PROTECTED SOURCE SCRIPT

已更新 Zen

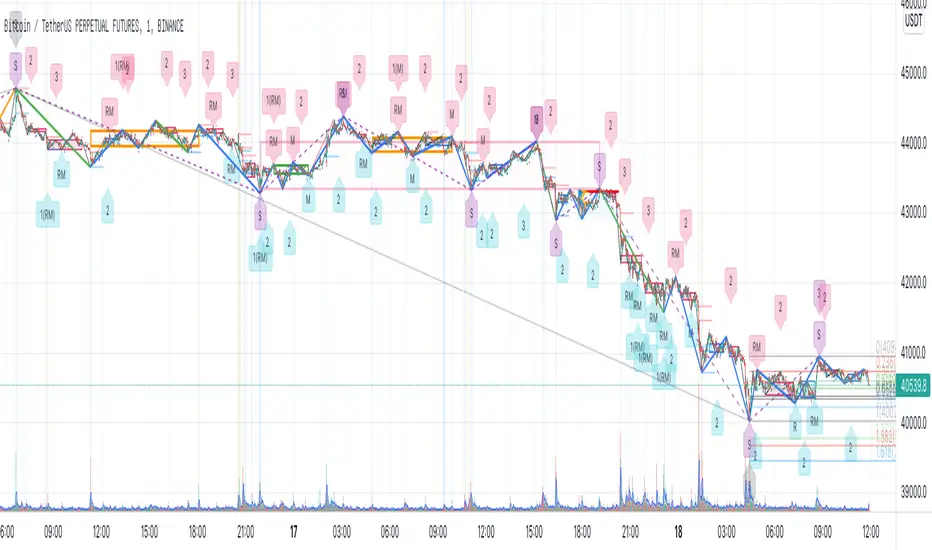

The Theory of Entanglement (缠论) is one of the most widely studied trading theories in China, but it is much less known among traders outside. Its philosophy is based on human greed, hatred, delusion, arrogance and doubt, which reveal the most fundamental aspect of the market. Fractals, strokes, line segments and pivots are basic elements in the Theory of Entanglement. However, manually drawing them on an ever-changing chart is both challenging and time consuming, and may lead to incorrect interpretation of the market trend. This indicator aims to automate the process of drawing strokes, line segments, and pivots for three consecutive levels such as 1m, 5m, and 30m (similar to time frames). The operation is then based on the so-called “same-level decomposition” technique. Buying and selling points are automatically marked on the chart, as well as points where trend divergence and range divergence occurred, which often signals a trend reversal.

Relations between fractal, stroke, line segment, pivot, and some important definitions:

• Stroke: Connecting two adjacent top and bottom fractals with at least one candlestick in between.

• Line segment: Consists of an odd number of strokes, at least three strokes are required, and the first three strokes must have overlapping parts.

• Level: Levels generally correspond to time frames of the chart, such as 1w, 1d, 4h, 30m, 5m, 1m etc. Sub-level: The above levels are respectively the sub-levels of the previous level.

• Pivot: The part of a trend type at a certain level that is overlapped by at least three consecutive sub-level trend types.

• Trend type: There are two trend types: trend and range. In trend, there are also two types: rising trend and falling trend.

• Range: At any level, a completed trend type contains only one pivot.

• Trend: At any level, a completed trend type contains at least two pivots in the same direction in sequence, which is called a trend at this level.

List of drawings on the chart:

1. Thin black lines: Strokes at the current level.

2. Thick blue lines: Strokes at a higher level, also line segments at the current level.

3. Purple dotted lines: Line segments at a higher level, also strokes at two levels higher from the current one.

4. Blue shaded rectangles: Pivots at the sub-level in a rising trend or range.

5. Red shaded rectangles: Pivots at the sub-level in a falling trend or range.

6. Green shaded rectangles: Pivots at the current level in a rising trend or range.

7. Orange shaded rectangles: Pivots at the current level in a falling trend or range.

List of symbols and labels on the chart (above the candle: sell signal, below the candle: buy signal)

