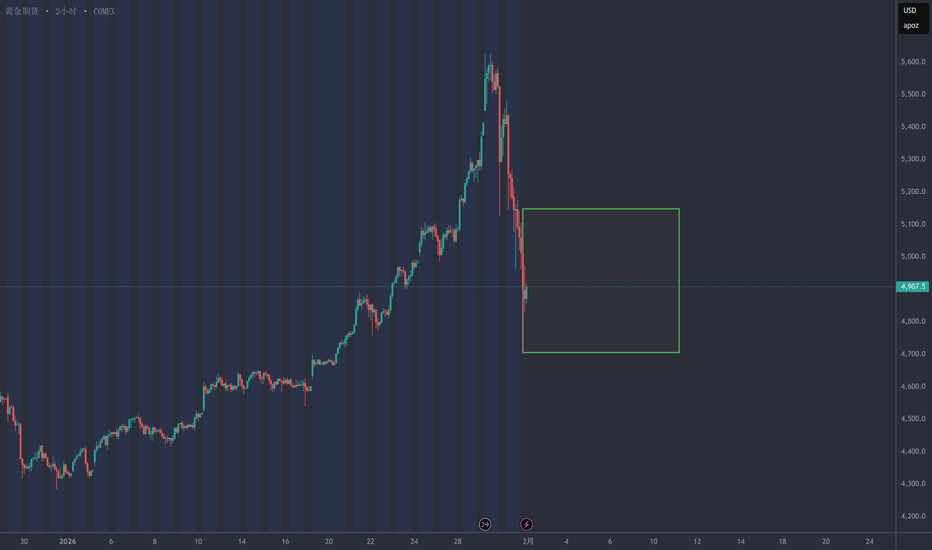

XAUUSD (H1) - 低于5000$: 回调还是快速反弹?市场背景 – 黄金进入关键重定价区域

黄金已正式跌破心理价位5,000美元,引发了新的讨论:

这是更深纠正阶段的开始,还是在急剧反弹之前的流动性重置?

时机至关重要。

由于对美联储领导层变动和未来货币政策方向的猜测,市场正在积极重定价风险。这给黄金注入了极大的波动性,流动性正在迅速重新分配,而不是干净的趋势。

➡️ 这不再是低波动性的趋势市场——这是一个决策区域。

结构与价格动作(H1)

之前的看涨H1结构已经失败,确认了短期纠正阶段

价格交易在之前的需求之下,现在 acting as supply

当前反弹为技术性回调,而非确认的反转

下行动能仍然活跃,直到价格重新占领关键结构水平

关键洞见:

👉 在5,000美元以下,黄金处于重平衡模式,而非趋势延续。

关键技术区域(H1)

主要供给 / 拒绝区域:

• 5,030 – 5,060

→ 之前的结构 + 斐波那契重合

→ 卖方可能防守的区域

中位反应区域:

• 4,650 – 4,700

→ 短期需求 / 潜在反弹区

深层流动性需求:

• 4,220 – 4,250

→ 主要流动性吸纳区

→ 技术性或结构性反弹的高概率区域

交易计划 – MMF风格

情景 1 – 卖出回调(主要在5,030以下)

在价格反弹至供给区时偏向卖出设置

等待拒绝 / 失败模式

不要追逐价格下跌

➡️ 在5,030以下偏向看跌纠正

情景 2 – 仅在深层流动性时买入

仅在主要需求处并确认时考虑买入:

• 4,650 – 4,700(仅供短线/反应)

• 4,220 – 4,250(更高概率的波段区域)

➡️ 不要盲目抄底

➡️ 确认 > 预测

宏观风险展望

美联储领导层不确定性 = 政策预期波动

任何转向鸽派可信度的变化可能引发剧烈的补空反弹

相反,长期不确定性短期内将黄金维持在压力之下

➡️ 预期快速波动、虚假突破和宽幅震荡

无效与确认

如果H1重新占领并维持在5,060以上,看跌偏向减弱

若4,220果断失败,深度修正将开启

总结

黄金在5,000美元以下并不是弱势——而是重定价。

这是一个流动性狩猎交易者的市场,而不是反过来。

现在的优势是耐心和精准:

在供给区卖出反弹

仅在流动性被证明的地方买入

在承担风险之前让结构确认

➡️ 在高波动性中,生存胜于预测。

图表形态

智者生存:黄金冲击5600,注意风险!!交易小Tips:知于行永远是理论最大的问题

复盘分析:行情受阻整理,没有出现比较大的调整后第二天直接反包,延续涨势,行情极速上行,冲击5600区域

市场分析:昨日黄鱼继续上行,单日振幅250+,日线表现上行情进入了极端的上涨行情,不管是幅度还是速度都是前所未有的大,行情进入“抢购高潮”,这很容易出现中长期投资者的获利了结,行情很容易进入阶段性顶部,当前行情还在上涨趋势,箜头没有表现之前,中短期可以看哆做哆,但一定要谨慎哆,做好防守

如果加速上行后出现极速下行的情况,不要被市场的热度冲昏了头脑,认为“回调”就是做哆的机会,这种情况若出现顶部,套住你的可不止一两个月

比特币,是否到了该贪婪的时刻最近加密市场很受伤,完全被黄金为首的大宗商品市场抢了风头。比特币也不再是数字黄金了,波动率也不及白银了。各种投机的交易都不带我们玩儿了,但市场下跌的时候,我们可是最惨烈的。

比特币还是华尔街的宠儿吗?木头姐的100万还有可能吗?

