PROTECTED SOURCE SCRIPT

Multi-Setup [by gr33njj]

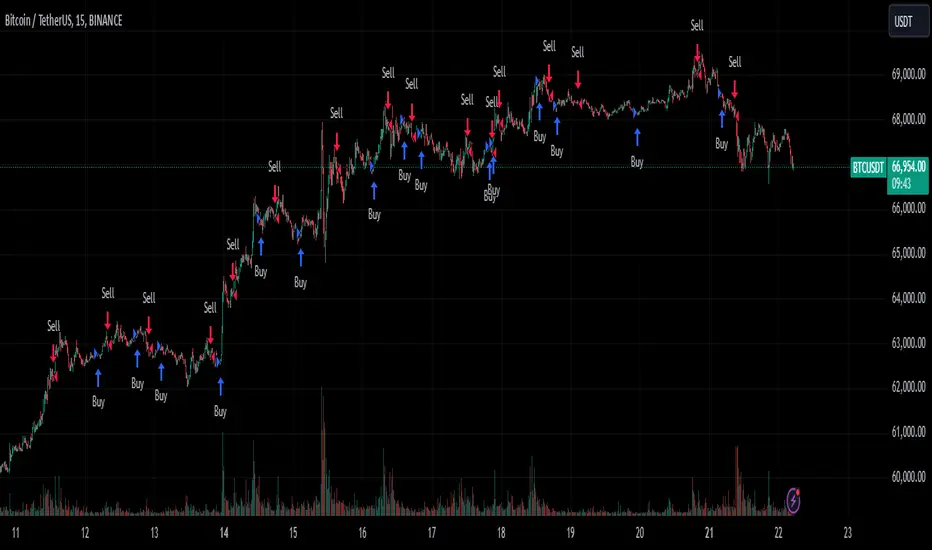

Multi-Setup (Wyckoff + Quasimodo + Intraday Structure + False Distribution + Liquidity Hunt)

Telegram StockyTiger

Telegram DM

X (twitter)

Documentation for the Trading System:

Name: Algorithmic Trading System Based on Wyckoff, Quasimodo, Intraday Structure, False Distribution, and Liquidity Hunt Setups

System Logic

The trading system uses an indicator based on a combination of several well-known strategies to generate buy and sell signals. The system works by recognizing key setups in price, volume, and market patterns.

Key Setups

Wyckoff Setups

Main phases of accumulation and distribution in the market. The following key elements are identified:

Entry Conditions:

Buy entry: occurs when the Spring setup is identified, along with volume confirmation (low volumes before the setup) and price rise (breaking previous highs).

Sell entry: occurs when the Upthrust setup is identified with volume confirmation and price decline.

Quasimodo

The Quasimodo strategy involves forming a specific price structure with repeating resistance and support levels.

Entry Conditions:

Buy entry: a "Quasimodo Buy" setup forms when there is a bounce from a formed low with volume confirmation and candlestick patterns (bullish engulfing or pin bar).

Sell entry: a "Quasimodo Sell" setup forms when there is a bounce from a formed high with volume confirmation and a bearish candlestick pattern.

Intraday Structure

Local support and resistance within the day are assessed.

Entry Conditions:

Buy entry: occurs when a local high is broken with volume confirmation.

Sell entry: occurs when a local low is broken with a confirming volume signal.

False Distribution

This setup involves false breakouts of resistance or support levels.

Entry Conditions:

Sell entry: occurs after a false breakout of a resistance level with confirmation from a bearish candlestick pattern.

Buy entry: occurs after a false breakout of a support level with confirmation from a bullish pattern.

Liquidity Hunt

The setup focuses on breaking key support and resistance levels where other traders' stop losses are placed.

Entry Conditions:

Buy entry: occurs if the price breaks a resistance level, confirmed by volume and a bullish engulfing or pin bar pattern.

Sell entry: occurs if the price breaks a support level with volume confirmation and a bearish pattern.

