PROTECTED SOURCE SCRIPT

已更新 Open Vsa

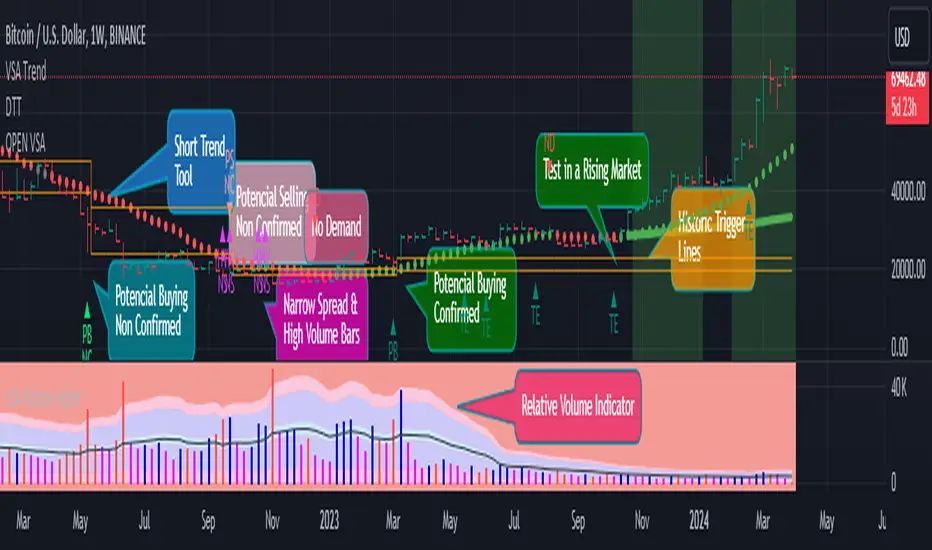

Vsa Trend is a tool that utilizes the principles of Volume Spread Analysis (VSA) to identify potential trading opportunities. This tool highlights several principles such as PB, PBNC, PS, PSNC, TE, ND, Short Trend Tool, Trigger Lines, and Multiple Alignment of Trends.

These principles assist in identifying potential buy and sell opportunities based on the relative volume of bullish and bearish bars in different trend scenarios. The Short Trend Tool is used to compare the trend and closing price to determine the color of the trend. Trigger Lines are key support and resistance levels based on PB, PBNC, PS, and PSNC bars.

The Multiple Alignment of Trends feature allows users to select between different modes such as NO, Scalping, Day Trading, and Position Trading to help identify multiple trends across various timeframes.

The Confirmation Beginning Alert feature provides users with confirmation alerts based on various filters such as ND/TE, ND/TE & Short Trend, and ND/TE & Short Trend & Trend Alignment. Using this tool in combination with an AVWAP tool can enhance its effectiveness in identifying potential trading opportunities.

-Vsa Trend is a tool that applies the principles of Volume Spread Analysis (VSA) to identify potential trading opportunities.

-The Short Trend Tool is used to compare the trend and closing price to determine the color of the trend.

-The Multiple Alignment of Trends feature enables users to choose between different modes such as NO, Scalping, Day Trading, and Position Trading to detect multiple trends across various timeframes.

-The Confirmation Beginning Alert feature provides users with confirmation alerts based on various filters such as ND/TE, ND/TE & Short Trend, and ND/TE & Short Trend & Trend Alignment.

1-PB (Potential buy confirmed. In bearish trend, a bearish bar of high relative volume with the following bullish bar)

2-PBNC (Potential buy not confirmed. In bearish trend, a bearish bar of high relative volume with the following bearish bar)

3-PS (Potential sell confirmed. In an uptrend, a bullish bar of high relative volume with the next bearish bar)

4-PSNC (Potential unconfirmed sell. In an uptrend, a bullish bar of high volume relative to the next bullish bar)

5-TE (Test confirmed. In an uptrend, a bearish bar with lower volume than the previous 2 bars, with the next bullish on average volume)

6-ND (No Confirmed Demand. In a downtrend, a bullish bar with lower volume than the previous 2 bars, with the next bearish on average volume)

7-Short Trend Tool (It is an SMA that compares its trend and the closing price to define its color

8-Trigger Lines (They are the maximum and minimum values of a PB, PBNC, PS, or PSNC bar) The idea is to look for a TEST confirmation on or NO DEMAND under that area. The above areas are also important support and resistance levels, which is why they are charted.

