PROTECTED SOURCE SCRIPT

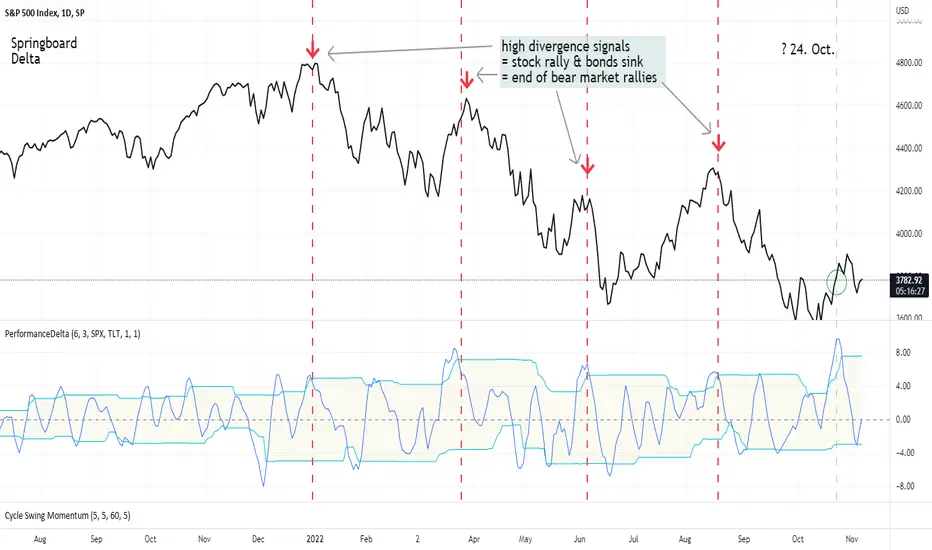

SpringBoard Delta (Bonds vs. Stocks Performance Oscillator)

Bonds and stocks move "in tandem" over the current market context. Higher yields cause bonds and stocks to decline. What's interesting is the timing of when the equity markets try to decouple from the bond market. That is, stocks begin to rise, but bonds do not.

Let's apply the above observation to a cyclical oscillator. We calculate the difference between the change in the price of stocks and the change in the price of bonds. If stocks and bonds move "in sync", that difference will be zero. If stocks move up and bonds move down, we' ll see high values of this indicator.

I like to call the cyclical difference indicator between stock and bond changes "The Springboard." The following chart tells why.

Let's apply the above observation to a cyclical oscillator. We calculate the difference between the change in the price of stocks and the change in the price of bonds. If stocks and bonds move "in sync", that difference will be zero. If stocks move up and bonds move down, we' ll see high values of this indicator.

I like to call the cyclical difference indicator between stock and bond changes "The Springboard." The following chart tells why.

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

Lars von Thienen

Join my blog and never miss an update:

stockmarketcycles.substack.com/subscribe

Join my blog and never miss an update:

stockmarketcycles.substack.com/subscribe

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

Lars von Thienen

Join my blog and never miss an update:

stockmarketcycles.substack.com/subscribe

Join my blog and never miss an update:

stockmarketcycles.substack.com/subscribe

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。