Conditions for Trade Entry

The system checks the fulfillment of conditions for both buy and sell setups. Once the entry conditions are met, the system opens a trade in the respective direction. Signals are further filtered based on volume and the presence of confirming candlestick patterns (e.g., engulfing or pin bar).

Trade Exit Logic

Trades can be closed based on one of the following conditions:

System Features:

The system integrates multiple setups to increase the likelihood of successful trades.

Volume and market structure analysis help minimize false signals.

It is designed to operate across various timeframes, considering both intraday and long-term structure.

Thus, the trading system is focused on identifying significant market patterns and confirming them with volume, increasing the probability of successful trading operations.

Telegram StockyTiger

Telegram DM

X (twitter)

Documentation for the Trading System:

Name: Algorithmic Trading System Based on Wyckoff, Quasimodo, Intraday Structure, False Distribution, and Liquidity Hunt Setups

System Logic

The trading system uses an indicator based on a combination of several well-known strategies to generate buy and sell signals. The system works by recognizing key setups in price, volume, and market patterns.

Key Setups

Wyckoff Setups

Main phases of accumulation and distribution in the market. The following key elements are identified:

- Preliminary Support (PS) and Preliminary Supply (PSY)

- Selling Climax (SC) and Buying Climax (BC)

- Automatic Rally (AR) and Automatic Reaction (AR)

- Secondary Test (ST)

- Spring and Upthrust

- Sign of Strength (SOS) and Sign of Weakness (SOW)

Entry Conditions:

Buy entry: occurs when the Spring setup is identified, along with volume confirmation (low volumes before the setup) and price rise (breaking previous highs).

Sell entry: occurs when the Upthrust setup is identified with volume confirmation and price decline.

Quasimodo

The Quasimodo strategy involves forming a specific price structure with repeating resistance and support levels.

Entry Conditions:

Buy entry: a "Quasimodo Buy" setup forms when there is a bounce from a formed low with volume confirmation and candlestick patterns (bullish engulfing or pin bar).

Sell entry: a "Quasimodo Sell" setup forms when there is a bounce from a formed high with volume confirmation and a bearish candlestick pattern.

Intraday Structure

Local support and resistance within the day are assessed.

Entry Conditions:

Buy entry: occurs when a local high is broken with volume confirmation.

Sell entry: occurs when a local low is broken with a confirming volume signal.

False Distribution

This setup involves false breakouts of resistance or support levels.

Entry Conditions:

Sell entry: occurs after a false breakout of a resistance level with confirmation from a bearish candlestick pattern.

Buy entry: occurs after a false breakout of a support level with confirmation from a bullish pattern.

Liquidity Hunt

The setup focuses on breaking key support and resistance levels where other traders' stop losses are placed.

Entry Conditions:

Buy entry: occurs if the price breaks a resistance level, confirmed by volume and a bullish engulfing or pin bar pattern.

Sell entry: occurs if the price breaks a support level with volume confirmation and a bearish pattern.

Conditions for Trade Entry

The system checks the fulfillment of conditions for both buy and sell setups. Once the entry conditions are met, the system opens a trade in the respective direction. Signals are further filtered based on volume and the presence of confirming candlestick patterns (e.g., engulfing or pin bar).

Trade Exit Logic

Trades can be closed based on one of the following conditions:

- Target profit is reached (take profit).

- Stop-loss level is hit.

- Opposite signal — if the system detects an opposite buy or sell signal.

System Features:

The system integrates multiple setups to increase the likelihood of successful trades.

Volume and market structure analysis help minimize false signals.

It is designed to operate across various timeframes, considering both intraday and long-term structure.

Thus, the trading system is focused on identifying significant market patterns and confirming them with volume, increasing the probability of successful trading operations.

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用它,没有任何限制 — 在此处了解更多信息。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用它,没有任何限制 — 在此处了解更多信息。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。