OPEN-SOURCE SCRIPT

已更新 Fourier Analysis and Filtering [tbiktag]

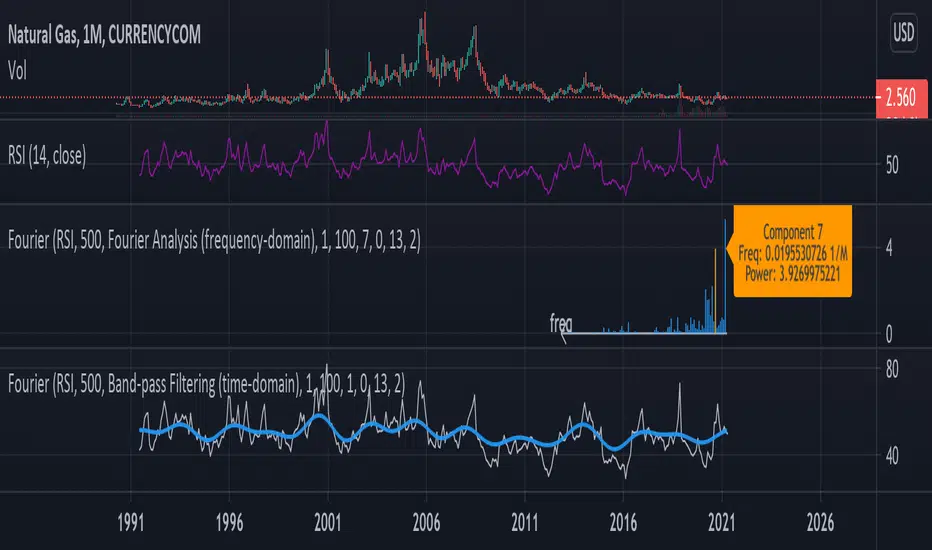

This tool uses Fourier transform to decompose the input time series into its periodic constituents and seasonalities, in other words, its frequency components. It also can reconstruct the time-domain data while using only the frequency components within a user-defined range (band-pass filtering). Thereby, this tool can reveal the cyclical characteristics of the studied market.

USAGE

The source and the size of the input data can be chosen by the “Dataset Source” and “Dataset Size” options. Price, volume, or some technical indicator (e.g., RSI, MACD, etc.) can serve as a source of the input data.

“Action” defines the type of the plot that will be displayed. Two options are available:

- Fourier Analysis

If selected, the frequency spectrum of the squares of the Fourier coefficient magnitudes is displayed. The zero-frequency component is on the right. Since the magnitudes of half of the coefficients are repeated, the graph displays only half of the frequency components.

The squared magnitude of a given frequency component is a measure of its power, that is, its contribution to the total variance of the dataset. Thus, by analyzing the frequency-domain spectrum, one can identify the most prominent seasonalities and then visualize them by using the "Band-pass Filtering" option (see below). Note that the zero component stores information about the amount of data, so it is naturally higher when the data is not centered at zero.

By activating the "Info about Frequency Component" option, the user can display information about the power and frequency of the selected Fourier component.

-Band-pass Filter

This option reconstructs and plots the dataset in the time domain, blocking frequency components outside of the cutoff frequencies (defined by the input parameters “Upper Cutoff” and “Lower Cutoff” input parameters in the “Band-pass Filter Properties” section).

FURTHER READING

In general, Fourier analysis has a long history of attempted applications for analyzing price data and estimating market cycles. For example, see the paper by John Ehlers

mesasoftware.com/papers/FourierTransformForTraders.pdf

and also some tools available here on TradingView, such as:

“Function: Discrete Fourier Transform” by RicardoSantos

“Fourier series Model Of The Market” by @e2e4mfck

“Ehlers Discrete Fourier Transform” by cheatcountry

Thus, I tried to make this tool versatile and user-friendly so you all can experiment with your own analysis.

Enjoy and don't hesitate to leave your feedback in the comments below!

USAGE

The source and the size of the input data can be chosen by the “Dataset Source” and “Dataset Size” options. Price, volume, or some technical indicator (e.g., RSI, MACD, etc.) can serve as a source of the input data.

“Action” defines the type of the plot that will be displayed. Two options are available:

- Fourier Analysis

If selected, the frequency spectrum of the squares of the Fourier coefficient magnitudes is displayed. The zero-frequency component is on the right. Since the magnitudes of half of the coefficients are repeated, the graph displays only half of the frequency components.

The squared magnitude of a given frequency component is a measure of its power, that is, its contribution to the total variance of the dataset. Thus, by analyzing the frequency-domain spectrum, one can identify the most prominent seasonalities and then visualize them by using the "Band-pass Filtering" option (see below). Note that the zero component stores information about the amount of data, so it is naturally higher when the data is not centered at zero.

By activating the "Info about Frequency Component" option, the user can display information about the power and frequency of the selected Fourier component.

-Band-pass Filter

This option reconstructs and plots the dataset in the time domain, blocking frequency components outside of the cutoff frequencies (defined by the input parameters “Upper Cutoff” and “Lower Cutoff” input parameters in the “Band-pass Filter Properties” section).

FURTHER READING

In general, Fourier analysis has a long history of attempted applications for analyzing price data and estimating market cycles. For example, see the paper by John Ehlers

mesasoftware.com/papers/FourierTransformForTraders.pdf

and also some tools available here on TradingView, such as:

“Function: Discrete Fourier Transform” by RicardoSantos

“Fourier series Model Of The Market” by @e2e4mfck

“Ehlers Discrete Fourier Transform” by cheatcountry

Thus, I tried to make this tool versatile and user-friendly so you all can experiment with your own analysis.

Enjoy and don't hesitate to leave your feedback in the comments below!

版本注释

Added the option to adjust the scale of the filtered data to the original input time series.+ cosmetic changes in the code

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。