OPEN-SOURCE SCRIPT

Machine Learning Gaussian Mixture Model | AlphaNatt

Machine Learning Gaussian Mixture Model | AlphaNatt

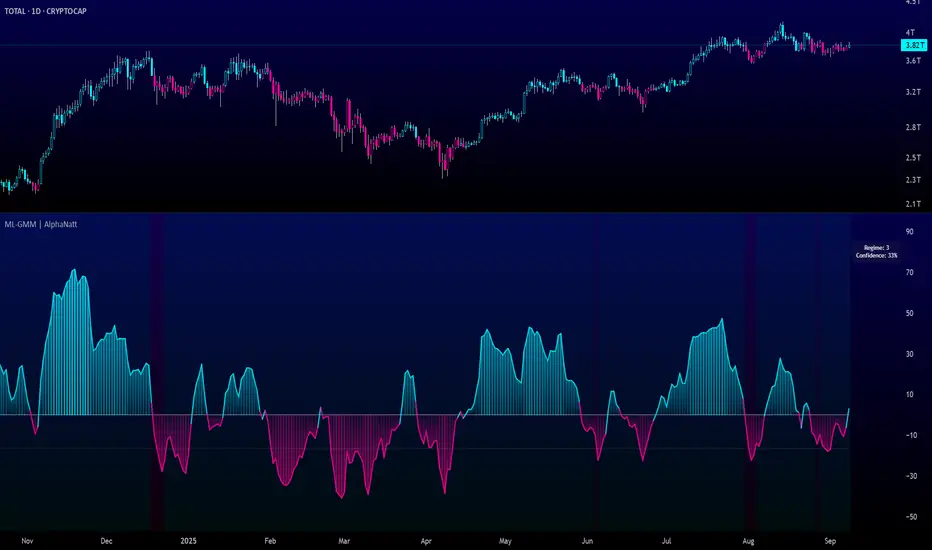

A revolutionary oscillator that uses Gaussian Mixture Models (GMM) with unsupervised machine learning to identify market regimes and automatically adapt momentum calculations - bringing statistical pattern recognition techniques to trading.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🤖 THE MACHINE LEARNING

Gaussian Mixture Models (GMM):

Unlike K-means clustering which assigns hard boundaries, GMM uses probabilistic clustering:

Expectation-Maximization Algorithm:

The indicator continuously learns and adapts using the E-M algorithm:

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎯 THREE MARKET REGIMES

The GMM identifies three distinct market states:

Regime 1 - Low Volatility:

Regime 2 - Normal Market:

Regime 3 - High Volatility:

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 KEY INNOVATIONS

1. Probabilistic Regime Detection:

Instead of binary regime assignment, provides probabilities:

2. Weighted Momentum Calculation:

3. Confidence Indicator:

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚙️ PARAMETER OPTIMIZATION

Training Period (50-500):

Number of Components (2-5):

Learning Rate (0.1-1.0):

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📊 TRADING STRATEGIES

Visual Signals:

1. Regime-Based Trading:

2. Confidence-Filtered Signals:

3. Adaptive Position Sizing:

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🚀 ADVANTAGES OVER OTHER ML INDICATORS

vs K-Means Clustering:

vs KNN (K-Nearest Neighbors):

vs Neural Networks:

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📈 PERFORMANCE CHARACTERISTICS

Best Market Conditions:

Key Strengths:

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🔬 TECHNICAL BACKGROUND

Gaussian Mixture Models are used extensively in:

The E-M algorithm was developed at Stanford in 1977 and is one of the most important algorithms in unsupervised machine learning.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 PRO TIPS

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ IMPORTANT NOTES

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🏆 CONCLUSION

The GMM Momentum Oscillator brings institutional-grade machine learning to retail trading. By identifying market regimes probabilistically and adapting momentum calculations accordingly, it provides:

This isn't just another indicator with "ML" in the name - it's a genuine implementation of Gaussian Mixture Models with the Expectation-Maximization algorithm, the same technology used in:

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Developed by AlphaNatt | Machine Learning Trading Systems

Version: 1.0

Algorithm: Gaussian Mixture Model with E-M

Classification: Unsupervised Learning Oscillator

Not financial advice. Always DYOR.

A revolutionary oscillator that uses Gaussian Mixture Models (GMM) with unsupervised machine learning to identify market regimes and automatically adapt momentum calculations - bringing statistical pattern recognition techniques to trading.

"Markets don't follow a single distribution - they're a mixture of different regimes. This oscillator identifies which regime we're in and adapts accordingly."

