INVITE-ONLY SCRIPT

已更新 TradeChartist Catalyst

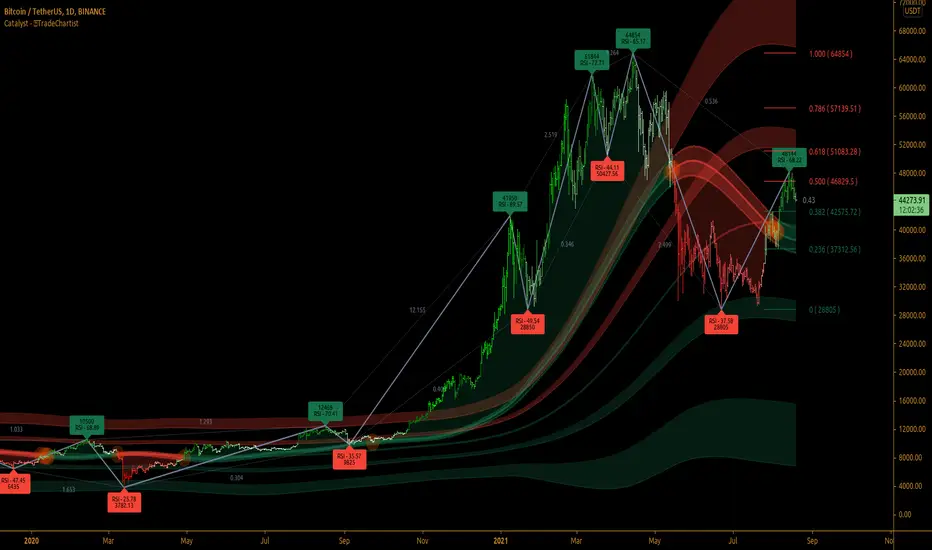

™TradeChartist Catalyst is an elegant script that combines Catalyst Trade Bands and automatic ZigZag/Fibonacci plots using an original logic to help users interact in a visually engaging and meaningful way with the charts.

===================================================================================================================

™TradeChartist Catalyst features

=============================

1. Catalyst Trade Bands

Catalyst Trade Bands comprises Equilibrium or Mean Bands, Inner Bands, Outer Bands and a Overall Mean Line. Catalyst Trade Bands help visualize the price action in relation to the Equilibrium Bands and clearly show how far away from the mean the current price is. The Trade Bands are of two types - Normal and Weighted. Weighted Bands are very sensitive to price action and a higher Bands length is recommended.

Simple 144 vs Weighted 144 Trade Bands

2. Equilibrium Touch Points

Every time the price touches the Equilibrium, an orange touch point appears on the chart. Normally, the Equilibrium line, for an optimal sample, acts as support or resistance. Price breaching or failing this line usually signals a Pull Back, a Throw Back or a Trend Change based on how the price interacts with it. This can be used with a secondary confirmation like RSI, Stochastic etc. For example, if the price falls back significantly only to touch the Equilibrium Line and fails to test the Overall Mean Line when Stochastic is below 30, this could mean a strong Pull Back rather than a Trend Change as shown in the example chart below.

When price fails the Equilibrium Bands, the fill colour of the Equilibrium bands changes to Bearish colour. If the Overall Mean line is below the Equilibrium bands and is in a reasonable distance, Mean will act as support as shown in the example below. Price failing the mean will test Inner Bands and strong bear momentum could take price to Outer Bands and beyond.

All the components of the Catalyst Trade Bands including the Touch Points can be enabled or disabled from the settings.

3. ZigZag & Fibonacci

Catalyst automatically plots ZigZag and Auto Fibonacci Retracement based on an intelligent logic and can be tweaked by changing the Zigzag & Auto-Fibs Factor from the settings. It also plots Fib ratios and connectors along with price highs and lows of ZigZag. The ratios can be especially useful to visually detect harmonic patterns and also serves as a useful feature for Fibonacci traders.

