INVITE-ONLY SCRIPT

已更新 Gregoire Channel Width

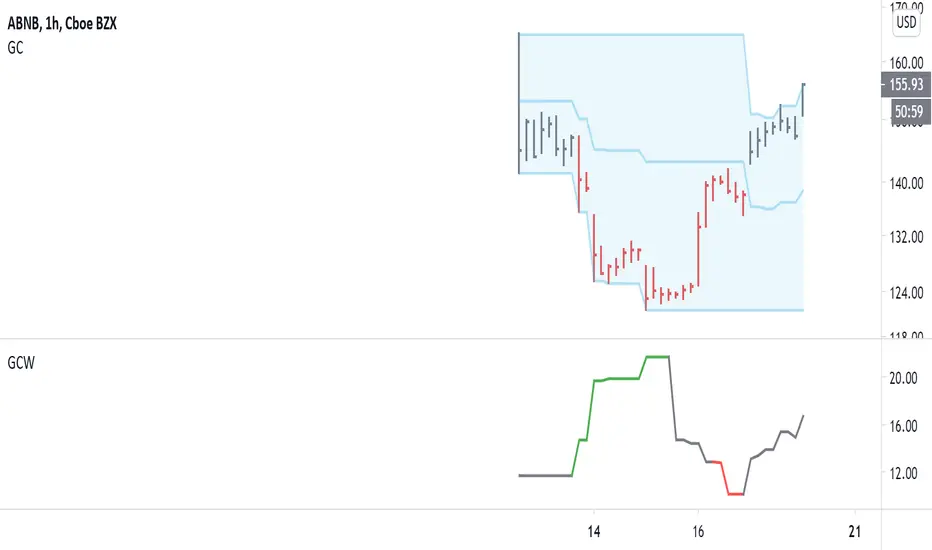

This indicator goes with the Gregoire Channel (not shown). It measures the distance from an edge to the middle of the channel.

This serves two purposes:

1) Volatility adjusted position sizing

2) Options buying/selling

-----------------

The formula for volatility adjusted position size is: (account value * risk) / (GC Width / Entry price).

For example, let's say we have a $15,000 account size and want to risk 2% on a TQQQ trade. The GC Width is $8.77 and entry is $167.59.

That gives us a position size of: (15,000 * 0.02) / (8.77 / 167.59) = $5,732.84. Our stop would be around the middle of the channel, in this case.

We use this so we avoid getting blown out in fast-moving markets, yet still make enough for slow moving markets. Too much risk destroys accounts!

-----------------

The green and red colors indicate areas to buy and sell options. RED = sell options, GREEN = buy options.

Options are priced according to volatility. We want to buy them when volatility is low, and sell them when volatility is high. These can also be used as take-profit areas: we buy options on the green and close for profit on the red areas, etc.

This serves two purposes:

1) Volatility adjusted position sizing

2) Options buying/selling

-----------------

The formula for volatility adjusted position size is: (account value * risk) / (GC Width / Entry price).

For example, let's say we have a $15,000 account size and want to risk 2% on a TQQQ trade. The GC Width is $8.77 and entry is $167.59.

That gives us a position size of: (15,000 * 0.02) / (8.77 / 167.59) = $5,732.84. Our stop would be around the middle of the channel, in this case.

We use this so we avoid getting blown out in fast-moving markets, yet still make enough for slow moving markets. Too much risk destroys accounts!

-----------------

The green and red colors indicate areas to buy and sell options. RED = sell options, GREEN = buy options.

Options are priced according to volatility. We want to buy them when volatility is low, and sell them when volatility is high. These can also be used as take-profit areas: we buy options on the green and close for profit on the red areas, etc.

版本注释

Use the link below to get access to this indicator, plus the Gregoire Channel and Gregoire Channel Strategy!版本注释

Cleaned up the expansion/contraction color signals.版本注释

Provided support for brand new markets with no history.Changed color scheme: GREEN means expansion, RED means contraction.

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系gregoirejohnb。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系gregoirejohnb。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。