OPEN-SOURCE SCRIPT

Relative Strength vs. Benchmark (相對強度)

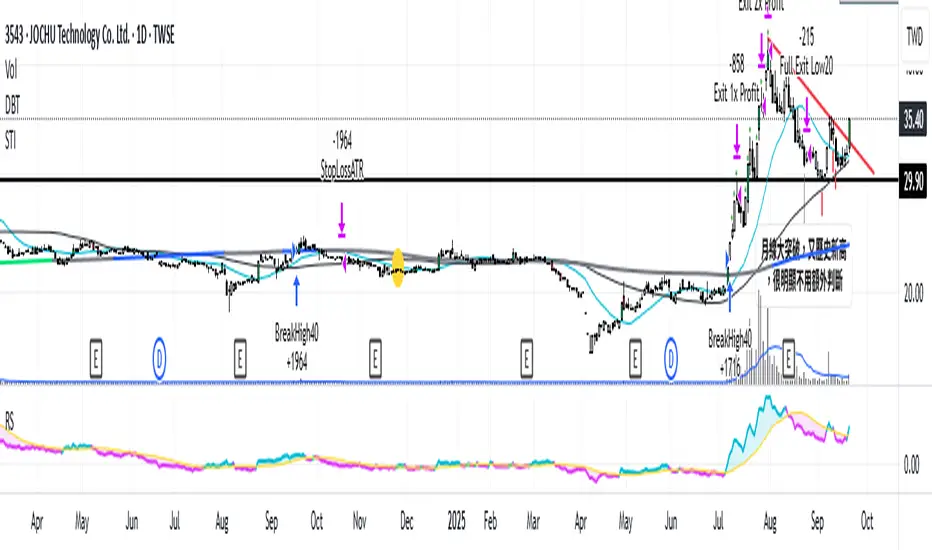

This "Relative Strength vs. Benchmark" indicator helps you see a stock's true performance against a benchmark (like the S&P 500) at a glance. By calculating the price ratio between the two, it strips away the overall market noise, allowing you to focus on identifying true market leaders and underperforming laggards.

How It Works

Core Formula: Relative Strength = Stock Price / Benchmark Index Price

A Rising Line: Means the stock is outperforming the benchmark.

A Falling Line: Means the stock is underperforming the benchmark.

The indicator also includes a Moving Average (MA) of the Relative Strength line itself. This MA helps to confirm the trend of relative strength and filter out short-term noise.

How to Use

Find Market Leaders: When the market is in an uptrend or consolidating, look for stocks whose RS line is breaking out to new highs.

Avoid Laggards: If the RS line is consistently below its moving average or making new lows, the stock is significantly underperforming the market and should be treated with caution.

Trend Change Signals: A cross of the RS line above its MA can be seen as a signal that a new trend of relative outperformance is beginning. A cross below suggests the trend is weakening.

Features & Settings

Customizable Benchmark: You can change the default benchmark from TWSE:TSE to any symbol you need, such as SP:SPX for the S&P 500 or NASDAQ:NDX for the Nasdaq 100.

Adjustable MA Length: Customize the period for the RS Moving Average to fit your trading style (short-term or long-term).

Visual Toggle: Easily turn the colored background fill on or off according to your preference.

Hope you find this tool helpful in your analysis!

How It Works

Core Formula: Relative Strength = Stock Price / Benchmark Index Price

A Rising Line: Means the stock is outperforming the benchmark.

A Falling Line: Means the stock is underperforming the benchmark.

The indicator also includes a Moving Average (MA) of the Relative Strength line itself. This MA helps to confirm the trend of relative strength and filter out short-term noise.

How to Use

Find Market Leaders: When the market is in an uptrend or consolidating, look for stocks whose RS line is breaking out to new highs.

Avoid Laggards: If the RS line is consistently below its moving average or making new lows, the stock is significantly underperforming the market and should be treated with caution.

Trend Change Signals: A cross of the RS line above its MA can be seen as a signal that a new trend of relative outperformance is beginning. A cross below suggests the trend is weakening.

Features & Settings

Customizable Benchmark: You can change the default benchmark from TWSE:TSE to any symbol you need, such as SP:SPX for the S&P 500 or NASDAQ:NDX for the Nasdaq 100.

Adjustable MA Length: Customize the period for the RS Moving Average to fit your trading style (short-term or long-term).

Visual Toggle: Easily turn the colored background fill on or off according to your preference.

Hope you find this tool helpful in your analysis!

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

RMS crypto screener

reurl.cc/33DLKX

reurl.cc/33DLKX

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

RMS crypto screener

reurl.cc/33DLKX

reurl.cc/33DLKX

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。