COMMENT-ECB's higher for longer view challenged, Q1 rate cut risk rises

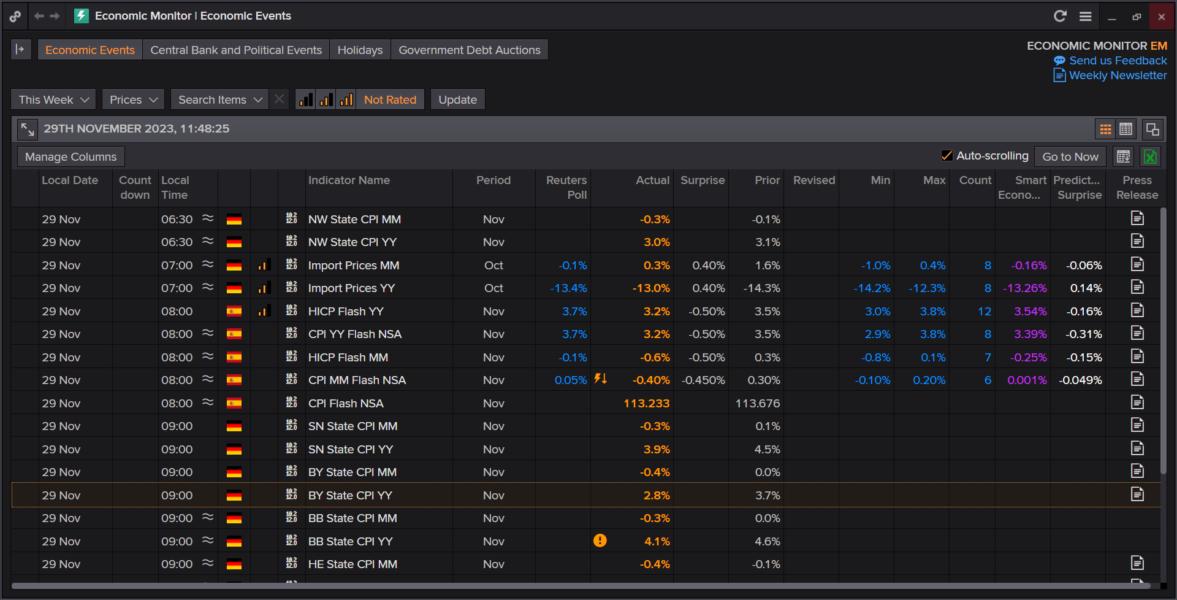

A continuation in the disinflationary trend seen across the German state CPI figures, as well as the flash Spanish inflation print pushes back against the European Central Bank’s higher for longer rhetoric. Instead, the data raises the risk that the bank could ease policy rates sooner with a cut by Q1 2024 becoming increasingly likely.

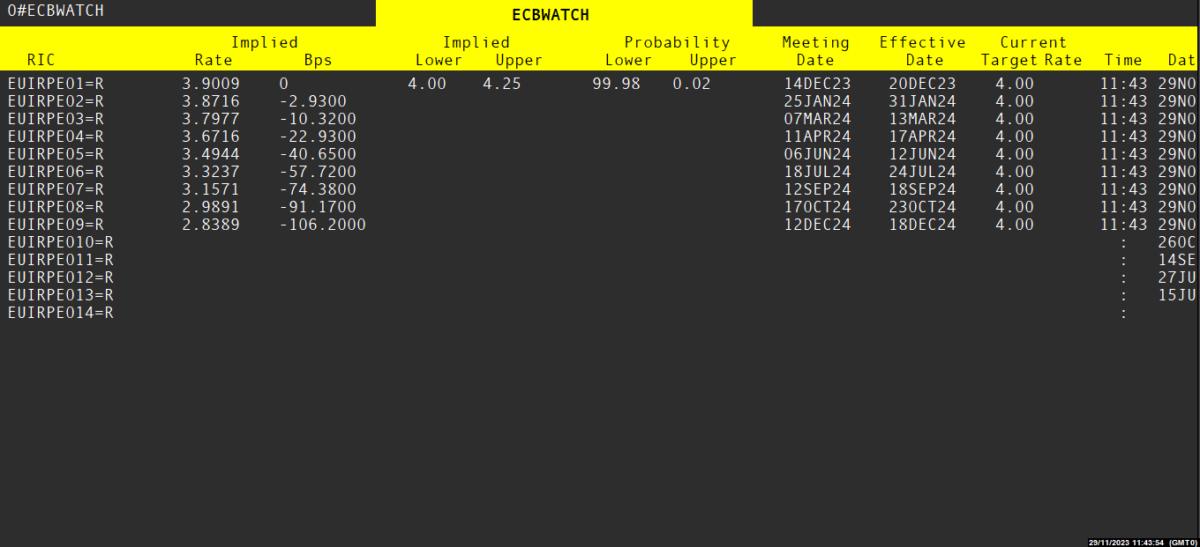

Currently, markets are pricing in 100bps of easing for 2024 with the first rate cut near enough fully priced in for April. However, the disinflationary trend opens the door for a March cut and with 10bps priced in, there is room for a dovish repricing (0#ECBWATCH).

For now, this has prompted EUR/USD back away from the 1.10 handle. Although, as traders continue to digest the dovish shift from the typically hawkish Fed policymaker, Christopher Waller, weakness in the Euro has been limited.

That said, the German 2-year yield is at a fresh multi-month low following a break below 2.9%, with risks now geared towards a test of 2.5%. Meanwhile, resistance situated at 3% will likely cap upside.

For more click on