OPEN-SOURCE SCRIPT

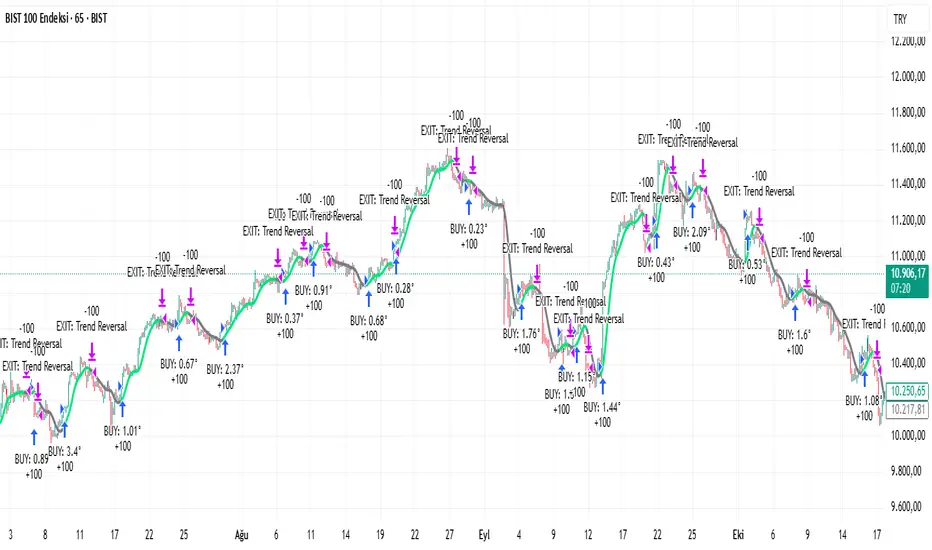

Recursive WMA Angle Strategy

Description: This strategy utilizes a recursive Weighted Moving Average (WMA) calculation to determine the trend direction and strength based on the slope (angle) of the curve. By calculating the angle of the smoothed moving average in degrees, the script filters out noise and aims to enter trades only during strong momentum phases.

How it Works:

Recursive WMA: The script calculates a series of nested WMAs (M1 to M5), creating a very smooth yet responsive curve.

Angle Calculation: It measures the rate of change of this curve over a user-defined lookback period and converts it into an angle (in degrees).

Entry Condition (Long): A long position is opened when the calculated angle exceeds the Min Angle for BUY threshold (default: 0.2), indicating a strong upward trend.

Exit Condition: The position is closed when the angle drops below the Min Angle for SELL threshold (default: -0.2), indicating a sharp trend reversal.

Settings:

MA Settings: Adjust the base lengths for the recursive calculation.

Angle Settings: Fine-tune the sensitivity by changing the Buy/Sell angle thresholds.

Date Filter: Restrict the backtest to a specific date range.

Note: This strategy is designed for Long-Only setups.

How it Works:

Recursive WMA: The script calculates a series of nested WMAs (M1 to M5), creating a very smooth yet responsive curve.

Angle Calculation: It measures the rate of change of this curve over a user-defined lookback period and converts it into an angle (in degrees).

Entry Condition (Long): A long position is opened when the calculated angle exceeds the Min Angle for BUY threshold (default: 0.2), indicating a strong upward trend.

Exit Condition: The position is closed when the angle drops below the Min Angle for SELL threshold (default: -0.2), indicating a sharp trend reversal.

Settings:

MA Settings: Adjust the base lengths for the recursive calculation.

Angle Settings: Fine-tune the sensitivity by changing the Buy/Sell angle thresholds.

Date Filter: Restrict the backtest to a specific date range.

Note: This strategy is designed for Long-Only setups.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。