OPEN-SOURCE SCRIPT

HL/OL Histogram + (Close-Open)

🧠 Core Concept

This indicator is designed to detect meaningful directional intent in price action using a combination of:

Intrabar candle structure (high - open, open - low)

Net price momentum (close - open)

Timed trigger levels (frozen buy/sell prices based on selected timeframe closes)

The core idea is to visually separate bullish and bearish energy in the current bar, and to mark the price at which momentum flips from down to up or vice versa, based on a change in the close - open differential.

🔍 Components Breakdown

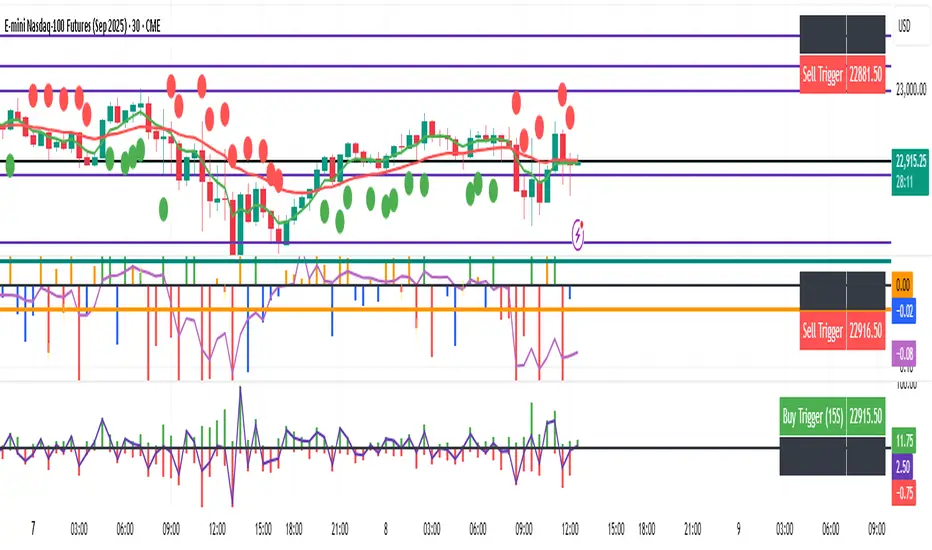

1. Histogram Bars

Green Bars (high - open): Represent bullish upper wicks, showing intrabar strength above the open.

Red Bars (open - low): Represent bearish lower wicks, showing pressure below the open.

Plotted as histograms above and below the zero line.

2. Close–Open Line (White)

Plots the difference between close and open for each bar.

Helps you visually track when momentum flips from negative to positive, or vice versa.

A bold black zero line provides clear reference for these flips.

3. Buy/Sell Signal Logic

A Buy Trigger is generated when close - open crosses above zero

A Sell Trigger occurs when close - open crosses below zero

These trigger events are one-shot, meaning they’re only registered once per signal direction. No retriggers occur until the opposite condition is met.

📈 Trigger Price Table (Static)

On a signal trigger, the close price from a lower timeframe (15S, 30S, 1, 2, 3, or 5 min) is captured.

This price is frozen and displayed in a table at the top-right of the pane.

The price remains fixed until the opposite trigger condition fires, at which point it is replaced.

Why close price?

Using the close from the lower timeframe gives a precise, decisive reference point — ideal for planning limit entries or confirming breakout commitment.

🛠️ Use Cases

Momentum traders can use the histogram and line to time entries after strong open rejection or close breakouts.

Scalpers can quickly gauge intrabar sentiment reversals and react to new momentum without waiting for candle closes.

Algo builders can use the frozen price logic as precise entry or confirmation points in automated strategies.

This indicator is designed to detect meaningful directional intent in price action using a combination of:

Intrabar candle structure (high - open, open - low)

Net price momentum (close - open)

Timed trigger levels (frozen buy/sell prices based on selected timeframe closes)

The core idea is to visually separate bullish and bearish energy in the current bar, and to mark the price at which momentum flips from down to up or vice versa, based on a change in the close - open differential.

🔍 Components Breakdown

1. Histogram Bars

Green Bars (high - open): Represent bullish upper wicks, showing intrabar strength above the open.

Red Bars (open - low): Represent bearish lower wicks, showing pressure below the open.

Plotted as histograms above and below the zero line.

2. Close–Open Line (White)

Plots the difference between close and open for each bar.

Helps you visually track when momentum flips from negative to positive, or vice versa.

A bold black zero line provides clear reference for these flips.

3. Buy/Sell Signal Logic

A Buy Trigger is generated when close - open crosses above zero

A Sell Trigger occurs when close - open crosses below zero

These trigger events are one-shot, meaning they’re only registered once per signal direction. No retriggers occur until the opposite condition is met.

📈 Trigger Price Table (Static)

On a signal trigger, the close price from a lower timeframe (15S, 30S, 1, 2, 3, or 5 min) is captured.

This price is frozen and displayed in a table at the top-right of the pane.

The price remains fixed until the opposite trigger condition fires, at which point it is replaced.

Why close price?

Using the close from the lower timeframe gives a precise, decisive reference point — ideal for planning limit entries or confirming breakout commitment.

🛠️ Use Cases

Momentum traders can use the histogram and line to time entries after strong open rejection or close breakouts.

Scalpers can quickly gauge intrabar sentiment reversals and react to new momentum without waiting for candle closes.

Algo builders can use the frozen price logic as precise entry or confirmation points in automated strategies.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。