INVITE-ONLY SCRIPT

已更新 Ekambit Volume Strength Index (EVSI)

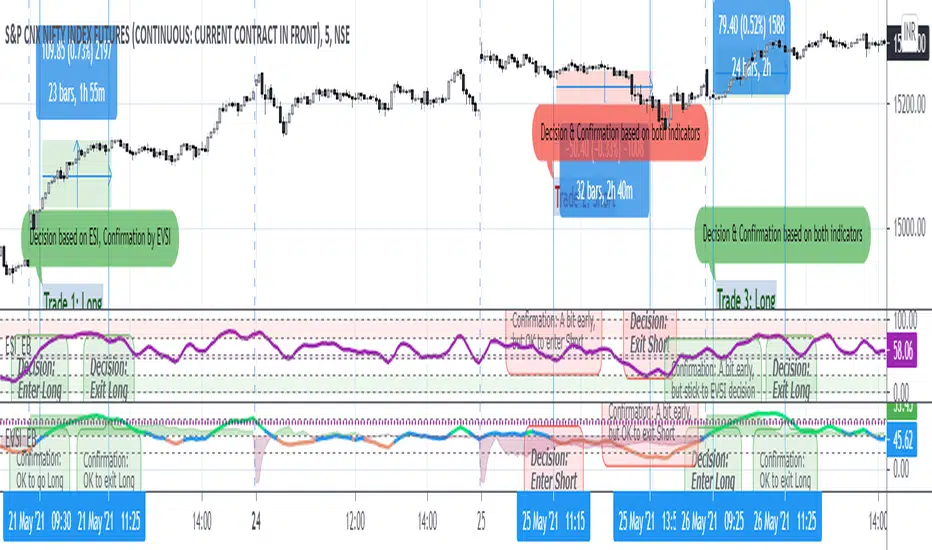

Ekambit Volume Strength Index (EVSI) is an innovative volume strength oscillator, which makes use of long-term historical volume strength as well as real-time volume strength in an easy to use format.

We at Ekambit Technologies use it daily, together with ESI indicator, with consistent success in the Indian and US markets.

This indicator is effective for intraday timeframes as we have backtested as well as deployed on the live market.

Usage:

1) Green & above mid-zone & rising: uptrend

2) Green & falling from high-zone: uptrend reversal

3) Red & below mid-zone & falling: downtrend

4) Red & rising from low-zone: downtrend reversal

5) Blue: transition middle-zone (wait to enter, or exit on opportunity)

For greater conviction before entering a trade, enable the "Show Trend" option, which compares recent volume strength with long-term historical volume strength.

For the above example,

* The purple dotted line (around 65) shows the long term historical volume trend strength.

* The green shaded area indicates that current volume trend strength is around 5% stronger than historical, which should provide greater conviction to the direction shown by EVSI indicator. This delta (recent minus historical) is shown with a base of 50, to align with the middle line of EVSI and provide you with an easy visually perceptible output.

Learning:

Just like price has memory, volume has memory. Volume indicates the collective outcome of all market participants. A larger number of participants makes it easier to predict the volume trend in a probabilistic manner.

Hence Index Futures like ES1!,

ES1!,  NQ1!,

NQ1!,  NIFTY1! and

NIFTY1! and  BANKNIFTY1! are better suited for volume analysis than individual stocks which can be less liquid, with price more easily influenced by a large buyer or seller.

BANKNIFTY1! are better suited for volume analysis than individual stocks which can be less liquid, with price more easily influenced by a large buyer or seller.

For Futures which trade almost 24x7, it's better to choose the high volume time periods i.e. when local Equity market is Open, rather than the overnight illiquid time periods.

We at Ekambit Technologies use it daily, together with ESI indicator, with consistent success in the Indian and US markets.

This indicator is effective for intraday timeframes as we have backtested as well as deployed on the live market.

Usage:

1) Green & above mid-zone & rising: uptrend

2) Green & falling from high-zone: uptrend reversal

3) Red & below mid-zone & falling: downtrend

4) Red & rising from low-zone: downtrend reversal

5) Blue: transition middle-zone (wait to enter, or exit on opportunity)

For greater conviction before entering a trade, enable the "Show Trend" option, which compares recent volume strength with long-term historical volume strength.

For the above example,

* The purple dotted line (around 65) shows the long term historical volume trend strength.

* The green shaded area indicates that current volume trend strength is around 5% stronger than historical, which should provide greater conviction to the direction shown by EVSI indicator. This delta (recent minus historical) is shown with a base of 50, to align with the middle line of EVSI and provide you with an easy visually perceptible output.

Learning:

Just like price has memory, volume has memory. Volume indicates the collective outcome of all market participants. A larger number of participants makes it easier to predict the volume trend in a probabilistic manner.

Hence Index Futures like

For Futures which trade almost 24x7, it's better to choose the high volume time periods i.e. when local Equity market is Open, rather than the overnight illiquid time periods.

版本注释

- Improved EVSI calculation

- Showcase latest example from 28-May-2021

- Show EVSI usage together with ESI indicator, for a stronger conviction for entering and exiting trades

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系ekambit。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

Kindly use the link below to obtain 7-days free access to this indicator, and get more information about its usage and configuration:

https://secure.ekambit.com/evsi/

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系ekambit。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

Kindly use the link below to obtain 7-days free access to this indicator, and get more information about its usage and configuration:

https://secure.ekambit.com/evsi/

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。