OPEN-SOURCE SCRIPT

Multi Timeframe Bollinger Bands Spectrum [Ata]

Multi-Timeframe Bollinger Bands Spectrum [Ata]

Technical Overview

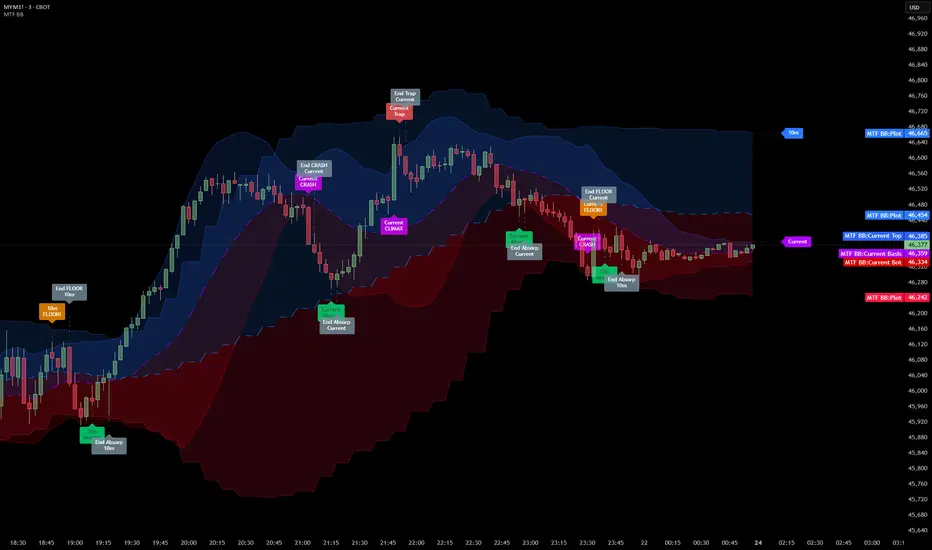

This script integrates multi-timeframe volatility analysis with volume-derived order flow estimation. By combining Bollinger Bands (statistical deviation) with internal candle volume logic, the indicator qualifies price movements to differentiate between sustained trends, reversals, and exhaustion events.

The system is designed to provide a structural context for price action, visualizing market regimes through a dual-zone spectrum and filtering signals based on the interaction between price location and specific volume thresholds.

Core Logic & Calculation

1. Volume Decomposition Algorithm

Instead of using total volume, the script estimates Buying Pressure vs. Selling Pressure based on the close position relative to the candle's High/Low range:

- Buying Volume (vb): Increases as the close approaches the High.

- Selling Volume (vs): Increases as the close approaches the Low.

This logic allows the detection of directional flow even within standard volume bars.

2. Statistical Spectrum

The indicator renders deviations from the Basis (SMA) as two distinct zones:

- Bullish Zone (Blue): Price positioning between the Basis and Upper Band.

- Bearish Zone (Red): Price positioning between the Basis and Lower Band.

This structure is applied across multiple timeframes (overlay) to visualize the macro trend context without noise.

3. Non-Repainting Execution

To ensure historical accuracy and reliability for backtesting, all higher-timeframe data is requested using "lookahead_off". Signals are confirmed only upon the closure of the respective timeframe's candle.

Signal Definitions

Signals are generated only when specific Volatility and Volume conditions intersect:

Reversal Setups (Reaction to Liquidity)

- WALL: Triggered when price rejects the Upper Band accompanied by Extreme Selling Volume (vs > Limit). This suggests active limit sell orders absorbing the rally.

- FLOOR: Triggered when price rejects the Lower Band accompanied by Extreme Buying Volume (vb > Limit). This suggests active limit buy orders absorbing the drop.

- ABSORP: Identifies absorption near the lower bands where selling pressure is met with passive buying (indicated by lower wicks and relative buy volume).

Momentum Setups (Trend Continuation)

- POWER: Validates a breakout above the Upper Band only if supported by Dominant Buying Volume and a strong candle body.

- PANIC: Validates a breakdown below the Lower Band only if supported by Dominant Selling Volume.

- TRAP: Marks failed breakouts where price exits the bands but volume analysis contradicts the move (e.g., low directional volume).