9-The PS/PSNC/PB/PBNC principles are always graphed as it helps us to keep in mind a possible setup in VSA. You can choose if you want to receive alerts when a principle is presented.

10. Multiple Alignment of Trends (Allows you to select between 3 modes. NO/Scalping/Day Trading and Position Trading) According to this, the "Short Trend Tool" is taken in several timeframes and when it has alignment in its trend color, it will change from color the corresponding background.

11. Confirmation Beginning Alert: Allows you to decide if you want to receive TEST or NO DEMAND Confirmation alerts under 3 filters

-ND/TE: Only the beginning is required with no short-term trend

-ND/TE & Short Trend: In addition to the principle, it takes into account the Color of the current short-term trend.

-ND/TE & Short Trend & Trend Alignment: In addition to the above, the color of the multiple alignment is taken into account to trigger an alert.

-It work better if you use in combination with a Daily VWAP tool

These principles assist in identifying potential buy and sell opportunities based on the relative volume of bullish and bearish bars in different trend scenarios. The Short Trend Tool is used to compare the trend and closing price to determine the color of the trend. Trigger Lines are key support and resistance levels based on PB, PBNC, PS, and PSNC bars.

The Multiple Alignment of Trends feature allows users to select between different modes such as NO, Scalping, Day Trading, and Position Trading to help identify multiple trends across various timeframes.

The Confirmation Beginning Alert feature provides users with confirmation alerts based on various filters such as ND/TE, ND/TE & Short Trend, and ND/TE & Short Trend & Trend Alignment. Using this tool in combination with an AVWAP tool can enhance its effectiveness in identifying potential trading opportunities.

-Vsa Trend is a tool that applies the principles of Volume Spread Analysis (VSA) to identify potential trading opportunities.

-The Short Trend Tool is used to compare the trend and closing price to determine the color of the trend.

-The Multiple Alignment of Trends feature enables users to choose between different modes such as NO, Scalping, Day Trading, and Position Trading to detect multiple trends across various timeframes.

-The Confirmation Beginning Alert feature provides users with confirmation alerts based on various filters such as ND/TE, ND/TE & Short Trend, and ND/TE & Short Trend & Trend Alignment.

1-PB (Potential buy confirmed. In bearish trend, a bearish bar of high relative volume with the following bullish bar)

2-PBNC (Potential buy not confirmed. In bearish trend, a bearish bar of high relative volume with the following bearish bar)

3-PS (Potential sell confirmed. In an uptrend, a bullish bar of high relative volume with the next bearish bar)

4-PSNC (Potential unconfirmed sell. In an uptrend, a bullish bar of high volume relative to the next bullish bar)

5-TE (Test confirmed. In an uptrend, a bearish bar with lower volume than the previous 2 bars, with the next bullish on average volume)

6-ND (No Confirmed Demand. In a downtrend, a bullish bar with lower volume than the previous 2 bars, with the next bearish on average volume)

7-Short Trend Tool (It is an SMA that compares its trend and the closing price to define its color

8-Trigger Lines (They are the maximum and minimum values of a PB, PBNC, PS, or PSNC bar) The idea is to look for a TEST confirmation on or NO DEMAND under that area. The above areas are also important support and resistance levels, which is why they are charted.

9-The PS/PSNC/PB/PBNC principles are always graphed as it helps us to keep in mind a possible setup in VSA. You can choose if you want to receive alerts when a principle is presented.

10. Multiple Alignment of Trends (Allows you to select between 3 modes. NO/Scalping/Day Trading and Position Trading) According to this, the "Short Trend Tool" is taken in several timeframes and when it has alignment in its trend color, it will change from color the corresponding background.

11. Confirmation Beginning Alert: Allows you to decide if you want to receive TEST or NO DEMAND Confirmation alerts under 3 filters

-ND/TE: Only the beginning is required with no short-term trend

-ND/TE & Short Trend: In addition to the principle, it takes into account the Color of the current short-term trend.

