PROTECTED SOURCE SCRIPT

已更新 CISD with deviations

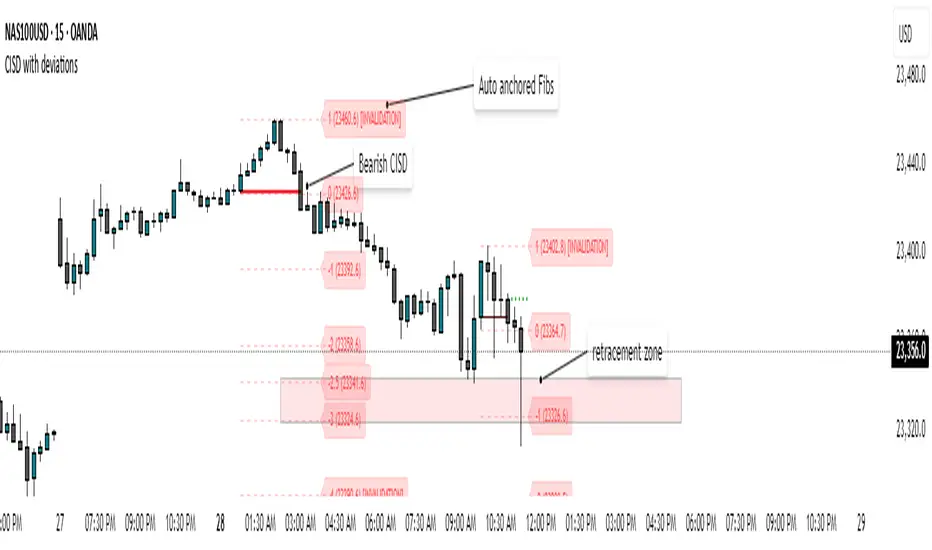

Change in State Delivery (CISD) is a well-recognized concept and serves as a key signal for identifying market direction through the behavior of CISD levels. In this approach, CISD is applied as the core measure of market structure, removing the variability that comes from user-defined interpretations.

How does it works :

Identifies CISD levels as the market delivers price.

Track whether price respects or violates these levels.

A confirmed shift (change in state) signals a potential transition in trend

Provides a clean structure map to guide execution

How to use it :

1)Align CISD shifts with your higher timeframe bias and the deviation levels marked by the indicator which often serve as the area for retracement or continuations.

2) Use CISD confirmation as a filter for trade entries.

3) Combine with liquidity pools, FVGs, or session timing for added confluence.

Features covered :

1) Automatic Bearish and Bullish CISD plotting.

2) Anchored Fibonacci levels are plotted based on the confirmed CISD. The Fibonacci levels are fixed and cannot be modified by the user because these levels serve a purpose.

3) Alerts can be set up by the users for whenever a bearish/bullish CISD is confirmed.

4) Automatic invalidations are set so that when price invalidates a CISD or hits the -4 level of a CISD as full target level, the CISD is automatically removed.

5) Currently , the maximum CISDs visible are limited to 3 each (bullish and bearish) to avoid cluttering on the chart.

How does it works :

Identifies CISD levels as the market delivers price.

Track whether price respects or violates these levels.

A confirmed shift (change in state) signals a potential transition in trend

Provides a clean structure map to guide execution

How to use it :

1)Align CISD shifts with your higher timeframe bias and the deviation levels marked by the indicator which often serve as the area for retracement or continuations.

2) Use CISD confirmation as a filter for trade entries.

3) Combine with liquidity pools, FVGs, or session timing for added confluence.

Features covered :

1) Automatic Bearish and Bullish CISD plotting.

2) Anchored Fibonacci levels are plotted based on the confirmed CISD. The Fibonacci levels are fixed and cannot be modified by the user because these levels serve a purpose.

3) Alerts can be set up by the users for whenever a bearish/bullish CISD is confirmed.

4) Automatic invalidations are set so that when price invalidates a CISD or hits the -4 level of a CISD as full target level, the CISD is automatically removed.

5) Currently , the maximum CISDs visible are limited to 3 each (bullish and bearish) to avoid cluttering on the chart.

版本注释

Bug fixes : i) Code was breaking when option show fib retracements as percentages was enabled : Fixed

ii) Added label customization for fib labels to have a cleaner chart.

版本注释

Added Fibonacci Level Alerts : ☑️ Enable Fibonacci Level Alerts - Turn this ON to activate the feature

☑️ Alert on -2.0 Level Hit - Check to get alerts when price hits -2.0 level

☑️ Alert on -2.5 Level Hit - Check to get alerts when price hits -2.5 level

☑️ Alert on -4.0 Level Hit - Check to get alerts when price hits -4.0 level (invalidation)

Alert Frequency:

Choose from: "All", "Once Per Bar", or "Once Per Bar Close"

Set Up TradingView Alerts

The Pine Script alerts will automatically trigger, but you need to set up TradingView's alert system:

Create Alert Condition:

-> Right-click on chart → "Add Alert" Or click the Alert button (bell icon) in the toolbar

-> Select your CISD indicator from the dropdown

Configure Notifications:

Choose notification method: Popup, Email, Webhook, SMS (if available)

Set sound alerts if desired

Configure frequency (this should match your Pine Script setting)

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。