OPEN-SOURCE SCRIPT

byquan GP - SRSI Channel

🔍 What Is It?

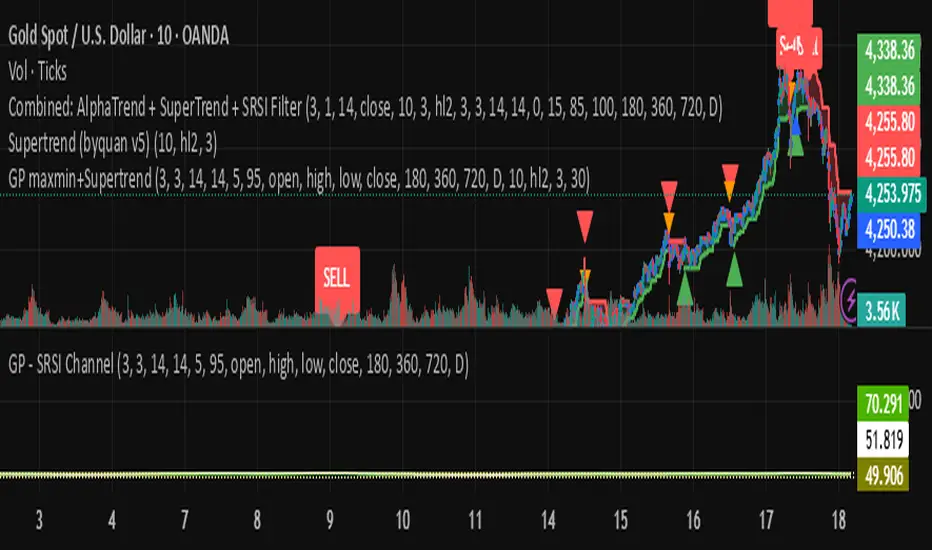

The GP – SRSI Channel is a momentum-based oscillator that measures the relative strength of price movements across multiple timeframes using the Stochastic RSI (SRSI) method.

Instead of using a single RSI line, this indicator analyzes four price inputs and four timeframes to create a dynamic channel that reflects the true market momentum — helping traders identify overbought and oversold zones with higher accuracy.

⚙️ How It Works

The indicator combines multiple layers of analysis to produce a smooth and reliable momentum channel.

1. Multi-Source RSI Calculation

It computes RSI and Stochastic RSI values for four different price sources:

Open

High

Low

Close

Each source generates its own SRSI value:

dsopen, dshigh, dslow, and dsclose

From these, it extracts:

starraymin: the lowest (most oversold) SRSI value

starraymax: the highest (most overbought) SRSI value

This forms a momentum range based on all price inputs.

2. Multi-Timeframe (MTF) Integration

To strengthen signal reliability, it repeats this SRSI analysis across four higher timeframes (configurable by user):

Parameter Default Value Meaning

Time 1 180 minutes 3-hour chart

Time 2 360 minutes 6-hour chart

Time 3 720 minutes 12-hour chart

Time 4 1D Daily chart

Each timeframe produces its own set of minimum, maximum, and close SRSI values.

These are then combined and normalized to a 0–100 scale.

3. Normalization and Channel Plot

The combined results create three main lines:

Min Line (Green–Red gradient) → represents oversold strength

Max Line (Green–Red gradient) → represents overbought strength

Close Line (White) → represents average SRSI value

The area between the Min and Max lines is filled with a color gradient to form the SRSI Channel, visually showing momentum strength and range.

4. Signal & Alerts

Two alert levels are defined:

Alert Min Level → Default = 5 (oversold)

Alert Max Level → Default = 95 (overbought)

When:

oranmin ≤ Alert Min Level → Market is in an oversold state (potential reversal up).

oranmax ≥ Alert Max Level → Market is in an overbought state (potential reversal down).

When either of these thresholds is crossed, the indicator triggers:

A white square marker on the chart.

A custom alert with the message:

“SRSI Channel reached alert threshold (oranmax ≥ MaxLevel or oranmin ≤ MinLevel)”

🧭 How to Use It

🪄 Step 1 — Add to Chart

Copy the code into a new Pine Script in TradingView.

Click Add to chart.

You’ll see three lines and a colored channel between them.

⚙️ Step 2 — Adjust Inputs

Core SRSI Settings

Setting Description

K, D Smoothing factors for Stochastic RSI.

RSI Length Number of bars for RSI calculation.

S Length Period used for %K in Stochastic RSI.

Alert Min/Max Level Defines oversold/overbought zones.

Multi-Timeframe Settings

Change Time 1 to Time 4 to suit your trading style:

Shorter timeframes → faster but more noise.

Longer timeframes → smoother, more reliable momentum.

📈 Step 3 — Interpret the Chart

Indicator Element Meaning

🟩 Lower Boundary (Min) Lowest SRSI reading → momentum weakness / possible rebound area

🟥 Upper Boundary (Max) Highest SRSI reading → strong momentum / possible exhaustion

⚪ Middle Line (Close) Average of all SRSI readings → overall momentum strength

🌈 Channel Fill Visualizes balance between overbought and oversold levels

When the channel widens → market volatility and strength increase.

When it narrows → consolidation or low-momentum phase.

🔔 Step 4 — Alerts

You can create alerts using:

Condition: SRSI Extreme

Message: SRSI Channel reached alert threshold

Use this to receive notifications when the market hits extreme momentum levels (great for reversal traders).

💡 Trading Tips

✅ Combine with Supertrend, MACD, or Moving Averages for confirmation.

✅ Look for SRSI extremes aligning with price support/resistance for stronger reversal entries.

✅ Use different timeframe combinations (e.g., 1H–4H–12H–1D) depending on your trading style.