Exhaustion Setups (Statistical Extremes)

- CLIMAX/CRASH: Identifies anomalies where price deviates significantly from the mean (Extreme Deviation) or when volume reaches unsustainable levels relative to the average, often preceding a mean reversion.

Input Parameters

- Bollinger Logic: Configuration for Length and Standard Deviation Multiplier.

- Volume Thresholds: Adjustable factors for Minimum Volume (Trend) and Extreme Volume (Reversal/Climax).

- Timeframe Layers: Toggle visibility for up to 5 higher timeframes.

- Theme: Adjusts label contrast for Dark/Light backgrounds.

Disclaimer

This indicator is strictly for analytical purposes. It provides a visualization of past market data based on statistical and volumetric formulas. Users should apply their own risk management protocols.

Technical Overview

This script integrates multi-timeframe volatility analysis with volume-derived order flow estimation. By combining Bollinger Bands (statistical deviation) with internal candle volume logic, the indicator qualifies price movements to differentiate between sustained trends, reversals, and exhaustion events.

The system is designed to provide a structural context for price action, visualizing market regimes through a dual-zone spectrum and filtering signals based on the interaction between price location and specific volume thresholds.

Core Logic & Calculation

1. Volume Decomposition Algorithm

Instead of using total volume, the script estimates Buying Pressure vs. Selling Pressure based on the close position relative to the candle's High/Low range:

- Buying Volume (vb): Increases as the close approaches the High.

- Selling Volume (vs): Increases as the close approaches the Low.

This logic allows the detection of directional flow even within standard volume bars.

2. Statistical Spectrum

The indicator renders deviations from the Basis (SMA) as two distinct zones:

- Bullish Zone (Blue): Price positioning between the Basis and Upper Band.

- Bearish Zone (Red): Price positioning between the Basis and Lower Band.

This structure is applied across multiple timeframes (overlay) to visualize the macro trend context without noise.

3. Non-Repainting Execution

To ensure historical accuracy and reliability for backtesting, all higher-timeframe data is requested using "lookahead_off". Signals are confirmed only upon the closure of the respective timeframe's candle.

Signal Definitions

Signals are generated only when specific Volatility and Volume conditions intersect:

Reversal Setups (Reaction to Liquidity)

- WALL: Triggered when price rejects the Upper Band accompanied by Extreme Selling Volume (vs > Limit). This suggests active limit sell orders absorbing the rally.

- FLOOR: Triggered when price rejects the Lower Band accompanied by Extreme Buying Volume (vb > Limit). This suggests active limit buy orders absorbing the drop.

- ABSORP: Identifies absorption near the lower bands where selling pressure is met with passive buying (indicated by lower wicks and relative buy volume).

Momentum Setups (Trend Continuation)

- POWER: Validates a breakout above the Upper Band only if supported by Dominant Buying Volume and a strong candle body.

- PANIC: Validates a breakdown below the Lower Band only if supported by Dominant Selling Volume.

- TRAP: Marks failed breakouts where price exits the bands but volume analysis contradicts the move (e.g., low directional volume).

Exhaustion Setups (Statistical Extremes)

- CLIMAX/CRASH: Identifies anomalies where price deviates significantly from the mean (Extreme Deviation) or when volume reaches unsustainable levels relative to the average, often preceding a mean reversion.

Input Parameters

- Bollinger Logic: Configuration for Length and Standard Deviation Multiplier.

- Volume Thresholds: Adjustable factors for Minimum Volume (Trend) and Extreme Volume (Reversal/Climax).

- Timeframe Layers: Toggle visibility for up to 5 higher timeframes.

- Theme: Adjusts label contrast for Dark/Light backgrounds.

Disclaimer

This indicator is strictly for analytical purposes. It provides a visualization of past market data based on statistical and volumetric formulas. Users should apply their own risk management protocols.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

Uncovering hidden market depth through Volume Dynamics & Data-Driven Logic.

Follow the flow:

x.com/sabanci_ata

Follow the flow:

x.com/sabanci_ata

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

Uncovering hidden market depth through Volume Dynamics & Data-Driven Logic.

Follow the flow:

x.com/sabanci_ata

Follow the flow:

x.com/sabanci_ata

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。