XAUUSD – 优先卖出在突破趋势线后XAUUSD – 优先卖出在突破趋势线后

Hello Traders,

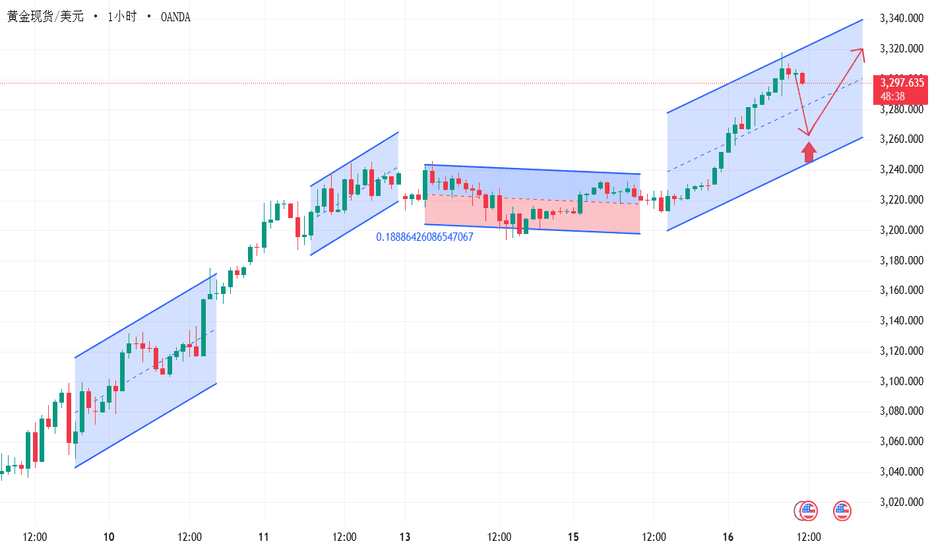

黄金连续多日强劲上涨,但目前市场出现了重要的反转信号。H4的上升趋势线已被突破,确认买入动能减弱。在中期内,优先考虑的情景将是卖出,而不是继续追高买入。

基本背景

美国财政部刚刚回购了额外20亿美元的债券,使本周的总回购量达到49亿美元。这一举动显示了稳定债券市场的努力,但也反映了美元的巨大压力和美国的金融状况。

在短期内,增加债券流动性使得黄金波动更加难以预测,而此时的趋势线突破是一个重要的警告信号。

技术观点

突破上升趋势线 → 确认结构变化。

MACD显示出动能减弱,买方力量明显减弱。

3865 – 3868区域是一个漂亮的阻力重测点以进行卖出。

如果价格大幅下跌,3830 – 3810 – 3790附近的支撑区域将是下一个目标。

今日交易情景

卖出(主要优先):

Entry: 3865 – 3868

SL: 3875

TP: 3855 – 3832 – 3810 – 3790

买入短线(逆趋势 – 高风险):

Entry: 3803 – 3805

SL: 3795

TP: 3822 – 3835 – 3850

结论

黄金已突破趋势线,短期和中期优先考虑卖出。

来自美国债券市场的消息进一步强调了不稳定的风险,使得逆趋势买入仅应视为短线交易。

关注我以便在价格路径变化时获得最新的交易情景更新。

Goldsell

LiamTrading – 黄金可能在下跌前出现一次假突破

黄金正在375x区域附近交易,并可能在调整下跌前出现一次“假突破”上升。H4图表上的价格结构显示:

