INVITE-ONLY SCRIPT

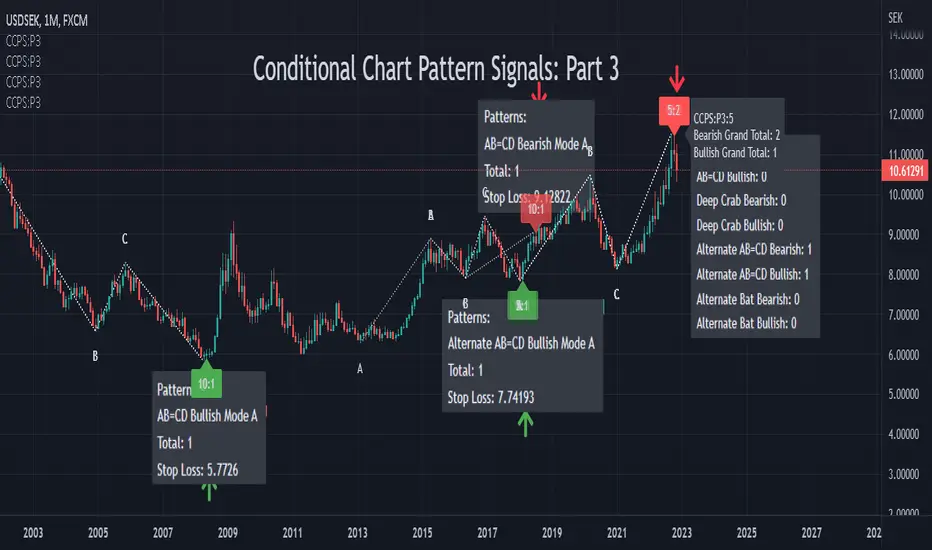

已更新 Conditional Chart Pattern Signals: Part 3

CCPS uses exclusive method to finalize pivot points and has more options to refine chart patterns.

Pattern List:

• AB=CD Bearish

• AB=CD Bullish

• Deep Crab Bearish

• Deep Crab Bullish

• Alternate AB=CD Bearish

• Alternate AB=CD Bullish

• Alternate Bat Bearish

• Alternate Bat Bullish

Label Tooltip: Show more information of the signal.

Volume: Random/Up/Down is determined by linear regression. Show pattern if volume trend is not required/up/down.

Percentile %: Intraday: 60 (active). Day and above: set at your preference. Range 0-100. A value of 0 means that no filter is applied and all patterns satisfy the condition. A value of 100 means that no pattern satisfies the condition.

Confirm Time: 1-3 candles.

Candle: Random/Bullish/Bearish.

Specification:

tinyurl.com/3aezxtan

Usage:

Enter at the open of the next bar after the signal or right when the signal appears (depending on your very own evaluation of the market at that time as sometimes price could reach targets within one bar). Adding caution, a little bit of experience will be needed to recognize if price actually reacts and follows the signals generated by CCPS.

Stop-loss suggested by the signal is generated as a quick analysis. In general, you need to place the stop-loss higher or have your own deeper analysis to have it. Take profit based on your preference of risk and/or other indicators of target/support/resistance.

Other Features:

• Non-repainting: show honest signals on the realtime bar, not on historical bars.

• Compact design.

• Support alerts.

Markets: All (Not designed and developed for a specific market). Test on: forex, index, commodity.

Timeframes: All (Not designed and developed for a specific timeframe). Test on: 30m, 1D, 1W, 1M.

Remark:

• Reversal patterns do not have magic. Indeed, they belong to counter-trend strategy and technical analysis of high-probability (potential) reversal zone. In case of more powerful fundamental factors, a trend could continue and break reversal patterns.

• We have tried to integrate multiple base periods in the indicator but the execution time limitation for one indicator does not allow us to do so. As a result, users need to manually add the indicator multiple times with different base periods in order to find more patterns. Some common base periods are 5, 10, 15 and 20. In the future, if the platform lifts the limitation, we will have a version in which the indicator would automatically scan different base periods for users.