1. Purple triangles below the candle: double golden cross of Stochastic and MACD, buy signal

2. Purple triangles above the candle: double death cross of Stochastic and MACD, sell signal

3. Blue triangles below the candle: EMA5 crosses EMA13 up, buy signal

4. Red triangles above the candle: EMA5 crosses EMA13 down, sell signal

5. Green triangles below the candle: EMA5 crosses EMA55 up, buy signal

6. Orange triangles above the candle: EMA5 crosses EMA55 down, sell signal

7. Blue circles on the low point of the candle: bottom divergence occurred, buy signal

8. Red circles on the high point of the candle: top divergence occurred, sell signal

9. Blue "R" label below the candle: bottom divergence calculated from RSI occurred, buy signal

10. Red "R" label above the candle: top divergence calculated from RSI occurred, sell signal

11. Blue "M" label below the candle: bottom divergence calculated from MACD occurred, buy signal

12. Red "M" label above the candle: top divergence calculated from MACD occurred, sell signal

13. Blue "RM" label below the candle: bottom divergence calculated from both RSI and MACD occurred, buy signal

14. Red "RM" label above the candle: top divergence calculated from both RSI and MACD occurred, sell signal

15. Blue "1(R)", "1(M)", "1(RM)" labels below the candle: 1st buying point due to bottom trend divergence or range divergence calculated from RSI, MACD, and both RSI and MACD occurred, respectively, buy signal

16. Red "1(R)", "1(M)", "1(RM)" labels above the candle: 1st selling point due to top trend divergence or range divergence calculated from RSI, MACD, and both RSI and MACD occurred, respectively, sell signal

17. Blue "3" label below the candle: 3rd buying point, buy signal

18. Red "3" label above the candle: 3rd selling point, sell signal

19. Green "3" label below the candle: 3rd buying point of a higher-level pivot, buy signal

20. Orange "3" label above the candle: 3rd selling point of a higher-level pivot, sell signal

21. Yellow-shaded vertical areas: candles where volume spikes occurred

22. Short red horizontal lines: highest point of volume spikes, potential support or resistance

23. Short blue horizontal lines: lowest point of volume spikes, potential support or resistance

Relations between fractal, stroke, line segment, pivot, and some important definitions:

• Stroke: Connecting two adjacent top and bottom fractals with at least one candlestick in between.

• Line segment: Consists of an odd number of strokes, at least three strokes are required, and the first three strokes must have overlapping parts.

• Level: Levels generally correspond to time frames of the chart, such as 1w, 1d, 4h, 30m, 5m, 1m etc. Sub-level: The above levels are respectively the sub-levels of the previous level.

• Pivot: The part of a trend type at a certain level that is overlapped by at least three consecutive sub-level trend types.

• Trend type: There are two trend types: trend and range. In trend, there are also two types: rising trend and falling trend.

• Range: At any level, a completed trend type contains only one pivot.

• Trend: At any level, a completed trend type contains at least two pivots in the same direction in sequence, which is called a trend at this level.

List of drawings on the chart:

1. Thin black lines: Strokes at the current level.

2. Thick blue lines: Strokes at a higher level, also line segments at the current level.

3. Purple dotted lines: Line segments at a higher level, also strokes at two levels higher from the current one.

4. Blue shaded rectangles: Pivots at the sub-level in a rising trend or range.

5. Red shaded rectangles: Pivots at the sub-level in a falling trend or range.

6. Green shaded rectangles: Pivots at the current level in a rising trend or range.

7. Orange shaded rectangles: Pivots at the current level in a falling trend or range.

List of symbols and labels on the chart (above the candle: sell signal, below the candle: buy signal)

