图表形态

26-2-4 Review: Trendline Failure in a Ranging SessionMarket Environment: Typical Ranging Session

Today’s session is characterized by structural disorder and trend inefficiency.

This type of market often creates the illusion of opportunity, while very few setups actually meet structural requirements.

BTC

BTC displayed a classic intraday range structure.

Several apparent “trendline” formations appeared on the chart, but they share the same structural issues:

Trendline ① broke shortly after forming, without repeated market validation.

→ This behaves more like structural noise than a confirmed trend.

→ It can be seen as a structure break, but the quality of the break is low.

Trendline ② shows the same problem.

Formation time was too short and lacked testing.

→ Reversal probability at this level remains weak.

Two later zones showed bottom-type signals, but:

Candle count insufficient

No valid trendline construction

Structural criteria not met

Conclusion:

Trendline methodology offered little practical value on BTC today.

The session favored observation rather than participation.

ETH

ETH showed slightly clearer structure than BTC, but still within a rotational environment.

Trendline ①

Loss of structure at point A followed by a downside break at B.

✔ This confirmed a short-term bullish-to-bearish structural shift.

Range Zone ②

Swing development was insufficient.

No valid trendline structure.

Trendline ③

Upside break at C confirmed a bearish-to-bullish shift.

However, follow-through momentum lacked sustainability and was quickly suppressed.

Trendline ④ region saw repeated structural flips, reflecting unstable order flow.

A breakout eventually occurred at point D.

However, an important detail:

Candles D and E both printed upper wicks at nearly the same level.

This indicates:

Buying interest was present

Supply repeatedly entered at the same resistance

Momentum sustainability was uncertain

The later reversal at point F aligns with this repeated supply response.

Gold

Gold showed a similar condition to BTC — limited structural opportunity.

Trendline ① was only marginally valid.

Temporary internal violations reduce its structural strength.

The downside break candle at point A showed:

✔ A long lower wick

✔ A near-bullish pinbar structure

➡️ This represents a low-quality break and cannot serve as reliable structural confirmation.

Waiting for confirmation at point B would significantly widen the stop distance, reducing trade efficiency.

No new high-quality swing structures developed for the remainder of the session.

Summary

Today’s market characteristics:

Frequent swings

Many signals that appear valid

Most lacking structural qualification

Trendline methodology weakened under ranging conditions

In this type of environment, non-participation aligns with structural discipline.

The focus remains on waiting for clean structure to return.

《市场结构观察 # 26-2-3|BTC · ETH · 黄金》当前市场环境:典型横盘震荡日

今天整体属于结构混乱、趋势失效的一天。

这种行情最容易“看哪都像机会”,但真正符合结构规则的点并不多。

BTC

BTC 今天几乎就是标准的震荡结构。

图中出现过几次类似“趋势线”的结构,但都有共同问题:

趋势线① 刚形成就被下破,没有经过市场反复测试

→ 更像是结构噪音,不是有效趋势

→ 可以理解为一次“结构破坏”,但质量很低

趋势线② 情况相同

形成时间太短,缺少验证

→ 反转确定性不足

后面两个粉框位置虽然出现底部信号,但:

❌ K线数量不足

❌ 无法构成有效趋势线

❌ 不满足结构分析的基本条件

➡️ 结论:

BTC 今天不适合用趋势线体系交易

属于“能分析,但不值得参与”的节奏。

ETH

ETH 相比 BTC 结构稍微清晰,但仍然偏震荡。

趋势线①

a 点失守 → b 点向下突破

✔ 这是一个多转空的结构确认点

区间②

K 线不足,不能形成趋势线

→ 这里的反转信号结构支撑不够

趋势线③

c 点向上突破 = 空转多确认

但后续走势显示:

👉 反转动能持续性不足,很快再度被压制

趋势线④ 区域反复拉扯,最终由d点向上产生一个突破。

但我们一定要注意,d和e这两条K线都带着上影线,而且上影线的位置差不多,就说明行情曾经两次到过这个位置,但都遇到了很强的压力,然后被压制,那我们就能得出结论:多方反转动能存在,但多方动能反复在同一位置被空方成功压制,这一波多方动能的持续性就不算很强了,未知可能会出现突发的空放力量再次压制多方动能。这也是我们在f点看见的又一次反转的根本原因。

黄金

黄金今天和 BTC 类似 —— 机会极少

趋势线① 属于勉强成立的结构

中途曾被短暂破坏,只能算“弱趋势线”

向下突破那根 K 线a:

✔ 有长下影线

✔ 接近看涨 Pinbar 形态

➡️ 这是低质量突破

→ 不能作为有效的结构反转确认

如果等 b 点再确认,止损空间又过大,交易性价比失衡。

后续全天没有新的清晰顶底结构形成。

总结

今天的市场特征很明确:

✔ 有很多“看起来像信号”的地方

❌ 但大多不满足结构规则

❌ 趋势线体系在震荡市明显失效

这种行情里,放弃交易本身就是一种交易决策。

今天更适合做的不是进场,而是等结构重新变得干净。今天是典型的横盘震荡阶段,这种行情风格最考验技术分析,而且这种行情不是全都能用趋势线理论进行分析的。

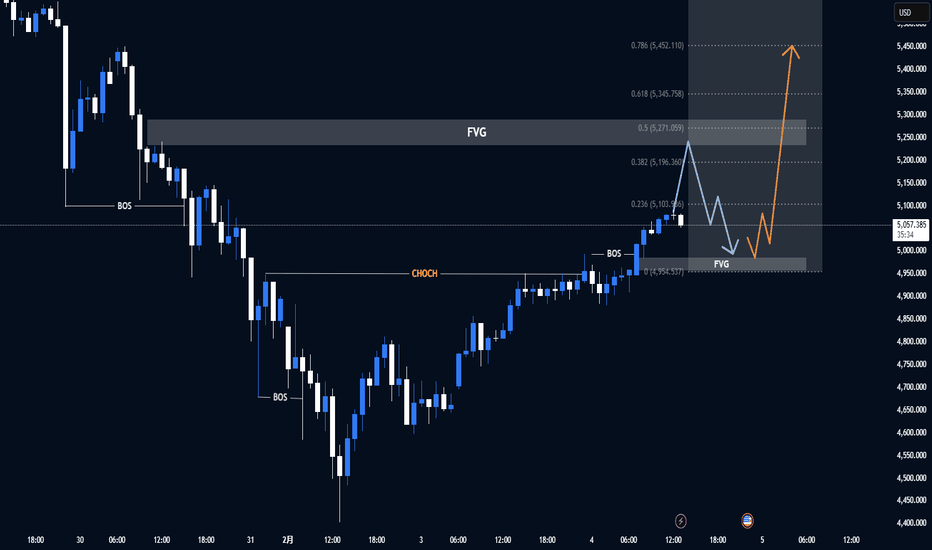

黄金刚刚翻转结构——是真反转还是流动性陷阱?黄金在经过数周的重压后,刚刚出现了明显的结构性变化——但现在不是追逐的时刻。

市场结构(M30)

价格打印出一个看涨的CHoCH,结束了之前的看跌序列

随后出现了向上的BOS,确认了短期的看涨控制

动能强劲,但价格现在接近一个关键反应区

关键关注区域

FVG 支持: ~4,950 – 4,980

→ 如果看涨结构保持,这是理想的回调延续区域

中间阻力 / 反应: ~5,100 – 5,150

→ 期待波动性和可能的洗盘

上方目标区: 5,270 – 5,450

→ 之前大幅卖出后的斐波那契0.5 → 0.786回撤

交易场景

看涨延续:

等待回调进入FVG + 更高的低点 → 继续向5,27x → 5,45x

失败场景:

失去FVG + M30收盘回落至 ~4,95x 之下 → 看涨结构失效,区间或反转风险

🧠 交易心态

这是一个反应市场,而不是预测市场。

结构翻转后,回调赚钱——突破则会被困住。

原油 CRUDE 趋势与基本交易策略周线复合:周线多头且未处于超买区(OB),这意味着趋势在未来⾄少1到2周内应整体维持多头。(牛)

日线复合:日线⾼点已经临近,但该⾼点应只是完成周W.1 或 A 浪的初始五浪上涨,随后将出现持续⼏天的修正,然后周线多头趋势将继续。(熊)

关键因素:日线时间因素显示,日线⾼点最迟应在下周后段形成,理想时间为周⼆。但任何形成的⾼点,都应是周 W.5(⾪属于 W.1 或 A),随后将进⼊ 周W.2 或 B 浪修正。

交易策略建议:原油应已接近⼀个⾄少会持续数天的⾼点。可以考虑对部分多头仓位使用移动⽌损以锁定利润,并将剩余仓位的⽌损调整⾄接近或等于保本位。

⚠ 短期交易者应以TradingBox信号系统为准!