现在市场看起来风声鹤唳,恐慌指数一直维持在极度恐慌区间,感觉熊市的阴影已经笼罩了市场。不过我觉得大家也不用太悲观,上个月我撰写文章,认为本轮调整也许和历史上的熊市会有差别。

首先,历史上三次大熊市,都没有华尔街参与,所以当熊市来临,市场的承接力有限。其次,任何市场都是从幼稚期走向成熟期的,加密市场也不可能一直处于幼稚期,所以市场的波动率也应该逐步降低。所以这一次调整,空间可能不会像之前那样夸张。但时间就不好说了。前三次熊市都是1年以上,而目前连半年都不够,所以我们并不能确定调整结束。

但调整也不是一口气走完的,如果我们按ABC的模式完成,那么现在可能就是A浪的末期了。

逻辑如下:

1、我很早就判断这一波的调整目标是ma144,现在看,ma144在7.1万美元,已经非常接近了。所以接下来应该进入B浪反弹周期。如果按照前三次熊市第一波下跌时间看,16周的下跌时间是比较合理的,后面还有40周的话,需要看B浪反弹的力度和时间来判断C浪了。

2、比特币日线走势,按照系统的ABC判断,A跌了35%,46个交易日,C跌了23%,58个交易日,应该说时间对称性不错,就是幅度还差一些。但已经创了新低,理论上C确认,那就是我们之前说的,因为B的时间短,可能C浪会用更长时间来完成调整。

另外如果我们用abc来看这个大C浪,1.618是7.44万美元,低点距离也就是1-2%,目前看已经是合理误差了。

所以现在开始考虑的应该是找买点,而不是继续看空了。

流动性分层理论:2个月前的预演路线完美重合,BTC这里可以抄底了吗?BTC目前下跌已经进入了一个流动性密集区(74k-78k的区间)

为什么这里是流动性密集区?

2025年3月-5月区间的合理低点(被反复测试)

2024年构成区间的最高点

从大周期的起涨点到目前为止的筹码真空带

在整个筹码密集区的不同价格都有抄底或至少是博反弹的人群,并且理由充分。

大量抄底(或博反弹)=买盘,也就是预期市场应该有流动性放大的区域。

在这种区域作为长期资金一定会加以多次试探。

因此在这里形成反弹甚至构成一个横盘区间是非常正常的。

那么为什么不认为这里是这轮下跌的底?

下跌的成交量不够,这里的下跌虽然也有小幅度放量,但远远构不成长期资金会认为“安全”的市场承接量,因此这里还将被继续测试才能知道真实的承接量情况。所以我只认为这里是个博反弹的好位置。

最后我要吹一波自己,自创流动性分层理论后,1月4日第一次公开分析就完美预演了这1个月的走势(其实图是12月20日前画好的),在这1个月中也尝试在更小的时间框架和更细分的交易结构下分析,时常差强人意,好在我始终维持理论的核心:流动性是长期资金的命脉!因此大趋势始终看空未酿成大错。

但随着我上一次意识到这个理论只能分析长期资金的真正长期框架,对小级别周期的行情推断力和突发情况应对能力不足,重新完善补充理论细节后,上一次对于小级别的分析也初显成效,后面随着动态发展会动态的尽量弥补弱点和不足。

BTC未来行情展望大家好,又到了分享一些新的想法的时间了。我在7月初的文章中写到了,btc的统治地位即将下降,其他币种有可能迎来一波新的爆发。那么现在回顾过去三个月的走势,BTC从当时到最高点126173涨幅是7%左右。ETH的涨幅则是65%。BTC的通知地位下降11%。相信当时看到我的帖子并大饼换仓成其他主流币种的伙伴们肯定都收益颇丰吧。

那么进入今天的主题,直接上结论,我已经在13号都已经清仓啦,群内的小伙伴应该比较清楚,这些天比较忙,发文可能较晚。清仓的原因简单概括为两条。第一是现在的我们应该都还记得几天前史诗级的下跌,这一波基本把做主流山寨杠杆交易的选手杀了个干干净净,其实对市场造成了非常大的伤害,那我们过去的牛市其实也有比较大的快速下跌,那么为什么这次对于市场有伤害呢,我的认为是主流山寨的下跌幅度和整个市场的爆仓金额都过于夸张。那我们回顾以前的牛市的快速下跌,一般都是10%甚至20多%的回调,爆仓金额也有限,主要杀得是高杠杆,那么这次来看的话,别说高杠杆,低杠杆都死伤惨重,对于市场的持续提升的信心造成了影响。当大家都开始敬畏这个市场的时候,这个市场估计也就到顶了。第二个原因是这波涨幅也已经很多了,我认为就算继续涨,也就是鱼尾行情了,对于用利润的回吐博取鱼尾收益,我还是离场观看吧。

后续走势想法:对于后市,我认为我们可能需要3-5个月的调整期,鉴于机构持仓的占比在现在的市场中越来越重,我对于调整幅度定在30%-50%。再多可能对于btc来说还是比较困难的,我当然对于未来BTC能到30万甚至100万充满了信心,但是短期来看,我可能需要做一做小仓位的空单来进行一些赚币避险行为了。最后希望大家上涨下跌都能赚钱~