• Because compiled script code limit is 65000, the indicator is separated into different parts. Each part contains different patterns and could be considered as an independent detector.

Pattern List:

• AB=CD Bearish

• AB=CD Bullish

• Deep Crab Bearish

• Deep Crab Bullish

• Alternate AB=CD Bearish

• Alternate AB=CD Bullish

• Alternate Bat Bearish

• Alternate Bat Bullish

Label Tooltip: Show more information of the signal.

Volume: Random/Up/Down is determined by linear regression. Show pattern if volume trend is not required/up/down.

Percentile %: Intraday: 60 (active). Day and above: set at your preference. Range 0-100. A value of 0 means that no filter is applied and all patterns satisfy the condition. A value of 100 means that no pattern satisfies the condition.

Confirm Time: 1-3 candles.

Candle: Random/Bullish/Bearish.

Specification:

tinyurl.com/3aezxtan

Usage:

Enter at the open of the next bar after the signal or right when the signal appears (depending on your very own evaluation of the market at that time as sometimes price could reach targets within one bar). Adding caution, a little bit of experience will be needed to recognize if price actually reacts and follows the signals generated by CCPS.

Stop-loss suggested by the signal is generated as a quick analysis. In general, you need to place the stop-loss higher or have your own deeper analysis to have it. Take profit based on your preference of risk and/or other indicators of target/support/resistance.

Other Features:

• Non-repainting: show honest signals on the realtime bar, not on historical bars.

• Compact design.

• Support alerts.

Markets: All (Not designed and developed for a specific market). Test on: forex, index, commodity.

Timeframes: All (Not designed and developed for a specific timeframe). Test on: 30m, 1D, 1W, 1M.

Remark:

• Reversal patterns do not have magic. Indeed, they belong to counter-trend strategy and technical analysis of high-probability (potential) reversal zone. In case of more powerful fundamental factors, a trend could continue and break reversal patterns.

• We have tried to integrate multiple base periods in the indicator but the execution time limitation for one indicator does not allow us to do so. As a result, users need to manually add the indicator multiple times with different base periods in order to find more patterns. Some common base periods are 5, 10, 15 and 20. In the future, if the platform lifts the limitation, we will have a version in which the indicator would automatically scan different base periods for users.

• Because compiled script code limit is 65000, the indicator is separated into different parts. Each part contains different patterns and could be considered as an independent detector.

版本注释

• AB=CD Bearish: From C to D, there should be no valley lower than C and no peak higher than D.• AB=CD Bullish: From C to D, there should be no peak higher than C and no valley lower than D.

版本注释

• Add Market Trend status (Bullish/Bearish/Sideways) and option for each pattern (Random/Bullish/Bearish).版本注释

• Add Power checkbox to restart the indicator when calculation timeout occurs. Users do not need to remove/readd the indicator.版本注释

• Update tags.版本注释

• Update tags.版本注释

Reduce runtime: from 12.3s / 23341 executions (US100 1h) to 10.1s / 23776 executions (US100 1h).仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系SupersafeTrader。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

Subscribe as a patron on any tier then message me your username and which indicator you want the access. I will confirm when the access is granted. If no indicator is specified, by default, all are unlocked.

Public Indicators: tinyurl.com/26emm5e2

Disclaimer: tinyurl.com/4rtrwhfd

Disclaimer: tinyurl.com/4rtrwhfd

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系SupersafeTrader。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

Subscribe as a patron on any tier then message me your username and which indicator you want the access. I will confirm when the access is granted. If no indicator is specified, by default, all are unlocked.

Public Indicators: tinyurl.com/26emm5e2

Disclaimer: tinyurl.com/4rtrwhfd

Disclaimer: tinyurl.com/4rtrwhfd

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。