INVITE-ONLY SCRIPT

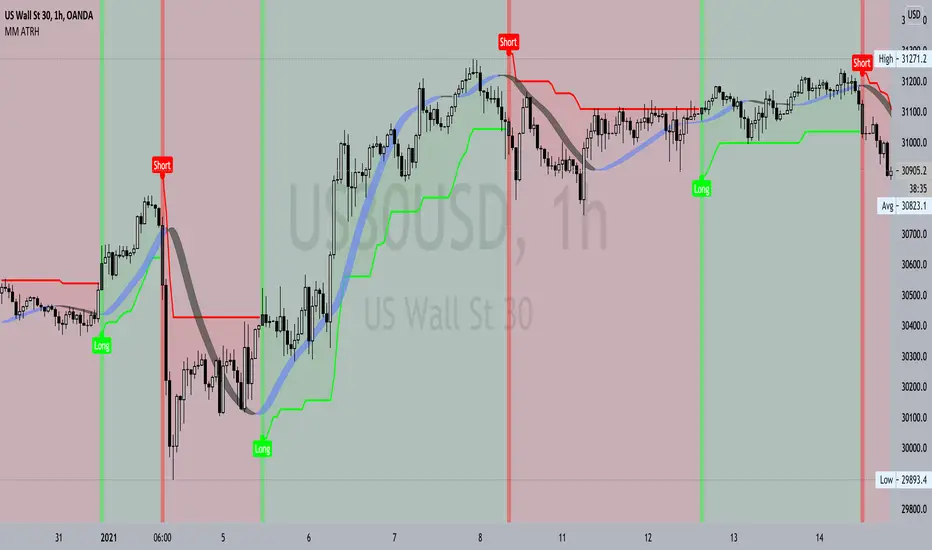

MM AverageTrueRangehUll

Features:

- Powerful 2 calculation used in one. Average True Range Multiplier & Sensitivity.

- Clearly shows trend direction, volatility , momentum & sentiment of any financial market.

- Dynamic stop loss levels formed by the help of average true range calculation which are produce right from the long or short signal and does stretch until the opposite directional signal appears.

- Generates potential long and short trade signals using complex formula of volatility , momentum and trend following.

- ATR calculation method can be changed from normal (ATR) to SMA version true range inside setting by ticking or unticking the input function named “Change ATR Calculation Method?”.

- Long and short signals labels can be turn off/on using “Reveal Long/Short Signals?”. - Background color can be shown/hidden using “Signal-light Show/Hide?”.

- Alert feature available for long and short signals.

Important two main settings of ATRH indicator:

1. ATR Multiplier

o A retail trader should adjust the setting depending on the financial market, instrument and timeframe as per required.

o Basically, higher timeframe has more range in price so ATR multiplier can be set higher.

o ATR multiplier value lower can produce more signals which will be as more trades opportunities but it can also lead to fake signals. 3-5 value is producing reasonable signals in any timeframe either it be lower or it be higher. If a trader by mistake doesn’t set a proper input value then the whole indicator could even function poorly so this setting must be used wisely.

2. Sensitivity

o Sensitivity can be from 0 to 1. It can be also integer or floating-point number example: 0.1, 0.3, 0.8 etc.

o It is used to control the signal generation speed by 3 to 5 candle bars before (if the value is set higher) or after (if the value is set lower) during the time of condition meeting for either long or short signals.

o Depending on any financial market or instrument sensitivity value should be managed well by a trader for his/her needs taking consideration on the nature of that particular financial market or instrument & timeframe.

Use link below or PM us for access you this indicator. Happy Trading

- Powerful 2 calculation used in one. Average True Range Multiplier & Sensitivity.

- Clearly shows trend direction, volatility , momentum & sentiment of any financial market.

- Dynamic stop loss levels formed by the help of average true range calculation which are produce right from the long or short signal and does stretch until the opposite directional signal appears.

- Generates potential long and short trade signals using complex formula of volatility , momentum and trend following.

- ATR calculation method can be changed from normal (ATR) to SMA version true range inside setting by ticking or unticking the input function named “Change ATR Calculation Method?”.

- Long and short signals labels can be turn off/on using “Reveal Long/Short Signals?”. - Background color can be shown/hidden using “Signal-light Show/Hide?”.

- Alert feature available for long and short signals.

Important two main settings of ATRH indicator:

1. ATR Multiplier

o A retail trader should adjust the setting depending on the financial market, instrument and timeframe as per required.

o Basically, higher timeframe has more range in price so ATR multiplier can be set higher.

o ATR multiplier value lower can produce more signals which will be as more trades opportunities but it can also lead to fake signals. 3-5 value is producing reasonable signals in any timeframe either it be lower or it be higher. If a trader by mistake doesn’t set a proper input value then the whole indicator could even function poorly so this setting must be used wisely.

2. Sensitivity

o Sensitivity can be from 0 to 1. It can be also integer or floating-point number example: 0.1, 0.3, 0.8 etc.

o It is used to control the signal generation speed by 3 to 5 candle bars before (if the value is set higher) or after (if the value is set lower) during the time of condition meeting for either long or short signals.

o Depending on any financial market or instrument sensitivity value should be managed well by a trader for his/her needs taking consideration on the nature of that particular financial market or instrument & timeframe.

Use link below or PM us for access you this indicator. Happy Trading

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系MoneyMovesInvestments。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系MoneyMovesInvestments。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。