INVITE-ONLY SCRIPT

已更新 SFC Valuation Model - Fair Value

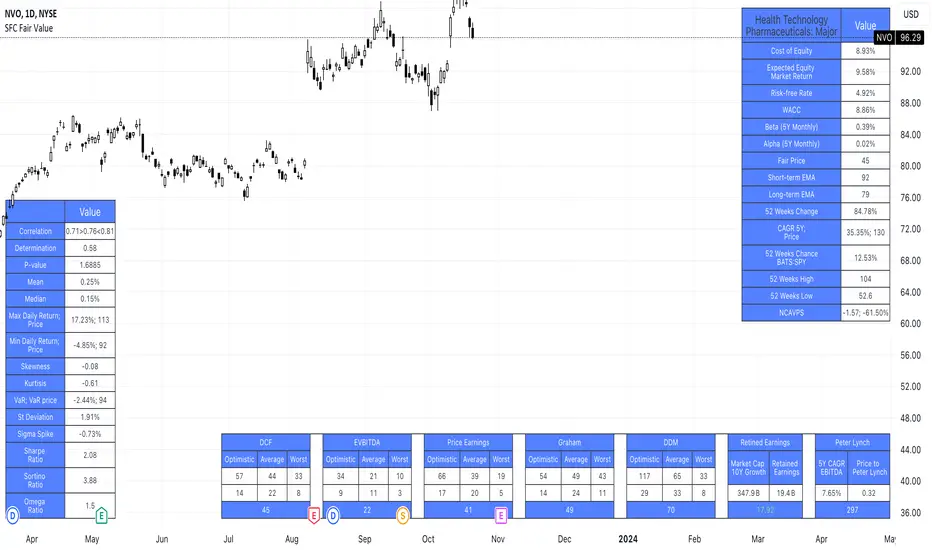

Valuation is the analytical process of determining the current (or projected) worth of an asset or a company. There are many techniques used for doing a valuation. An analyst placing a value on a company looks at the business's management, the composition of its capital structure, the prospect of future earnings, and the market value of its assets, among other metrics.

Fundamental analysis is often employed in valuation, although several other methods may be employed such as the capital asset pricing model (CAPM) or the dividend discount model (DDM), Discounted Cash Flow (DCF) and many others.

A valuation can be useful when trying to determine the fair value of a security, which is determined by what a buyer is willing to pay a seller, assuming both parties enter the transaction willingly. When a security trades on an exchange, buyers and sellers determine the market value of a stock or bond.

There is no universal standard for calculating the intrinsic value of a company or stock. Financial analysts attempt to determine an asset's intrinsic value by using fundamental and technical analyses to gauge its actual financial performance.

Intrinsic value is useful because it can help an investor understand whether a potential investment is overvalued or undervalued.

This indicator allows investors to simulate different scenarios depending on their view of the stock's value. It calculates different models automatically, but users can define the fair value manually by changing the settings.

For example: change the weight of the model; choose how conservatively want to evaluate the stock; use different growth rate or discount rate and so on.

The indicator shows other useful metrics in order to help investors to evaluate the stock.

This indicator can save users hours of searching financial data and calculating fair value.

There are few valuation methods/steps

- Macroeconomics - analyse the current economic;

- Define how the sector is performing;

- Relative valuation method - compare few stocks and find the Outlier;

- Absolute valuation method historically- define how the stock performed in the past;

- Absolute valuation method - define how the stock is performed now and find the fair value;

- Technical analysis

How to use:

1. Once you have completed the initial evaluation steps, simply load the indicator.

2. Check the default settings and see if they suit you.

3. Find the fair value and wait for the stock to reach it.

Fundamental analysis is often employed in valuation, although several other methods may be employed such as the capital asset pricing model (CAPM) or the dividend discount model (DDM), Discounted Cash Flow (DCF) and many others.

A valuation can be useful when trying to determine the fair value of a security, which is determined by what a buyer is willing to pay a seller, assuming both parties enter the transaction willingly. When a security trades on an exchange, buyers and sellers determine the market value of a stock or bond.

There is no universal standard for calculating the intrinsic value of a company or stock. Financial analysts attempt to determine an asset's intrinsic value by using fundamental and technical analyses to gauge its actual financial performance.

Intrinsic value is useful because it can help an investor understand whether a potential investment is overvalued or undervalued.

This indicator allows investors to simulate different scenarios depending on their view of the stock's value. It calculates different models automatically, but users can define the fair value manually by changing the settings.

For example: change the weight of the model; choose how conservatively want to evaluate the stock; use different growth rate or discount rate and so on.

The indicator shows other useful metrics in order to help investors to evaluate the stock.

This indicator can save users hours of searching financial data and calculating fair value.

There are few valuation methods/steps

- Macroeconomics - analyse the current economic;

- Define how the sector is performing;

- Relative valuation method - compare few stocks and find the Outlier;

- Absolute valuation method historically- define how the stock performed in the past;

- Absolute valuation method - define how the stock is performed now and find the fair value;

- Technical analysis

How to use:

1. Once you have completed the initial evaluation steps, simply load the indicator.

2. Check the default settings and see if they suit you.

3. Find the fair value and wait for the stock to reach it.

版本注释

- added descriptions for all metrics- added more metrics for full analysis

- added Graham valuation model

版本注释

- added calculated price for min\max returns. They could be used as Stop Loss and Take Profit prices.版本注释

- added CAGR版本注释

- added Retained Earnings Valuation版本注释

- added Peter Lynch Valuation Method- added Net current asset value per share (NCAVPS)

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系SerpentForexClub。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

If you have nay questions just send me a PM.

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系SerpentForexClub。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

If you have nay questions just send me a PM.

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。