OPEN-SOURCE SCRIPT

已更新 NCI Trading Plan - By LightNCI

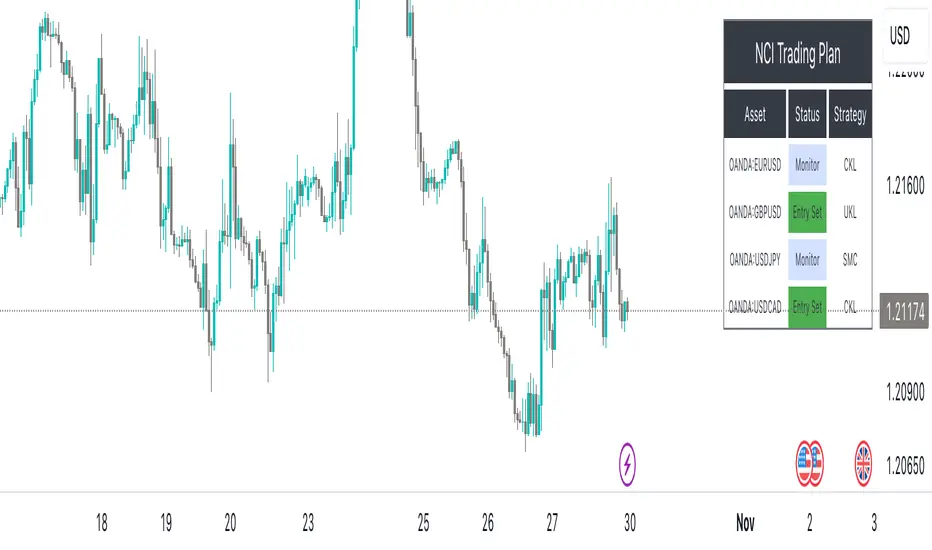

NCI Trading Plan - By LightNCI

NCI, which stands for New Concept Integration by Jayce PHAM, is a comprehensive approach that incorporates various critical aspects of trading to provide a logical, structured, and integrated approach to the financial markets. NCI covers market structure, key levels, smart money concepts, multiple timeframes and market cycles

About the NCI Trading Plan Indicator

The NCI Trading Plan is just a table allowing traders to keep track of multiple assets on a single chart, ensuring a comprehensive overview of trading statuses and strategies for each asset. The status is not automatically update. Using the NCI strategy, you may update it yourself the status of each asset.

Features

1. Display up to 10 different assets: Designed to support multi-asset trading strategies.

2. Dynamic Status Indication: Visualize the trading status for each asset:

i. Monitor: Asset is under review or surveillance.

ii. Confirmation: A potential trading signal or setup is being confirmed.

iii. Entry Set: An order for the asset has been placed.

iv. Forward-Test: An asset under monitored for it to being forward test.

3. Strategy Indication: Each asset can be tagged with a specific strategy identifier:

i. CKL: Confluence Key Level

ii. UKL: Un-Confluence Key Level

iii. SMC: Smart Money Concept

iv. BRT: Break & Re-Test

v. RTNKL: Re-Test of New Key Level

4. Customisable Display: Choose which assets you wish to display with a simple toggle on/off feature.

5. Stylisation: Color-code the statuses, table and fonts to suit your visual preference.

How to use

1. Toggle Display: Use the "Show Asset" checkboxes to determine which assets are visible.

2. Asset Name: Assign a name or symbol to each asset.

3. Status Selection: Choose the current trading status for each asset.

4. Strategy Selection: Assign a trading strategy to each asset.

5. Style: Customise the appearance of your trading plan by selecting preferred colours for different statuses and headers.

Conclusion

The NCI Trading Plan ensures a systematic and organised approach to multi-asset trading. By maintaining a visual overview of various assets and their corresponding trading statuses and strategies, traders can efficiently manage their portfolio and ensure timely decision-making.

Tip: To reset or modify an asset's status or strategy, simply adjust the settings in the panel on the left. The table will update in real-time.

NCI, which stands for New Concept Integration by Jayce PHAM, is a comprehensive approach that incorporates various critical aspects of trading to provide a logical, structured, and integrated approach to the financial markets. NCI covers market structure, key levels, smart money concepts, multiple timeframes and market cycles

About the NCI Trading Plan Indicator

The NCI Trading Plan is just a table allowing traders to keep track of multiple assets on a single chart, ensuring a comprehensive overview of trading statuses and strategies for each asset. The status is not automatically update. Using the NCI strategy, you may update it yourself the status of each asset.

Features

1. Display up to 10 different assets: Designed to support multi-asset trading strategies.

2. Dynamic Status Indication: Visualize the trading status for each asset:

i. Monitor: Asset is under review or surveillance.

ii. Confirmation: A potential trading signal or setup is being confirmed.

iii. Entry Set: An order for the asset has been placed.

iv. Forward-Test: An asset under monitored for it to being forward test.

3. Strategy Indication: Each asset can be tagged with a specific strategy identifier:

i. CKL: Confluence Key Level

ii. UKL: Un-Confluence Key Level

iii. SMC: Smart Money Concept

iv. BRT: Break & Re-Test

v. RTNKL: Re-Test of New Key Level

4. Customisable Display: Choose which assets you wish to display with a simple toggle on/off feature.

5. Stylisation: Color-code the statuses, table and fonts to suit your visual preference.

How to use

1. Toggle Display: Use the "Show Asset" checkboxes to determine which assets are visible.

2. Asset Name: Assign a name or symbol to each asset.

3. Status Selection: Choose the current trading status for each asset.

4. Strategy Selection: Assign a trading strategy to each asset.

5. Style: Customise the appearance of your trading plan by selecting preferred colours for different statuses and headers.

Conclusion

The NCI Trading Plan ensures a systematic and organised approach to multi-asset trading. By maintaining a visual overview of various assets and their corresponding trading statuses and strategies, traders can efficiently manage their portfolio and ensure timely decision-making.

Tip: To reset or modify an asset's status or strategy, simply adjust the settings in the panel on the left. The table will update in real-time.

版本注释

Update for Asset: Instead of manual typing, allow the user to open up the list of chart and select them.开源脚本

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

免责声明

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

开源脚本

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

免责声明

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.