X-indicator

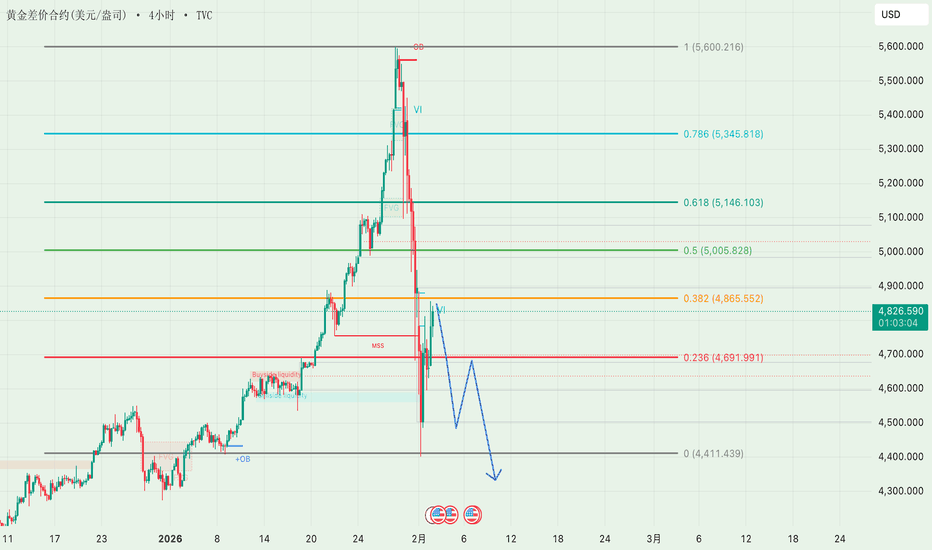

黄金反弹还是陷阱?黄金正在反弹——但背景很重要。

在强烈的抛售之后,价格现在正在回撤到一个关键的阻力区,没有打破结构。这是许多交易者被困于追逐“底部”的地方,而聪明的钱在分配。

市场结构

清晰的下行趋势:低高点和低低点保持完好

当前的走势 = 回撤,并不是强劲的看涨延续

价格在下降趋势线下反应

关键技术区

FVG / 供应区在5.26x左右 → 高概率反应区域

该区域与回撤水平和之前的失衡相一致

如果-那么场景

如果价格拒绝5.26x:

→ 下行趋势持续,目标4.63x → 4.51x → 4.40x

如果价格突破并保持在5.26x以上(H1收盘):

→ 看跌偏见减弱,等待新的结构再进行交易

交易心态

这是在抛售后的分配,而不是积累。

不要将反弹与趋势变化混淆。

📌 强劲的趋势不会安静地反转——它们首先会考验耐心。

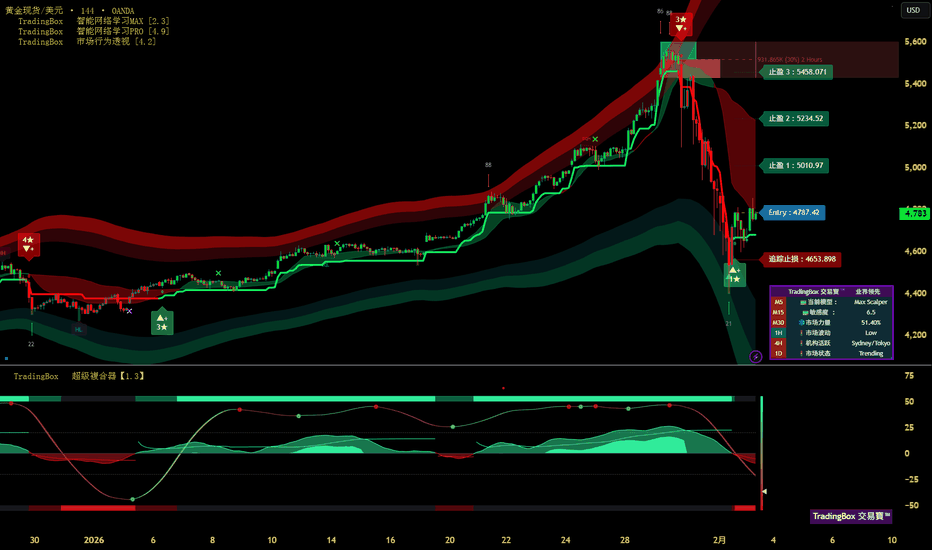

XAUUSD - 高波动期,关注关键反应区。📌 市场背景

黄金目前在高波动环境中交易,经历了跌破5,000美元水平的剧烈下跌,反映出在主要宏观不确定性之前的激进重新定价。市场已经从平稳的趋势行为转向由流动性驱动、快速反应的阶段,价格在关键技术区域之间急剧波动。