强阻力位于3770–3773区域,与0.786 – 1.0的斐波那契扩展区域重合。这是一个容易出现下跌反应的汇合区域。

主趋势线仍保持上升,但RSI逐渐减弱,警示买入力量不再强劲。

短期支撑位于3710–3713,同时也是0.5 – 0.618斐波那契区域,适合进行买入剥头皮交易。

更大的支撑位于3688–3691,与趋势线底部和重要斐波那契汇合,被视为稳定的“买入区”。

交易计划参考

Sell: 3770 – 3773, SL 3778, TP 3756 – 3743 – 3725 – 3710

Buy scalping: 3710 – 3713, SL 3705, TP 3725 – 3736 – 3748 – 3760

Buy zone: 3688 – 3691, SL 3684, TP 3699 – 3710 – 3725 – 3736 – 3745 – 3760

总之,黄金可能在达到3770–3773阻力区域前出现一次假上升,然后回头调整。交易者应耐心等待在重要价格区域的确认信号,以实现最佳入场并严格管理风险。

这是我对XAUUSD的个人观点。如果觉得有用,请关注以最快速度获取后续情景更新,持续更新于comulity

LiamTrading – XAUUSD 长期趋势正在形成黄金继续保持强劲的上涨势头,目前交易价格在3,680 – 3,685附近。在连续上涨的蜡烛图之后,价格开始显示出积累和轻微调整的迹象,为接下来的阶段打开了重要的剧本。

技术分析

在日线图上,RSI已超过70,显示出超买状态。这通常是调整早期的警告信号。

价格结构显示,如果出现短期调整,FVG区域3,630 – 3,600将是第一个观察点。

更强的支撑区域位于3,510 – 3,475,与斐波那契0.5 – 0.382重合,也是之前被突破的阻力区。这被视为潜在的长期“买入区”。

如果调整完成,黄金完全有可能回到上涨趋势,目标更远可达3,800(斐波那契扩展2.618 – 3.618)。

交易策略

短期:关注3,630 – 3,600的反应。如果保持稳固,可能会有短期反弹。

需要注意的价格区域在3552-3562,这里会有反应。

中期:等待价格测试3,500 – 3,475区域,以寻找更可持续的买入机会。

长期:大趋势仍倾向于上涨,目标期望指向3,800。

这是我对XAUUSD的个人观点,大家可以参考以制定自己的计划。如果觉得有用,请关注我以便最快更新黄金的后续剧本。

LiamTrading – XAUUSD 新趨勢形成黃金在鮑威爾主席宣布降息後出現明顯回調。從 H1 週期來看,空頭道氏結構正在逐步形成,顯示中期下行的可能性較大。

多頭流動性基本已被清理,強勢反彈的可能性不高。除了消息公佈後短暫的 FVG 外,市場情緒仍偏向空頭。缺口的出現也表明在美聯儲聲明後,空頭已經展現出足夠的信心來主導市場。

當前的下跌有望推動金價測試 363x 區域,甚至可能延伸至 361x。需要關注的關鍵位置在 3651 強支撐,此處曾在消息公佈後快速反彈逾 20 美元。

今日交易計劃:

做空 3657 – 3659,止損 3666,止盈 3651 – 3646 – 3638 – 3634 – 3626 – 3615

做多 3634 – 3632,止損 3628,止盈 3640 – 3652 – 3660

買入區域 3607 – 3604,止損 3600,止盈 3616 – 3625 – 3638 – 3647 – 3660

以上為我對今日黃金的個人觀點,僅供參考。若覺得有幫助,請關注我以獲取更多黃金走勢分析與交易思路。

XAUUSD – PPI前瞻:关键流动性水平与交易计划市场观点 (Market View):

在昨日卖方主导流动性区域导致金价大幅下跌后,黄金(XAUUSD)目前在亚洲时段自 362x → 364x 反弹。短期内,价格可能在亚洲和欧洲时段于 362x–365x 区间波动,并在等待 美国PPI数据 公布前横盘整理。

今日PPI预期为 0.3%(前值0.9%),显示通胀压力减弱。然而,实际数据可能高于预期,这常常会形成**“新闻陷阱”**。从技术面来看,黄金可能需要先回测 360x 流动性,然后在 CPI 和美联储会议 前恢复上行趋势。

👉 简而言之: 结构依然看涨,但在延续上涨前可能会出现短期流动性扫盘。

关键水平 (Key Levels):

阻力位: 3647 – 3654 – 3665 – 3674 – 3704

支撑位: 3635 – 3613 – 3600 – 3586

交易计划 (Trading Plan):

🔵 买入区间: 3600 – 3598

止损 SL: 3592 (或更紧在3580)

止盈 TP: 3605 → 3610 → 3615 → 3620 → 3630 → 3640 → 3650+

🔴 卖出区间: 3703 – 3705

止损 SL: 3710

止盈 TP: 3698 → 3694 → 3690 → 3680 → 3670 → 3660+

总结 (Summary):

✅ 黄金仍处于上升趋势,但可能在进一步上涨前回测 360x 流动性。

✅ 今日PPI和明日CPI可能引发新闻陷阱 —— 操作需谨慎。

👉 关注这些关键水平,并关注 MMFLOW TRADING 获取实时更新和精准 BIGWIN 交易机会!

