OPEN-SOURCE SCRIPT

已更新 MA Ratio Weighted Trend System I [InvestorUnknown]

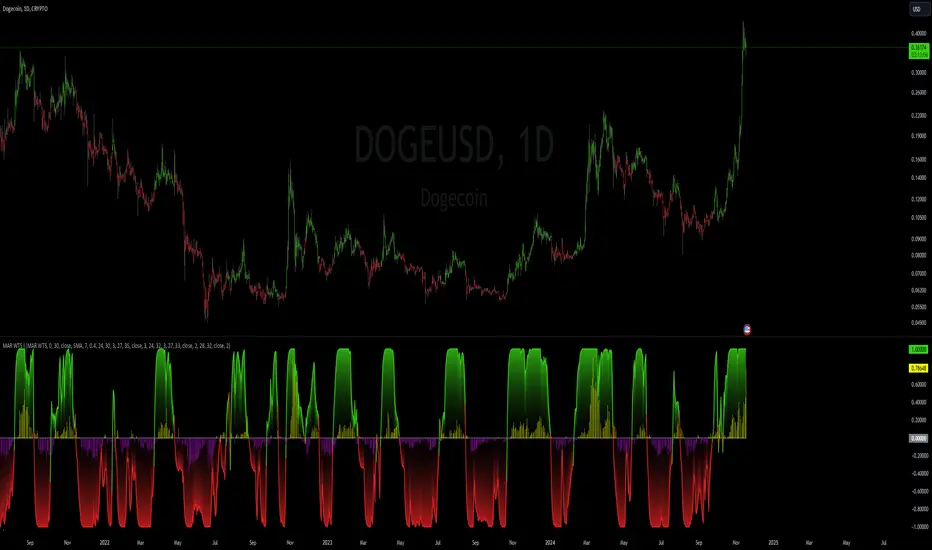

The MA Ratio Weighted Trend System I combines slow and fast indicators to identify stable trends and capture potential market turning points. By dynamically adjusting the weight of fast indicators based on the Moving Average Ratio (MAR), the system aims to provide timely entry and exit signals while maintaining overall trend stability through slow indicators.

Slow and Fast Indicators with Dynamic Weighting

Slow Indicators: Designed for stable trend identification, these indicators maintain a constant weight in the overall signal calculation. They include:

Fast Indicators: Aim to detect rapid market changes and potential turning points. Their weights are dynamically adjusted based on the absolute value of the Moving Average Ratio (MAR). Fast indicators include:

Dynamic Weighting Mechanism:

Moving Average Ratio (MAR) is calculated as the ratio of the price to its moving average, minus one (for simplicity and visualization).

Weight Calculation

Fast indicator weights are determined based on the absolute value of MAR, possibly with an offset to avoid scenarios where MAR follows rapid price reversals too closely:

Pine Script®

Threshold-Based vs. Continuous Weighting:

Offset Mechanism

The offset parameter shifts the MAR used for weighting by a certain number of bars. This helps avoid situations where the MAR follows sudden price movements too closely, preventing fast indicators from failing to provide timely exit signals.

Signal Calculation

The final signal is a weighted average of the slow and fast indicators:

Pine Script®

Backtesting and Performance Metrics

Enables users to test the indicator's performance over historical data, comparing it to a buy-and-hold strategy.

Alerts

Set up alerts for when the signal crosses above or below the thresholds.

Pine Script®

Important Notes

Slow and Fast Indicators with Dynamic Weighting

Slow Indicators: Designed for stable trend identification, these indicators maintain a constant weight in the overall signal calculation. They include:

- DMI For Loop (Directional Movement Index)

- CCI For Loop (Commodity Channel Index)

- Aroon For Loop

Fast Indicators: Aim to detect rapid market changes and potential turning points. Their weights are dynamically adjusted based on the absolute value of the Moving Average Ratio (MAR). Fast indicators include:

- ZLEMA For Loop (Zero-Lag Exponential Moving Average)

- IIRF For Loop (Infinite Impulse Response Filter)

Dynamic Weighting Mechanism:

Moving Average Ratio (MAR) is calculated as the ratio of the price to its moving average, minus one (for simplicity and visualization).

Weight Calculation

Fast indicator weights are determined based on the absolute value of MAR, possibly with an offset to avoid scenarios where MAR follows rapid price reversals too closely:

// Function to calculate weights based on MAR

f_mar_weights(series float mar, simple int offset, simple float weight_thre) =>

o_mar = math.abs(mar[offset])

float fast_weight = 0

float slow_weight = 1

if o_mar != 0

if weight_thre > 0

if o_mar <= weight_thre

fast_weight := o_mar

else

fast_weight := o_mar

[fast_weight, slow_weight]

Threshold-Based vs. Continuous Weighting:

- Threshold-Based: Fast indicators receive weight only when the absolute MAR exceeds a user-defined threshold (weight_thre).

- Continuous: By setting weight_thre to zero, fast indicators always receive some weight, though this may increase false signals.

Offset Mechanism

The offset parameter shifts the MAR used for weighting by a certain number of bars. This helps avoid situations where the MAR follows sudden price movements too closely, preventing fast indicators from failing to provide timely exit signals.

Signal Calculation

The final signal is a weighted average of the slow and fast indicators:

// Calculate Signal (as weighted average)

float sig = math.round(((DMI*slow_w) + (CCI*slow_w) + (Aroon*slow_w) + (ZLEMA*fast_w) + (IIRF*fast_w)) / (3*slow_w + 2*fast_w), 2)

Backtesting and Performance Metrics

Enables users to test the indicator's performance over historical data, comparing it to a buy-and-hold strategy.

Alerts

Set up alerts for when the signal crosses above or below the thresholds.

alertcondition(long_alert, "LONG (MAR Weighted Trend System)", "MAR Weighted Trend System flipped ⬆LONG⬆")

alertcondition(short_alert, "SHORT (MAR Weighted Trend System)", "MAR Weighted Trend System flipped ⬇Short⬇")

Important Notes

- Customization: Due to the experimental nature of this indicator, users are strongly encouraged to adjust and calibrate the settings to align with their trading strategies and market conditions.

- Default Settings Disclaimer: The default settings are not optimized or recommended for any specific use and serve only as placeholders for the indicator's publication.

- Backtest Results Disclaimer: Historical backtest results are not indicative of future performance. Market conditions change, and past results do not guarantee future outcomes.

版本注释

Updated the code to pinescript v6, added backtesting library v2 with more backtesting functions and removed old backtesting functions from the code版本注释

Updated the code to pinescript v6, added backtesting library v2 with more backtesting functions and removed old backtesting functions from the code开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。