PROTECTED SOURCE SCRIPT

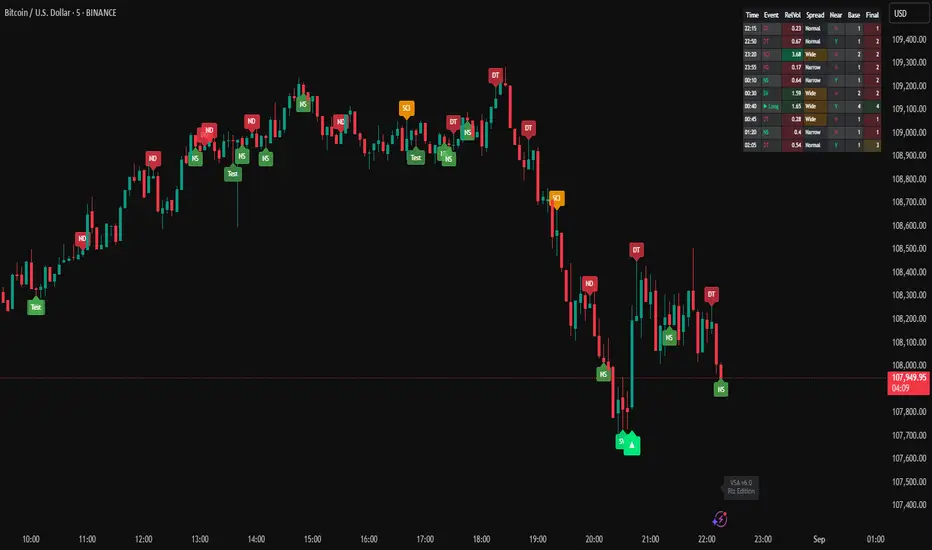

VSA Events + Signals (Riz Edition)

What it is

A Volume-Spread-Analysis toolkit that identifies classic VSA events, scores their quality with trend & location context, and prints entry signals (▲ Long / ▼ Short) only when price action confirms. Includes an on-chart event dashboard, rich alerts, HTF trend filter, VWAP/PDH/PDL location checks, and a chop/session filter. Works on any symbol/timeframe.

What it detects (labels)

Bullish / Strength

NS – No Supply (down bar, narrow spread, low relative volume)

Test – Test of supply (lower low, low volume, closes high)

SV – Stopping Volume (down, wide spread, high vol, higher close)

CA – Climactic Action (down, ultra/record vol, wide spread)

SO – Shakeout (down, ultra/record vol, long lower wick)

Bearish / Weakness

ND – No Demand (up bar, narrow spread, low relative volume)

DT – Distribution Test (higher high, low volume, closes low)

SCI – Supply Coming In (up, wide, high vol, lower close)

BC – Buying Climax (up, ultra/record vol, wide spread)

UT – Upthrust (up, ultra/record vol, long upper wick)

How signals are generated

Event → Candidate

When a bullish/bearish event occurs and filters pass (session, non-chop, recent strength/weakness, optional HTF agreement), the bar becomes a candidate (stored for confirmBars bars).

Scoring

Base score = sum of event weights (you control the weights).

Trend bonus = +w_Trend if trend agrees.

Location bonus = +w_Location if the candidate price is near VWAP or PDH/PDL (proxATR * ATR).

The candidate keeps this stored score.

Trigger (no repaint)

On confirmed bars only:

Long (▲) if price breaks above the candidate high or prints a strong up close;

Short (▼) if price breaks below the candidate low or prints a strong down close;

Candidate is invalidated if price breaches the opposite level first.

Final score = stored score + w_Confirm must be ≥ minScore.

Dashboard (panel)

Toggle Show Table to see the latest events/signals:

Time, Event, RelVol, Spread (Narrow/Wide/Normal), Near (VWAP/PDH/PDL), Base, Final.

Key inputs (organized in the script)

General: Version watermark, Debug.

Volume & Spread: Volume SMA length, relative-volume thresholds, ATR length, narrow/wide multipliers.

Trend/Context: Trend EMA length, optional HTF timeframe & confirmation.

Confirmation & Memory: confirmBars, memBars, minScore.

