OPEN-SOURCE SCRIPT

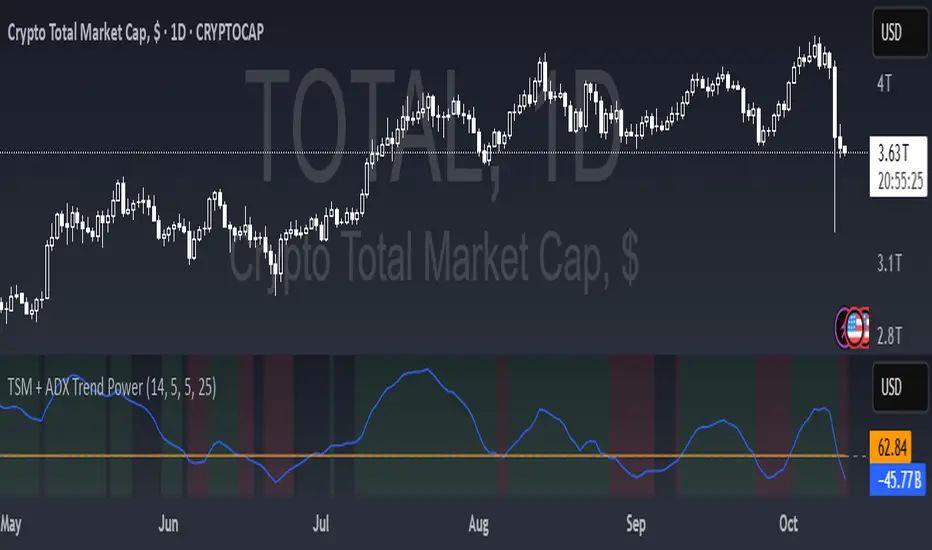

TSM + ADX Trend Power

Logic Behind This Indicator

This indicator combines two momentum/trend tools to identify strong, reliable trends in price movement:

1. TSM (Time Series Momentum)

What it does: Measures the difference between the current price and a smoothed average of past prices.

Formula: EMA(close - EMA(close, 14), 14)

Logic:

If TSM > 0 → Price is above its recent average = upward momentum

If TSM < 0 → Price is below its recent average = downward momentum

2. ADX (Average Directional Index)

What it does: Measures trend strength (not direction).

Logic:

ADX > 25 → Strong trend (either up or down)

ADX < 25 → Weak or no trend (choppy/sideways market)

Combined Logic (TSM + ADX)

The indicator only signals a trend when both conditions are met:

Condition Meaning

Uptrend TSM > 0 AND ADX > 25 → Strong upward momentum

Downtrend TSM < 0 AND ADX > 25 → Strong downward momentum

No signal ADX < 25 → Trend is too weak to trust

What It Aims to Detect

This indicator combines two momentum/trend tools to identify strong, reliable trends in price movement:

1. TSM (Time Series Momentum)

What it does: Measures the difference between the current price and a smoothed average of past prices.

Formula: EMA(close - EMA(close, 14), 14)

Logic:

If TSM > 0 → Price is above its recent average = upward momentum

If TSM < 0 → Price is below its recent average = downward momentum

2. ADX (Average Directional Index)

What it does: Measures trend strength (not direction).

Logic:

ADX > 25 → Strong trend (either up or down)

ADX < 25 → Weak or no trend (choppy/sideways market)

Combined Logic (TSM + ADX)

The indicator only signals a trend when both conditions are met:

Condition Meaning

Uptrend TSM > 0 AND ADX > 25 → Strong upward momentum

Downtrend TSM < 0 AND ADX > 25 → Strong downward momentum

No signal ADX < 25 → Trend is too weak to trust

What It Aims to Detect

- Strong, sustained trends (not just noise or small moves)

- Filters out weak/choppy markets where momentum indicators often give false signals

- Entry/exit points:

- Green background = Strong uptrend (consider buying/holding)

- Red background = Strong downtrend (consider selling/shorting)

- No color = Weak trend (stay out or wait)

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。