Gold prices are waiting for a major breakthrough!Market News:

Spot gold prices fluctuated in early Asian trading on Wednesday (August 13), currently trading around $3,345/oz. Mild US inflation data for July has further intensified market bets on a September Federal Reserve rate cut, and a weakening US dollar has boosted the appeal of international gold. Combined with the positive news of an extended US-China tariff truce, the gold market is at a critical turning point!

For London gold prices, expectations of a rate cut are a strong catalyst, as lower interest rates weaken the dollar's appeal and reduce the opportunity cost of holding gold. While gold could face short-term pressure if inflation unexpectedly spikes, the current data reinforces its position as a safe-haven asset, attracting buyers from other currencies, particularly as a weaker US dollar further reduces the cost of gold.

While the market will focus in the short term on this week's PPI, unemployment benefits, and retail sales data, in the long term, the Federal Reserve's accommodative policy and geopolitical uncertainty will continue to support gold's upside potential.

Technical Analysis:

The US dollar index surged, then retreated back to 98.0. Gold dipped to 3330.9 in late trading before bottoming out and rebounding, closing with a small bullish candlestick pattern on the daily chart. The daily chart is currently trading at the middle Bollinger Band level, with the RSI indicator adjusting towards its neutral 50-value midpoint. The hourly Bollinger Bands are converging, the moving averages are converging, and the RSI is moving towards its midpoint. The four-hour chart saw heavy volume dip to the 30-level, testing the lower Bollinger Band before re-entering 3350. The 10-day and 7-day moving averages are converging. Gold trading strategies continue to favor short-term trading in a wide range.

Based on the current gold market trend analysis, the prevailing pattern remains a broad, sweeping range between 3450 and 3250, a stalemate that has persisted for two to three months. This pattern of holding highs, breaking lows, and maintaining a sustained decline indicates that the previous bullish, volatile market has been disrupted. The new structure could face two potential scenarios: one is a transitional period of neither strong nor weak sweeping activity, building momentum through broad consolidation for subsequent direction; the other is a turning point above 3400, with the market gradually extending downward, leading to a volatile selling strategy.

Given the non-unilateral nature of the structure, after such a significant decline, caution is warranted regarding the need for corrections in the Asian session. The intraday strength will depend on the strength and duration of the correction. If the rebound is weak and the market is effectively suppressed, the market may continue to fluctuate in a bearish, volatile market. Conversely, if key support is maintained and the market stabilizes, a return to a sweeping transition could occur.

Trading strategy:

Short-term gold: Buy at 3322-3325, stop loss at 3314, target at 3350-3370;

Short-term gold: Sell at 3357-3360, stop loss at 3369, target at 3330-3310;

Key points:

First support level: 3332, second support level: 3318, third support level: 3303

First resistance level: 3355, second resistance level: 3368, third resistance level: 3380

Gold - Sell around 3362, target 3340-3320Gold Market Analysis:

Yesterday's daily close was a large negative candlestick, which wiped out five days of gains. We sold at 3369 yesterday to take profits. Yesterday's close was a clear reversal signal, and the analysis chart also shows a breakout signal. The large negative candlestick pattern on the daily chart reaffirms the sell position. Today's strategy is undoubtedly bearish, and we should continue to sell on rebounds. Today's CPI data is out, and I believe we can still maintain our selling strategy before the data is released. Let's look at the daily chart. The current selling is only short-term, and the long-term direction remains uncertain. The daily chart is still in a wave structure and is still in the process of correction. Its overall direction is unclear. We are just followers, and we need to find its rhythm and follow it, either buying or selling. The 1-hour profit-taking chart shows that 3366 is the first minor resistance level in the Asian session today, and 3362 is the hourly high. We will continue to sell based on this level. The 1-hour high of yesterday's rebound was around 3380, which has become a new strong resistance level. If this level is not broken, it is basically a sell-off. On the contrary, if it unexpectedly breaks, it is necessary to adjust the strategy and rhythm. Gold's recent fundamentals and data have a significant impact on the market, and the buying and selling cycles are very fast.

