OPEN-SOURCE SCRIPT

已更新 Sweep + MSS

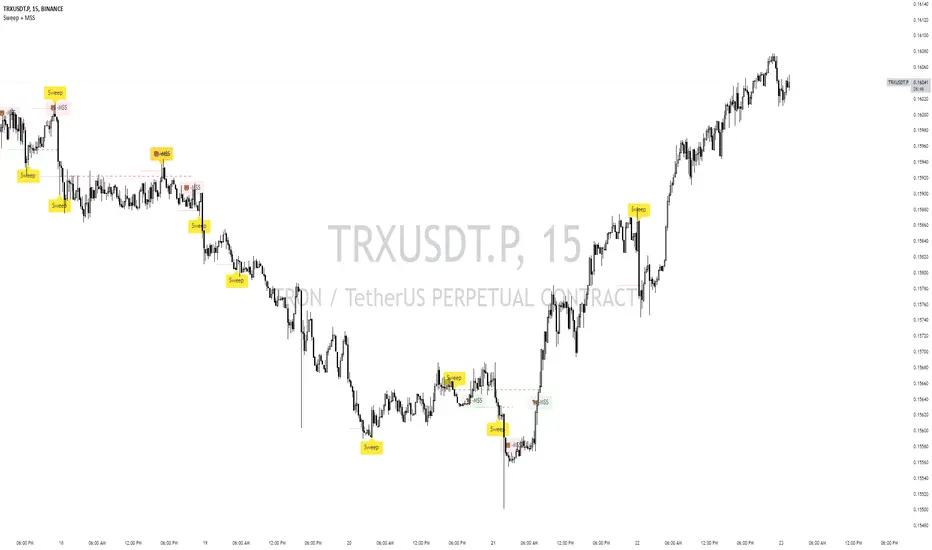

# Sweep + MSS Indicator

This indicator identifies market sweeps and Market Structure Shifts (MSS) to help traders recognize potential trend changes and market manipulations.

How it works:

1. Sweep Detection:

- Identifies when price briefly moves beyond a recent high/low (pivot point) and then reverses.

- Bullish sweep: Price drops below a recent low, then closes above it.

- Bearish sweep: Price rises above a recent high, then closes below it.

2. Market Structure Shift (MSS):

- Occurs when price action invalidates a previous sweep level.

- Bullish MSS: Price closes above a bearish sweep level.

- Bearish MSS: Price closes below a bullish sweep level.

Key Features:

- Customizable pivot lookback length for sweep detection

- Minimum bar requirement after a sweep before MSS can trigger

- One MSS per sweep level to avoid multiple signals

- Visual representation with lines connecting sweep points to MSS triggers

- Emoji labels for easy identification (🐂-MSS for bullish, 🐻-MSS for bearish)

Logic Behind MSS:

The MSS aims to identify potential trend changes by recognizing when the market invalidates a previous sweep level. This often indicates a shift in market structure, suggesting that the previous trend may be weakening or reversing.

- A bullish MSS occurs when the price closes above a bearish sweep level, potentially signaling a shift from bearish to bullish sentiment.

- A bearish MSS occurs when the price closes below a bullish sweep level, potentially signaling a shift from bullish to bearish sentiment.

By requiring a minimum number of bars between the sweep and the MSS, the indicator helps filter out noise and focuses on more significant structural changes in the market.

This indicator can be a valuable tool for traders looking to identify potential trend changes and entry/exit points based on market structure analysis.

This indicator identifies market sweeps and Market Structure Shifts (MSS) to help traders recognize potential trend changes and market manipulations.

How it works:

1. Sweep Detection:

- Identifies when price briefly moves beyond a recent high/low (pivot point) and then reverses.

- Bullish sweep: Price drops below a recent low, then closes above it.

- Bearish sweep: Price rises above a recent high, then closes below it.

2. Market Structure Shift (MSS):

- Occurs when price action invalidates a previous sweep level.

- Bullish MSS: Price closes above a bearish sweep level.

- Bearish MSS: Price closes below a bullish sweep level.

Key Features:

- Customizable pivot lookback length for sweep detection

- Minimum bar requirement after a sweep before MSS can trigger

- One MSS per sweep level to avoid multiple signals

- Visual representation with lines connecting sweep points to MSS triggers

- Emoji labels for easy identification (🐂-MSS for bullish, 🐻-MSS for bearish)

Logic Behind MSS:

The MSS aims to identify potential trend changes by recognizing when the market invalidates a previous sweep level. This often indicates a shift in market structure, suggesting that the previous trend may be weakening or reversing.

- A bullish MSS occurs when the price closes above a bearish sweep level, potentially signaling a shift from bearish to bullish sentiment.

- A bearish MSS occurs when the price closes below a bullish sweep level, potentially signaling a shift from bullish to bearish sentiment.

By requiring a minimum number of bars between the sweep and the MSS, the indicator helps filter out noise and focuses on more significant structural changes in the market.

This indicator can be a valuable tool for traders looking to identify potential trend changes and entry/exit points based on market structure analysis.

版本注释

- Added New Filters- Upgraded Pine Version

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。