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🤖 THE MACHINE LEARNING

Gaussian Mixture Models (GMM):

Unlike K-means clustering which assigns hard boundaries, GMM uses probabilistic clustering:

- Models data as coming from multiple Gaussian distributions

- Each market regime is a different Gaussian component

- Provides probability of belonging to each regime

- More sophisticated than simple clustering

Expectation-Maximization Algorithm:

The indicator continuously learns and adapts using the E-M algorithm:

- E-step: Calculate probability of current market belonging to each regime

- M-step: Update regime parameters based on new data

- Continuous learning without repainting

- Adapts to changing market conditions

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎯 THREE MARKET REGIMES

The GMM identifies three distinct market states:

Regime 1 - Low Volatility:

- Quiet, ranging markets

- Uses RSI-based momentum calculation

- Reduces false signals in choppy conditions

- Background: Pink tint

Regime 2 - Normal Market:

- Standard trending conditions

- Uses Rate of Change momentum

- Balanced sensitivity

- Background: Gray tint

Regime 3 - High Volatility:

- Strong trends or volatility events

- Uses Z-score based momentum

- Captures extreme moves

- Background: Cyan tint

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 KEY INNOVATIONS

1. Probabilistic Regime Detection:

Instead of binary regime assignment, provides probabilities:

- 30% Regime 1, 60% Regime 2, 10% Regime 3

- Smooth transitions between regimes

- No sudden indicator jumps

2. Weighted Momentum Calculation:

- Combines three different momentum formulas

- Weights based on regime probabilities

- Automatically adapts to market conditions

3. Confidence Indicator:

- Shows how certain the model is (white line)

- High confidence = strong regime identification

- Low confidence = transitional market state

- Line transparency changes with confidence

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚙️ PARAMETER OPTIMIZATION

Training Period (50-500):

- 50-100: Quick adaptation to recent conditions

- 100: Balanced (default)

- 200-500: Stable regime identification

Number of Components (2-5):

- 2: Simple bull/bear regimes

- 3: Low/Normal/High volatility (default)

- 4-5: More granular regime detection

Learning Rate (0.1-1.0):

- 0.1-0.3: Slow, stable learning

- 0.3: Balanced (default)

- 0.5-1.0: Fast adaptation

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📊 TRADING STRATEGIES

Visual Signals:

- Cyan gradient: Bullish momentum

- Magenta gradient: Bearish momentum

- Background color: Current regime

- Confidence line: Model certainty

1. Regime-Based Trading:

- Regime 1 (pink): Expect mean reversion

- Regime 2 (gray): Standard trend following

- Regime 3 (cyan): Strong momentum trades

2. Confidence-Filtered Signals:

- Only trade when confidence > 70%

- High confidence = clearer market state

- Avoid transitions (low confidence)

3. Adaptive Position Sizing:

- Regime 1: Smaller positions (choppy)

- Regime 2: Normal positions

- Regime 3: Larger positions (trending)

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🚀 ADVANTAGES OVER OTHER ML INDICATORS

vs K-Means Clustering:

- Soft clustering (probabilities) vs hard boundaries

- Captures uncertainty and transitions

- More mathematically robust

vs KNN (K-Nearest Neighbors):

- Unsupervised learning (no historical labels needed)

- Continuous adaptation

- Lower computational complexity

vs Neural Networks:

- Interpretable (know what each regime means)

- No overfitting issues

- Works with limited data

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📈 PERFORMANCE CHARACTERISTICS

Best Market Conditions:

- Markets with clear regime shifts

- Volatile to trending transitions

- Multi-timeframe analysis

- Cryptocurrency markets (high regime variation)

Key Strengths:

- Automatically adapts to market changes

- No manual parameter adjustment needed

- Smooth transitions between regimes

- Probabilistic confidence measure

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🔬 TECHNICAL BACKGROUND

Gaussian Mixture Models are used extensively in:

- Speech recognition (Google Assistant)

- Computer vision (facial recognition)

- Astronomy (galaxy classification)

- Genomics (gene expression analysis)

- Finance (risk modeling at investment banks)

The E-M algorithm was developed at Stanford in 1977 and is one of the most important algorithms in unsupervised machine learning.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 PRO TIPS

- Watch regime transitions: Best opportunities often occur when regimes change

- Combine with volume: High volume + regime change = strong signal

- Use confidence filter: Avoid low confidence periods

- Multi-timeframe: Compare regimes across timeframes

- Adjust position size: Scale based on identified regime

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ IMPORTANT NOTES

- Machine learning adapts but doesn't predict the future

- Best used with other confirmation indicators

- Allow time for model to learn (100+ bars)

- Not financial advice - educational purposes

- Backtest thoroughly on your instruments

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🏆 CONCLUSION

The GMM Momentum Oscillator brings institutional-grade machine learning to retail trading. By identifying market regimes probabilistically and adapting momentum calculations accordingly, it provides:

- Automatic adaptation to market conditions

- Clear regime identification with confidence levels

- Smooth, professional signal generation

- True unsupervised machine learning

This isn't just another indicator with "ML" in the name - it's a genuine implementation of Gaussian Mixture Models with the Expectation-Maximization algorithm, the same technology used in:

- Google's speech recognition

- Tesla's computer vision

- NASA's data analysis

- Wall Street risk models

"Let the machine learn the market regimes. Trade with statistical confidence."

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Developed by AlphaNatt | Machine Learning Trading Systems

Version: 1.0

Algorithm: Gaussian Mixture Model with E-M

Classification: Unsupervised Learning Oscillator

Not financial advice. Always DYOR.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

Free Analysis Platform 👉 alphanatt.com

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

Free Analysis Platform 👉 alphanatt.com

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。