Support 333 and 3341, resistance 3366 and 3380, and the watershed between strength and weakness is 3362.

Fundamental Analysis:

Today, focus on the most important data this week, CPI. This economic data has recently moved significantly, even surpassing the non-farm payroll data.

Trading Recommendation:

Gold - Sell around 3362, target 3340-3320

Gold prices plummeted! Gold was sold off strongly!Market News:

Spot gold prices fluctuated narrowly in early Asian trading on Tuesday (August 12), currently trading around $3,355 per ounce. Gold prices plummeted on Monday after Trump announced he would not impose tariffs on gold imports, putting significant pressure on London gold prices. The renewed extension of the US-China trade tariff truce, potential progress in Russia-Ukraine peace talks, and market anxiety over upcoming US inflation data have collectively weakened gold's safe-haven appeal, accelerating a price decline and sell-off. Amidst multiple negative headwinds, market attention is turning to the upcoming US inflation data. The Consumer Price Index (CPI) will be released on Tuesday, followed by the Producer Price Index (PPI) on Thursday. These figures will provide key insights into the Federal Reserve's interest rate path. If inflation data falls short of expectations, bets on a rate cut will strengthen, benefiting gold. Conversely, if inflation exceeds expectations, further dollar strength will weigh on international gold prices.

Technical Analysis:

Technically, the gold daily chart closed with a single, large, bearish candlestick, breaking below 3345, the low since August 4th. The New York closing price fell below the 10/7-day moving average at 3350. Gold is poised for a short-term correction due to data news. The short-term four-hour moving average formed a downward crossover at 3380, the RSI indicator is trading below its mid-axis, and the Bollinger Bands on the hourly chart are opening downward, with prices trading within the lower mid-range. Looking at the current gold market, yesterday's sharp drop has wiped out the buying advantage created by last week's weekly close. Next, focus on the direction of the market after the major market move: Support in the 3375-3380 area has been broken, and subsequent resistance could continue to be based on the intraday high and last week's high, maintaining a selling strategy. The 3340 area below is a key support level. If this level holds, buying could trigger a rebound at any time. However, if it does, the market will immediately return to selling.

Trading Strategy:

Short-term gold buy at 3332-3335, stop loss at 3324, target at 3360-3380;

Short-term gold sell at 3376-3379, stop loss at 3388, target at 3350-3330;

Key Points:

First Support Level: 3340, Second Support Level: 3333, Third Support Level: 3320

First Resistance Level: 3368, Second Resistance Level: 3381, Third Resistance Level: 3396

“黄金4小时图技术分析:空头趋势确认,目标价位2974.71美元”1. 当前价格:3187.68 美元。

2. 关键位置:

入场点(Entry Point):约 3235.94 美元。

止损点(Stop Loss):最高设定在 3290.58 美元。

目标点(EA Target Point):2974.71 美元。

阻力点(Resistance Point):3121.49 美元。

3. 区域分析:

紫色区域表示价格曾多次测试的关键支撑/阻力区。

当前价格已跌破入场点,表明可能已进入空头趋势。

若价格未能有效突破阻力点(3121.49),则可能继续下探至目标点(2974.71)。

4. 移动均线:

红线和蓝线为中短期均线,显示当前趋势开始下行。

---

技术策略建议(仅供参考):

空单思路:

入场:靠近 3235.94(回调进场)

止损:3290.58 上方

目标:2974.71

注意事项:

若价格重新站稳在 3235.94 上方并持续上涨,空头策略需谨慎。

请结合消息面及基本面数据综合判断。

Gold prices may still have room to plummet!Market news:

In the early Asian session on Friday (May 2), spot gold fluctuated narrowly at a low of more than two weeks and is currently trading around $3,235/ounce. London gold prices fell 1.5% on Thursday, hitting an intraday low of $3,201/ounce, the lowest since April 14. The signal of easing trade tensions suppressed the safe-haven buying demand for international gold. The rise in the US dollar and US bond yields also suppressed gold prices, and the largest gold consumer country is on consecutive holidays. Investors will usher in the US non-farm payrolls report on Friday, which is expected to trigger a big market trend. Gold is affected by multiple negative factors: the US dollar index rebounded to a high of 104.88 due to the hawkish stance of the Federal Reserve, suppressing the attractiveness of gold pricing; the easing of the situation in the Middle East and the passage of the US military aid bill weakened the safe-haven demand; the US Dow Jones surged more than 1,000 points in a single day, triggering funds to turn to risky assets; the technical overbought (RSI reached 75) triggered programmed selling, and the leveraged funds stampede exacerbated volatility; the real focus of the market has now shifted to tonight's non-agricultural data. If the non-agricultural data confirms the weakness of the labor market, gold may stop falling and rebound, while the US dollar and US bond yields may continue to be under pressure; on the contrary, strong non-agricultural data may restore confidence in the US dollar, and gold needs to be wary of the risk of a correction.

Technical Review:

Gold stopped at 3202/3205, and after a second dip in the late trading, it bottomed out and rebounded, and the bulls counterattacked and closed above the 3230 mark. Let's look at the strength of the rebound during the day, and it is expected to continue to fluctuate in a cycle. Technically, the daily line has a continuous negative structure, which maintains a bias towards selling. The rebound selling layout is the main one, and the low-price buying is auxiliary. The gold daily line level includes a negative hammer line with a certain lower shadow. After opening high and moving low, the gold price has stabilized and fluctuated after touching the 3200 area. The upper resistance level is running around the 3250 level. After further breakthrough, gold is expected to change the pattern of selling pressure.Today's key data: Non-agricultural data at 20:30, the previous value is 228,000, and the market estimate for this period is only 130,000. According to the market estimate, it is bullish for gold and silver, but it should be noted that the actual value announced is greater than the expected value of 130,000, and the actual value announced is between the previous value and the estimated value. Form a decline first and then rise!

Today's analysis:

Gold rebounded weakly, and it is still a selling trend. Gold broke down yesterday and fell, and then fluctuated at a low level, but the trend is still selling. The rebound is an opportunity to sell. Today's non-agricultural data, before the data, continue to rebound and sell first! Before the market reverses, the rebound is an opportunity to sell. There is no bottom for the decline, just continue to sell along the trend. Today is the key to whether the market will turn around. If gold does not break 3200 today, then there is a chance for buying gold! The 1-hour moving average of gold continues to cross the downward selling arrangement and diverge. There is still room for gold to go down. The 1-hour gold rebounded in the early trading and was under pressure near 3244 and fell directly. Then gold continued to go short at highs below 3244 in the early trading. If it breaks through 3244, then gold will have to pay attention to the resistance near the last low of 3260. Today is the non-agricultural data, which is also an important date for the market to have a turning point. If gold starts to close with a big positive line at the bottom today, then this round of gold adjustment may be temporarily over.

Operation ideas:

Buy short-term gold at 3205-3208, stop loss at 3196, target at 3260-3280;

Sell short-term gold at 3250-3253, stop loss at 3263, target at 3220-3200;

Key points:

First support level: 3223, second support level: 3210, third support level: 3192

First resistance level: 3250, second resistance level: 3262, third resistance level: 3280

Follow the market closely and chase the short-term rise

The trend of gold prices will be mainly affected by the performance of the US dollar, the progress of trade negotiations and geopolitical risks.

In the short term, the US dollar index hovering at a low level near 98.00 may continue to provide support for gold prices, while the market uncertainty caused by Trump's tariff remarks is expected to maintain the favor of safe-haven funds for gold.

From a technical perspective, after stabilizing above $3,400, gold prices are expected to further challenge the round mark of $3,500.

Trend: Upward trend

Support: around 3400.00

Resistance: around 3458.50

Strategy:

Logic of view:

Around 3430, light long view, stop loss 3400, take profit around 3450----3500

The unicorn is coming

The market unicorn is here. I believe that my friends have seen this week's market. I know that many people are waiting and watching...

However, new opportunities have come, as the general weakness of the US dollar, uncertainty around tariffs and concerns about a global recession still provide strong support for gold

According to my technical analysis, now is the best time to buy the rise

Don't ask your barber if you need a haircut

It is important to understand important trends during trading.

