OPEN-SOURCE SCRIPT

Brown's Exponential Smoothing Tool (BEST)

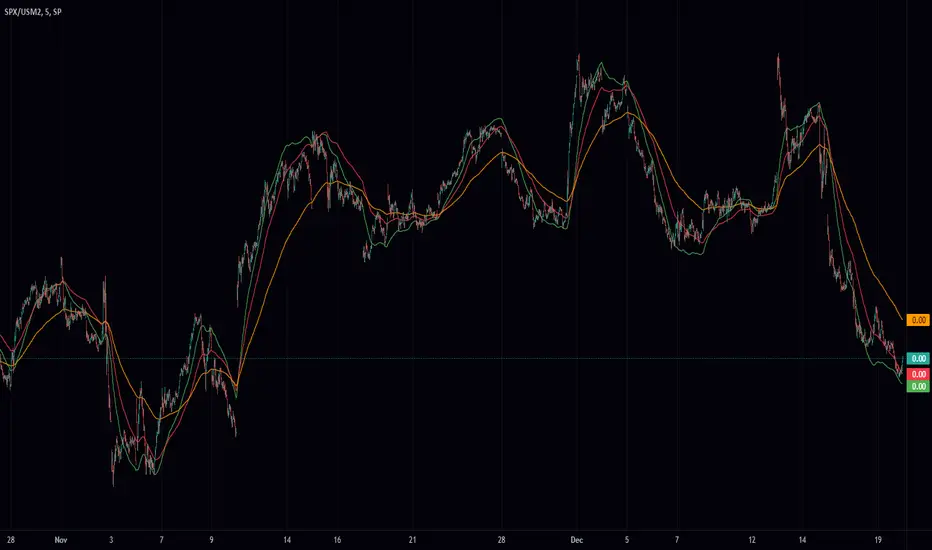

Brown's Exponential Smoothing Tool (BEST) is a script for technical analysis in financial markets. It is designed to smooth out price fluctuations and identify trends in a given time series data.

The script begins by defining the "BEST" indicator, which will be overlaid on top of the chart. The user can then specify the source of the data (e.g. close price) and set the values for the smoothing factor (alpha) and the style of exponential smoothing (BES, DBES, or TBES).

The script then defines three functions for calculating the exponential smoothing: "bes", "tbes", and "dbes". The "bes" function applies a single iteration of exponential smoothing to the input data, using the specified alpha value. The "tbes" function applies three iterations of exponential smoothing, using the triple exponential moving average (TEMA) formula to smooth out the data even further. The "dbes" function applies two iterations of exponential smoothing, using the double exponential moving average (DEMA) formula to smooth out the data.

Finally, the script defines a "ma" function, which returns the exponential smoothing result based on the style selected by the user. The script plots the result of the "ma" function on the chart, using the color orange.

In summary, Brown's Exponential Smoothing Tool is a script for smoothing out financial time series data and identifying trends. It allows the user to choose from three different styles of exponential smoothing, each of which has its own strengths and weaknesses. By applying exponential smoothing to financial data, traders and analysts can better understand the underlying trends and make more informed decisions.

The script begins by defining the "BEST" indicator, which will be overlaid on top of the chart. The user can then specify the source of the data (e.g. close price) and set the values for the smoothing factor (alpha) and the style of exponential smoothing (BES, DBES, or TBES).

The script then defines three functions for calculating the exponential smoothing: "bes", "tbes", and "dbes". The "bes" function applies a single iteration of exponential smoothing to the input data, using the specified alpha value. The "tbes" function applies three iterations of exponential smoothing, using the triple exponential moving average (TEMA) formula to smooth out the data even further. The "dbes" function applies two iterations of exponential smoothing, using the double exponential moving average (DEMA) formula to smooth out the data.

Finally, the script defines a "ma" function, which returns the exponential smoothing result based on the style selected by the user. The script plots the result of the "ma" function on the chart, using the color orange.

In summary, Brown's Exponential Smoothing Tool is a script for smoothing out financial time series data and identifying trends. It allows the user to choose from three different styles of exponential smoothing, each of which has its own strengths and weaknesses. By applying exponential smoothing to financial data, traders and analysts can better understand the underlying trends and make more informed decisions.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。