OPEN-SOURCE SCRIPT

LSVR - Liquidity Sweep & Volume Reversal

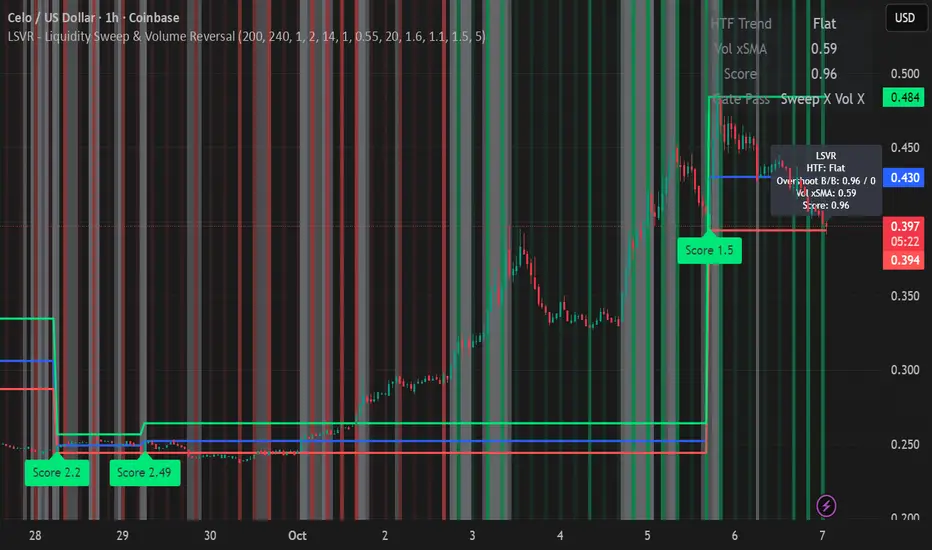

LSVR condenses a pro workflow into one visual overlay: Higher-Timeframe (HTF) Trend → Liquidity Sweep & Reclaim → Volume Confirmation. A signal only prints when all three gates align at bar close, and the chart shows everything you need—trend context, the sweep “trap” candle, and a projected Entry/SL/TP based on your chosen R multiple.

How it works

HTF Trend Filter: Projects a smoothed KAMA/EMA from a higher timeframe to the chart using a safe, lookahead-off request. Long signals are considered only above the HTF line; shorts only below.

Liquidity Sweep & Reclaim: Finds confirmed swing highs/lows, then detects an ATR-scaled overshoot through that swing followed by a reclaim (close back inside a configurable % of the bar range).

Volume Confirmation: Requires either a volume spike over Volume SMA × multiplier or optional OBV divergence. No participation = no signal.

Score: Each setup is scored: trend (0/1) + overshoot strength (0..1.5) + conviction (0/1). Signals fire only when the score ≥ Min Signal Score.

What you see

HTF Ribbon (subtle green/red backdrop) for bias.

Sweep Box on the signal candle (green = long, red = short).

Signal markers (“L” / “S”) with a small score label.

Projected lines that persist until the next signal: Entry (close), Stop (beyond swept swing), Target (R multiple).

Heatmap that intensifies when the score crosses your threshold.

Dashboard (top-right): HTF direction, Volume×SMA, current Score, gate pass status.

Tooltip on the last bar with quick stats.

Quick start

Apply to any liquid symbol and set HTF to ~3–6× your chart timeframe (e.g., 15m chart → 1H–4H).

Trade with the HTF trend: take L signals above the HTF line and S signals below it.

Entry = signal bar close, SL = beyond the swept swing, TP = your Projected Take-Profit (R).

Tighten or loosen selectivity with Min Signal Score, Reclaim %, Overshoot (ATR×), and Cooldown.

Recommended presets

Choppy/crypto 15m: minScore 1.25, reclaimPct 0.60–0.65, overshootATR 1.0–1.2, useOBVDiv=false, cooldown 8.

FX 5m / session trend: minScore 1.0–1.1, reclaimPct 0.50–0.55, overshootATR 0.8–1.0, useOBVDiv=true, cooldown 5.

Indices 1m (RTH): minScore 1.2, reclaimPct 0.55–0.60, useOBVDiv=false, cooldown 10.

Non-repainting by design

HTF values use lookahead_off with realtime offset.

Swings are confirmed pivots (no “forming” pivots).

Signals print at bar close only.

Notes

OBV divergence can add sensitivity on liquid markets; keep it off for stricter filtering.

Use Cooldown to avoid clustered sweeps.

This is an overlay/analysis tool, not financial advice. Test settings in Replay/Paper Trading before using live.

How it works

HTF Trend Filter: Projects a smoothed KAMA/EMA from a higher timeframe to the chart using a safe, lookahead-off request. Long signals are considered only above the HTF line; shorts only below.

Liquidity Sweep & Reclaim: Finds confirmed swing highs/lows, then detects an ATR-scaled overshoot through that swing followed by a reclaim (close back inside a configurable % of the bar range).

Volume Confirmation: Requires either a volume spike over Volume SMA × multiplier or optional OBV divergence. No participation = no signal.

Score: Each setup is scored: trend (0/1) + overshoot strength (0..1.5) + conviction (0/1). Signals fire only when the score ≥ Min Signal Score.

What you see

HTF Ribbon (subtle green/red backdrop) for bias.

Sweep Box on the signal candle (green = long, red = short).

Signal markers (“L” / “S”) with a small score label.

Projected lines that persist until the next signal: Entry (close), Stop (beyond swept swing), Target (R multiple).

Heatmap that intensifies when the score crosses your threshold.

Dashboard (top-right): HTF direction, Volume×SMA, current Score, gate pass status.

Tooltip on the last bar with quick stats.

Quick start

Apply to any liquid symbol and set HTF to ~3–6× your chart timeframe (e.g., 15m chart → 1H–4H).

Trade with the HTF trend: take L signals above the HTF line and S signals below it.

Entry = signal bar close, SL = beyond the swept swing, TP = your Projected Take-Profit (R).

Tighten or loosen selectivity with Min Signal Score, Reclaim %, Overshoot (ATR×), and Cooldown.

Recommended presets

Choppy/crypto 15m: minScore 1.25, reclaimPct 0.60–0.65, overshootATR 1.0–1.2, useOBVDiv=false, cooldown 8.

FX 5m / session trend: minScore 1.0–1.1, reclaimPct 0.50–0.55, overshootATR 0.8–1.0, useOBVDiv=true, cooldown 5.

Indices 1m (RTH): minScore 1.2, reclaimPct 0.55–0.60, useOBVDiv=false, cooldown 10.

Non-repainting by design

HTF values use lookahead_off with realtime offset.

Swings are confirmed pivots (no “forming” pivots).

Signals print at bar close only.

Notes

OBV divergence can add sensitivity on liquid markets; keep it off for stricter filtering.

Use Cooldown to avoid clustered sweeps.

This is an overlay/analysis tool, not financial advice. Test settings in Replay/Paper Trading before using live.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。