1. Purple triangles below the candle: double golden cross of Stochastic and MACD, buy signal

2. Purple triangles above the candle: double death cross of Stochastic and MACD, sell signal

3. Blue triangles below the candle: EMA5 crosses EMA13 up, buy signal

4. Red triangles above the candle: EMA5 crosses EMA13 down, sell signal

5. Green triangles below the candle: EMA5 crosses EMA55 up, buy signal

6. Orange triangles above the candle: EMA5 crosses EMA55 down, sell signal

7. Blue circles on the low point of the candle: bottom divergence occurred, buy signal

8. Red circles on the high point of the candle: top divergence occurred, sell signal

9. Blue "R" label below the candle: bottom divergence calculated from RSI occurred, buy signal

10. Red "R" label above the candle: top divergence calculated from RSI occurred, sell signal

11. Blue "M" label below the candle: bottom divergence calculated from MACD occurred, buy signal

12. Red "M" label above the candle: top divergence calculated from MACD occurred, sell signal

13. Blue "RM" label below the candle: bottom divergence calculated from both RSI and MACD occurred, buy signal

14. Red "RM" label above the candle: top divergence calculated from both RSI and MACD occurred, sell signal

15. Blue "1(R)", "1(M)", "1(RM)" labels below the candle: 1st buying point due to bottom trend divergence or range divergence calculated from RSI, MACD, and both RSI and MACD occurred, respectively, buy signal

16. Red "1(R)", "1(M)", "1(RM)" labels above the candle: 1st selling point due to top trend divergence or range divergence calculated from RSI, MACD, and both RSI and MACD occurred, respectively, sell signal

17. Blue "3" label below the candle: 3rd buying point, buy signal

18. Red "3" label above the candle: 3rd selling point, sell signal

19. Green "3" label below the candle: 3rd buying point of a higher-level pivot, buy signal

20. Orange "3" label above the candle: 3rd selling point of a higher-level pivot, sell signal

21. Yellow-shaded vertical areas: candles where volume spikes occurred

22. Short red horizontal lines: highest point of volume spikes, potential support or resistance

23. Short blue horizontal lines: lowest point of volume spikes, potential support or resistance

版本注释

Improved algorithm for volume spikes calculation.版本注释

Fixed bugs in drawing pivots.版本注释

Improved method for setting alerts. To set alerts for buy and sell signals, switch to the trading time frame, then choose Create Alert under the Alerts menu:• For golden crosses (triangle symbols under candles), choose Zen -> Cross Up -> Less Than -> Value -> 0.00

• For death crosses (triangle symbols above candles), choose Zen -> Cross Down -> Greater Than -> Value -> 0.00

• For buying points (blue “R”, “M”, “RM”, “1(R)”, “1(M)”, “1(RM)”, and “3” labels), choose Zen -> Buying Point -> Less Than -> Zen -> Reference Point

• For selling points (red “R”, “M”, “RM”, “1(R)”, “1(M)”, “1(RM)”, and “3” labels), choose Zen -> Selling Point -> Greater Than -> Zen -> Reference Point

版本注释

1. Added labels for 2nd buying points and 2nd selling points2. Added colors for bullish/bearish outside strokes and bullish/bearish outside line segments

3. To set alerts for outside strokes and outside line segments, switch to the trading time frame, then choose Create Alert under the Alerts menu:

• For bullish outside stroke, choose Zen -> Outside Stroke/Line Segment -> Inside Channel -> (Upper Bound) Value -> -5.00 -> (Lower Bound) Value -> -15.00

• For bearish outside stroke, choose Zen -> Outside Stroke/Line Segment -> Inside Channel -> (Upper Bound) Value -> 15.00 -> (Lower Bound) Value -> 5.00

• For bullish outside line segment, choose Zen -> Outside Stroke/Line Segment -> Inside Channel -> (Upper Bound) Value -> -15.00 -> (Lower Bound) Value -> -25.00

• For bearish outside line segment, choose Zen -> Outside Stroke/Line Segment -> Inside Channel -> (Upper Bound) Value -> 25.00 -> (Lower Bound) Value -> 15.00

版本注释

Revised method for highlighting outside strokes and line segments.版本注释

Fixed minor bugs in drawing pivots.版本注释

Added alert settings for volume spikes. To set alerts for volume spikes, switch to the trading time frame, then choose Create Alert under the Alerts menu:• For 1st percentile volume spikes, choose Zen -> Volume Spike -> Inside Channel -> (Upper Bound) Value -> 25.00 -> (Lower Bound) Value -> 15.00