板块轮动推动 FTSE 再创趋势新高FTSE 本周开局即突破至新的趋势高点。让我们深入看看,这一波上涨更多来自板块轮动,而非单纯的动能爆发。

乍看之下,这次突破似乎是一段直接的动能推动,但从价格形成的过程来看,其实走势相对克制。指数并未出现急速拉升,而是在上升趋势支撑位与 50 日移动平均线上方,经历了数周的横向整理。这种以时间换空间的修正,使市场得以消化卖压,同时并未破坏整体结构。

从板块表现来看,也提供了重要线索。过去一个月,市场的领涨结构相当分散,原材料板块率先带动涨势,公用事业、房地产、金融与能源板块则持续稳定参与。广泛的参与度有助于趋势稳健推进,而不是依赖少数股票单独拉动指数。

近期,领涨动能并未消失,而是出现了轮动。金融与能源板块接棒领涨,公用事业与医疗保健提供支撑,而原材料与科技板块则进入整理阶段。这种交棒式的轮动,有助于解释为何本轮突破给人的感受偏向“有序而非亢奋”——资金是在指数内部重新配置,而非流出市场。

从较短周期来看,动能已重新启动,尤其是在小时图上,涨势伴随着清晰的多头 K 线结构,且价格重叠程度有限。随着整理区间向上突破,市场焦点自然转向:此前整理区间的上沿是否会转化为有效支撑。若价格回测该区域时的表现,将成为关键观察点,尤其对希望顺势参与、而非追高进场的交易者而言。

UK100 日线 K 线图

过往表现并非未来结果的可靠指标

UK100 小时线 K 线图

过往表现并非未来结果的可靠指标

免责声明:

本文仅供信息与学习参考,不构成任何投资建议,亦未考虑任何投资者的个人财务状况或投资目标。文中提及的任何过往表现,均不代表或保证未来结果或收益。社交媒体内容不适用于英国居民。

点差交易与差价合约(CFDs)属于高风险金融工具,因杠杆作用可能导致资金迅速亏损。**85.24% 的零售投资者账户在本平台进行点差交易与差价合约交易时出现亏损。**在交易前,请确认您已充分理解其运作机制,并评估自身是否能够承担相关风险。

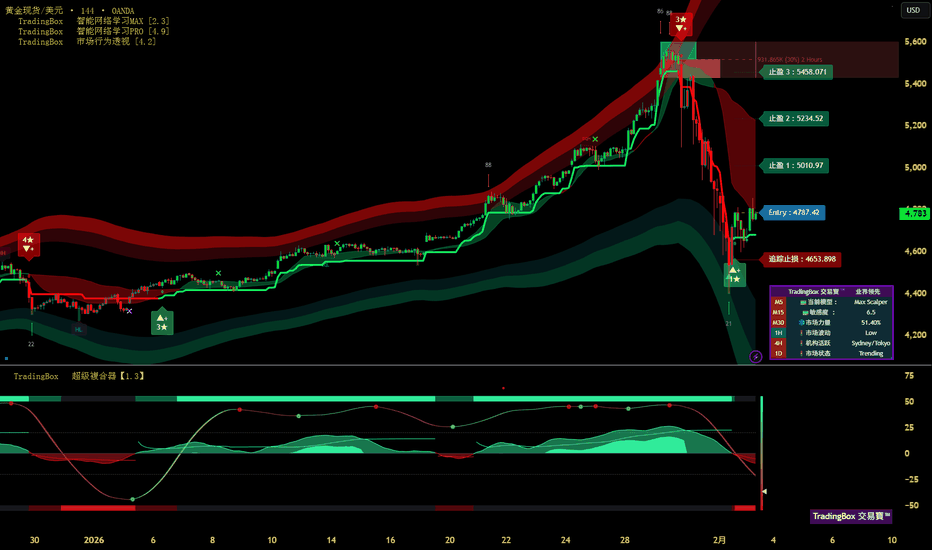

XAUUSD - 高波动期,关注关键反应区。📌 市场背景

黄金目前在高波动环境中交易,经历了跌破5,000美元水平的剧烈下跌,反映出在主要宏观不确定性之前的激进重新定价。市场已经从平稳的趋势行为转向由流动性驱动、快速反应的阶段,价格在关键技术区域之间急剧波动。

随着美联储领导层的持续变化和未来货币政策方向的不确定性,黄金对预期、资金流动和新闻头条极为敏感。

➡️ 当前状态:波动条件 - 等待确认,避免情绪交易。

📊 结构与价格行动 (M30)

之前的看跌冲动正在失去动能,短期内开始形成更高的低点。

目前价格处于技术性恢复阶段,但尚未确认趋势反转。

市场仍然尊重需求和关键水平,产生剧烈反应。

此阶段未确认看涨CHoCH - 需要进一步验证。

🔎 关键见解:

黄金交易在一个决策区间内,每个关键水平都可能触发强烈的方向性波动。

🎯 交易计划 - MMF风格

🔵 主要情景 - 买入技术回调

专注于基于反应的执行,而非预测。

买入区间1:4,667 - 4,650

(近期需求 + 第一个恢复基础)

买入区间2:4,496 - 4,480

(深层需求 + 之前流动性扫荡低点)

➡️ 仅在以下情况下执行买入:

