PROTECTED SOURCE SCRIPT

已更新 Expected Move Bands

Expected Moves

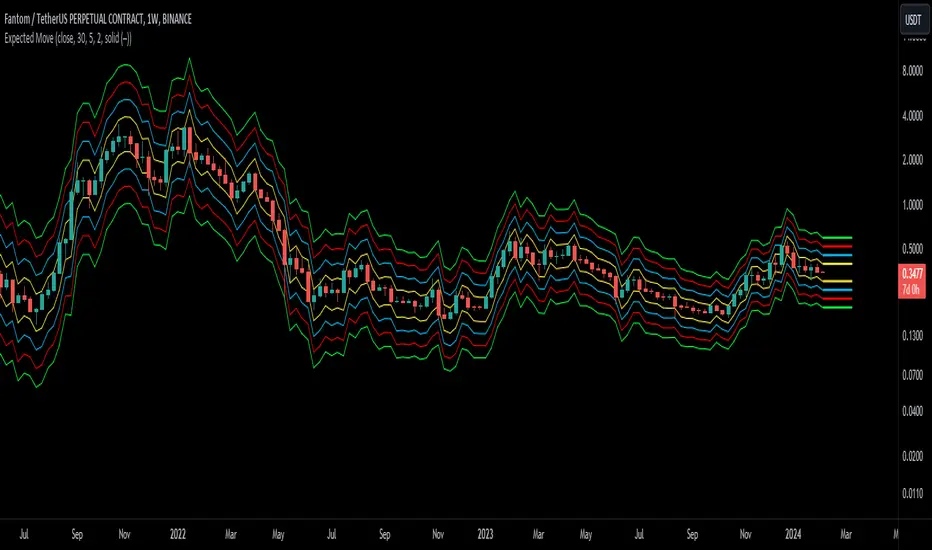

The Expected Move of a security shows the amount that a stock is expected to rise or fall from its current market price based on its level of volatility or implied volatility. The expected move of a stock is usually measured with standard deviations.

An Expected Move Range of 1 SD shows that price will be near the 1 SD range 68% of the time given enough samples.

Expected Move Bands

This indicator gets the Expected Move for 1-4 Standard Deviation Ranges using Historical Volatility. Then it displays it on price as bands.

The Expected Move indicator also allows you to see MTF Expected Moves if you want to.

This indicator calculates the expected price movements by analyzing the historical volatility of an asset. Volatility is the measure of fluctuation.

This script uses log returns for the historical volatility calculation which can be modelled as a normal distribution most of the time meaning it is symmetrical and stationary unlike other scripts that use bands to find "reversals". They are fundamentally incorrect.

What these ranges tell you is basically the odds of the price movement being between these levels.

If you take enough samples, 95.5% of the them will be near the 2nd Standard Deviation. And so on. (The 3rd Standard deviation is 99.7%)

For higher timeframes you might need a smaller sample size.

Features

The Expected Move of a security shows the amount that a stock is expected to rise or fall from its current market price based on its level of volatility or implied volatility. The expected move of a stock is usually measured with standard deviations.

An Expected Move Range of 1 SD shows that price will be near the 1 SD range 68% of the time given enough samples.

Expected Move Bands

This indicator gets the Expected Move for 1-4 Standard Deviation Ranges using Historical Volatility. Then it displays it on price as bands.

The Expected Move indicator also allows you to see MTF Expected Moves if you want to.

This indicator calculates the expected price movements by analyzing the historical volatility of an asset. Volatility is the measure of fluctuation.

This script uses log returns for the historical volatility calculation which can be modelled as a normal distribution most of the time meaning it is symmetrical and stationary unlike other scripts that use bands to find "reversals". They are fundamentally incorrect.

What these ranges tell you is basically the odds of the price movement being between these levels.

If you take enough samples, 95.5% of the them will be near the 2nd Standard Deviation. And so on. (The 3rd Standard deviation is 99.7%)

For higher timeframes you might need a smaller sample size.

Features

- MTF Option

- Parameter customization

版本注释

Improved the volatility calculations.受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

Link Tree: linktr.ee/tradersendeavors

Access our indicators: patreon.com/user?u=80987417

Access our indicators: patreon.com/user?u=80987417

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

Link Tree: linktr.ee/tradersendeavors

Access our indicators: patreon.com/user?u=80987417

Access our indicators: patreon.com/user?u=80987417

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。