随着美联储领导层的持续变化和未来货币政策方向的不确定性,黄金对预期、资金流动和新闻头条极为敏感。

➡️ 当前状态:波动条件 - 等待确认,避免情绪交易。

📊 结构与价格行动 (M30)

之前的看跌冲动正在失去动能,短期内开始形成更高的低点。

目前价格处于技术性恢复阶段,但尚未确认趋势反转。

市场仍然尊重需求和关键水平,产生剧烈反应。

此阶段未确认看涨CHoCH - 需要进一步验证。

🔎 关键见解:

黄金交易在一个决策区间内,每个关键水平都可能触发强烈的方向性波动。

🎯 交易计划 - MMF风格

🔵 主要情景 - 买入技术回调

专注于基于反应的执行,而非预测。

买入区间1:4,667 - 4,650

(近期需求 + 第一个恢复基础)

买入区间2:4,496 - 4,480

(深层需求 + 之前流动性扫荡低点)

➡️ 仅在以下情况下执行买入:

出现明确的看涨蜡烛反应

或在M30上形成更高低点结构

上涨目标:

TP1:4,932

TP2:5,124(主要恢复阻力 / 供应区)

🔴 替代情景 - 在阻力反应时卖出

如果价格回撤到供应区并未能保持看涨动能:

卖出区间:5,120 - 5,140

→ 寻找M30结构后的短期拒绝

❌ 无效化

M30确认收盘低于4,480将使恢复结构无效,并需要全面重新评估。

🧠 总结

黄金正处于高波动、构建结构的阶段,不适合情绪或激进定位。关键在于:

交易关键水平,而非冲动

等待价格确认

将风险管理置于预测之上

📌 在波动市场中,纪律胜过频率。

金汇得手:黄金开盘拉升 今日主多辅空走势 美元指数昨天收阳,今天关注97-98区间。

黄金昨天低开,再次大跌接近500点到4400附近,日线长影阴线。单看收线,今天倾向上涨,早盘开盘拉升100多美金。但是如果昨天高点不破,行情大概率也上不去或大区间震荡为主。目前 下方支撑日内低点附近,触及可以做多。强支撑4590和4400,今天大概率不会再触及。阻力昨天高点附近,触及可以小止损空。行情如果站稳4900,上方再看100-250美金,触及再空。

操作建议:接近日内低点和昨天低点多,接近昨天高点空,见5000或5140都是做空位置。昨天早盘4700多,4600多,4767空,4400附近多,美盘4675多。

原油低开收大阴,低点正好是周线支撑,不破可以小止损多。上方阻力62.6附近,也是日内多空分水,不破暂时看62.6-61.3区间,站稳继续看63.3甚至昨天高点附近,触及可以再空。分析仅供参考,实盘为准。

白银急挫震撼市场:反形态正在酝酿?年初出现近乎指数型的强劲涨势后,白银在上周五出现戏剧性的回落,光芒瞬间黯淡。本文将解析这波急跌背后的关键因素,并探讨一种较少被讨论、但可能在接下来几个交易日逐步成形的技术形态。

特朗普提名美联储主席人选,贵金属泡沫被戳破

1 月期间,随着政治不确定性与通胀担忧升温,资金大量涌入被视为避险资产的贵金属。白银表现尤为突出,与黄金、铂金同步大幅上涨,动能持续堆叠,市场仓位也逐渐趋于单边。

然而,当唐纳德·特朗普正式确认提名 Kevin Warsh 为下一任美联储主席人选后,市场预期出现明显转变。该任命强化了对通胀纪律的预期,并支撑美元走强,直接动摇了贵金属上涨的核心支柱。在情绪与仓位本就偏向极端的背景下,市场风向的突然转变,引发了整个贵金属板块快速且失序的回调。

顶部结构浮现,为“反形态”打开空间

从白银的日线 K 线来看,目前走势几乎可视为教科书级别的趋势末端情境。2025 年大部分时间,白银维持稳健而持续的上升趋势;进入新年度后,涨势明显加速,近乎指数型推进,吸引了大量追高的末端买盘。

这波最后的急拉,正是市场变得脆弱的关键。当信心高涨、仓位过度集中,任何外在变量都可能成为引爆点。

上周五的价格行为,标志着结构性的转折。一开始看似只是获利了结,但很快演变成更为混乱的抛售,错站方向的交易者被迫快速降低敞口。从跌幅的规模与 K 线结构来看,这并非一次例行性修正,而是对一段长期未曾受到严格考验的趋势,所发出的首次实质挑战。