-ND/TE & Short Trend & Trend Alignment: In addition to the above, the color of the multiple alignment is taken into account to trigger an alert.

-It work better if you use in combination with a Daily VWAP tool

版本注释

Fix in the selection of the timeframe of the VWAP版本注释

New options have been added to discriminate trigger lines.版本注释

In this update, a trend alignment visualization tool has been created in several timeframes for 5 different instruments. Its focus is mainly towards day trading and scalping.版本注释

Minor changes版本注释

It is not possible to add more features without affecting the speed, so a new indicator is created for this purpose (TREND MASTER). In this update the response speed has been improved to a value of around 1 second.

版本注释

En el presente video, te cuento lo que pasó con el resto de indicadores.

版本注释

The code has been optimized to improve response speed版本注释

Minor changes. Trend Master tool is avaible.版本注释

Less is more. It was removed so funtionalities not related with VSA trading metodology.

Also was created a VSA Relative volume alternative

版本注释

Traders, don't be fooled!

Tired of paying exorbitant fees for indicators that don't deliver?

Enough of spending hundreds of dollars a year on tools that don't help you improve your trading.

**For almost a year, we've given you the opportunity to try VSA Trend for free.**

Many of you have experienced the benefits of this powerful indicator:**

-Effective and easy to use.

-Consistent results.

-Customizable to your trading style.

But now, it's time to take the next step.

However, we have a special offer for you:

20% discount on the annual purchase of VSA Trend.

Offer valid only until April 8th.

**Don't miss out on this opportunity to get a professional tool at an exceptional price.**

Visit tradingreactivo.com and start improving your trading today.

Why pay more?

On average, competitors sell you similar indicators for almost $1000 per year. (DYOR)

VSA Trend offers you the same quality and results for only $60 per year.

You won't regret it.

Don't pay more!

VSA Trend: The best value for money on the market.

**Visit tradingreactivo.com and start improving your trading today.**

版本注释

Visit tradingreactivo.com and start improving your trading today.版本注释

Attention! Your favorite product is now FREEYes, you read that right! Now you can enjoy all its benefits at no cost.

What has changed? We have found a way to further improve our product, making it slightly superior and consistent. We want the experience to be even more satisfying for you, which is why it is now free forever.

What are you waiting for? Sign up now and discover everything it has to offer:

And much more...

Don't miss this unique opportunity.

You will not regret it!

P.S. Share this news with your friends so they can also enjoy it for free.

Good luck!

版本注释

First, read thisthen decide by yourself

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3423101

https://www.mejorbrokerdebolsa.com/traders-perdedores-en-brokers/

https://www.youtube.com/watch?v=0M2sIpD9t4Q

https://www.mejorbrokerdebolsa.com/cual-es-el-porcentaje-de-traders-que-pierde/

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3018540

https://faculty.haas.berkeley.edu/odean/Papers%20current%20versions/Individual_Investor_Performance_Final.pdf

https://ceur-ws.org/Vol-3147/paper12.pdf

https://faculty.haas.berkeley.edu/odean/papers/day%20traders/Day%20Trading%20and%20Learning%20110217.pdf

https://www.nasaa.org/8219/state-securities-regulators-highlight-problems-with-day-trading/

https://www.mejorbrokerdebolsa.com/traders-perdedores-en-brokers/

https://www.forexfactory.com/thread/224370-95-losers-fact-or-fiction

http://www.econ.yale.edu/~shiller/behfin/2004-04-10/barber-lee-liu-odean.pdf

https://www.sciencedirect.com/science/article/abs/pii/S1386418113000190

版本注释

In this version, the option to check the alignment on multiple timeframes has been added. The background color will change depending on your timeframe.If you are scalping, your timeframe is possibly 5 minutes or less, and the corresponding alignment will be taken into account.

But if you are daytrading, your timeframe can be between 15 minutes to 1 hour, so other TFs are considered for the alignment.

In addition, a table has been added to see in real time the status of the trend in different individual TFs.

Always be careful, and remember this scientific paper:

Day Trading for a Living? by Fernando Chague

版本注释

minor changes版本注释

A new Trigger Lines option has been added, and it works very well.版本注释

Time Based AVWAP Tool was added . It can help you to see who is in control of the market.受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。