4. Fibonacci Customisation

Catalyst users can customise Fibonacci type and levels, including levels colour from Catalyst settings. In addition to Auto-Fibs, users can also plot Fibonacci levels based on Days or Candles lookback. This is a very useful feature if the user wants to override Auto-Fibs to suit his/her needs. Users can also reverse the Fibonacci Levels by enabling Reverse from settings.

In the following example chart of

USDCAD, Fibonacci levels based on 10 days lookback is plotted.

USDCAD, Fibonacci levels based on 10 days lookback is plotted.

===================================================================================================================

Best Practice: Test with different settings first using Paper Trades before trading with real money

===================================================================================================================

===================================================================================================================

™TradeChartist Catalyst features

=============================

1. Catalyst Trade Bands

Catalyst Trade Bands comprises Equilibrium or Mean Bands, Inner Bands, Outer Bands and a Overall Mean Line. Catalyst Trade Bands help visualize the price action in relation to the Equilibrium Bands and clearly show how far away from the mean the current price is. The Trade Bands are of two types - Normal and Weighted. Weighted Bands are very sensitive to price action and a higher Bands length is recommended.

Simple 144 vs Weighted 144 Trade Bands

2. Equilibrium Touch Points

Every time the price touches the Equilibrium, an orange touch point appears on the chart. Normally, the Equilibrium line, for an optimal sample, acts as support or resistance. Price breaching or failing this line usually signals a Pull Back, a Throw Back or a Trend Change based on how the price interacts with it. This can be used with a secondary confirmation like RSI, Stochastic etc. For example, if the price falls back significantly only to touch the Equilibrium Line and fails to test the Overall Mean Line when Stochastic is below 30, this could mean a strong Pull Back rather than a Trend Change as shown in the example chart below.

When price fails the Equilibrium Bands, the fill colour of the Equilibrium bands changes to Bearish colour. If the Overall Mean line is below the Equilibrium bands and is in a reasonable distance, Mean will act as support as shown in the example below. Price failing the mean will test Inner Bands and strong bear momentum could take price to Outer Bands and beyond.

All the components of the Catalyst Trade Bands including the Touch Points can be enabled or disabled from the settings.

3. ZigZag & Fibonacci

Catalyst automatically plots ZigZag and Auto Fibonacci Retracement based on an intelligent logic and can be tweaked by changing the Zigzag & Auto-Fibs Factor from the settings. It also plots Fib ratios and connectors along with price highs and lows of ZigZag. The ratios can be especially useful to visually detect harmonic patterns and also serves as a useful feature for Fibonacci traders.

4. Fibonacci Customisation

Catalyst users can customise Fibonacci type and levels, including levels colour from Catalyst settings. In addition to Auto-Fibs, users can also plot Fibonacci levels based on Days or Candles lookback. This is a very useful feature if the user wants to override Auto-Fibs to suit his/her needs. Users can also reverse the Fibonacci Levels by enabling Reverse from settings.

In the following example chart of

===================================================================================================================

Best Practice: Test with different settings first using Paper Trades before trading with real money

===================================================================================================================

版本注释

Code Optimised/updated- Added option to show RSI at ZigZag Highs and Lows.

- Mean Touchpoint to show even when price doesn't touch Mean during Gap up/Gap down.

版本注释

Added - Tooltip that shows the current RSI at current price fib label版本注释

Code optimised仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系TradeChartist。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

Get in touch with me via Private Message to request trial access to the invite-only scripts and for more information.

Get in touch with me if you would like access to my Premium scripts for a trial before deciding on lifetime access.

Telegram - @Trade_Chartist

Free Scripts - bit.ly/Free-Scripts

Telegram - @Trade_Chartist

Free Scripts - bit.ly/Free-Scripts

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系TradeChartist。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

Get in touch with me via Private Message to request trial access to the invite-only scripts and for more information.

Get in touch with me if you would like access to my Premium scripts for a trial before deciding on lifetime access.

Telegram - @Trade_Chartist

Free Scripts - bit.ly/Free-Scripts

Telegram - @Trade_Chartist

Free Scripts - bit.ly/Free-Scripts

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。