

消息面上,咱们能看到多空交织,但长期来看,积极信号非常多:

长期利好:

机构入场:Tether在2025年Q4一次性购入近8900枚BTC,价值高达7.85亿美元,这可是实打实的巨鲸增持啊!Galaxy Digital预测比特币到2027年底可能飙升至25万美元,这给长期信心打了一剂强心针。

监管进步:Bitwise申请山寨币ETF,以及2026年《负责任金融创新法案》允许大型银行提供数字资产托管和质押服务,都意味着加密货币的合规化和主流机构接纳度正在大大提高。

宏观联动:黄金创纪录上涨,历史数据显示黄金往往领先比特币三个月预示流动性拐点,Tom Lee也指出黄金白银的抛物线走势预示2026年BTC和ETH前景乐观。这些都给加密市场带来了积极的宏观预期。

其他积极:沃伦·巴菲特退休可能会让部分传统资金寻求新的增长点;Jez关联钱包大额杠杆做多BTC、ETH、SOL,显示大户的看涨情绪。

短期利空/风险:

安全事件:BtcTurk再次被盗,Binance做市商账户疑似被盗导致Meme币BROCCOLI714异常拉盘暴跌,Trust Wallet扩展程序也出现安全预警。这些都打击了短期的市场信心。

监管担忧:印度央行警示稳定币风险,美国参议员对CBDC的隐私担忧,以及Flow基金会披露交易所AML/KYC缺陷导致被盗,都显示监管和安全挑战依然存在。

宏观压力:美国初请失业金人数下降,劳动力市场强劲,可能导致美联储长期维持高利率,这会压制短期风险资产的表现,也使得加密货币在2025年整体表现落后于股市和黄金。

4. 交易建议:

综合以上所有分析,咱们可以这样预判:

短期(15分钟、1小时)趋势:震荡偏空后有企稳反弹迹象。15分钟图显示了强劲的短期反弹动能,但1小时图仍处于下跌趋势的压力之下。

中期(4小时)趋势:下跌。在经历一次拉升未果后,中期抛压再次显现。

长期(1日)趋势:震荡筑底,潜在上涨。日线MACD的强劲金叉和RSI的筑底回升,与大量长期利好消息形成共振,预示着长期底部正在构筑。

关键支撑位和阻力位:

短线支撑:87400(15分钟图近期低点),87000(心理关口,1小时图重要支撑)。

短线阻力:88000-88200(15分钟/1小时图近期高点,均线压力),88500-88600(之前的支撑位,现在成为阻力)。

中线支撑:86800-87000(4小时图重要低点)。

中线阻力:89000-89200(4小时图下跌前的平台,均线阻力)。

长线支撑:85000-84000(日线图重要支撑区,历史低点附近)。

长线阻力:90000-91000(日线图关键均线和震荡区间上限)。

可能出现的反转形态:

短线:如果比特币能在87000-87400区域形成有效的双底或头肩底形态,结合15分钟和1小时MACD的持续改善,那可能会迎来一波更强的短线反弹。

长线:日线MACD的金叉和RSI的筑底回升非常关键,它们预示着一个更大的底部结构(比如W底或多重底)正在形成。一旦这种长期底部形态确认,并伴随价格有效突破长期下降趋势线,那将是牛市启动的重要信号。

咱们的做单思路嘛:

综合来看,咱们可以这样操作:长期来看,现在是逐步逢低布局的好时机,尤其是在价格回调到87000甚至85000附近时,可以考虑分批建仓,因为日线级别的看涨信号和未来的基本面利好非常强劲。但短期和中期(1小时到4小时)市场仍偏弱,波动较大,所以短线操作者要保持谨慎,严格控制仓位,并设置好止损。

短线(激进者):可以在15分钟图回调到87600-87700附近,不破支撑且MACD再次金叉时尝试小仓位做多,目标看88000-88200,但一旦跌破87400就要及时止损。

中长线(稳健者):耐心等待价格再次向87000甚至86000-85000区域靠拢时,结合日线MACD的强势金叉信号,开始分批建仓。不要急于一步到位,用时间和空间换取未来的收益。

记住呀,在量化交易的世界里,数据是地图,耐心是指南针。愿咱们都能穿越迷雾,抓住属于自己的财富彼岸!

-------------------------

受限于图表篇幅和平台合规准则,更多关于实时资讯对市场情绪影响的量化拆解,已更新在我的青岚加密课堂,qinglan.org个人资料页 (Profile)。欢迎点击我的头像,通过主页展示的渠道进行更多技术探讨。