OPEN-SOURCE SCRIPT

Weighted Regression Bands (Zeiierman)

█ Overview

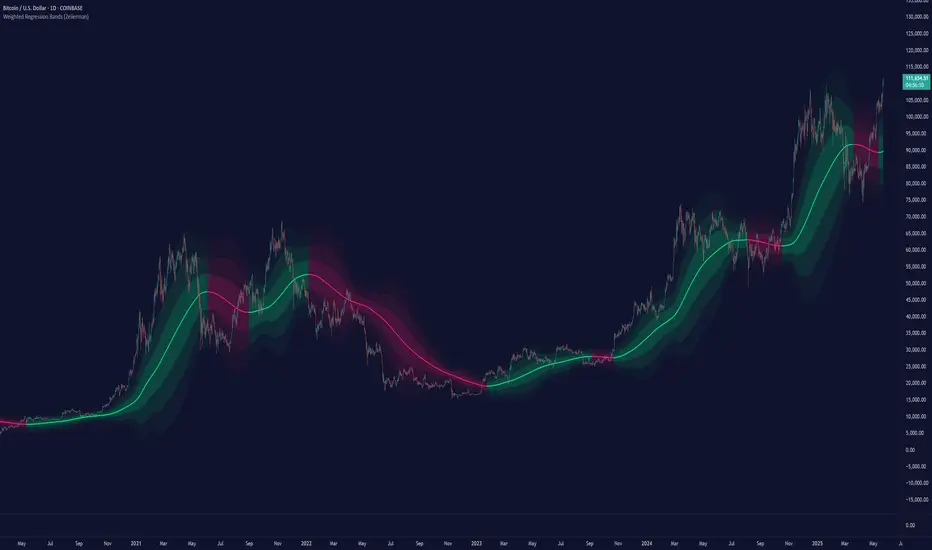

Weighted Regression Bands is a precision-engineered trend and volatility tool designed to adapt to the real market structure instead of reacting to price noise.

This indicator analyzes Weighted High/Low medians and applies user-selectable smoothing methods — including Kalman Filtering, ALMA, and custom Linear Regression — to generate a Fair Value line. Around this, it constructs dynamic standard deviation bands that adapt in real-time to market volatility.

The result is a visually clean and structurally intelligent trend framework suitable for breakout traders, mean reversion strategies, and trend-driven analysis.

█ How It Works

█ How to Use

⚪ Trend Trading & Filtering

⚪ Volatility-Based Entries

█ Settings

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

Weighted Regression Bands is a precision-engineered trend and volatility tool designed to adapt to the real market structure instead of reacting to price noise.

This indicator analyzes Weighted High/Low medians and applies user-selectable smoothing methods — including Kalman Filtering, ALMA, and custom Linear Regression — to generate a Fair Value line. Around this, it constructs dynamic standard deviation bands that adapt in real-time to market volatility.

The result is a visually clean and structurally intelligent trend framework suitable for breakout traders, mean reversion strategies, and trend-driven analysis.

█ How It Works

⚪ Structural High/Low Analysis

At the heart of this indicator is a custom high/low weighting system. Instead of using just the raw high or low values, it calculates a midline = (high + low) / 2, then applies one of three weighting methods to determine which price zones matter most.

Users can select the method using the “Weighted HL Method” setting:

- Simple

Selects the single most dominant median (highest or lowest) in the lookback window. Ideal for fast, reactive signals.- Advanced

Ranks each bar based on a composite score: median × range × recency. This method highlights structurally meaningful bars that had both volatility and recency. A built-in Kalman filter is applied for extra stability.- Smooth

Blends multiple bars into a single weighted average using smoothed decay and range. This provides the softest and most stable structural response.

⚪ Smoothing Methods (ALMA / Linear Regression)

- ALMA provides responsive, low-lag smoothing for fast trend reading.

- Linear Regression projects the Fair Value forward, ideal for trend modeling.

⚪ Kalman Smoothing Filter

Before trend calculations, the indicator applies an optional Kalman-style smoothing filter. This helps:

- Reduce choppy false shifts in trend,

- Retain signal clarity during volatile periods,

- Provide stability for long-term setups.

⚪ Deviation Bands (Dynamic Volatility Envelopes)

- The indicator builds ±1, ±2, and ±3 standard deviation bands around the fair value line:

- Calculated from the standard deviation of price,

- Bands expand and contract based on recent volatility,

- Visualizes potential overbought/oversold or trending conditions.

█ How to Use

⚪ Trend Trading & Filtering

- Use the Fair Value line to identify the dominant direction.

- Only trade in the direction of the slope for higher probability setups.

⚪ Volatility-Based Entries

- Watch for price reaching outer bands (+2σ, +3σ) for possible exhaustion.

- Mean reversion entries become higher quality when far from Fair Value.

█ Settings

- Length – Lookback for Weighted HL and trend smoothing

- Deviation Multiplier – Controls how wide the bands are from the fair value line

- Method – Choose between ALMA or Linear Regression smoothing

- Smoothing – Strength of Kalman Filter (1 = none, <1 = stronger smoothing)

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

Access my indicators at: zeiierman.com

Join Our Free Discord: discord.gg/zeiiermantrading

Join Our Free Discord: discord.gg/zeiiermantrading

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

Access my indicators at: zeiierman.com

Join Our Free Discord: discord.gg/zeiiermantrading

Join Our Free Discord: discord.gg/zeiiermantrading

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。