How to grasp trading trends requires us to think about it.

The gold trend continues to rise. Everything is going according to my prediction.

Many people will consider taking advantage of the decline to make a profit.

But I want to tell you not to go against your original intention and take risks during trading.

As Hansen said, the world is in chaos today. Investors are looking for safe havens in the face of recession concerns, geopolitical tensions, fiscal deficit concerns, and central banks reducing their holdings of US dollar assets and seeking diversification.

We raised our gold forecast to $3,500.

Gold, bullish at $3190!

After the gold price broke through the previous high of $3022 before the last decline, it laid the foundation for the subsequent rise. The key to judging whether the decline is over is not to find the support position, but to focus on the breakthrough of the previous high position before the last decline. On the contrary, the rising market is also not to guess where the top is, but to focus on the previous high of $3190 before the last pull-up. If this position is lost, it will enter a short-term shock or adjustment.

Look for gold below 3190, pay attention to the breakthrough of $3245-50 above, and further pay attention to $3265-70 after the breakthrough!

If the support of 3190 is broken and the decline continues, 3170 needs to be followed up.

3300? Gold price rises to a new high?

On April 16, the spot gold price exceeded $3,280 per ounce, and New York gold futures reached the $3,300 mark for the first time, with a single-day increase of 1.85%, setting a historical record. This milestone breakthrough marks that the gold market has entered a comprehensive risk-averse mode, reflecting the profound changes in the global economic and political landscape.

Gold operation strategy on Wednesday

Gold long order: 3255-3254 long, stop loss 3244, target 3280-3282

Gold short order: 3280-3281 short, stop loss 3291, target 3255-3250

Key points:

First support level: 3250, second support level:

3245, third support level: 3240

First resistance level: 3280, second resistance level: 3285, third resistance level: 3290

9.2 Analysis of short-term gold operationsGold is long near 2490.

In the 4-hour period, there is a pressure level of 2530 on the top and a first-line support of 2492 on the bottom (it cannot fall after being touched multiple times). It is not a unilateral trend at present, so it still takes a long time to fall back. The middle track of the Bollinger Bands runs horizontally, and the price of gold is supported by the lower track of the Bollinger Bands. You can go long if it is close to 2492.

There is non-agricultural data this week. Gold will definitely break this week. The shock pattern between 2492-2530 will not last long. If you grasp the signal well, the big market is about to emerge.

Trading strategy: Gold is long near 2492, stop loss is 2482, target is 2510

What kind of analysis and suggestions do you have on the trend of gold? Everyone is welcome to like and comment.

Don't worry about short-term rises.The JOLTS report was one of U.S. Treasury Secretary Janet Yellen's top labor indicators when she was Fed chair. The indicator is also a labor market data that the Fed pays close attention to. The previous record number of job vacancies was an important impetus for the Federal Reserve to continue to raise interest rates with a hawkish attitude.

Mehta said signs of further tightening in the U.S. employment sector could intensify the Federal Reserve's hawkish expectations and trigger a new rally in the dollar and U.S. Treasury yields, pushing gold back toward the $1,900/oz mark.

韭菜平凡之路:警惕疯狂的鲨鱼形态,1770~1780择机空,止损1781~1787,止盈1760~1757短线黄金仍有可能上冲1770~1800区间,关注1750支撑,1757是0.618回调位是否被击穿。黄金若跌破1750则回调风险较大

日内高空空头策略:

1770~1780择机空,

止损1781~1787,

止盈1760~1757

日内赌反弹多头策略:

1)1757多,止损1754,止盈1765

2)1750多,止损1747,止盈1760~1764

跌破1750观望

1770以上追涨黄金的风险:

空头想在1780~1800区间

拿到鲨鱼C点

第一攻击目标是1680,击穿1685

破掉月线上行通道,

空头拿到100美元做空利润后,

随后引发第二轮股灾,

引导黄金狂泻向鲨鱼D点1400

黄金潜在的周线级别鲨鱼形态

黄金从天堂到地狱只需要1个多月?这个看上去疯狂的鲨鱼形态成立的关键是需要美股出现第二轮股灾。如果多头守住1685,或者美股因为美联储救市很难出现第二波暴跌,则此鲨鱼形态难以成立。