• For 2nd percentile volume spikes, choose Zen -> Volume Spike -> Inside Channel -> (Upper Bound) Value -> 15.00 -> (Lower Bound) Value -> 5.00

版本注释

Enabled parameter settings for user input.版本注释

Added automatic drawing of Fibonacci retracement. Options for the input source: None, Last Stroke, Last Outside Stroke, Last Line Segment, Last Outside Line Segment.版本注释

1. Fixed minor bugs in drawing higher-level pivots. 2. Added black triangles above and under the candle for potentially incoming crash and rally.版本注释

1. Added options to turn off the display of triangles above and under candles (alerts are not affected). 2. Added two additional Fibonacci retracement levels: 1.382 and 1.272. 3. Added options to adjust label font size.版本注释

Major update !!! Now four levels of strokes and three levels of pivots are shown on the same chart. For example, on the 1m viewing time frame, the longest stroke at the highest level is the stroke of the 1d time frame.Minor changes: 1. Added labels to indicate the end of higher level and higher higher level line segments. 2. Improved speed in drawing strokes and line segments.

Note: Alerts set previously may need to be updated or reset.

版本注释

Added one more option for Auto Fibonacci Retracement: Last Line Segment (Higher Level).版本注释

Minor display adjustment.版本注释

1. Fixed minor issues in drawing current-level pivots. 2. Added an option to change label text color. 3. Added display of price information when moving mouse over labels. 4. Added the 2nd and 3rd buying and selling points on higher levels.版本注释

1. Fixed minor errors in drawing current-level pivots. 2. Added options to change colors of crossover symbols.版本注释

Minor bug fix.版本注释

1. Added labels for higher-level divergence points and the 1st buying and selling points. 2. Added Auto Fibonacci Extension with two input options: a. Last line segment, b. Last line segment (higher level).版本注释

1. Fixed errors when setting alerts under certain time frames. 2. Added options to extend Auto Fibonacci levels to left and right.版本注释

1. Completed adding all three levels of 1st, 2nd and 3rd buying and selling points, and all three levels of divergence points.版本注释

1. Adjusted label locations for better display. 2. Increased max_bars_back to resolve issues in setting alerts.版本注释

Fixed errors in drawing higher-level pivots.版本注释

Another major update! Now the lowest-level strokes are formed by connecting top and bottom fractals, exactly following the original theory. Also the labels (R, M, RM, 1(R), 1(M), 1(RM), 2, 3 etc.) are only displayed after top or bottom fractals appear, which provide more reliable entry signals.版本注释

Minor bug fix.版本注释

Redefined conditions for forming lowest-level strokes from fractals.版本注释

1. Improved method for volume spikes calculation. 2. Added requirement for forming strokes.版本注释

Fixed display errors.版本注释

Fixed errors in drawing strokes.版本注释

Fixed display errors on certain time frames.版本注释

Fixed display issues for free account.版本注释

1. Fixed display issues for certain time frames. 2. Added an option for changing the ratio between strokes, for regarding a single stroke as a line segment.版本注释

1. Converted the source code to Pine version 5. 2. Resolved issues in drawing lowest-level pivots.版本注释

1. Added an option to require minimum three overlapping candles along each stroke. 2. Fixed minor display issues.版本注释

1. Resolved issues in drawing strokes. 2. Adjusted the allowable range of the Ratio parameter in settings.版本注释

Minor bug fix.版本注释

1. Added options for changing pivot border colors. 2. Adjusted default parameters for volume spikes.版本注释

Added an option to select the type of strokes: Old style (minimum five candles per stroke), New style (minimum four candles per stroke).版本注释

For those who use the previous version of this indicator, there is no need to update.版本注释

The maintainance of this indicator has been stopped. Please do not update this version.由于一些特定原因,本指标已停止维护,请之前使用此指标的用户不要再更新。

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。