出现明确的看涨蜡烛反应

或在M30上形成更高低点结构

上涨目标:

TP1:4,932

TP2:5,124(主要恢复阻力 / 供应区)

🔴 替代情景 - 在阻力反应时卖出

如果价格回撤到供应区并未能保持看涨动能:

卖出区间:5,120 - 5,140

→ 寻找M30结构后的短期拒绝

❌ 无效化

M30确认收盘低于4,480将使恢复结构无效,并需要全面重新评估。

🧠 总结

黄金正处于高波动、构建结构的阶段,不适合情绪或激进定位。关键在于:

交易关键水平,而非冲动

等待价格确认

将风险管理置于预测之上

📌 在波动市场中,纪律胜过频率。

金汇得手:黄金开盘拉升 今日主多辅空走势 美元指数昨天收阳,今天关注97-98区间。

黄金昨天低开,再次大跌接近500点到4400附近,日线长影阴线。单看收线,今天倾向上涨,早盘开盘拉升100多美金。但是如果昨天高点不破,行情大概率也上不去或大区间震荡为主。目前 下方支撑日内低点附近,触及可以做多。强支撑4590和4400,今天大概率不会再触及。阻力昨天高点附近,触及可以小止损空。行情如果站稳4900,上方再看100-250美金,触及再空。

操作建议:接近日内低点和昨天低点多,接近昨天高点空,见5000或5140都是做空位置。昨天早盘4700多,4600多,4767空,4400附近多,美盘4675多。

原油低开收大阴,低点正好是周线支撑,不破可以小止损多。上方阻力62.6附近,也是日内多空分水,不破暂时看62.6-61.3区间,站稳继续看63.3甚至昨天高点附近,触及可以再空。分析仅供参考,实盘为准。

白银急挫震撼市场:反形态正在酝酿?年初出现近乎指数型的强劲涨势后,白银在上周五出现戏剧性的回落,光芒瞬间黯淡。本文将解析这波急跌背后的关键因素,并探讨一种较少被讨论、但可能在接下来几个交易日逐步成形的技术形态。

特朗普提名美联储主席人选,贵金属泡沫被戳破

1 月期间,随着政治不确定性与通胀担忧升温,资金大量涌入被视为避险资产的贵金属。白银表现尤为突出,与黄金、铂金同步大幅上涨,动能持续堆叠,市场仓位也逐渐趋于单边。

然而,当唐纳德·特朗普正式确认提名 Kevin Warsh 为下一任美联储主席人选后,市场预期出现明显转变。该任命强化了对通胀纪律的预期,并支撑美元走强,直接动摇了贵金属上涨的核心支柱。在情绪与仓位本就偏向极端的背景下,市场风向的突然转变,引发了整个贵金属板块快速且失序的回调。

顶部结构浮现,为“反形态”打开空间

从白银的日线 K 线来看,目前走势几乎可视为教科书级别的趋势末端情境。2025 年大部分时间,白银维持稳健而持续的上升趋势;进入新年度后,涨势明显加速,近乎指数型推进,吸引了大量追高的末端买盘。

这波最后的急拉,正是市场变得脆弱的关键。当信心高涨、仓位过度集中,任何外在变量都可能成为引爆点。

上周五的价格行为,标志着结构性的转折。一开始看似只是获利了结,但很快演变成更为混乱的抛售,错站方向的交易者被迫快速降低敞口。从跌幅的规模与 K 线结构来看,这并非一次例行性修正,而是对一段长期未曾受到严格考验的趋势,所发出的首次实质挑战。

低周期观察:典型顶部过程正在发展

进一步观察小时级别走势,可以看到更清晰的细节。近期的价格行为显示,白银在高点附近迟迟无法有效突破,随后卖压逐步累积,形成典型的顶部过程。

“加速上涨 → 高位停滞 → 下行动能快速扩散”的组合,往往正是反形态开始酝酿的位置。尽管在日线级别上,形态尚未完全确认,但市场行为的转变已相当明确。接下来几个交易日白银的表现,将是判断这波走势仅属修正,还是具有更深层结构性意义的关键。

白银(XAG/USD)日线 K 线图

过往表现并非未来结果的可靠指标

白银(XAG/USD)小时线 K 线图

过往表现并非未来结果的可靠指标

免责声明

本文仅供信息与学习用途,不构成任何投资建议,亦未考虑任何投资者的个别财务状况或投资目标。文中提及的过往表现,并非未来结果或绩效的可靠指标。社交媒体内容不适用于英国居民。

差价合约(CFD)及点差交易属于高风险杠杆型金融产品,可能在短时间内造成重大损失。**85.24% 的零售投资者账户在本平台交易差价合约及点差交易时遭受亏损。**请在交易前确认您已充分了解其运作方式,并评估自己是否能够承担相关风险。