✅ Treat it as a momentum filter — not a direct buy/sell signal tool.

⚖️ Summary

The GP – SRSI Channel is a sophisticated multi-timeframe momentum indicator that helps traders visualize market strength and identify overbought or oversold conditions with exceptional clarity.

Features:

4 price sources × 4 timeframes = deep momentum insight

Dynamic, color-coded SRSI channel

Built-in alert system for extreme conditions

Clean and intuitive visual design

Best suited for:

Swing and position traders

Traders who use RSI/Stoch indicators

Those seeking to confirm entries with multi-timeframe momentum data

🎯 Understand the market’s true momentum — before it moves.

The GP – SRSI Channel is a momentum-based oscillator that measures the relative strength of price movements across multiple timeframes using the Stochastic RSI (SRSI) method.

Instead of using a single RSI line, this indicator analyzes four price inputs and four timeframes to create a dynamic channel that reflects the true market momentum — helping traders identify overbought and oversold zones with higher accuracy.

⚙️ How It Works

The indicator combines multiple layers of analysis to produce a smooth and reliable momentum channel.

1. Multi-Source RSI Calculation

It computes RSI and Stochastic RSI values for four different price sources:

Open

High

Low

Close

Each source generates its own SRSI value:

dsopen, dshigh, dslow, and dsclose

From these, it extracts:

starraymin: the lowest (most oversold) SRSI value

starraymax: the highest (most overbought) SRSI value

This forms a momentum range based on all price inputs.

2. Multi-Timeframe (MTF) Integration

To strengthen signal reliability, it repeats this SRSI analysis across four higher timeframes (configurable by user):

Parameter Default Value Meaning

Time 1 180 minutes 3-hour chart

Time 2 360 minutes 6-hour chart

Time 3 720 minutes 12-hour chart

Time 4 1D Daily chart

Each timeframe produces its own set of minimum, maximum, and close SRSI values.

These are then combined and normalized to a 0–100 scale.

3. Normalization and Channel Plot

The combined results create three main lines:

Min Line (Green–Red gradient) → represents oversold strength

Max Line (Green–Red gradient) → represents overbought strength

Close Line (White) → represents average SRSI value

The area between the Min and Max lines is filled with a color gradient to form the SRSI Channel, visually showing momentum strength and range.

4. Signal & Alerts

Two alert levels are defined:

Alert Min Level → Default = 5 (oversold)

Alert Max Level → Default = 95 (overbought)

When:

oranmin ≤ Alert Min Level → Market is in an oversold state (potential reversal up).

oranmax ≥ Alert Max Level → Market is in an overbought state (potential reversal down).

When either of these thresholds is crossed, the indicator triggers:

A white square marker on the chart.

A custom alert with the message:

“SRSI Channel reached alert threshold (oranmax ≥ MaxLevel or oranmin ≤ MinLevel)”

🧭 How to Use It

🪄 Step 1 — Add to Chart

Copy the code into a new Pine Script in TradingView.

Click Add to chart.

You’ll see three lines and a colored channel between them.

⚙️ Step 2 — Adjust Inputs

Core SRSI Settings

Setting Description

K, D Smoothing factors for Stochastic RSI.

RSI Length Number of bars for RSI calculation.

S Length Period used for %K in Stochastic RSI.

Alert Min/Max Level Defines oversold/overbought zones.

Multi-Timeframe Settings

Change Time 1 to Time 4 to suit your trading style:

Shorter timeframes → faster but more noise.

Longer timeframes → smoother, more reliable momentum.

📈 Step 3 — Interpret the Chart

Indicator Element Meaning

🟩 Lower Boundary (Min) Lowest SRSI reading → momentum weakness / possible rebound area

🟥 Upper Boundary (Max) Highest SRSI reading → strong momentum / possible exhaustion

⚪ Middle Line (Close) Average of all SRSI readings → overall momentum strength

🌈 Channel Fill Visualizes balance between overbought and oversold levels

When the channel widens → market volatility and strength increase.

When it narrows → consolidation or low-momentum phase.

🔔 Step 4 — Alerts

You can create alerts using:

Condition: SRSI Extreme

Message: SRSI Channel reached alert threshold

Use this to receive notifications when the market hits extreme momentum levels (great for reversal traders).

💡 Trading Tips

✅ Combine with Supertrend, MACD, or Moving Averages for confirmation.

✅ Look for SRSI extremes aligning with price support/resistance for stronger reversal entries.

✅ Use different timeframe combinations (e.g., 1H–4H–12H–1D) depending on your trading style.

✅ Treat it as a momentum filter — not a direct buy/sell signal tool.

⚖️ Summary

The GP – SRSI Channel is a sophisticated multi-timeframe momentum indicator that helps traders visualize market strength and identify overbought or oversold conditions with exceptional clarity.

Features:

4 price sources × 4 timeframes = deep momentum insight

Dynamic, color-coded SRSI channel

Built-in alert system for extreme conditions

Clean and intuitive visual design

Best suited for:

Swing and position traders

Traders who use RSI/Stoch indicators

Those seeking to confirm entries with multi-timeframe momentum data

🎯 Understand the market’s true momentum — before it moves.

开源脚本

本着TradingView的真正精神,此脚本的创建者将其开源,以便交易者可以查看和验证其功能。向作者致敬!虽然您可以免费使用它,但请记住,重新发布代码必须遵守我们的网站规则。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

开源脚本

本着TradingView的真正精神,此脚本的创建者将其开源,以便交易者可以查看和验证其功能。向作者致敬!虽然您可以免费使用它,但请记住,重新发布代码必须遵守我们的网站规则。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。