OPEN-SOURCE SCRIPT

已更新 Volume Cluster Heatmap [BackQuant]

Volume Cluster Heatmap [BackQuant]

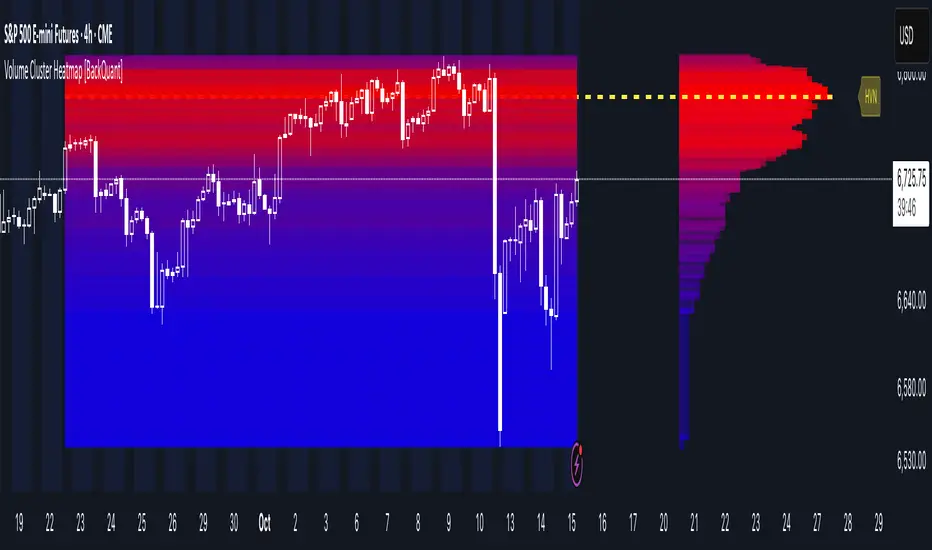

A visualization tool that maps traded volume across price levels over a chosen lookback period. It highlights where the market builds balance through heavy participation and where it moves efficiently through low-volume zones. By combining a heatmap, volume profile, and high/low volume node detection, this indicator reveals structural areas of support, resistance, and liquidity that drive price behavior.

What Are Volume Clusters?

A volume cluster is a horizontal aggregation of traded volume at specific price levels, showing where market participants concentrated their buying and selling.

High Volume Nodes (HVN): Price levels with significant trading activity; often act as support or resistance.

Low Volume Nodes (LVN): Price levels with little trading activity; price moves quickly through these areas, reflecting low liquidity.

Volume clusters help identify key structural zones, reveal potential reversals, and gauge market efficiency by highlighting where the market is balanced versus areas of thin liquidity.

By creating heatmaps, profiles, and highlighting high and low volume nodes (HVNs and LVNs), it allows traders to see where the market builds balance and where it moves efficiently through thin liquidity zones.

Example: Bitcoin breaking away from the high-volume zone near 118k and moving cleanly through the low-volume pocket around 113k–115k, illustrating how markets seek efficiency:

Core Features

Visual Analysis Components:

Alerts

How It Works

Each bar’s volume is distributed proportionally across the horizontal price levels it touches. Over the lookback period, this builds a cumulative volume profile, identifying price levels with the most and least trading activity. The highest cumulative volume levels become HVNs, while the lowest are LVNs. A side volume profile shows aggregated volume per level, and a heatmap overlay visually reinforces market structure.

Applications for Traders

Advanced Display Options

Best Practices for Usage

Technical Notes

This indicator is ideal for understanding market structure, detecting key liquidity areas, and filtering out noise to model price more accurately in high-frequency or algorithmic strategies.

A visualization tool that maps traded volume across price levels over a chosen lookback period. It highlights where the market builds balance through heavy participation and where it moves efficiently through low-volume zones. By combining a heatmap, volume profile, and high/low volume node detection, this indicator reveals structural areas of support, resistance, and liquidity that drive price behavior.

What Are Volume Clusters?