低周期观察:典型顶部过程正在发展

进一步观察小时级别走势,可以看到更清晰的细节。近期的价格行为显示,白银在高点附近迟迟无法有效突破,随后卖压逐步累积,形成典型的顶部过程。

“加速上涨 → 高位停滞 → 下行动能快速扩散”的组合,往往正是反形态开始酝酿的位置。尽管在日线级别上,形态尚未完全确认,但市场行为的转变已相当明确。接下来几个交易日白银的表现,将是判断这波走势仅属修正,还是具有更深层结构性意义的关键。

白银(XAG/USD)日线 K 线图

过往表现并非未来结果的可靠指标

白银(XAG/USD)小时线 K 线图

过往表现并非未来结果的可靠指标

免责声明

本文仅供信息与学习用途,不构成任何投资建议,亦未考虑任何投资者的个别财务状况或投资目标。文中提及的过往表现,并非未来结果或绩效的可靠指标。社交媒体内容不适用于英国居民。

差价合约(CFD)及点差交易属于高风险杠杆型金融产品,可能在短时间内造成重大损失。**85.24% 的零售投资者账户在本平台交易差价合约及点差交易时遭受亏损。**请在交易前确认您已充分了解其运作方式,并评估自己是否能够承担相关风险。

CME提高金属保证金 → 周一缺口风险?| 黄金关键影响黄金不再自由波动——它正在进行结构性的调整。

在创出历史新高(ATH)后,XAUUSD出现了明确的结构变化(CHoCH),随后出现了一系列看跌的突破(BOS),确认了这次调整是可控的,而非恐慌性抛售。价格目前正尊重一个下行的修正通道,这通常出现在市场决定下一个主要走势之前。

🧠 基本面背景(流动性 > 头条新闻)

CME提高了贵金属的保证金要求

更高的保证金 = 强制性减少杠杆交易者的头寸

这通常会在周初造成流动性驱动的缺口

重要提示:这是机械性压力,而不是宏观趋势的逆转

➡️ 预计首先会有波动,随后才是清晰的趋势。

📊 技术结构(高时间框架 → 低时间框架)

ATH拒绝 + CHOCH = 看涨动能暂停

通道内的多个突破 = distribution阶段

价格正向关键流动性区间收缩

🔑 关键水平

5,090 – 5,120:上通道 / 卖方反应区

4,620缺口区域:如果周一开盘有缺口,则为高概率流动性磁铁

4,410支撑区:高时间框架需求及通道底部(关键水平)

🎯 情景(如果 – 则)

如果周一缺口到4,620

→ 预计剧烈波动和假突破

→ 在任何看涨偏见之前,等待接受/吸收

如果价格干净利落地失守4,620

→ 下一个目标 = 4,410支撑

如果价格迅速回升至4,900以上

→ 缺口可能成为陷阱 → 压缩回到区间内

XAUUSD (H1) - 低于5000$: 回调还是快速反弹?市场背景 – 黄金进入关键重定价区域

黄金已正式跌破心理价位5,000美元,引发了新的讨论:

这是更深纠正阶段的开始,还是在急剧反弹之前的流动性重置?

时机至关重要。

由于对美联储领导层变动和未来货币政策方向的猜测,市场正在积极重定价风险。这给黄金注入了极大的波动性,流动性正在迅速重新分配,而不是干净的趋势。

➡️ 这不再是低波动性的趋势市场——这是一个决策区域。

结构与价格动作(H1)

之前的看涨H1结构已经失败,确认了短期纠正阶段

价格交易在之前的需求之下,现在 acting as supply

当前反弹为技术性回调,而非确认的反转

下行动能仍然活跃,直到价格重新占领关键结构水平

关键洞见:

👉 在5,000美元以下,黄金处于重平衡模式,而非趋势延续。

关键技术区域(H1)

主要供给 / 拒绝区域:

• 5,030 – 5,060

→ 之前的结构 + 斐波那契重合

→ 卖方可能防守的区域

中位反应区域:

• 4,650 – 4,700

→ 短期需求 / 潜在反弹区

深层流动性需求:

• 4,220 – 4,250

→ 主要流动性吸纳区

→ 技术性或结构性反弹的高概率区域

交易计划 – MMF风格

情景 1 – 卖出回调(主要在5,030以下)

在价格反弹至供给区时偏向卖出设置

等待拒绝 / 失败模式

不要追逐价格下跌

➡️ 在5,030以下偏向看跌纠正

情景 2 – 仅在深层流动性时买入

仅在主要需求处并确认时考虑买入:

• 4,650 – 4,700(仅供短线/反应)

• 4,220 – 4,250(更高概率的波段区域)

➡️ 不要盲目抄底

➡️ 确认 > 预测

宏观风险展望

美联储领导层不确定性 = 政策预期波动

任何转向鸽派可信度的变化可能引发剧烈的补空反弹

相反,长期不确定性短期内将黄金维持在压力之下

➡️ 预期快速波动、虚假突破和宽幅震荡

无效与确认

如果H1重新占领并维持在5,060以上,看跌偏向减弱

若4,220果断失败,深度修正将开启

总结

黄金在5,000美元以下并不是弱势——而是重定价。

这是一个流动性狩猎交易者的市场,而不是反过来。

现在的优势是耐心和精准:

在供给区卖出反弹

仅在流动性被证明的地方买入

在承担风险之前让结构确认

➡️ 在高波动性中,生存胜于预测。

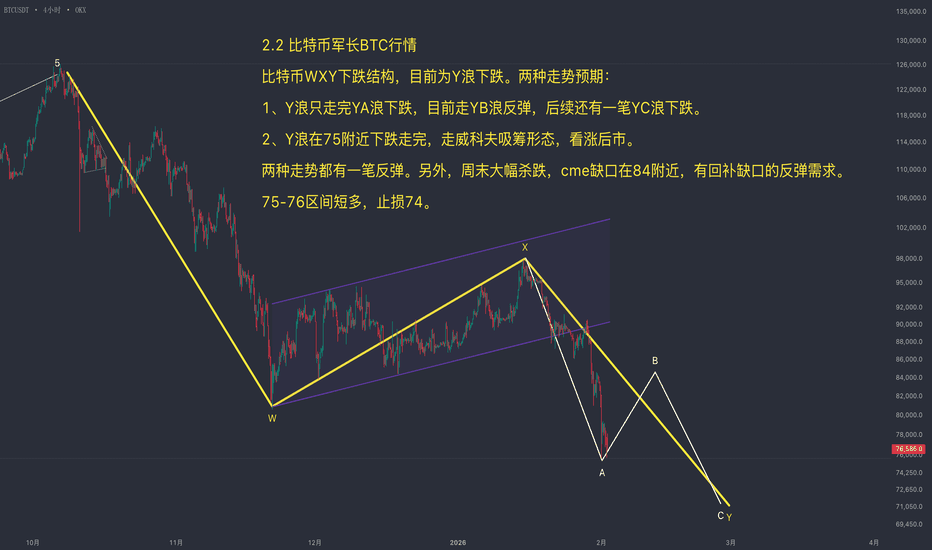

青岚加密课堂:2月2日 BTC分析| 暴跌后的比特币:抄底还是逃命?欢迎来到青岚加密课堂,咱们今天对BTC 四个周期包括消息面进行分析:

首先,技术面咱们多周期联动着看:

* 日线级别(长期趋势):哎哟,这个空头格局是明牌啦。价格已经跌穿了所有主要均线,MA5、MA10、MA20呈现完美的空头排列。MACD在零轴下方死叉,绿柱子老长了,RSI在22.5,妥妥的超卖区域。这说明大趋势还是向下没跑,空头力量非常强。不过呢,昨天(2月1日)那根日K线收了根带长下影的阴线,说明在76000-77000美元附近有资金尝试抄底,但今天这根K线目前还是阴线,反弹力度很弱,止跌信号还需要确认。

* 4小时级别(中期趋势):和日线同步,也是空头排列。价格被MA5死死压着,每次反弹到MA5附近就被打下来。MACD同样在零轴下方,虽然绿柱子有缩短迹象,但双线距离零轴还很远,属于下跌中继的弱势反弹。关键阻力就在78000-78500(MA5附近),过不去就还是下跌通道。

* 1小时级别(短期趋势):这里稍微有点意思。价格在76000-78000这个区间内反复震荡,形成了一个小的箱体。MACD在零轴下方有金叉的迹象,但力度很弱,更像是下跌后的横盘修复。RSI在35附近徘徊,既不算强也不算弱。这个级别告诉我们,暴跌之后市场在喘气,多空暂时平衡,但平衡很脆弱。

* 15分钟级别(超短期动向):这就是咱们看盘口的节奏了。价格在小区间内上蹿下跳,波动剧烈。MACD在零轴附近反复粘合,没有明确方向。这说明在1小时级别的箱体内,多空双方在进行高频的拉锯战,任何一方都还没取得压倒性优势。

