OPEN-SOURCE SCRIPT

DRIP Yearly Performance

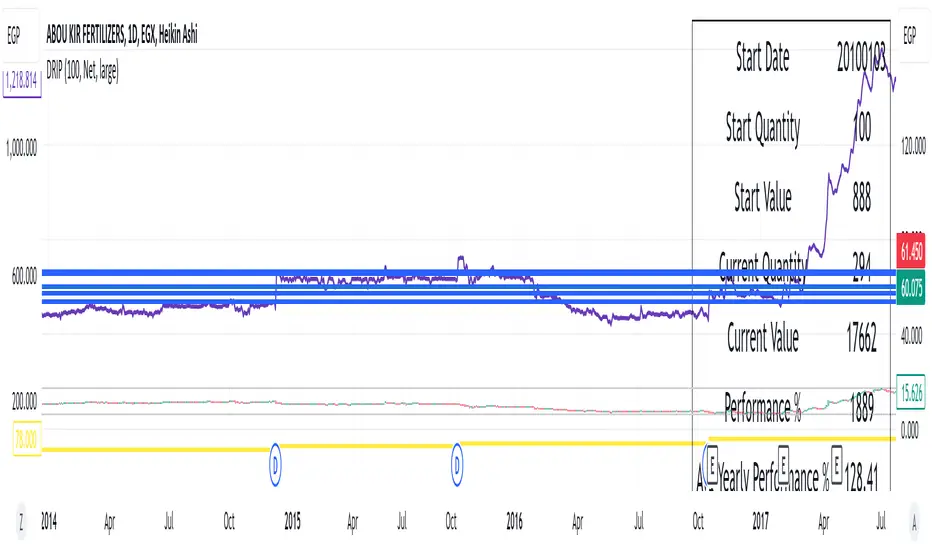

Overview: The DRIP Yearly Performance indicator is designed for long-term investors using Dividend Reinvestment Plans (DRIP). This script calculates both the total and average yearly performance of an asset, factoring in the reinvestment of dividends over time. It provides key insights into portfolio growth by tracking the number of accumulated units from dividend reinvestment and how this impacts overall performance.

Key Features:

Inputs Explained:

Who Can Benefit: This indicator is ideal for long-term investors and dividend growth investors who want to measure their investment returns over time while factoring in the effects of dividend reinvestment.

Use Cases:

Key Features:

- Dividend Reinvestment (DRIP) Calculation: Automatically adjusts the number of units held by reinvesting dividends, enhancing the calculation of total returns.

- Custom Start Date: Choose a custom start date to begin tracking performance from a specific time period, allowing for more tailored performance analysis.

- Performance Metrics: Displays key metrics such as the initial investment value, current value, total performance percentage, and the average yearly performance, all in an easy-to-read table format.

- Visual Representation: Plots accumulated units and overall performance on the chart, with customizable colors for clarity.

Inputs Explained:

- Start Quantity: Define the initial number of units (shares) held at the start of the investment.

- Dividend Type: Choose between tracking Net or Gross dividends for reinvestment purposes. Net is always better unless you have a special case and you need to base your calculations on gross.

- Start Date: Select a custom date to begin tracking performance. This allows users to focus on performance from any historical point.

- Table Size: Customize the size of the text in the performance table to suit your visual preferences.

- Performance Line Color: Choose the color of the performance plot line that tracks the value of your investment over time.

- Accumulator Line Color: Customize the color of the line that tracks the accumulated units (shares) due to reinvested dividends.

Who Can Benefit: This indicator is ideal for long-term investors and dividend growth investors who want to measure their investment returns over time while factoring in the effects of dividend reinvestment.

Use Cases:

- Tracking Dividend Impact: See how reinvesting dividends enhances your overall portfolio value.

- Custom Performance Analysis: Set a custom start date to analyze performance from a specific point in time.

- Visualizing Growth: Use the chart's plots to visually track your growing number of shares (units) and overall performance.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。