A volume cluster is a horizontal aggregation of traded volume at specific price levels, showing where market participants concentrated their buying and selling.

High Volume Nodes (HVN): Price levels with significant trading activity; often act as support or resistance.

Low Volume Nodes (LVN): Price levels with little trading activity; price moves quickly through these areas, reflecting low liquidity.

Volume clusters help identify key structural zones, reveal potential reversals, and gauge market efficiency by highlighting where the market is balanced versus areas of thin liquidity.

By creating heatmaps, profiles, and highlighting high and low volume nodes (HVNs and LVNs), it allows traders to see where the market builds balance and where it moves efficiently through thin liquidity zones.

Example: Bitcoin breaking away from the high-volume zone near 118k and moving cleanly through the low-volume pocket around 113k–115k, illustrating how markets seek efficiency:

Core Features

Visual Analysis Components:

- Heatmap Display: Displays volume intensity as colored boxes, lines, or a combination for a dynamic view of market participation.

- Volume Profile Overlay: Shows cumulative volume per price level along the right-hand side of the chart.

- HVN & LVN Labels: Marks high and low volume nodes with color-coded lines and labels.

- Customizable Colors & Transparency: Adjust high and low volume colors and minimum transparency for clear differentiation.

- Session Reset & Timeframe Control: Dynamically resets clusters at the start of new sessions or chosen timeframes (intraday, daily, weekly).

Alerts

- HVN / LVN Alerts: Notify when price reaches a significant high or low volume node.

- High Volume Zone Alerts: Trigger when price enters the top X% of cumulative volume, signaling key areas of market interest.

How It Works

Each bar’s volume is distributed proportionally across the horizontal price levels it touches. Over the lookback period, this builds a cumulative volume profile, identifying price levels with the most and least trading activity. The highest cumulative volume levels become HVNs, while the lowest are LVNs. A side volume profile shows aggregated volume per level, and a heatmap overlay visually reinforces market structure.

Applications for Traders

- Identify strong support and resistance at HVNs.

- Detect areas of low liquidity where price may move quickly (LVNs).

- Determine market balance zones where price may consolidate.

- Filter noise: because volume clusters aggregate activity into levels, minor fluctuations and irrelevant micro-moves are removed, simplifying analysis and improving strategy development.

- Combine with other indicators such as VWAP, Supertrend, or CVD for higher-probability entries and exits.

- Use volume clusters to anticipate price reactions to breaking points in thin liquidity zones.

Advanced Display Options

- Heatmap Styles: Boxes, lines, or both. Boxes provide a traditional heatmap, lines are better for high granularity data.

- Line Mode Example: Simplified line visualization for easier reading at high level counts:

- Profile Width & Offset: Adjust spacing and placement of the volume profile for clarity alongside price.

- Transparency Control: Lower transparency for more opaque visualization of high-volume zones.

Best Practices for Usage

- Reduce the number of levels when using line mode to avoid clutter.

- Use HVN and LVN markers in conjunction with volume profiles to plan entries and exits.

- Apply session resets to monitor intraday vs. multi-day volume accumulation.

- Combine with other technical indicators to confirm high-probability trading signals.

- Watch price interactions with LVNs for potential rapid movements and with HVNs for possible support/resistance or reversals.

Technical Notes

- Each bar contributes volume proportionally to the price levels it spans, creating a dynamic and accurate representation of traded interest.

- Volume profiles are scaled and offset for visual clarity alongside live price.

- Alerts are fully integrated for HVN/LVN interaction and high-volume zone entries.

- Optimized to handle large lookback windows and numerous price levels efficiently without performance degradation.

This indicator is ideal for understanding market structure, detecting key liquidity areas, and filtering out noise to model price more accurately in high-frequency or algorithmic strategies.

版本注释

Added heatmap transparency user input.开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

Check out whop.com/signals-suite for Access to Invite Only Scripts!

Or go to backquant.com/

Or go to backquant.com/

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

Check out whop.com/signals-suite for Access to Invite Only Scripts!

Or go to backquant.com/

Or go to backquant.com/

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。