然后,咱们把消息面揉进来看:

消息面简直是“雪上加霜”哦。核心就三点:

1. 宏观鹰派冲击:沃什可能被提名为美联储主席的消息,让市场担心“缩表”加速,全球流动性收紧。这直接带崩了黄金、白银,风险资产BTC自然也难以独善其身。

2. 内部杠杆出清:隔夜高达25亿美元的清算(消息#47),尤其是16亿美元的多头爆仓(消息#3),说明市场里过热的杠杆被暴力清洗了一波。链上数据也显示市场从“相信”转向“焦虑”(消息#2),这是情绪降温的表现。

3. 结构性担忧:市场在担心MicroStrategy这类高杠杆大户会不会被迫抛售(消息#4、#19),虽然Saylor嘴硬说“更多橙色”(消息#44),但这种担忧本身就会压制买盘。

所以,咱们的综合预判和做单思路就很清晰了:

当前市场是 “长期和中期趋势明确看跌,短期进入超跌后的震荡修复阶段” 。消息面全是利空和担忧,没有任何能立刻扭转趋势的利好。技术上的超卖(日线RSI极低)只能带来反弹,但反转需要更强的买盘和基本面配合,目前看不到。

做单思路(仅供教学讨论,不构成投资建议):

1. 对于激进型选手:可以依托 1小时级别的箱体(76000-78000) 做高抛低吸。靠近78000(同时也是4小时MA5压力) 尝试轻仓做空,止损放在78500上方;靠近76000前低区域 可以尝试博反弹多单,但必须严格止损在75500下方。记住,这只是短线抢反弹,快进快出,有利润就跑。

2. 对于稳健型选手:建议继续观望,或者只做空不做多。因为大趋势向下,顺势而为才是王道。可以等待价格 反弹至4小时级别MA5(约78000-78500) 或者 1小时箱体上沿 附近,出现滞涨信号(比如上影线、指标背离)时,再布局空单,看向前低76000,甚至更低。

3. 关键风控位:上方强阻力在78500-79000(4小时MA5+前期小平台),这里过不去,空头格局不变。下方关键支撑在76000-75500,这里如果有效跌破,下跌空间会再次打开,可能直奔74000甚至更低。

最后,青岚姐送大家一句今天的心得:

“在趋势的洪流里,逆势抄底是勇者的游戏,但顺势而为才是智者的生存之道。当市场用暴跌完成‘风险教育’时,我们要做的不是急于证明自己勇敢,而是先确保自己活着。” 咱们一起保持冷静,耐心等待更确定的信号。好了,今天的分析就到这里,大家有什么问题,咱们评论区见!

-------------------------

受限于图表篇幅和平台合规准则,行情分析有时效性,

最新的分析已更新在我的青岚加密课堂:qinglan.org

或欢迎点击我的头像关注我,通过主页展示的渠道进行更多技术探讨。

2.2 比特币走势分析:周末市场遭现货砸盘狙击,结构显示短期反弹需求强烈,Y浪目标与缺口回补成为焦点(比特币合约交易)军长2.2 比特币价格今日行情:周末期间,市场遭遇某交易所超过10亿美元的现货砸盘,导致价格暴跌近10%,这是一次典型的利用流动性匮乏时段对散户合约的精准狙击。

从结构上看,自126,000美元开始的W-X-Y浪型中,当前已确认处于Y浪下跌。Y浪存在两种潜在目标:短期可能在75,000美元附近(W浪的0.618)结束;长期则可能走等长结构,反弹后仍需再探新低。

同时,威科夫模型显示价格处于测试支撑阶段,芝加哥交易所开盘形成的巨大跳空缺口也亟待回补。多种技术视角均指向短期有强烈反弹需求。

智者生存:黄金冲击5600,注意风险!!交易小Tips:知于行永远是理论最大的问题

复盘分析:行情受阻整理,没有出现比较大的调整后第二天直接反包,延续涨势,行情极速上行,冲击5600区域

市场分析:昨日黄鱼继续上行,单日振幅250+,日线表现上行情进入了极端的上涨行情,不管是幅度还是速度都是前所未有的大,行情进入“抢购高潮”,这很容易出现中长期投资者的获利了结,行情很容易进入阶段性顶部,当前行情还在上涨趋势,箜头没有表现之前,中短期可以看哆做哆,但一定要谨慎哆,做好防守

如果加速上行后出现极速下行的情况,不要被市场的热度冲昏了头脑,认为“回调”就是做哆的机会,这种情况若出现顶部,套住你的可不止一两个月