Weights: Bullish & Bearish event weights + w_Trend, w_Location, w_Confirm.

Location Filters: VWAP (hlc3), PDH/PDL, proxATR.

Session & Chop: Session time window, ATR/Range chop threshold.

Display: Toggle each event type, signals, table.

Alerts: One alert per event type + Bullish/ Bearish Entry alerts.

Tuning tips

Raise minScore to be stricter.

Increase w_Location and/or lower proxATR to favor entries at VWAP/PDH/PDL.

Use useHTFTrend for extra confirmation on higher timeframes.

Adjust confirmBars to control how long a setup can wait for a break.

Notes

Uses barstate.isconfirmed and no lookahead requests for triggers to avoid repainting.

Spot FX/CFDs use broker tick volume—treat relative-volume thresholds accordingly.

Educational tool, not financial advice. Test and size risk appropriately.

A Volume-Spread-Analysis toolkit that identifies classic VSA events, scores their quality with trend & location context, and prints entry signals (▲ Long / ▼ Short) only when price action confirms. Includes an on-chart event dashboard, rich alerts, HTF trend filter, VWAP/PDH/PDL location checks, and a chop/session filter. Works on any symbol/timeframe.

What it detects (labels)

Bullish / Strength

NS – No Supply (down bar, narrow spread, low relative volume)

Test – Test of supply (lower low, low volume, closes high)

SV – Stopping Volume (down, wide spread, high vol, higher close)

CA – Climactic Action (down, ultra/record vol, wide spread)

SO – Shakeout (down, ultra/record vol, long lower wick)

Bearish / Weakness

ND – No Demand (up bar, narrow spread, low relative volume)

DT – Distribution Test (higher high, low volume, closes low)

SCI – Supply Coming In (up, wide, high vol, lower close)

BC – Buying Climax (up, ultra/record vol, wide spread)

UT – Upthrust (up, ultra/record vol, long upper wick)

How signals are generated

Event → Candidate

When a bullish/bearish event occurs and filters pass (session, non-chop, recent strength/weakness, optional HTF agreement), the bar becomes a candidate (stored for confirmBars bars).

Scoring

Base score = sum of event weights (you control the weights).

Trend bonus = +w_Trend if trend agrees.

Location bonus = +w_Location if the candidate price is near VWAP or PDH/PDL (proxATR * ATR).

The candidate keeps this stored score.

Trigger (no repaint)

On confirmed bars only:

Long (▲) if price breaks above the candidate high or prints a strong up close;

Short (▼) if price breaks below the candidate low or prints a strong down close;

Candidate is invalidated if price breaches the opposite level first.

Final score = stored score + w_Confirm must be ≥ minScore.

Dashboard (panel)

Toggle Show Table to see the latest events/signals:

Time, Event, RelVol, Spread (Narrow/Wide/Normal), Near (VWAP/PDH/PDL), Base, Final.

Key inputs (organized in the script)

General: Version watermark, Debug.

Volume & Spread: Volume SMA length, relative-volume thresholds, ATR length, narrow/wide multipliers.

Trend/Context: Trend EMA length, optional HTF timeframe & confirmation.

Confirmation & Memory: confirmBars, memBars, minScore.

Weights: Bullish & Bearish event weights + w_Trend, w_Location, w_Confirm.

Location Filters: VWAP (hlc3), PDH/PDL, proxATR.

Session & Chop: Session time window, ATR/Range chop threshold.

Display: Toggle each event type, signals, table.

Alerts: One alert per event type + Bullish/ Bearish Entry alerts.

Tuning tips

Raise minScore to be stricter.

Increase w_Location and/or lower proxATR to favor entries at VWAP/PDH/PDL.

Use useHTFTrend for extra confirmation on higher timeframes.

Adjust confirmBars to control how long a setup can wait for a break.

Notes

Uses barstate.isconfirmed and no lookahead requests for triggers to avoid repainting.

Spot FX/CFDs use broker tick volume—treat relative-volume thresholds accordingly.

Educational tool, not financial advice. Test and size risk appropriately.

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用它,没有任何限制 — 在此处了解更多信息。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用它,没有任何限制 — 在此处了解更多信息。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。